444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The aerospace engine blade market is a critical segment of the aerospace industry, providing essential components for aircraft engines. Engine blades play a pivotal role in the propulsion system, contributing to the performance, efficiency, and safety of aircraft. As the demand for air travel continues to grow, driven by factors such as increasing passenger traffic, fleet expansion, and technological advancements, the aerospace engine blade market is poised for significant growth.

Meaning:

Aerospace engine blades are specialized components designed to extract energy from the combustion process and convert it into thrust to propel an aircraft forward. These blades come in various forms, including fan blades, compressor blades, turbine blades, and rotor blades, each serving a specific function within the engine. Engine blades are typically made from advanced materials such as titanium, nickel-based superalloys, and composites to withstand high temperatures, pressures, and mechanical loads encountered during operation.

Executive Summary:

The aerospace engine blade market is experiencing robust growth due to increasing demand for commercial aircraft, military aviation modernization programs, and technological innovations in engine design. Manufacturers are investing in research and development to develop lighter, more durable, and higher-performing engine blades to meet the evolving needs of the aerospace industry. Key market players are focusing on enhancing manufacturing processes, optimizing material properties, and improving aerodynamic designs to gain a competitive edge in the market.

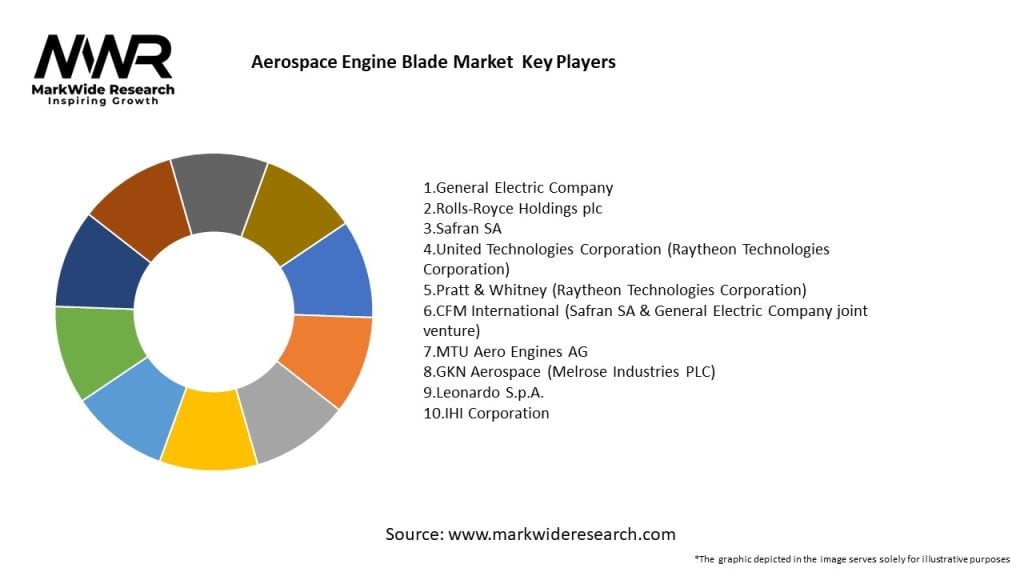

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The aerospace engine blade market operates in a dynamic environment shaped by technological advancements, market trends, regulatory changes, and competitive dynamics. Demand for engine blades is influenced by factors such as aircraft production rates, fleet modernization cycles, geopolitical events, and macroeconomic conditions. Continuous innovation, collaboration, and adaptation are essential for stakeholders to navigate market complexities, capitalize on growth opportunities, and sustain long-term success in the aerospace industry.

The aerospace engine blade market exhibits regional variations influenced by factors such as aircraft production hubs, engine manufacturing facilities, regulatory environments, and customer preferences. Major regions contributing to market growth include:

Competitive Landscape:

Leading Companies in the Aerospace Engine Blade Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The aerospace engine blade market can be segmented based on various factors, including:

Segmentation provides a structured approach to understanding market dynamics, customer needs, and competitive positioning within specific segments of the aerospace engine blade market.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Understanding these factors through a SWOT analysis helps aerospace engine blade manufacturers capitalize on strengths, address weaknesses, leverage opportunities, and mitigate threats to achieve sustainable growth and competitiveness in the market.

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has had a significant impact on the aerospace industry, including the aerospace engine blade market. Key effects include:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the aerospace engine blade market remains positive, driven by long-term trends such as increasing air travel demand, fleet expansion, technological innovation, and sustainability initiatives. While near-term challenges such as the Covid-19 pandemic and economic uncertainties may impact market dynamics, the aerospace industry is expected to recover gradually, supporting growth opportunities for engine blade manufacturers. Continued investment in research and development, strategic partnerships, and operational excellence will be key to unlocking the full potential of the aerospace engine blade market and achieving sustainable growth in the years to come.

Conclusion:

The aerospace engine blade market is a vital segment of the aerospace industry, providing essential components for aircraft propulsion systems. Engine blades play a critical role in enhancing engine performance, efficiency, and reliability, driving demand from commercial and military aviation sectors worldwide. Despite challenges such as market volatility, regulatory compliance, and supply chain disruptions, aerospace engine blade manufacturers are well-positioned to capitalize on opportunities arising from technological advancements, market trends, and customer requirements. By focusing on innovation, diversification, operational excellence, and customer-centric strategies, companies can navigate market complexities, achieve sustainable growth, and contribute to the advancement of the global aerospace industry.

What is Aerospace Engine Blade?

Aerospace engine blades are critical components of jet engines, designed to withstand extreme temperatures and pressures while providing thrust. They play a vital role in the efficiency and performance of aircraft engines.

What are the key players in the Aerospace Engine Blade Market?

Key players in the Aerospace Engine Blade Market include General Electric, Pratt & Whitney, Rolls-Royce, and Safran, among others. These companies are known for their advanced manufacturing techniques and innovative designs in aerospace engine technology.

What are the growth factors driving the Aerospace Engine Blade Market?

The growth of the Aerospace Engine Blade Market is driven by increasing air travel demand, advancements in engine technology, and the need for fuel-efficient engines. Additionally, the rise in military aircraft procurement contributes to market expansion.

What challenges does the Aerospace Engine Blade Market face?

The Aerospace Engine Blade Market faces challenges such as high manufacturing costs, stringent regulatory requirements, and the need for continuous innovation. These factors can hinder the development and production of new engine blade technologies.

What opportunities exist in the Aerospace Engine Blade Market?

Opportunities in the Aerospace Engine Blade Market include the development of lightweight materials, such as composites and advanced alloys, and the increasing focus on sustainable aviation practices. These trends can lead to more efficient and environmentally friendly engine designs.

What trends are shaping the Aerospace Engine Blade Market?

Trends in the Aerospace Engine Blade Market include the adoption of additive manufacturing techniques, which allow for complex geometries and reduced waste. Additionally, there is a growing emphasis on digital twin technology for performance monitoring and predictive maintenance.

Aerospace Engine Blade Market

| Segmentation Details | Description |

|---|---|

| Material | Nickel Alloys, Titanium Alloys, Steel, Composite Materials |

| Manufacturing Process | Forging, Casting, Additive Manufacturing, Machining |

| Application | Commercial Aviation, Military Aviation, Space Exploration, Unmanned Aerial Vehicles |

| Blade Type | Fan Blades, Compressor Blades, Turbine Blades, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Aerospace Engine Blade Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at