444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The aerospace and automotive MRAM (Magnetoresistive Random Access Memory) market represents a crucial intersection of two industries reliant on high-performance computing solutions. MRAM technology offers non-volatile memory capabilities, low power consumption, and radiation resistance, making it ideal for applications in aerospace and automotive systems where reliability, durability, and data integrity are paramount.

Meaning

MRAM is a type of non-volatile memory that utilizes magnetic fields to store data. Unlike traditional volatile memories like RAM, MRAM retains data even when power is turned off. This makes MRAM suitable for applications requiring fast access times, low power consumption, and high reliability, such as aerospace and automotive systems.

Executive Summary

The aerospace and automotive MRAM market is experiencing steady growth, driven by increasing demand for reliable, high-performance computing solutions in both industries. MRAM technology offers significant advantages over traditional memory technologies, including fast read/write speeds, low power consumption, and resistance to radiation and extreme temperatures. As aerospace and automotive systems become increasingly reliant on data-driven technologies, the adoption of MRAM is expected to rise, presenting lucrative opportunities for industry participants.

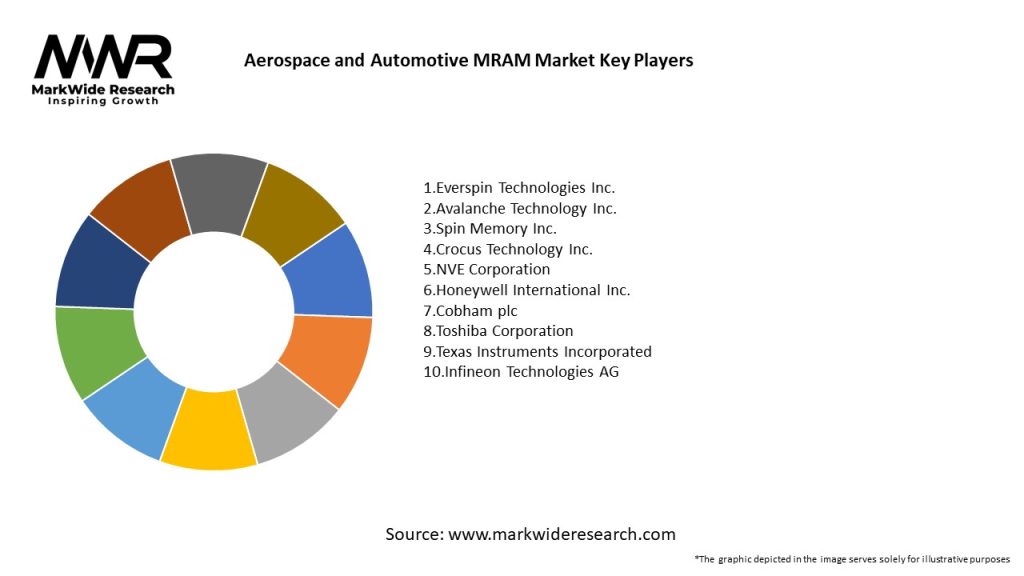

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The aerospace and automotive MRAM market operates within a dynamic landscape shaped by technological advancements, market trends, regulatory developments, and competitive dynamics. Understanding these market dynamics is essential for industry participants to identify opportunities, mitigate risks, and formulate effective strategies to capitalize on the growing demand for MRAM in aerospace and automotive applications.

Regional Analysis

The aerospace and automotive MRAM market exhibits regional variations driven by factors such as technological innovation, industry regulations, market demand, and competitive landscape. Key regions influencing market growth and adoption include:

Competitive Landscape

Leading Companies in the Aerospace and Automotive MRAM Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The aerospace and automotive MRAM market can be segmented based on various factors, including:

Segmentation enables a detailed analysis of market trends, demand dynamics, and growth opportunities within specific market segments, allowing industry participants to tailor their strategies and offerings to meet customer requirements effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the aerospace and automotive MRAM market, with both challenges and opportunities emerging in the wake of the global crisis. Key impacts of Covid-19 on the market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The aerospace and automotive MRAM market is poised for significant growth and innovation, driven by the increasing adoption of data-intensive applications, autonomous technologies, and electrification trends in both industries. Despite challenges such as cost constraints, technical limitations, and regulatory hurdles, MRAM technology holds immense potential to revolutionize aerospace and automotive computing, enabling safer, smarter, and more efficient transportation solutions in the future.

Conclusion

The aerospace and automotive MRAM market represents a dynamic and evolving landscape driven by technological innovation, market trends, regulatory requirements, and competitive dynamics. MRAM technology offers unparalleled advantages in terms of reliability, performance, and durability for aerospace and automotive applications, making it an indispensable component of next-generation computing solutions. As industry stakeholders continue to invest in R&D, collaborate on technology development, and address market challenges, the future outlook for MRAM in aerospace and automotive sectors remains promising, paving the way for safer, smarter, and more connected transportation systems in the years to come.

What is Aerospace and Automotive MRAM?

Aerospace and Automotive MRAM refers to Magnetoresistive Random Access Memory technology specifically designed for applications in the aerospace and automotive sectors. This type of memory is known for its non-volatility, high speed, and durability under extreme conditions.

What are the key players in the Aerospace and Automotive MRAM Market?

Key players in the Aerospace and Automotive MRAM Market include companies like Everspin Technologies, Intel Corporation, and Micron Technology, among others. These companies are involved in the development and production of MRAM solutions tailored for high-reliability applications.

What are the growth factors driving the Aerospace and Automotive MRAM Market?

The growth of the Aerospace and Automotive MRAM Market is driven by the increasing demand for high-performance memory solutions in advanced automotive systems and aerospace applications. Factors such as the rise of electric vehicles and the need for reliable data storage in avionics are also contributing to market expansion.

What challenges does the Aerospace and Automotive MRAM Market face?

The Aerospace and Automotive MRAM Market faces challenges such as high manufacturing costs and competition from alternative memory technologies like Flash and DRAM. Additionally, the need for stringent compliance with safety and reliability standards in aerospace applications can hinder market growth.

What opportunities exist in the Aerospace and Automotive MRAM Market?

Opportunities in the Aerospace and Automotive MRAM Market include the growing trend towards automation and smart technologies in vehicles, as well as advancements in aerospace systems. The increasing focus on energy efficiency and performance in both sectors presents significant potential for MRAM adoption.

What trends are shaping the Aerospace and Automotive MRAM Market?

Trends shaping the Aerospace and Automotive MRAM Market include the integration of MRAM in next-generation automotive electronics and the development of hybrid memory solutions. Additionally, the push for more robust and reliable memory systems in aerospace applications is driving innovation in MRAM technology.

Aerospace and Automotive MRAM Market

| Segmentation Details | Description |

|---|---|

| Product Type | Embedded MRAM, Standalone MRAM, Hybrid MRAM, Multi-Die MRAM |

| Application | Aerospace Systems, Automotive Electronics, Industrial Automation, Consumer Electronics |

| End User | Aerospace Manufacturers, Automotive OEMs, Electronics Suppliers, Research Institutions |

| Technology | Spintronics, CMOS Integration, 3D Integration, Advanced Packaging |

Leading Companies in the Aerospace and Automotive MRAM Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at