444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Aerostructures market refers to the manufacturing and production of various components and structures used in the aerospace industry. These include fuselage, wings, empennage, nacelles, and other critical parts of an aircraft. Aerostructures play a vital role in ensuring the structural integrity, aerodynamic performance, and overall safety of an aircraft. This market analysis delves into the key aspects of the Aerostructures market, providing insights into its growth, trends, challenges, and opportunities.

Meaning

Aerostructures are the structural components of an aircraft that provide strength, stability, and aerodynamic efficiency. They are typically made of advanced composite materials, aluminum alloys, or a combination of both. Aerostructures encompass a wide range of parts, including the fuselage (the main body of the aircraft), wings (providing lift), empennage (tail section), and nacelles (housing the engines). These components undergo rigorous design, manufacturing, and testing processes to ensure they meet stringent safety and performance standards.

Executive Summary

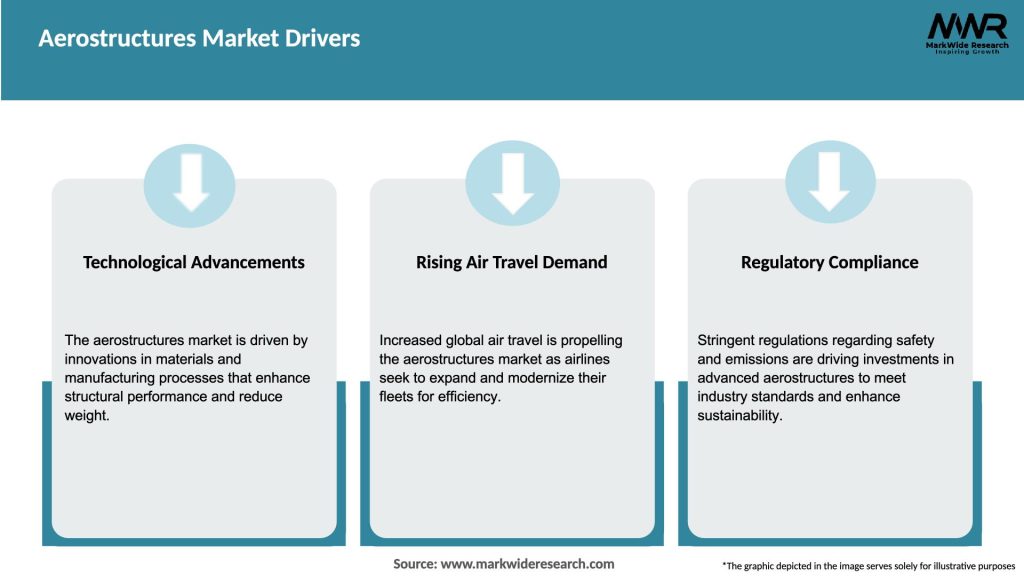

The Aerostructures market has witnessed significant growth in recent years, driven by the rising demand for commercial and military aircraft globally. The increasing air travel, expanding airline fleets, and the need for fuel-efficient aircraft are key factors propelling market growth. Additionally, advancements in material technologies and manufacturing processes have led to the development of lightweight, durable, and cost-effective Aerostructures. However, the market also faces challenges such as regulatory constraints, supply chain disruptions, and intense competition among market players.

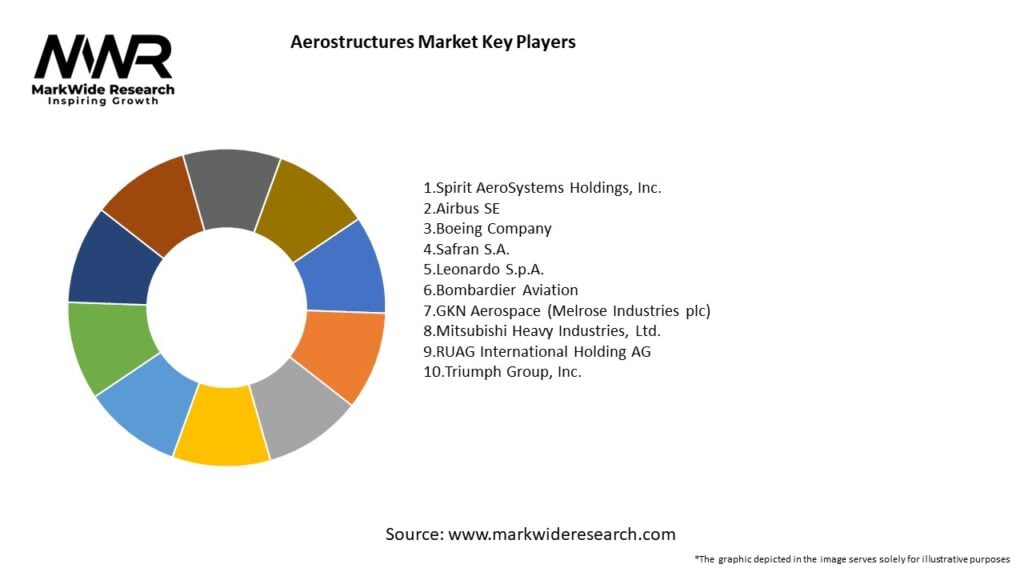

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Aerostructures market is highly dynamic, influenced by various factors, including technological advancements, market trends, regulatory changes, and macroeconomic conditions. Industry players must continually adapt to these dynamics to stay competitive and meet the evolving needs of customers. Collaboration with aircraft manufacturers, research institutions, and suppliers is crucial for fostering innovation and developing next-generation Aerostructures.

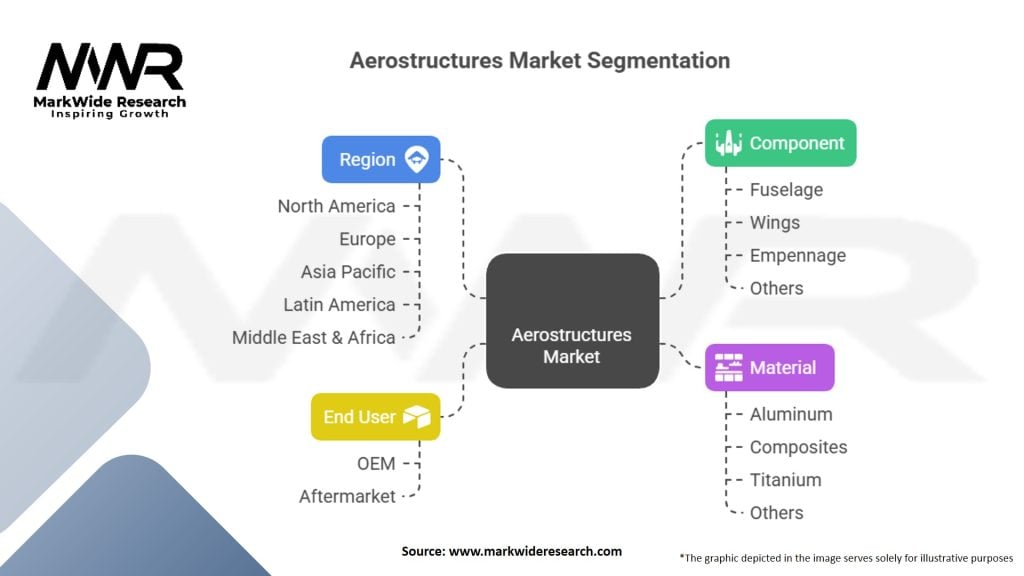

Regional Analysis

The Aerostructures market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America holds a significant market share, driven by the presence of major aircraft manufacturers and defense contractors in the region. Europe follows closely, with strong aerospace capabilities and a growing commercial aviation sector. Asia-Pacific is witnessing rapid market growth due to increased air travel demand, rising defense budgets, and the establishment of manufacturing facilities by international aerospace companies. Latin America and the Middle East and Africa present emerging opportunities for Aerostructures manufacturers, supported by expanding aviation sectors and regional development plans.

Competitive Landscape

Leading Companies in Aerostructures Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Aerostructures market can be segmented based on the following criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the aerospace industry, including the Aerostructures market. The decline in air travel demand and temporary suspension of aircraft production affected the market negatively. Many airlines deferred their fleet expansion plans, resulting in reduced demand for new Aerostructures. However, the market has shown signs of recovery as air travel gradually resumes and the aerospace industry adapts to the changing landscape. The focus on sustainability and fuel efficiency in the post-pandemic era presents opportunities for Aerostructures manufacturers to support aircraft modernization and replacement programs.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Aerostructures market is expected to witness steady growth in the coming years, driven by increasing air travel demand, aircraft modernization programs, and advancements in materials and manufacturing technologies. The growing emphasis on sustainability, fuel efficiency, and lightweight design will shape the future of Aerostructures. Industry players need to adapt to evolving market trends, invest in R&D, and foster collaborations to stay competitive and meet the changing needs of the aerospace industry.

Conclusion

The Aerostructures market plays a critical role in the aerospace industry, providing the necessary structural components for aircraft. With the increasing demand for air travel, advancements in materials, and the focus on sustainability, the Aerostructures market is poised for growth. However, challenges such as high costs, supply chain complexities, and regulatory requirements need to be addressed. By embracing innovation, collaborating with key stakeholders, and adopting sustainable practices, Aerostructures manufacturers can navigate the market dynamics and seize opportunities for long-term success.

What is Aerostructures?

Aerostructures refer to the components of an aircraft or spacecraft that provide structural support and shape. This includes parts such as wings, fuselage, and tail sections, which are critical for the overall integrity and performance of the vehicle.

What are the key players in the Aerostructures Market?

Key players in the Aerostructures Market include Boeing, Airbus, and Lockheed Martin, which are known for their extensive involvement in aerospace manufacturing. Other notable companies include Northrop Grumman and Safran, among others.

What are the growth factors driving the Aerostructures Market?

The Aerostructures Market is driven by increasing air travel demand, advancements in lightweight materials, and the rise of unmanned aerial vehicles. Additionally, the push for fuel efficiency and sustainability in aviation is propelling innovation in aerostructure designs.

What challenges does the Aerostructures Market face?

Challenges in the Aerostructures Market include stringent regulatory requirements, high manufacturing costs, and supply chain disruptions. These factors can impact production timelines and overall market growth.

What opportunities exist in the Aerostructures Market?

Opportunities in the Aerostructures Market include the development of advanced composite materials and the increasing demand for electric and hybrid aircraft. Furthermore, the expansion of space exploration initiatives presents new avenues for growth.

What trends are shaping the Aerostructures Market?

Current trends in the Aerostructures Market include the integration of digital technologies such as additive manufacturing and automation in production processes. Additionally, there is a growing focus on sustainability and reducing the environmental impact of aerospace manufacturing.

Aerostructures Market:

| Segmentation | Details |

|---|---|

| Component | Fuselage, Wings, Empennage, Others |

| Material | Aluminum, Composites, Titanium, Others |

| End User | OEM, Aftermarket |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Aerostructures Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at