444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The aerospace and defense fiber optic cables market represents a critical segment within the advanced materials and communication infrastructure industry, serving the specialized needs of military, commercial aviation, and space exploration applications. This market encompasses high-performance optical fiber solutions designed to withstand extreme environmental conditions while delivering superior data transmission capabilities essential for modern aerospace and defense systems.

Market dynamics indicate robust growth driven by increasing demand for lightweight, high-bandwidth communication solutions in next-generation aircraft and defense platforms. The sector benefits from ongoing modernization programs across global defense forces and the commercial aviation industry’s push toward more connected, data-intensive operations. Growth rates in this specialized market segment consistently outpace traditional fiber optic applications, with the industry experiencing approximately 8.5% CAGR over recent years.

Technological advancement continues to shape market evolution, with manufacturers developing increasingly sophisticated fiber optic solutions that meet stringent aerospace and defense specifications. These cables must perform reliably in challenging environments including extreme temperatures, vibration, electromagnetic interference, and radiation exposure. The market serves diverse applications from avionics systems and flight control networks to military communications and satellite operations.

Regional distribution shows strong concentration in North America and Europe, reflecting the presence of major aerospace manufacturers and defense contractors. However, emerging markets in Asia-Pacific are gaining significance as countries expand their defense capabilities and commercial aviation sectors. The market’s specialized nature creates opportunities for companies that can deliver certified, high-reliability solutions meeting strict industry standards.

The aerospace and defense fiber optic cables market refers to the specialized segment focused on manufacturing, distributing, and implementing optical fiber communication solutions specifically designed for aerospace and military applications. These cables represent advanced communication infrastructure components engineered to meet the unique performance, reliability, and environmental requirements of aircraft, spacecraft, and defense systems.

Fiber optic technology in aerospace and defense applications involves the transmission of data through light signals within specially designed optical fibers, offering significant advantages over traditional copper-based communication systems. These solutions provide superior bandwidth capacity, electromagnetic immunity, and weight reduction benefits critical for modern aerospace platforms where every pound matters and communication reliability is paramount.

Market scope encompasses various cable types including single-mode and multi-mode fibers, tactical field cables, airborne communication systems, and specialized connectors and components. The sector serves multiple end-users including commercial airlines, military organizations, aerospace manufacturers, satellite operators, and defense contractors requiring high-performance communication solutions.

Strategic positioning within the global fiber optics industry places the aerospace and defense segment as a high-value, specialized market characterized by stringent quality requirements and long product lifecycles. The market demonstrates consistent growth patterns driven by increasing digitization of aerospace systems and growing defense spending across major economies.

Key growth drivers include the modernization of aging aircraft fleets, development of next-generation fighter jets and commercial aircraft, expansion of satellite communication networks, and increasing adoption of fly-by-wire systems. Approximately 72% of new aircraft programs now incorporate advanced fiber optic communication systems as standard equipment, reflecting the technology’s critical importance in modern aviation.

Market challenges center around the complex certification processes required for aerospace applications, high development costs, and the need for specialized manufacturing capabilities. However, these barriers also create competitive advantages for established players and limit market entry for unqualified competitors.

Competitive landscape features a mix of specialized aerospace suppliers and diversified technology companies, with market leadership often determined by certification capabilities, technical expertise, and established relationships with major aerospace and defense contractors. The market’s specialized nature supports premium pricing for qualified solutions.

Technology evolution continues driving market transformation with several key insights shaping industry development:

Application diversity spans multiple aerospace and defense sectors, with each segment presenting unique requirements and growth opportunities. The market’s technical complexity creates natural barriers to entry while rewarding companies that invest in specialized capabilities and certifications.

Modernization initiatives across global defense forces represent the primary driver for aerospace and defense fiber optic cables market growth. Military organizations worldwide are upgrading communication systems to support network-centric warfare capabilities, requiring advanced fiber optic solutions that can handle increased data loads while maintaining security and reliability standards.

Commercial aviation expansion continues driving demand as airlines seek to improve operational efficiency through enhanced connectivity and data analytics capabilities. Modern aircraft require sophisticated communication networks to support everything from passenger entertainment systems to real-time engine monitoring and predictive maintenance applications.

Next-generation aircraft programs incorporate fiber optic communication systems as fundamental design elements rather than add-on components. Programs such as advanced fighter jets, commercial aircraft, and unmanned aerial vehicles rely heavily on fiber optic networks for flight control, sensor data transmission, and communication systems.

Space exploration activities generate increasing demand for specialized fiber optic solutions capable of operating in the harsh environment of space. Satellite communication systems, space stations, and interplanetary missions require ultra-reliable optical communication systems that can function for extended periods without maintenance.

Regulatory requirements for improved aircraft safety and communication capabilities drive adoption of advanced fiber optic systems. Aviation authorities worldwide are implementing stricter requirements for aircraft communication and monitoring systems, creating mandatory demand for qualified fiber optic solutions.

Certification complexity represents a significant market restraint, as aerospace and defense fiber optic cables must undergo extensive testing and qualification processes before approval for use in critical applications. These certification requirements can take several years and require substantial investment, limiting the ability of new entrants to compete effectively.

High development costs associated with creating aerospace-grade fiber optic solutions create barriers for market participation. The specialized materials, manufacturing processes, and testing requirements necessary to meet aerospace standards result in significantly higher costs compared to commercial fiber optic products.

Limited supplier base for qualified components and materials creates supply chain vulnerabilities and potential bottlenecks. The specialized nature of aerospace and defense applications requires suppliers with specific certifications and capabilities, limiting sourcing options for manufacturers.

Long product lifecycles in aerospace applications can limit market growth as aircraft and defense systems often remain in service for decades. Once fiber optic systems are installed and certified, replacement cycles may extend 20-30 years, reducing recurring demand opportunities.

Technical complexity of integrating fiber optic systems into existing aircraft and defense platforms presents ongoing challenges. Retrofit applications require specialized engineering solutions and extensive testing to ensure compatibility with legacy systems.

Emerging technologies create substantial opportunities for aerospace and defense fiber optic cables market expansion. The integration of artificial intelligence, machine learning, and advanced sensor systems in aerospace applications requires high-bandwidth communication networks that fiber optic solutions can uniquely provide.

Unmanned systems growth presents significant market opportunities as military and commercial operators increasingly deploy unmanned aerial vehicles, autonomous aircraft, and robotic systems. These platforms require lightweight, high-performance communication systems where fiber optic cables offer distinct advantages.

Space commercialization opens new market segments as private companies expand satellite constellations, space tourism, and commercial space stations. According to MarkWide Research analysis, commercial space activities are driving approximately 15% annual growth in specialized fiber optic cable demand.

International market expansion offers growth opportunities as emerging economies invest in defense modernization and commercial aviation infrastructure. Countries in Asia-Pacific, Middle East, and Latin America are expanding their aerospace capabilities, creating demand for advanced communication systems.

Retrofit and upgrade programs for existing aircraft fleets provide ongoing market opportunities. As operators seek to extend aircraft service life and improve capabilities, fiber optic system upgrades offer attractive return on investment through improved efficiency and reduced maintenance costs.

Supply chain dynamics in the aerospace and defense fiber optic cables market reflect the specialized nature of the industry, with limited qualified suppliers and long lead times for critical components. Manufacturers must maintain close relationships with certified material suppliers and invest in specialized production capabilities to meet market demands.

Technology advancement continues reshaping market dynamics as manufacturers develop new fiber optic solutions with enhanced performance characteristics. Recent innovations include radiation-hardened fibers for space applications, ultra-lightweight cables for aircraft weight reduction, and high-temperature resistant solutions for engine compartment installations.

Customer relationships play a critical role in market dynamics, with long-term partnerships between fiber optic suppliers and aerospace manufacturers being essential for success. These relationships often span multiple aircraft programs and require ongoing technical support and product development collaboration.

Regulatory environment significantly influences market dynamics through certification requirements, safety standards, and export controls. Changes in regulations can create new opportunities or challenges for market participants, requiring continuous monitoring and adaptation of business strategies.

Competitive intensity remains moderate due to high barriers to entry and specialized market requirements. However, competition for major aircraft programs can be intense, with suppliers investing heavily in research and development to maintain technological leadership and secure design wins.

Primary research methodologies employed in analyzing the aerospace and defense fiber optic cables market include comprehensive interviews with industry executives, technical specialists, and procurement managers across major aerospace and defense organizations. These discussions provide insights into current market trends, technology requirements, and future development priorities.

Secondary research encompasses analysis of industry reports, technical publications, patent filings, and regulatory documents to understand market structure, competitive positioning, and technology evolution. Government procurement data and defense spending analyses provide additional market sizing and trend information.

Market modeling techniques incorporate multiple data sources to develop comprehensive market assessments, including bottom-up analysis of aircraft production forecasts, defense spending trends, and technology adoption rates. Cross-validation of findings ensures accuracy and reliability of market projections.

Expert validation processes involve consultation with industry specialists, technical experts, and market participants to verify research findings and validate market assumptions. This approach ensures that analysis reflects current market realities and emerging trends accurately.

Data triangulation methods combine quantitative and qualitative research approaches to provide comprehensive market understanding. Multiple research methodologies are employed to ensure robust analysis and minimize potential biases in market assessment.

North America dominates the aerospace and defense fiber optic cables market, accounting for approximately 45% market share globally. The region benefits from the presence of major aerospace manufacturers, significant defense spending, and advanced technology development capabilities. The United States leads regional demand through military modernization programs and commercial aircraft production.

Europe represents the second-largest market region with approximately 30% market share, driven by strong aerospace manufacturing capabilities and defense cooperation programs. Countries including France, Germany, and the United Kingdom maintain significant aerospace industries requiring advanced fiber optic communication solutions.

Asia-Pacific emerges as the fastest-growing regional market, experiencing growth rates exceeding 12% annually as countries expand defense capabilities and commercial aviation sectors. China, India, Japan, and South Korea are investing heavily in aerospace infrastructure and domestic manufacturing capabilities.

Middle East and Africa present growing opportunities driven by defense modernization programs and expanding commercial aviation sectors. Countries in this region are upgrading military capabilities and expanding airline operations, creating demand for advanced communication systems.

Latin America shows moderate growth potential as countries modernize defense forces and expand commercial aviation infrastructure. Brazil and Mexico lead regional demand through domestic aerospace programs and military modernization initiatives.

Market leadership in the aerospace and defense fiber optic cables sector is characterized by companies with specialized technical capabilities, extensive certification portfolios, and established relationships with major aerospace and defense contractors. The competitive landscape includes both dedicated aerospace suppliers and diversified technology companies.

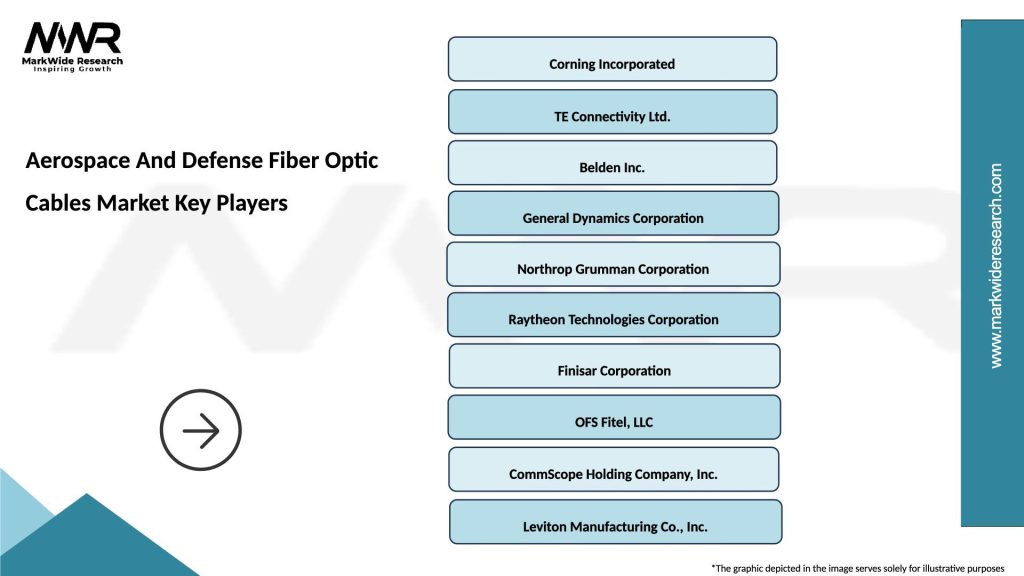

Key market participants include:

Competitive strategies focus on technology innovation, certification maintenance, strategic partnerships, and geographic expansion. Companies invest heavily in research and development to maintain technological leadership and meet evolving customer requirements.

By Cable Type:

By Application:

By End-User:

Single-mode fiber cables represent the premium segment of the aerospace and defense fiber optic cables market, offering superior performance for long-distance communication applications. These solutions are particularly important for large aircraft and satellite communication systems where signal integrity over extended distances is critical.

Multi-mode fiber cables serve the largest volume segment, providing cost-effective solutions for shorter-distance, high-bandwidth applications within aircraft and ground systems. This category benefits from standardization efforts and economies of scale in manufacturing.

Tactical fiber cables address specialized military requirements for field-deployable communication systems. These ruggedized solutions must withstand harsh environmental conditions while providing reliable communication capabilities for military operations.

Airborne applications drive the highest growth rates within the market, as aircraft manufacturers increasingly adopt fiber optic solutions for weight reduction and performance improvement. Modern aircraft programs incorporate fiber optic networks as fundamental design elements.

Space applications represent the most technically demanding segment, requiring fiber optic cables capable of operating in extreme radiation and temperature environments. This category commands premium pricing due to specialized requirements and limited supplier base.

Aerospace manufacturers benefit from fiber optic cable adoption through significant weight reduction, improved system reliability, and enhanced performance capabilities. These advantages translate to improved fuel efficiency, increased payload capacity, and reduced maintenance requirements for aircraft operators.

Defense contractors gain competitive advantages through fiber optic system integration, offering superior communication capabilities, electromagnetic immunity, and enhanced security features. These benefits are critical for winning contracts and meeting stringent military requirements.

Airlines and operators realize operational benefits including reduced fuel consumption, lower maintenance costs, and improved passenger connectivity. Fiber optic systems enable advanced analytics and predictive maintenance capabilities that optimize fleet operations.

Military organizations achieve enhanced operational capabilities through improved communication systems, better situational awareness, and increased mission effectiveness. Fiber optic networks support network-centric warfare concepts and advanced weapon systems.

Technology suppliers benefit from premium pricing opportunities, long-term customer relationships, and stable demand patterns. The specialized nature of aerospace and defense applications creates sustainable competitive advantages for qualified suppliers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization trends drive development of increasingly compact fiber optic cable solutions that maintain performance while reducing size and weight. This trend supports integration into space-constrained aircraft and unmanned systems where every cubic inch matters.

Integration complexity increases as fiber optic systems become more sophisticated and interconnected. Modern aircraft require seamless integration between multiple fiber optic networks supporting different functions, creating opportunities for system-level suppliers.

Artificial intelligence integration creates new requirements for high-bandwidth communication systems capable of supporting real-time data processing and machine learning applications. Fiber optic networks enable the data transmission speeds necessary for AI-powered aerospace systems.

Sustainability focus influences material selection and manufacturing processes as aerospace companies prioritize environmental responsibility. Fiber optic cables support sustainability goals through weight reduction and improved fuel efficiency.

Cybersecurity emphasis drives adoption of fiber optic solutions due to their inherent security advantages over electrical communication systems. The difficulty of intercepting optical signals makes fiber optic networks attractive for sensitive defense applications.

Technology partnerships between fiber optic suppliers and aerospace manufacturers continue expanding as companies collaborate on next-generation aircraft programs. These partnerships enable co-development of optimized solutions and ensure early design integration.

Manufacturing investments in specialized production capabilities reflect growing market confidence and demand projections. Companies are expanding aerospace-qualified manufacturing capacity to support anticipated growth in aircraft production and defense spending.

Certification achievements for new fiber optic cable products enable market entry and competitive positioning. Recent certifications for space-qualified and high-temperature resistant cables open new application opportunities.

Merger and acquisition activity consolidates market capabilities as companies seek to expand technical expertise and customer relationships. Strategic acquisitions enable rapid market entry and capability enhancement for established players.

Research initiatives focus on developing next-generation fiber optic technologies including radiation-hardened fibers, ultra-lightweight cables, and enhanced connector systems. These developments support future aerospace and defense requirements.

Investment priorities should focus on developing specialized capabilities that address emerging aerospace and defense requirements. Companies should prioritize research and development in areas such as space-qualified solutions, ultra-lightweight cables, and high-temperature resistant products.

Partnership strategies with major aerospace manufacturers provide the most effective path to market success. MWR analysis suggests that companies with established design partnerships achieve approximately 60% higher success rates in winning production contracts compared to those relying solely on competitive bidding.

Geographic expansion into emerging markets offers significant growth opportunities, particularly in Asia-Pacific where defense spending and commercial aviation are expanding rapidly. Companies should establish local partnerships and manufacturing capabilities to serve these growing markets effectively.

Technology diversification beyond traditional fiber optic cables into complete system solutions provides opportunities for higher value capture and stronger customer relationships. Integration capabilities become increasingly important as aircraft systems become more complex.

Supply chain resilience requires investment in alternative sourcing strategies and strategic inventory management. Companies should develop relationships with multiple qualified suppliers and maintain appropriate inventory levels to ensure delivery reliability.

Market trajectory indicates continued strong growth driven by ongoing aerospace modernization programs and increasing adoption of advanced communication systems. The market is expected to maintain growth rates exceeding 8% annually over the next decade, supported by both commercial and defense sector demand.

Technology evolution will continue driving market development as manufacturers develop increasingly sophisticated fiber optic solutions. Future innovations are expected to focus on enhanced environmental resistance, improved performance characteristics, and integration with emerging technologies such as artificial intelligence and quantum communication.

Application expansion into new aerospace and defense segments will create additional growth opportunities. Emerging applications in space tourism, commercial space stations, and advanced unmanned systems will drive demand for specialized fiber optic solutions.

Market consolidation is likely to continue as companies seek to achieve scale advantages and expand technical capabilities. Strategic partnerships and acquisitions will shape the competitive landscape as the market matures and requirements become more sophisticated.

Regional dynamics will shift as emerging markets develop domestic aerospace capabilities and increase defense spending. Asia-Pacific markets are expected to achieve the highest growth rates, while established markets in North America and Europe will focus on technology advancement and system upgrades.

The aerospace and defense fiber optic cables market represents a specialized but critical segment of the global fiber optics industry, characterized by stringent technical requirements, premium pricing opportunities, and stable long-term growth prospects. The market’s unique combination of technical challenges and performance requirements creates sustainable competitive advantages for qualified suppliers while limiting competition from unqualified entrants.

Growth drivers including defense modernization, commercial aviation expansion, and space commercialization provide strong foundation for continued market development. The increasing sophistication of aerospace systems and growing emphasis on connectivity and data analytics ensure ongoing demand for advanced fiber optic communication solutions.

Success factors in this market center on technical expertise, certification capabilities, and established customer relationships rather than cost competition alone. Companies that invest in specialized capabilities and maintain close partnerships with aerospace manufacturers are best positioned to capitalize on market opportunities and achieve sustainable growth in this demanding but rewarding sector.

What is Aerospace And Defense Fiber Optic Cables?

Aerospace And Defense Fiber Optic Cables are specialized cables designed for high-performance communication and data transmission in aerospace and defense applications. They are known for their lightweight, durability, and resistance to electromagnetic interference, making them ideal for use in aircraft, satellites, and military systems.

What are the key players in the Aerospace And Defense Fiber Optic Cables Market?

Key players in the Aerospace And Defense Fiber Optic Cables Market include companies like TE Connectivity, Corning Incorporated, and Molex, which provide advanced fiber optic solutions for various aerospace and defense applications, among others.

What are the growth factors driving the Aerospace And Defense Fiber Optic Cables Market?

The growth of the Aerospace And Defense Fiber Optic Cables Market is driven by the increasing demand for high-speed data transmission, advancements in fiber optic technology, and the rising need for secure communication systems in military operations.

What challenges does the Aerospace And Defense Fiber Optic Cables Market face?

Challenges in the Aerospace And Defense Fiber Optic Cables Market include the high cost of fiber optic installation, the complexity of integration with existing systems, and stringent regulatory requirements that can hinder market growth.

What opportunities exist in the Aerospace And Defense Fiber Optic Cables Market?

Opportunities in the Aerospace And Defense Fiber Optic Cables Market include the growing trend of modernization in military communication systems, the expansion of satellite networks, and the increasing adoption of fiber optics in unmanned aerial vehicles (UAVs).

What trends are shaping the Aerospace And Defense Fiber Optic Cables Market?

Trends in the Aerospace And Defense Fiber Optic Cables Market include the development of ruggedized fiber optic cables for harsh environments, the integration of fiber optics with advanced avionics systems, and the push towards more sustainable and energy-efficient communication solutions.

Aerospace And Defense Fiber Optic Cables Market

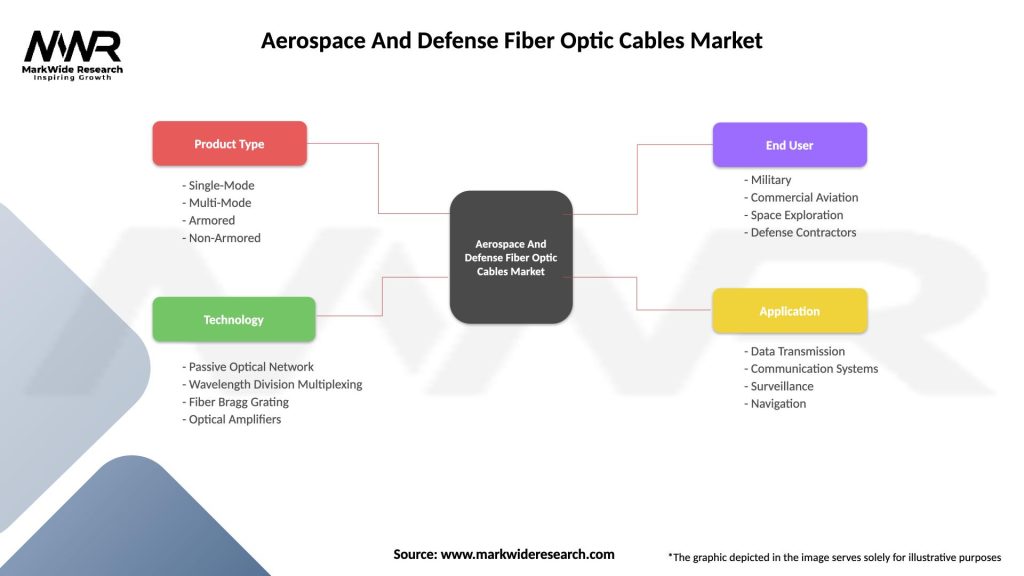

| Segmentation Details | Description |

|---|---|

| Product Type | Single-Mode, Multi-Mode, Armored, Non-Armored |

| Technology | Passive Optical Network, Wavelength Division Multiplexing, Fiber Bragg Grating, Optical Amplifiers |

| End User | Military, Commercial Aviation, Space Exploration, Defense Contractors |

| Application | Data Transmission, Communication Systems, Surveillance, Navigation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Aerospace And Defense Fiber Optic Cables Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at