444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Aerospace and Defense C-class Parts Market is a crucial segment within the broader aerospace and defense industry. C-class parts refer to the low-cost components and consumables that are essential for the operation of aerospace and defense equipment. These parts include fasteners, connectors, bearings, adhesives, seals, and other small components that are necessary for the smooth functioning of aircraft, missiles, ships, and other defense systems.

The demand for C-class parts in the aerospace and defense sector is driven by the need to maintain and repair existing equipment, as well as to support new production and development projects. The market for C-class parts is characterized by its scale and diversity, with a wide range of suppliers catering to the specific requirements of various aerospace and defense manufacturers.

Meaning

C-class parts are critical to the functioning and safety of aerospace and defense equipment. Despite their small size and relatively low cost compared to major components, these parts play a significant role in the overall performance and reliability of the systems they are integrated into. Without the proper functioning of C-class parts, the overall operational efficiency of aerospace and defense equipment can be compromised, leading to potential safety risks and increased maintenance costs.

Executive Summary

The Aerospace and Defense C-class Parts Market is witnessing steady growth due to the continuous demand for maintenance, repair, and operations (MRO) activities in the aerospace and defense sector. The market is characterized by intense competition among suppliers, technological advancements, and increasing government investments in defense modernization programs. Key players in the market are focusing on strategic partnerships, mergers and acquisitions, and product innovations to gain a competitive edge.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The Aerospace and Defense C-class Parts Market is driven by several key factors:

Market Restraints

Despite the positive outlook, the Aerospace and Defense C-class Parts Market faces certain challenges:

Market Opportunities

The Aerospace and Defense C-class Parts Market presents several opportunities for industry participants:

Market Dynamics

The Aerospace and Defense C-class Parts Market is characterized by dynamic trends and factors that influence its growth and evolution. Key dynamics include:

Regional Analysis

The Aerospace and Defense C-class Parts Market exhibits regional variations in terms of demand, supply chain dynamics, and competitive landscape. The key regions analyzed in this market are:

Each region presents unique opportunities and challenges for C-class parts suppliers, and understanding the regional dynamics is crucial for market participants to formulate effective strategies.

Competitive Landscape

Leading Companies in Aerospace and Defense C-class Parts Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

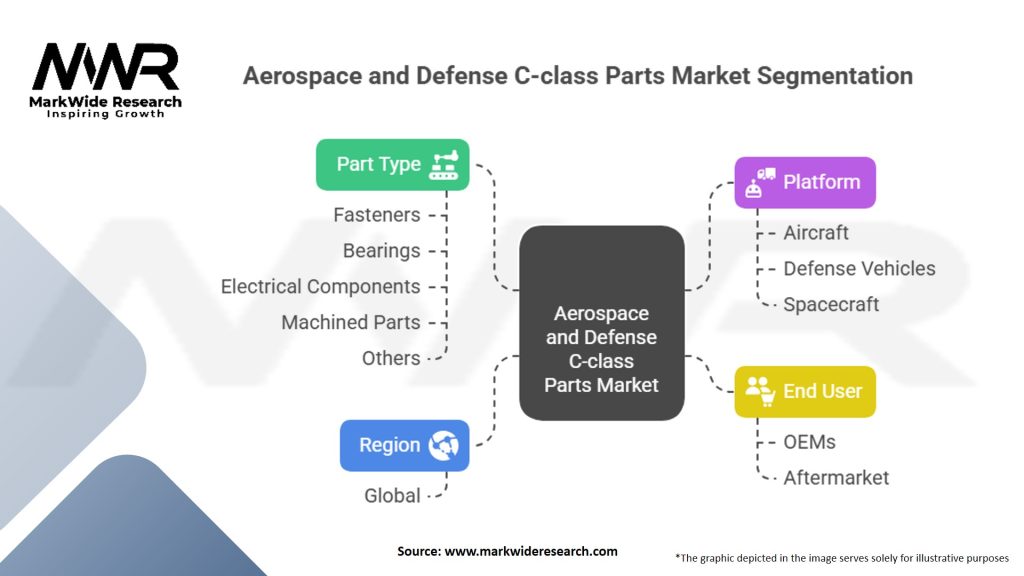

Segmentation

The Aerospace and Defense C-class Parts Market can be segmented based on various parameters:

Segmenting the market helps in understanding the specific needs and trends within each segment and enables suppliers to tailor their offerings accordingly.

Category-wise Insights

Each category of C-class parts presents unique opportunities and challenges, and suppliers need to understand the specific requirements and industry standards associated with each category to succeed in the market.

Key Benefits for Industry Participants and Stakeholders

The Aerospace and Defense C-class Parts Market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the Aerospace and Defense C-class Parts Market provides a comprehensive understanding of the market’s internal and external factors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding the strengths, weaknesses, opportunities, and threats helps market participants formulate effective strategies to leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats.

Market Key Trends

The Aerospace and Defense C-class Parts Market is influenced by several key trends:

These key trends shape the market landscape and provide opportunities for suppliers to innovate, differentiate, and stay ahead of the competition.

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Aerospace and Defense C-class Parts Market. The aerospace industry experienced a severe downturn as travel restrictions, lockdown measures, and reduced passenger demand resulted in a decline in commercial aviation activities. This led to a decrease in new aircraft orders and a slowdown in MRO activities, affecting the demand for C-class parts.

However, the defense sector proved to be more resilient during the pandemic, with governments worldwide continuing their defense modernization programs and procurement activities. The defense sector’s stability helped mitigate the impact on the C-class parts market to some extent.

Suppliers faced challenges such as supply chain disruptions, manufacturing delays, and reduced cash flow during the pandemic. However, companies that adapted quickly to the changing market conditions, implemented cost optimization measures, and focused on customer support were able to navigate the crisis more effectively.

As the global economy recovers and travel restrictions ease, the commercial aviation sector is expected to gradually rebound, leading to a resurgence in demand for C-class parts. The defense sector is also anticipated to continue its growth trajectory, driven by geopolitical uncertainties and the need for modernizing military capabilities.

Key Industry Developments

These industry developments indicate a shift towards advanced technologies, sustainability, and collaborative approaches, shaping the future of the Aerospace and Defense C-class Parts Market.

Analyst Suggestions

Based on the analysis of the Aerospace and Defense C-class Parts Market, analysts suggest the following strategies for industry participants:

Future Outlook

The Aerospace and Defense C-class Parts Market is poised for steady growth in the coming years. The market’s recovery from the impact of the Covid-19 pandemic, coupled with the increasing demand for modern aircraft, defense systems, and sustainable practices, will drive the market’s growth.

Technological advancements, such as additive manufacturing, lightweight materials, and connectivity, will continue to shape the development and production of C-class parts, leading to improved performance, efficiency, and reliability.

The industry’s focus on sustainability will further drive the adoption of eco-friendly solutions and practices, pushing suppliers to innovate and differentiate through sustainable offerings.

Strategic partnerships, collaborations, and digitalization will be key drivers for success in the market, enabling suppliers to offer integrated solutions, enhance operational efficiency, and deliver value-added services.

While challenges such as pricing pressures, supply chain disruptions, and regulatory compliance will persist, market participants who adapt to changing market dynamics, invest in innovation, and prioritize customer relationships will be well-positioned to capitalize on the opportunities in the Aerospace and Defense C-class Parts Market.

Conclusion

The Aerospace and Defense C-class Parts Market presents significant opportunities for suppliers in various product categories, including fasteners, connectors, bearings, adhesives, and seals. The market’s growth is driven by the continuous demand for maintenance, repair, and operations in the aerospace and defense sector.

Understanding market dynamics, regional variations, and customer requirements is crucial for suppliers to formulate effective strategies. Building strong customer relationships, focusing on quality and reliability, investing in innovation and sustainability, and embracing digitalization are key success factors in the market.

Despite challenges and the impact of the Covid-19 pandemic, the Aerospace and Defense C-class Parts Market is expected to recover and witness steady growth. Suppliers that can adapt to changing market conditions, leverage technological advancements, and deliver value-added solutions will thrive in this competitive market.

What is Aerospace and Defense C-class Parts?

Aerospace and Defense C-class Parts refer to the components that are essential for the functioning of aerospace and defense systems but are typically lower in cost and complexity compared to A-class and B-class parts. These parts include fasteners, nuts, bolts, and other hardware that play a critical role in assembly and maintenance.

What are the key players in the Aerospace and Defense C-class Parts Market?

Key players in the Aerospace and Defense C-class Parts Market include companies like Boeing, Lockheed Martin, and Northrop Grumman, which are known for their extensive supply chains and manufacturing capabilities. Other notable companies include Honeywell and Raytheon Technologies, among others.

What are the main drivers of growth in the Aerospace and Defense C-class Parts Market?

The growth of the Aerospace and Defense C-class Parts Market is driven by increasing defense budgets, rising demand for commercial aircraft, and advancements in manufacturing technologies. Additionally, the need for maintenance, repair, and overhaul (MRO) services in the aerospace sector contributes to market expansion.

What challenges does the Aerospace and Defense C-class Parts Market face?

The Aerospace and Defense C-class Parts Market faces challenges such as stringent regulatory requirements, supply chain disruptions, and the need for high-quality standards. Additionally, the increasing complexity of aerospace systems can complicate the sourcing and integration of C-class parts.

What opportunities exist in the Aerospace and Defense C-class Parts Market?

Opportunities in the Aerospace and Defense C-class Parts Market include the growing trend towards automation in manufacturing, the rise of additive manufacturing technologies, and the increasing focus on sustainability. These factors can lead to innovative solutions and improved efficiency in part production.

What trends are shaping the Aerospace and Defense C-class Parts Market?

Trends shaping the Aerospace and Defense C-class Parts Market include the adoption of digital technologies for inventory management, the shift towards lightweight materials, and the integration of smart technologies in parts. These trends are enhancing operational efficiency and reducing costs in the aerospace and defense sectors.

Aerospace and Defense C-class Parts Market

| Segmentation Details | Description |

|---|---|

| Part Type | Fasteners, Bearings, Electrical Components, Machined Parts, Others |

| Platform | Aircraft, Defense Vehicles, Spacecraft |

| End User | OEMs, Aftermarket |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Aerospace and Defense C-class Parts Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at