444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The aerial mapping and surveying sensor system market is pivotal in providing accurate and detailed geospatial data for various applications such as urban planning, infrastructure development, environmental monitoring, and disaster management. These systems encompass a wide range of sensors, including LiDAR, photogrammetry cameras, hyperspectral imagers, and radar, mounted on aerial platforms such as drones, fixed-wing aircraft, and helicopters. As demand for high-resolution geospatial data continues to rise across industries, the aerial mapping and surveying sensor system market plays a crucial role in enabling efficient and cost-effective data collection for informed decision-making.

Meaning:

Aerial mapping and surveying sensor systems refer to the integrated set of sensors, instruments, and platforms used to capture, process, and analyze geospatial data from aerial perspectives. These systems employ various sensing technologies, including LiDAR, photogrammetry, multispectral imaging, and radar, to collect data on terrain elevation, land cover, infrastructure, and environmental conditions. Aerial mapping and surveying sensor systems are essential for generating accurate and up-to-date maps, 3D models, and spatial datasets used in diverse applications such as urban planning, agriculture, forestry, and disaster response.

Executive Summary:

The aerial mapping and surveying sensor system market is experiencing robust growth driven by increasing demand for geospatial data across industries, advancements in sensor technology, and growing adoption of unmanned aerial vehicles (UAVs) for aerial surveying applications. Key market players are focusing on developing innovative sensor systems capable of capturing high-resolution data with enhanced accuracy and efficiency. However, challenges such as regulatory constraints, privacy concerns, and data processing complexities remain significant barriers to market expansion. To capitalize on growth opportunities and overcome industry challenges, companies are investing in research and development (R&D), forging strategic partnerships, and expanding their product portfolios to cater to evolving customer needs.

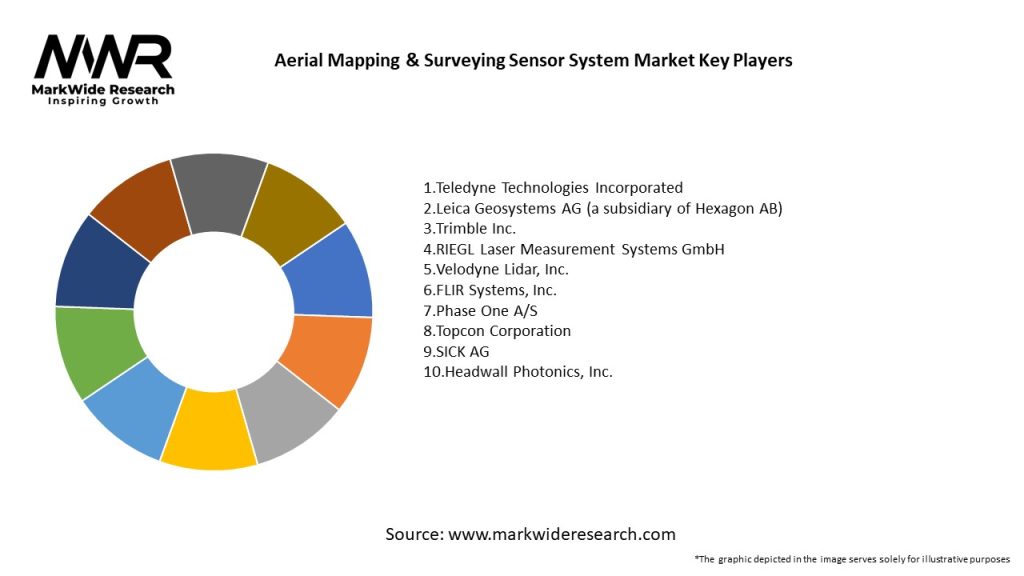

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The aerial mapping and surveying sensor system market operates in a dynamic environment influenced by technological innovations, market trends, regulatory developments, and macroeconomic factors. Companies in the market must adapt to changing market dynamics, anticipate customer needs, and leverage strategic partnerships and collaborations to stay competitive and capitalize on growth opportunities.

Regional Analysis:

The aerial mapping and surveying sensor system market exhibits regional variations in terms of market size, growth potential, and adoption rates. Key regions driving market growth include:

Competitive Landscape:

Leading Companies in the Aerial Mapping and Surveying Sensor System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

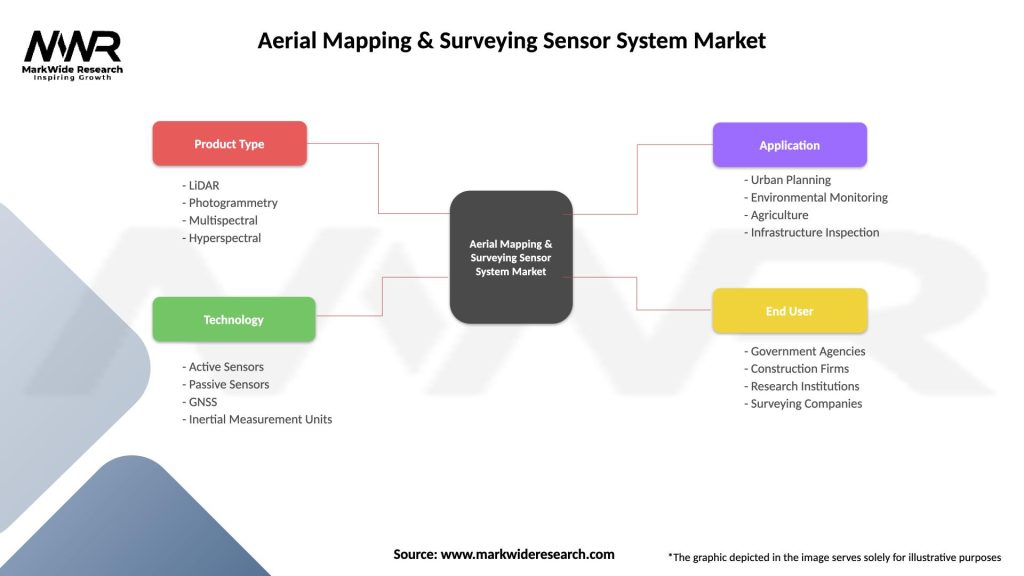

Segmentation:

The aerial mapping and surveying sensor system market can be segmented based on various factors, including:

Segmentation provides insights into market dynamics, customer preferences, and growth opportunities, enabling companies to tailor their strategies and offerings to specific market segments and applications.

Category-wise Insights:

Understanding category-wise insights helps companies identify market trends, technological advancements, and customer preferences within specific sensor categories, enabling them to develop targeted products and solutions.

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the aerial mapping and surveying sensor system market:

Understanding these factors helps companies formulate strategic plans, mitigate risks, and capitalize on market opportunities to maintain a competitive edge in the aerial mapping and surveying sensor system market.

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has had both positive and negative impacts on the aerial mapping and surveying sensor system market:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the aerial mapping and surveying sensor system market is optimistic, with continued growth expected driven by technological advancements, expanding applications, and increasing demand for geospatial intelligence across industries. Key trends such as miniaturization, multi-sensor fusion, automation, and cloud-based solutions will shape the market landscape, offering opportunities for innovation, differentiation, and market expansion. However, challenges such as regulatory complexity, data privacy concerns, and economic uncertainties may present barriers to market growth. Companies that adapt to market dynamics, anticipate customer needs, and leverage emerging technologies will be well-positioned to succeed in the evolving aerial mapping and surveying sensor system market.

Conclusion:

In conclusion, the aerial mapping and surveying sensor system market plays a pivotal role in providing accurate and timely geospatial data for a wide range of applications, spanning urban planning, agriculture, infrastructure development, and disaster management. Despite challenges such as regulatory constraints, data processing complexities, and economic uncertainties, the market is witnessing robust growth driven by technological advancements, expanding applications, and increasing demand for geospatial intelligence. Companies that invest in innovation, address regulatory challenges, and focus on sustainability will be well-positioned to capitalize on growth opportunities and maintain a competitive edge in the dynamic aerial mapping and surveying sensor system market.

What is Aerial Mapping & Surveying Sensor System?

Aerial Mapping & Surveying Sensor System refers to technologies and equipment used to capture data from aerial platforms for mapping and surveying purposes. This includes various sensors such as LiDAR, photogrammetry cameras, and multispectral sensors that provide detailed geographic information.

What are the key companies in the Aerial Mapping & Surveying Sensor System Market?

Key companies in the Aerial Mapping & Surveying Sensor System Market include DJI, Hexagon AB, and Trimble Inc., which are known for their innovative solutions in aerial data collection and processing, among others.

What are the drivers of growth in the Aerial Mapping & Surveying Sensor System Market?

The growth of the Aerial Mapping & Surveying Sensor System Market is driven by the increasing demand for accurate geographic data in industries such as construction, agriculture, and environmental monitoring. Advancements in sensor technology and the rising adoption of drones for surveying are also significant factors.

What challenges does the Aerial Mapping & Surveying Sensor System Market face?

Challenges in the Aerial Mapping & Surveying Sensor System Market include regulatory restrictions on drone usage, high initial investment costs for advanced sensor systems, and the need for skilled personnel to operate these technologies effectively.

What opportunities exist in the Aerial Mapping & Surveying Sensor System Market?

Opportunities in the Aerial Mapping & Surveying Sensor System Market include the expansion of smart city initiatives, the integration of AI and machine learning for data analysis, and the growing use of these systems in disaster management and urban planning.

What trends are shaping the Aerial Mapping & Surveying Sensor System Market?

Trends in the Aerial Mapping & Surveying Sensor System Market include the increasing use of drone technology for real-time data collection, the development of more compact and efficient sensors, and the rise of cloud-based data processing solutions that enhance accessibility and collaboration.

Aerial Mapping & Surveying Sensor System Market

| Segmentation Details | Description |

|---|---|

| Product Type | LiDAR, Photogrammetry, Multispectral, Hyperspectral |

| Technology | Active Sensors, Passive Sensors, GNSS, Inertial Measurement Units |

| Application | Urban Planning, Environmental Monitoring, Agriculture, Infrastructure Inspection |

| End User | Government Agencies, Construction Firms, Research Institutions, Surveying Companies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Aerial Mapping and Surveying Sensor System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at