444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The aerospace mergers and acquisitions market represents a dynamic landscape where industry consolidation drives innovation, efficiency, and competitive advantage. This sector encompasses strategic transactions involving aircraft manufacturers, defense contractors, component suppliers, and technology providers seeking to enhance their market position through strategic partnerships and acquisitions. Market dynamics indicate robust activity driven by technological advancement requirements, supply chain optimization needs, and the pursuit of economies of scale.

Industry consolidation has accelerated significantly, with major aerospace companies pursuing strategic acquisitions to strengthen their technological capabilities and expand market reach. The market demonstrates consistent growth patterns, with transaction volumes reflecting a 12.5% annual increase in strategic aerospace deals over recent years. Cross-border transactions represent approximately 35% of total aerospace M&A activity, highlighting the global nature of industry consolidation efforts.

Defense sector integration continues to drive substantial merger and acquisition activity, as companies seek to diversify revenue streams and leverage complementary technologies. The commercial aviation segment simultaneously experiences consolidation pressures, with suppliers and manufacturers pursuing strategic combinations to enhance operational efficiency and technological innovation capabilities.

The aerospace mergers and acquisitions market refers to the comprehensive ecosystem of strategic transactions, partnerships, and consolidation activities within the aviation and defense industries. This market encompasses various transaction types including horizontal mergers between competitors, vertical acquisitions along supply chains, and strategic partnerships designed to enhance technological capabilities and market positioning.

Strategic transactions in this sector typically involve companies seeking to acquire advanced technologies, expand geographical presence, access new customer segments, or achieve operational synergies. The market includes activities ranging from small-scale technology acquisitions to major industry-transforming mergers that reshape competitive landscapes and market dynamics.

Market participants include original equipment manufacturers, tier-one suppliers, technology specialists, private equity firms, and strategic investors focused on aerospace and defense opportunities. These transactions often involve complex regulatory considerations, national security reviews, and extensive due diligence processes reflecting the strategic importance of aerospace capabilities.

Strategic consolidation within the aerospace industry continues to accelerate, driven by technological transformation requirements and competitive pressures. The market demonstrates strong fundamentals with increasing transaction volumes and strategic value creation opportunities across multiple aerospace segments. Digital transformation initiatives account for approximately 28% of aerospace acquisition rationale, reflecting industry-wide modernization priorities.

Market leaders are pursuing aggressive acquisition strategies to secure critical technologies, particularly in areas such as artificial intelligence, advanced materials, and sustainable aviation solutions. The integration of acquired capabilities enables companies to offer comprehensive solutions while reducing development timelines and costs. Supply chain consolidation represents another significant driver, with companies seeking to secure critical component sources and enhance manufacturing efficiency.

Regulatory environments across major markets continue to evolve, with increased scrutiny on transactions involving critical defense technologies and foreign investment considerations. Despite regulatory complexities, transaction activity remains robust, supported by strong industry fundamentals and long-term growth prospects in both commercial and defense aerospace segments.

Transaction patterns reveal several critical insights about aerospace merger and acquisition dynamics:

Technological advancement requirements serve as the primary catalyst for aerospace merger and acquisition activity. Companies recognize the necessity of acquiring cutting-edge capabilities to remain competitive in an increasingly sophisticated market environment. Digital transformation initiatives drive substantial acquisition activity as traditional aerospace companies seek to integrate advanced analytics, artificial intelligence, and connectivity solutions into their operations.

Supply chain optimization represents another critical driver, with companies pursuing vertical integration strategies to enhance control over critical components and manufacturing processes. The COVID-19 pandemic highlighted supply chain vulnerabilities, accelerating consolidation efforts aimed at securing reliable supplier relationships and reducing dependency risks.

Economies of scale motivate many strategic transactions, as companies seek to spread development costs across larger revenue bases and achieve operational efficiencies. The high cost of aerospace research and development makes consolidation an attractive strategy for sharing investment burdens while accelerating innovation timelines.

Market access expansion drives cross-border acquisition activity, with companies seeking to establish presence in high-growth regions and access new customer segments. Regulatory requirements often necessitate local partnerships or acquisitions to compete effectively in international markets, particularly in defense-related segments.

Regulatory complexity presents significant challenges for aerospace merger and acquisition transactions. National security considerations, antitrust regulations, and foreign investment restrictions create lengthy approval processes that can delay or prevent strategic transactions. Defense-related acquisitions face particularly stringent scrutiny, with governments carefully evaluating potential impacts on national security capabilities.

Integration challenges pose substantial risks for aerospace mergers and acquisitions. The technical complexity of aerospace systems, combined with stringent quality and safety requirements, makes post-merger integration particularly challenging. Cultural differences between organizations can further complicate integration efforts and delay realization of anticipated synergies.

Valuation concerns often impede transaction completion, as the cyclical nature of aerospace markets creates uncertainty about long-term value creation potential. Economic downturns can significantly impact aerospace demand, making accurate valuation assessment challenging for both buyers and sellers.

Talent retention represents a critical constraint, as aerospace companies depend heavily on specialized engineering and technical expertise. Merger and acquisition activity can trigger talent flight, potentially undermining the strategic value of acquired capabilities and technologies.

Sustainable aviation technologies present substantial acquisition opportunities as the industry transitions toward environmental sustainability. Companies developing electric propulsion systems, sustainable aviation fuels, and lightweight materials represent attractive acquisition targets for established aerospace manufacturers seeking to enhance their environmental credentials.

Urban air mobility emergence creates new market segments with significant consolidation potential. Traditional aerospace companies are actively acquiring startups and technology providers focused on electric vertical takeoff and landing aircraft, autonomous flight systems, and urban transportation infrastructure.

Space commercialization offers expanding opportunities for strategic acquisitions and partnerships. The growing commercial space sector attracts investment from traditional aerospace companies seeking to diversify into satellite manufacturing, launch services, and space-based applications.

Aftermarket services represent high-value acquisition opportunities with attractive recurring revenue characteristics. Companies providing maintenance, repair, and overhaul services, as well as digital fleet management solutions, command premium valuations due to their stable cash flow profiles and growth potential.

Competitive pressures continue to intensify across aerospace segments, driving consolidation as companies seek to achieve scale advantages and technological differentiation. The market demonstrates cyclical characteristics influenced by commercial aviation demand patterns, defense spending levels, and broader economic conditions affecting capital availability for strategic transactions.

Technology disruption accelerates market dynamics, with established companies pursuing acquisitions to access innovative capabilities and prevent competitive displacement. MarkWide Research analysis indicates that technology-focused acquisitions demonstrate 18% higher success rates in achieving strategic objectives compared to traditional consolidation transactions.

Capital availability influences transaction volumes and pricing dynamics, with favorable financing conditions supporting increased merger and acquisition activity. Private equity participation has grown substantially, bringing additional capital and operational expertise to aerospace transactions while creating exit opportunities for existing stakeholders.

Geopolitical factors increasingly impact market dynamics, with trade tensions and national security considerations affecting cross-border transaction feasibility. Companies must navigate complex regulatory environments while pursuing strategic growth opportunities in an interconnected global aerospace ecosystem.

Comprehensive analysis of the aerospace mergers and acquisitions market employs multiple research methodologies to ensure accuracy and completeness. Primary research involves extensive interviews with industry executives, investment bankers, legal advisors, and regulatory officials to gather firsthand insights about market trends and transaction dynamics.

Secondary research encompasses detailed analysis of public transaction databases, regulatory filings, company annual reports, and industry publications to identify patterns and quantify market activity. Transaction data analysis includes examination of deal structures, valuation multiples, strategic rationales, and post-merger performance outcomes.

Qualitative research methods include case study analysis of significant aerospace transactions to understand success factors and common challenges. Expert interviews provide insights into regulatory trends, financing conditions, and strategic considerations influencing transaction decision-making processes.

Quantitative analysis involves statistical modeling of transaction volumes, pricing trends, and market concentration metrics to identify patterns and forecast future activity levels. Data validation processes ensure accuracy and reliability of research findings through multiple source verification and cross-referencing methodologies.

North American markets dominate aerospace merger and acquisition activity, accounting for approximately 45% of global transaction volume. The region benefits from a mature aerospace ecosystem, favorable regulatory environment for domestic transactions, and strong capital market support for strategic consolidation activities. United States defense spending drives substantial acquisition activity among defense contractors seeking to enhance capabilities and market positioning.

European aerospace markets demonstrate strong consolidation activity, representing roughly 30% of global transactions. Cross-border European transactions benefit from regulatory harmonization efforts, while national champions pursue strategic acquisitions to compete with global aerospace leaders. Sustainable aviation initiatives drive significant acquisition activity focused on environmental technologies and alternative propulsion systems.

Asia-Pacific regions show rapidly growing merger and acquisition activity, with 15% market share reflecting expanding aerospace capabilities and increasing domestic demand. Chinese aerospace companies pursue strategic acquisitions to access advanced technologies, while established regional players seek partnerships with global aerospace leaders.

Emerging markets present growing opportunities for aerospace merger and acquisition activity, driven by expanding aviation markets and increasing defense modernization requirements. Latin American and Middle Eastern aerospace companies increasingly participate in strategic transactions to enhance technological capabilities and market access.

Major aerospace corporations lead strategic acquisition activity through comprehensive growth strategies targeting technology enhancement and market expansion:

Transaction type segmentation reveals distinct patterns across aerospace merger and acquisition categories:

By Transaction Type:

By Industry Segment:

By Geographic Scope:

Technology acquisitions demonstrate the highest strategic value creation potential, with companies pursuing capabilities in artificial intelligence, advanced materials, and digital systems. These transactions typically command premium valuations due to their transformative potential and competitive differentiation capabilities.

Supply chain acquisitions focus on securing critical component sources and enhancing manufacturing efficiency. Vertical integration strategies enable companies to reduce supply chain risks while capturing additional value across the aerospace ecosystem. Tier-one supplier acquisitions represent particularly attractive opportunities due to their established customer relationships and technical expertise.

Service-oriented acquisitions target companies with recurring revenue models and stable cash flow characteristics. Maintenance, repair, and overhaul providers command premium valuations due to their defensive business characteristics and growth potential in expanding global aircraft fleets.

Geographic expansion acquisitions enable access to high-growth markets and regional aerospace ecosystems. These transactions often involve partnerships with local companies to navigate regulatory requirements and establish market presence in strategically important regions.

Strategic buyers realize substantial benefits through aerospace merger and acquisition activities:

Financial stakeholders benefit from value creation opportunities and portfolio diversification:

Industry ecosystem participants gain from increased efficiency and innovation acceleration:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration drives substantial aerospace merger and acquisition activity as traditional companies seek to integrate advanced technologies. Artificial intelligence acquisitions represent approximately 22% of technology-focused aerospace transactions, reflecting industry-wide digitization priorities and competitive pressures.

Sustainability focus increasingly influences acquisition strategies, with companies pursuing targets developing electric propulsion systems, sustainable aviation fuels, and lightweight materials. Environmental regulations and customer demands for sustainable solutions drive premium valuations for companies with relevant capabilities.

Supply chain resilience has become a critical strategic priority, accelerating vertical integration trends and supplier acquisition activity. Companies seek to reduce dependency risks and enhance control over critical components through strategic acquisitions and partnerships.

Space sector convergence creates new acquisition opportunities as traditional aerospace companies expand into commercial space markets. Satellite technology, launch services, and space-based applications represent high-growth segments attracting substantial investment and acquisition activity.

Private equity participation continues expanding, with financial sponsors increasingly targeting aerospace opportunities. MWR data indicates that private equity involvement in aerospace transactions has grown by 25% annually, bringing operational expertise and capital to support industry consolidation.

Regulatory evolution continues shaping aerospace merger and acquisition landscapes, with governments updating foreign investment screening processes and national security review procedures. Recent regulatory changes emphasize critical technology protection while maintaining openness to beneficial strategic transactions.

Technology convergence accelerates as aerospace companies acquire capabilities in adjacent sectors including automotive, telecommunications, and software development. These cross-industry acquisitions enable aerospace companies to access innovative technologies and talent pools while diversifying revenue sources.

Strategic partnership expansion complements traditional merger and acquisition activity, with companies forming joint ventures and strategic alliances to share development costs and risks. These partnerships often serve as precursors to full acquisitions as relationships mature and strategic alignment strengthens.

Startup ecosystem integration intensifies as established aerospace companies actively acquire innovative startups to access disruptive technologies and entrepreneurial talent. Venture capital partnerships and corporate venture arms facilitate identification and acquisition of promising aerospace technology companies.

Cross-border activity evolution reflects changing geopolitical dynamics, with companies adapting acquisition strategies to navigate regulatory complexities while pursuing strategic growth opportunities in global markets.

Strategic planning enhancement should prioritize long-term technology roadmaps and capability requirements to guide acquisition targeting and due diligence processes. Companies must develop comprehensive integration capabilities to realize anticipated synergies and value creation potential from aerospace transactions.

Regulatory preparation requires early engagement with relevant authorities and comprehensive compliance planning for complex aerospace transactions. Companies should invest in regulatory expertise and maintain strong relationships with government stakeholders to facilitate approval processes.

Integration excellence demands dedicated resources and proven methodologies to address the unique challenges of aerospace merger and acquisition integration. Cultural alignment, talent retention, and technical integration require specialized approaches reflecting industry characteristics.

Technology assessment capabilities must evolve to evaluate rapidly advancing aerospace technologies and their strategic value potential. Companies should develop internal expertise or partner with specialized advisors to assess technology acquisition opportunities effectively.

Portfolio optimization strategies should balance growth investments with operational efficiency improvements to maximize value creation from aerospace merger and acquisition activities. Regular portfolio reviews ensure alignment with strategic objectives and market opportunities.

Transaction activity is projected to maintain robust levels driven by continued industry consolidation needs and technology advancement requirements. MarkWide Research forecasts indicate aerospace merger and acquisition activity will grow at a compound annual growth rate of 8.5% over the next five years, supported by strong industry fundamentals and capital availability.

Technology-focused acquisitions will likely accelerate as aerospace companies seek to integrate artificial intelligence, autonomous systems, and sustainable aviation technologies. The convergence of aerospace with other high-technology sectors creates expanding acquisition opportunities and strategic value creation potential.

Geographic diversification will continue driving cross-border transaction activity, despite regulatory complexities and geopolitical considerations. Companies will pursue strategic acquisitions to access high-growth markets while navigating evolving regulatory frameworks and national security requirements.

Private equity participation is expected to expand further, bringing additional capital and operational expertise to aerospace transactions. Financial sponsors will likely focus on platform acquisitions and add-on strategies to build comprehensive aerospace capabilities and achieve superior returns.

Regulatory evolution will continue shaping transaction dynamics, with governments balancing economic benefits against national security considerations. Companies must adapt to changing regulatory environments while pursuing strategic growth opportunities in an increasingly complex global marketplace.

The aerospace mergers and acquisitions market represents a dynamic and strategically critical sector driving industry consolidation and innovation acceleration. Strong fundamentals including long-term growth prospects, technology advancement requirements, and capital availability support continued robust transaction activity across commercial aviation, defense, and emerging aerospace segments.

Strategic imperatives including digital transformation, sustainability initiatives, and supply chain optimization will continue driving acquisition activity as companies seek to enhance competitive positioning and operational capabilities. The integration of advanced technologies through strategic acquisitions enables aerospace companies to accelerate innovation while sharing development costs and risks.

Market evolution reflects broader industry transformation toward more sustainable, efficient, and technologically advanced aerospace systems. Companies that successfully navigate regulatory complexities while executing strategic acquisitions will be best positioned to capitalize on long-term growth opportunities and maintain competitive leadership in an increasingly sophisticated aerospace marketplace.

What is Aerospace Mergers and Acquisitions?

Aerospace Mergers and Acquisitions refer to the consolidation of companies within the aerospace sector through various forms of financial transactions, including mergers, acquisitions, and joint ventures. This process aims to enhance market share, expand product offerings, and achieve operational efficiencies.

What are the key players in the Aerospace Mergers and Acquisitions Market?

Key players in the Aerospace Mergers and Acquisitions Market include Boeing, Lockheed Martin, and Northrop Grumman, which are involved in various strategic transactions to strengthen their positions. Other notable companies include Raytheon Technologies and Airbus, among others.

What are the growth factors driving the Aerospace Mergers and Acquisitions Market?

The Aerospace Mergers and Acquisitions Market is driven by factors such as the increasing demand for advanced aerospace technologies, the need for cost reduction through economies of scale, and the pursuit of innovation in aerospace manufacturing and services.

What challenges does the Aerospace Mergers and Acquisitions Market face?

Challenges in the Aerospace Mergers and Acquisitions Market include regulatory hurdles, integration difficulties post-merger, and the high costs associated with acquisitions. Additionally, geopolitical tensions can impact cross-border transactions.

What opportunities exist in the Aerospace Mergers and Acquisitions Market?

Opportunities in the Aerospace Mergers and Acquisitions Market include the potential for strategic partnerships to develop new technologies, the expansion into emerging markets, and the consolidation of supply chains to enhance efficiency and reduce costs.

What trends are shaping the Aerospace Mergers and Acquisitions Market?

Trends in the Aerospace Mergers and Acquisitions Market include a focus on sustainability through green technologies, increased investment in space exploration, and the rise of digital transformation initiatives within aerospace companies.

Aerospace Mergers and Acquisitions Market

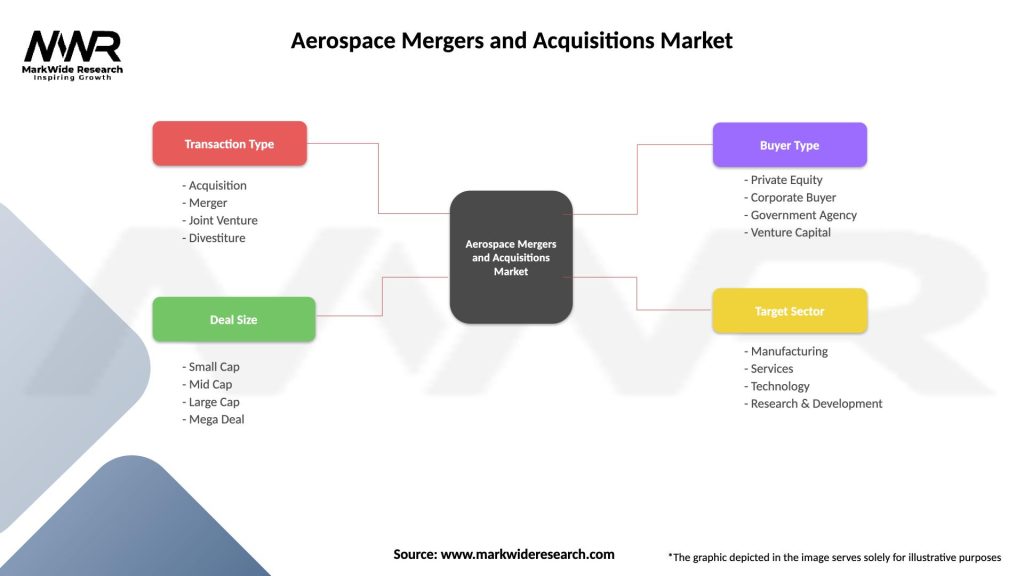

| Segmentation Details | Description |

|---|---|

| Transaction Type | Acquisition, Merger, Joint Venture, Divestiture |

| Deal Size | Small Cap, Mid Cap, Large Cap, Mega Deal |

| Buyer Type | Private Equity, Corporate Buyer, Government Agency, Venture Capital |

| Target Sector | Manufacturing, Services, Technology, Research & Development |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Aerospace Mergers and Acquisitions Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at