444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Africa drilling and completion fluids market is a pivotal catalyst for hydrocarbon exploration, enabling efficient drilling operations and reservoir management. This comprehensive market overview delves into the intricate landscape of drilling and completion fluids, encompassing their significance, executive summary, key insights, drivers, restraints, opportunities, and the dynamic forces shaping their trajectory within the evolving energy landscape of the African continent.

Meaning

Drilling and completion fluids are essential substances used in oil and gas exploration to facilitate wellbore stability, cuttings removal, and reservoir integrity. These fluids serve critical roles throughout the drilling process, from well spudding to well completion. By controlling pressure, lubricating equipment, and preventing formation damage, drilling and completion fluids contribute to efficient operations and successful hydrocarbon recovery.

Executive Summary

The Africa drilling and completion fluids market plays a foundational role in ensuring operational efficiency and reservoir productivity within the continent’s energy sector. As exploration and production activities expand, the market’s contribution becomes increasingly vital. This executive summary encapsulates the essence of the market, highlighting technological advancements, regional dynamics, competitive landscapes, and the transformative potential of drilling and completion fluids in shaping Africa’s energy future.

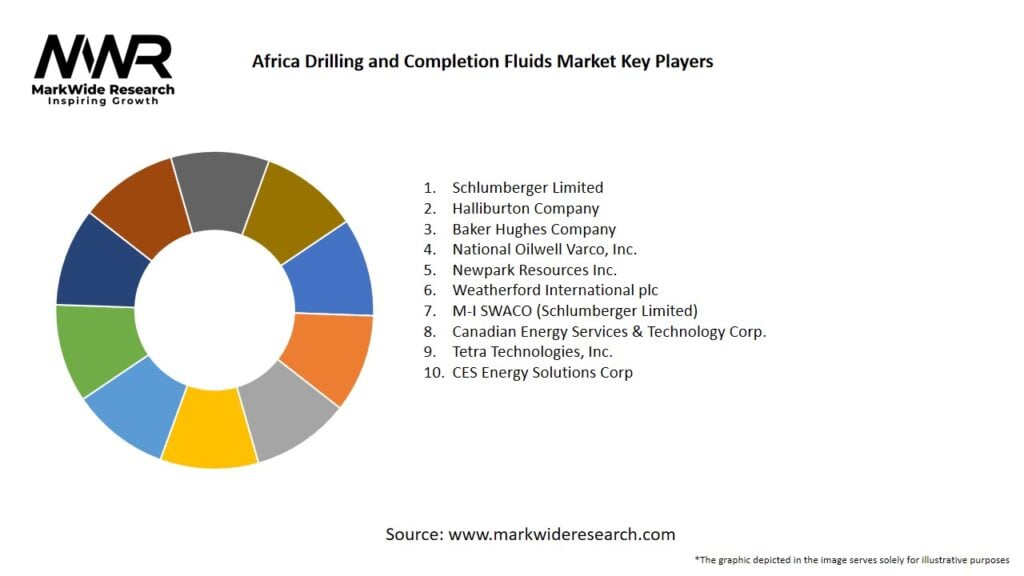

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

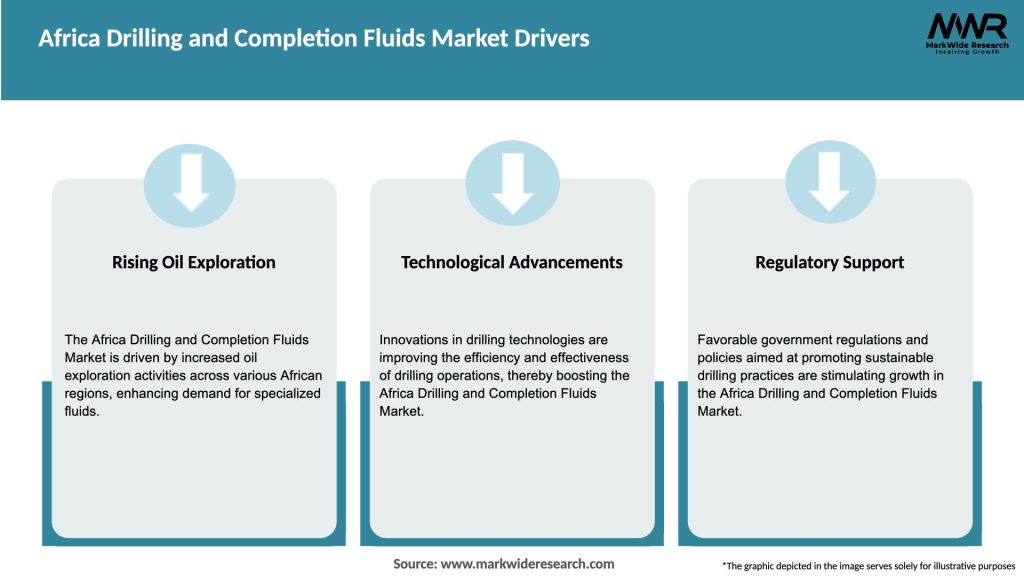

Market Drivers

Several factors are driving the growth of the Africa Drilling and Completion Fluids market:

Market Restraints

Despite its growth potential, the Africa Drilling and Completion Fluids market faces several challenges:

Market Opportunities

The Africa Drilling and Completion Fluids market presents several growth opportunities:

Market Dynamics

The Africa Drilling and Completion Fluids market is influenced by several dynamic factors:

Regional Analysis

The Africa Drilling and Completion Fluids market shows significant regional variations:

Competitive Landscape

Leading Companies in the Africa Drilling and Completion Fluids Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

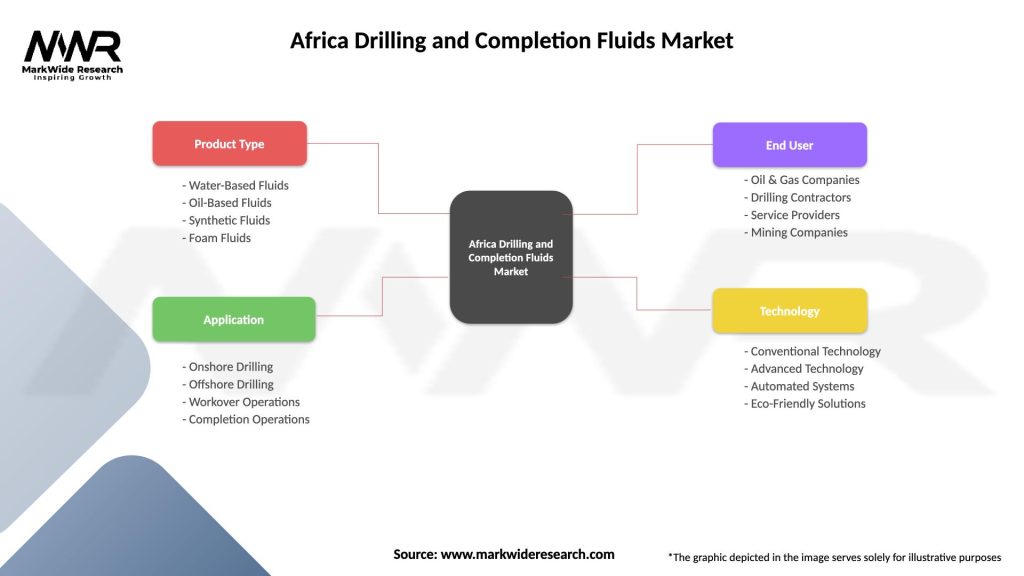

Segmentation

The Africa Drilling and Completion Fluids market can be segmented based on various factors:

Category-wise Insights

Each category of drilling and completion fluids offers specific benefits and use cases:

Key Benefits for Industry Participants and Stakeholders

The Africa Drilling and Completion Fluids market offers several key benefits for stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic introduced unprecedented challenges and opportunities for the Africa drilling and completion fluids market. Supply chain disruptions highlighted the need for local sourcing and storage of essential fluids. Exploration companies adapted drilling operations to align with health and safety guidelines. Economic uncertainties impacted investment in exploration activities, influencing fluid demand. As Africa’s energy sector recovers and adapts, the drilling and completion fluids market’s role in enabling exploration resilience and operational efficiency remains pivotal.

Key Industry Developments

The Africa drilling and completion fluids market is characterized by transformative industry developments that shape its trajectory. Technological advancements refine fluid formulations, enhancing performance in diverse geological conditions. Collaborations between fluid manufacturers and exploration companies yield customized solutions that optimize wellbore stability and reservoir management. The integration of nanotechnology drives enhanced fluid performance and reservoir recovery. These industry developments collectively contribute to the market’s growth and evolution, ensuring exploration excellence and fostering operational efficiency.

Analyst Suggestions

Stakeholders navigating the dynamic Africa drilling and completion fluids market can benefit from analyst suggestions that offer strategic guidance. Embracing environmentally responsible fluid formulations aligns with regulatory standards and enhances ecological sustainability. Collaboration between fluid manufacturers and exploration companies fosters the development of tailored solutions that optimize wellbore stability and hydrocarbon recovery. Prioritizing local storage and sourcing of essential fluids ensures operational resilience. By heeding these suggestions, stakeholders can drive the market’s growth and contribute to transformative exploration excellence.

Future Outlook

The future outlook of the Africa drilling and completion fluids market radiates with innovation, sustainability, and transformative potential. Technological advancements in fluid formulations enhance operational efficiency and wellbore stability. Collaborations between fluid manufacturers, exploration companies, and regulatory bodies yield solutions that align with environmental standards. Deepwater exploration trends drive the development of fluids that withstand extreme conditions. As Africa aims to optimize its energy potential and promote responsible exploration, the drilling and completion fluids market is poised to shape exploration horizons, fostering operational efficiency and hydrocarbon recovery.

Conclusion

In the realm of hydrocarbon exploration, the Africa drilling and completion fluids market stands as a catalyst for operational efficiency and exploration success. From well spudding to reservoir management, drilling and completion fluids play a pivotal role in optimizing wellbore stability, cuttings transport, and hydrocarbon recovery. This comprehensive exploration encompassed market overview, meaning, executive summary, key insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise perspectives, benefits for stakeholders, SWOT analysis, key trends, Covid-19 impact, industry developments, analyst suggestions, and future outlook. As exploration activities expand and Africa’s energy potential unfolds, stakeholders are positioned to redefine exploration excellence, operational efficiency, and responsible resource utilization.

What is Drilling and Completion Fluids?

Drilling and Completion Fluids are specialized fluids used in the drilling and completion of oil and gas wells. They serve various functions, including cooling the drill bit, transporting cuttings, and maintaining wellbore stability.

What are the key players in the Africa Drilling and Completion Fluids Market?

Key players in the Africa Drilling and Completion Fluids Market include Halliburton, Schlumberger, Baker Hughes, and Weatherford, among others. These companies provide a range of products and services tailored to the unique challenges of drilling in the region.

What are the growth factors driving the Africa Drilling and Completion Fluids Market?

The Africa Drilling and Completion Fluids Market is driven by increasing oil and gas exploration activities, advancements in drilling technologies, and the rising demand for energy. Additionally, the need for efficient and environmentally friendly drilling solutions is propelling market growth.

What challenges does the Africa Drilling and Completion Fluids Market face?

The Africa Drilling and Completion Fluids Market faces challenges such as fluctuating oil prices, regulatory hurdles, and environmental concerns. These factors can impact investment and operational decisions in the drilling sector.

What opportunities exist in the Africa Drilling and Completion Fluids Market?

Opportunities in the Africa Drilling and Completion Fluids Market include the development of unconventional oil and gas resources and the adoption of innovative fluid technologies. Additionally, increasing investments in renewable energy sources may create new avenues for growth.

What trends are shaping the Africa Drilling and Completion Fluids Market?

Trends in the Africa Drilling and Completion Fluids Market include the growing use of bio-based fluids, advancements in fluid recycling technologies, and a focus on sustainability. These trends reflect the industry’s shift towards more environmentally responsible practices.

Africa Drilling and Completion Fluids Market

| Segmentation Details | Description |

|---|---|

| Product Type | Water-Based Fluids, Oil-Based Fluids, Synthetic Fluids, Foam Fluids |

| Application | Onshore Drilling, Offshore Drilling, Workover Operations, Completion Operations |

| End User | Oil & Gas Companies, Drilling Contractors, Service Providers, Mining Companies |

| Technology | Conventional Technology, Advanced Technology, Automated Systems, Eco-Friendly Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Africa Drilling and Completion Fluids Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at