444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The advanced authentication in financial services market represents a critical component of modern banking and financial technology infrastructure, addressing the escalating need for robust security measures in digital financial transactions. Financial institutions worldwide are increasingly adopting sophisticated authentication technologies to combat rising cyber threats, regulatory compliance requirements, and evolving customer expectations for seamless yet secure digital experiences.

Market dynamics indicate substantial growth momentum driven by the proliferation of digital banking services, mobile payment platforms, and open banking initiatives. The sector encompasses various authentication methods including biometric authentication, multi-factor authentication (MFA), behavioral analytics, and risk-based authentication solutions. These technologies collectively address the fundamental challenge of balancing security with user experience in financial services.

Growth projections suggest the market is expanding at a compound annual growth rate (CAGR) of 15.2% through the forecast period, reflecting the urgent need for enhanced security measures. Digital transformation initiatives across financial institutions, coupled with increasing regulatory mandates for stronger authentication protocols, continue to drive market expansion. The integration of artificial intelligence and machine learning technologies further enhances the sophistication and effectiveness of authentication solutions.

Regional adoption patterns show North America leading with approximately 38% market share, followed by Europe at 29% and Asia-Pacific demonstrating the fastest growth trajectory. The market’s evolution reflects the broader transformation of financial services toward digital-first approaches while maintaining stringent security standards.

The advanced authentication in financial services market refers to the comprehensive ecosystem of technologies, solutions, and services designed to verify user identities and secure access to financial systems, applications, and transactions through sophisticated verification methods beyond traditional username-password combinations.

Authentication technologies in this context encompass biometric verification systems including fingerprint scanning, facial recognition, voice authentication, and iris scanning, alongside behavioral biometrics that analyze user patterns such as typing rhythm, mouse movements, and device interaction behaviors. Multi-factor authentication combines multiple verification elements including something the user knows (passwords), something they have (tokens or devices), and something they are (biometric characteristics).

Risk-based authentication represents another crucial component, utilizing real-time analysis of transaction contexts, user locations, device characteristics, and behavioral patterns to assess risk levels and determine appropriate authentication requirements. This adaptive approach enables financial institutions to implement frictionless authentication for low-risk scenarios while applying stringent verification for high-risk transactions.

Market transformation in advanced authentication for financial services reflects the industry’s response to evolving security threats and changing customer expectations. The convergence of regulatory pressures, technological advancement, and digital banking adoption creates a compelling growth environment for authentication solution providers.

Key market drivers include the increasing frequency and sophistication of cyber attacks targeting financial institutions, with fraud attempts increasing by 23% annually across digital channels. Regulatory compliance requirements such as PSD2 in Europe, Open Banking standards globally, and various data protection regulations mandate stronger authentication protocols, driving institutional adoption of advanced solutions.

Technology innovation continues to reshape the market landscape, with artificial intelligence and machine learning enabling more sophisticated fraud detection and risk assessment capabilities. Biometric authentication adoption has reached 67% penetration among major financial institutions, reflecting growing confidence in these technologies’ reliability and user acceptance.

Competitive dynamics feature established cybersecurity companies, specialized authentication providers, and emerging fintech innovators competing across various solution categories. The market demonstrates strong consolidation trends as larger players acquire specialized technologies and capabilities to offer comprehensive authentication platforms.

Strategic market insights reveal several critical trends shaping the advanced authentication landscape in financial services:

Primary market drivers propelling growth in advanced authentication for financial services encompass regulatory, technological, and market-driven factors that collectively create sustained demand for sophisticated security solutions.

Regulatory mandates represent the most significant driver, with global financial regulators implementing stringent authentication requirements. Payment Services Directive 2 (PSD2) in Europe mandates strong customer authentication for electronic payments, while similar regulations worldwide require financial institutions to implement multi-factor authentication protocols. These regulatory frameworks create non-negotiable compliance requirements driving technology adoption.

Cyber threat evolution continues accelerating, with financial services experiencing the highest frequency of targeted attacks among all industries. Account takeover fraud and synthetic identity theft represent growing threats that traditional authentication methods cannot adequately address. The sophistication of attack vectors necessitates equally advanced defensive measures, driving demand for behavioral analytics and AI-powered authentication solutions.

Digital banking proliferation creates expanded attack surfaces requiring comprehensive authentication coverage. As financial institutions extend services across mobile applications, web platforms, and API-enabled third-party integrations, the complexity of securing multiple touchpoints drives adoption of unified authentication platforms.

Customer experience expectations increasingly favor seamless, frictionless authentication that maintains security without compromising usability. This balance drives innovation in passive authentication methods and risk-based approaches that minimize user friction while maintaining robust security standards.

Market constraints affecting advanced authentication adoption in financial services include technological, operational, and economic challenges that may limit implementation speed and scope across different market segments.

Implementation complexity represents a significant barrier, particularly for smaller financial institutions with limited technical resources. Legacy system integration challenges require substantial technical expertise and careful planning to avoid service disruptions during authentication system upgrades. The complexity of integrating multiple authentication methods while maintaining system performance creates implementation hesitancy among some institutions.

Cost considerations impact adoption decisions, especially for community banks and credit unions with constrained technology budgets. While authentication solutions provide clear security benefits, the total cost of ownership including licensing, implementation, training, and ongoing maintenance may strain smaller institutions’ resources.

Privacy concerns surrounding biometric data collection and storage create regulatory and customer acceptance challenges. Data protection regulations such as GDPR impose strict requirements for biometric data handling, requiring institutions to implement comprehensive privacy protection measures that may complicate deployment strategies.

User adoption resistance occasionally emerges, particularly among older customer demographics less comfortable with biometric authentication methods. Customer education requirements and change management processes add complexity and cost to authentication system rollouts, potentially slowing adoption timelines.

Emerging opportunities in the advanced authentication market for financial services present significant growth potential across various technology segments and geographic regions, driven by evolving security requirements and technological innovation.

Artificial intelligence integration offers substantial opportunities for enhancing authentication accuracy and reducing false positives. Machine learning algorithms can analyze vast datasets of user behavior patterns, transaction histories, and contextual information to create more sophisticated risk assessment models. This capability enables financial institutions to implement truly adaptive authentication that evolves with changing threat landscapes.

Emerging market expansion presents significant growth opportunities as developing economies accelerate digital banking adoption. Mobile-first authentication solutions particularly suit markets where smartphone penetration exceeds traditional banking infrastructure, enabling financial institutions to implement advanced security measures without extensive physical infrastructure investments.

Open banking initiatives create new authentication requirements as financial institutions enable third-party access to customer data and services. This regulatory trend drives demand for API-secured authentication solutions that can manage complex permission structures while maintaining security across multiple service providers.

Cryptocurrency and digital asset services represent emerging application areas requiring specialized authentication approaches. As traditional financial institutions expand into digital asset custody and trading services, they require authentication solutions capable of securing high-value, irreversible transactions with appropriate risk management capabilities.

Market dynamics in advanced authentication for financial services reflect complex interactions between technological innovation, regulatory evolution, competitive pressures, and changing customer expectations that collectively shape market development trajectories.

Technology convergence drives market evolution as authentication solutions increasingly integrate multiple verification methods into unified platforms. Biometric fusion combining multiple biometric modalities enhances accuracy while reducing spoofing risks, with multi-modal systems showing 94% accuracy improvement over single-factor approaches. This convergence enables financial institutions to deploy comprehensive authentication strategies through single vendor relationships.

Competitive intensity continues increasing as traditional cybersecurity companies, specialized authentication providers, and technology giants compete for market share. Innovation cycles accelerate as companies invest heavily in research and development to differentiate their offerings through superior accuracy, reduced friction, and enhanced integration capabilities.

Partnership ecosystems emerge as authentication providers collaborate with financial institutions, system integrators, and technology platforms to create comprehensive security solutions. These partnerships enable faster deployment, reduced integration complexity, and enhanced solution effectiveness through combined expertise and resources.

Regulatory evolution continues shaping market dynamics as authorities worldwide refine authentication requirements based on emerging threats and technological capabilities. Standards harmonization efforts across different jurisdictions create opportunities for global solution providers while potentially creating compliance challenges for regional specialists.

Research methodology for analyzing the advanced authentication in financial services market employs comprehensive primary and secondary research approaches to ensure accurate market assessment and reliable growth projections.

Primary research activities include extensive interviews with key stakeholders across the financial services authentication ecosystem, including chief information security officers at major banks, authentication technology vendors, regulatory compliance specialists, and cybersecurity consultants. These interviews provide insights into current implementation challenges, technology preferences, and future investment priorities.

Secondary research encompasses analysis of regulatory filings, technology vendor reports, industry publications, and academic research focusing on authentication technologies and financial services security. Market data validation occurs through cross-referencing multiple sources and applying statistical analysis to identify consistent trends and eliminate outliers.

Quantitative analysis utilizes market sizing models based on financial institution technology spending patterns, authentication solution pricing structures, and adoption rate projections. Qualitative assessment evaluates market dynamics through competitive analysis, regulatory impact assessment, and technology trend evaluation to provide comprehensive market understanding.

Geographic coverage spans major financial markets including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with regional analysis accounting for local regulatory requirements, market maturity levels, and competitive landscapes specific to each geography.

Regional market dynamics for advanced authentication in financial services demonstrate significant variation in adoption patterns, regulatory drivers, and competitive landscapes across major geographic markets.

North America maintains market leadership with approximately 38% global market share, driven by stringent regulatory requirements, high cybersecurity awareness, and substantial technology investment by major financial institutions. United States banks lead in biometric authentication adoption, with 72% of major institutions implementing fingerprint or facial recognition systems. The region benefits from a mature cybersecurity vendor ecosystem and strong regulatory support for authentication innovation.

Europe represents the second-largest market at 29% share, with PSD2 regulations serving as the primary catalyst for advanced authentication adoption. Strong customer authentication requirements drive comprehensive technology upgrades across European financial institutions. The region demonstrates particular strength in privacy-focused authentication solutions that comply with GDPR requirements while maintaining security effectiveness.

Asia-Pacific exhibits the fastest growth trajectory with CAGR of 18.7%, reflecting rapid digital banking adoption and increasing cybersecurity investments. China and India lead regional growth through mobile-first authentication strategies that leverage high smartphone penetration rates. The region’s diverse regulatory landscape creates opportunities for flexible authentication solutions that can adapt to varying compliance requirements.

Latin America and Middle East & Africa represent emerging markets with significant growth potential as financial inclusion initiatives drive digital banking expansion. These regions particularly favor mobile-based authentication solutions that can operate effectively with limited traditional banking infrastructure.

Competitive landscape in the advanced authentication market for financial services features diverse players ranging from established cybersecurity companies to specialized authentication technology providers and emerging fintech innovators.

Market consolidation trends show larger cybersecurity companies acquiring specialized authentication technologies to build comprehensive security platforms. Innovation competition centers on accuracy improvements, reduced false positive rates, and enhanced user experience capabilities that differentiate solutions in competitive procurement processes.

Market segmentation for advanced authentication in financial services encompasses multiple dimensions including technology type, deployment model, organization size, and application area, each representing distinct market dynamics and growth opportunities.

By Technology Type:

By Deployment Model:

By Organization Size:

Category analysis reveals distinct market dynamics and growth patterns across different authentication technology segments, each addressing specific security challenges and use cases within financial services.

Biometric Authentication Category demonstrates the strongest growth momentum with fingerprint recognition achieving 78% adoption rate among mobile banking applications. Facial recognition technology shows rapid advancement in accuracy and speed, making it increasingly viable for high-volume transaction processing. Voice authentication gains traction for telephone banking and customer service applications where visual biometrics are impractical.

Multi-Factor Authentication remains the foundation of enterprise security strategies, with SMS-based verification declining by 31% due to security vulnerabilities while app-based authenticators and push notifications gain preference. Hardware tokens maintain importance for high-security applications despite user experience challenges.

Behavioral Analytics represents the fastest-growing category as financial institutions seek passive authentication methods that operate transparently without user interaction. Keystroke dynamics, mouse movement patterns, and device interaction behaviors create unique user profiles enabling continuous authentication throughout sessions.

Risk-Based Authentication integrates multiple data sources including geolocation, device fingerprinting, and transaction history to create dynamic security policies. This category particularly appeals to institutions seeking to balance security with user experience by applying appropriate authentication levels based on assessed risk.

Industry participants across the financial services authentication ecosystem realize significant benefits from advanced authentication technology adoption, creating value for institutions, customers, and technology providers.

Financial Institutions Benefits:

Customer Benefits:

Technology Provider Benefits:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the advanced authentication landscape in financial services reflect technological evolution, changing user expectations, and regulatory developments that influence solution development and adoption patterns.

Passwordless Authentication emerges as a dominant trend with financial institutions moving toward zero-password environments using biometric and device-based authentication methods. This trend addresses both security vulnerabilities inherent in password-based systems and user experience challenges associated with complex password requirements.

Continuous Authentication gains momentum as institutions implement ongoing verification throughout user sessions rather than single-point authentication at login. Behavioral biometrics enable this approach by monitoring user interaction patterns and flagging anomalies that may indicate account compromise or unauthorized access.

Mobile-First Authentication reflects the shift toward smartphone-centric financial services, with mobile biometric adoption reaching 83% among digital banking users. Financial institutions prioritize authentication methods optimized for mobile devices, including fingerprint scanning, facial recognition, and voice verification.

AI-Powered Risk Assessment transforms authentication decision-making through machine learning algorithms that analyze vast datasets to identify fraud patterns and assess transaction risk in real-time. This capability enables dynamic authentication requirements that adapt to changing threat landscapes and user behaviors.

Decentralized Identity concepts gain attention as blockchain and distributed ledger technologies offer new approaches to identity verification and authentication that could reduce reliance on centralized authentication systems while enhancing privacy protection.

Industry developments in advanced authentication for financial services demonstrate accelerating innovation and strategic partnerships that shape market evolution and competitive dynamics.

Regulatory Milestones include the implementation of Strong Customer Authentication requirements under PSD2, driving widespread adoption of multi-factor authentication across European financial institutions. Similar regulatory developments in other jurisdictions create global momentum for authentication technology upgrades.

Technology Breakthroughs feature significant improvements in biometric accuracy and speed, with facial recognition systems achieving 99.7% accuracy under optimal conditions. Voice authentication technology advances enable reliable verification even in noisy environments, expanding application possibilities for telephone banking and customer service.

Strategic Acquisitions reshape the competitive landscape as major cybersecurity companies acquire specialized authentication providers to build comprehensive security platforms. These consolidation activities create more integrated solution offerings while potentially reducing vendor diversity in the market.

Partnership Announcements between authentication technology providers and major financial institutions demonstrate growing collaboration in solution development and deployment. These partnerships often result in customized authentication platforms optimized for specific institutional requirements and customer bases.

Standards Development through organizations like the FIDO Alliance creates interoperable authentication protocols that reduce vendor lock-in risks and enable more flexible authentication architectures across different systems and service providers.

Strategic recommendations for financial institutions considering advanced authentication investments focus on balancing security effectiveness, user experience, and operational efficiency while preparing for future technology evolution.

Technology Selection Strategy should prioritize solutions offering multiple authentication methods within unified platforms rather than point solutions addressing single authentication requirements. MarkWide Research analysis indicates that integrated platforms provide 34% better ROI compared to disparate authentication tools due to reduced complexity and maintenance requirements.

Implementation Approach recommendations emphasize phased deployment strategies that begin with high-risk applications and gradually expand to comprehensive authentication coverage. This approach enables institutions to gain experience with new technologies while minimizing operational disruption and user adoption challenges.

Vendor Partnership strategies should focus on providers demonstrating strong financial services expertise, regulatory compliance capabilities, and roadmaps aligned with emerging authentication trends. Long-term partnerships with established vendors often provide better support and evolution paths than frequent technology changes.

User Experience Optimization requires careful balance between security requirements and customer convenience, with particular attention to authentication method preferences across different customer demographics and transaction types. Customer feedback integration should guide authentication policy development to ensure sustainable adoption.

Regulatory Preparedness involves selecting authentication solutions capable of adapting to evolving compliance requirements without requiring complete system replacements. Flexible platforms supporting multiple authentication standards provide better long-term regulatory compliance capabilities.

Future market outlook for advanced authentication in financial services indicates continued robust growth driven by evolving security threats, regulatory expansion, and technological innovation that will reshape authentication approaches over the next decade.

Technology Evolution will likely center on artificial intelligence integration that enables more sophisticated behavioral analysis and fraud detection capabilities. Quantum-resistant authentication methods will become increasingly important as quantum computing advances threaten current cryptographic approaches. Biometric fusion technologies combining multiple biometric modalities will improve accuracy while reducing spoofing vulnerabilities.

Market Growth Projections suggest sustained expansion with CAGR of 15.2% through 2030, driven by increasing digital banking adoption, regulatory compliance requirements, and growing cybersecurity awareness. Emerging markets will contribute disproportionately to growth as financial inclusion initiatives drive digital banking expansion in underserved regions.

Regulatory Evolution will likely expand authentication requirements to cover additional financial services and transaction types while potentially harmonizing standards across different jurisdictions. Privacy regulations will continue influencing biometric authentication implementation approaches, requiring enhanced data protection measures.

Competitive Landscape Changes may include further consolidation as larger technology companies acquire specialized authentication providers to build comprehensive security platforms. Open source authentication initiatives could emerge as alternatives to proprietary solutions, particularly for smaller financial institutions seeking cost-effective options.

Innovation Areas will likely focus on seamless authentication experiences that operate transparently without user interaction while maintaining high security standards. Contextual authentication using environmental and behavioral factors will become more sophisticated, enabling truly adaptive security policies that respond to changing risk conditions in real-time.

Advanced authentication in financial services represents a critical and rapidly evolving market segment that addresses fundamental security challenges facing modern financial institutions. The convergence of regulatory requirements, technological innovation, and changing customer expectations creates a compelling growth environment for authentication solution providers while driving comprehensive security improvements across the financial services industry.

Market dynamics indicate sustained growth momentum supported by increasing cyber threats, expanding digital banking services, and evolving regulatory frameworks that mandate stronger authentication protocols. The integration of artificial intelligence, behavioral analytics, and biometric technologies continues advancing authentication effectiveness while improving user experience through more seamless and intuitive verification methods.

Strategic considerations for market participants emphasize the importance of balanced approaches that address security requirements without compromising operational efficiency or customer satisfaction. Financial institutions must navigate complex technology selection decisions while preparing for continued evolution in authentication methods and regulatory requirements. MWR analysis suggests that institutions investing in flexible, integrated authentication platforms will achieve better long-term outcomes compared to those implementing fragmented point solutions.

Future prospects remain highly positive as the advanced authentication in financial services market continues expanding to address emerging security challenges and support the ongoing digital transformation of financial services. Success in this market will depend on continued innovation, strategic partnerships, and the ability to balance security effectiveness with user experience excellence in an increasingly complex threat landscape.

What is Advanced Authentication in Financial Services?

Advanced Authentication in Financial Services refers to the use of sophisticated methods and technologies to verify the identity of users accessing financial systems. This includes multi-factor authentication, biometric verification, and behavioral analytics to enhance security and protect sensitive financial data.

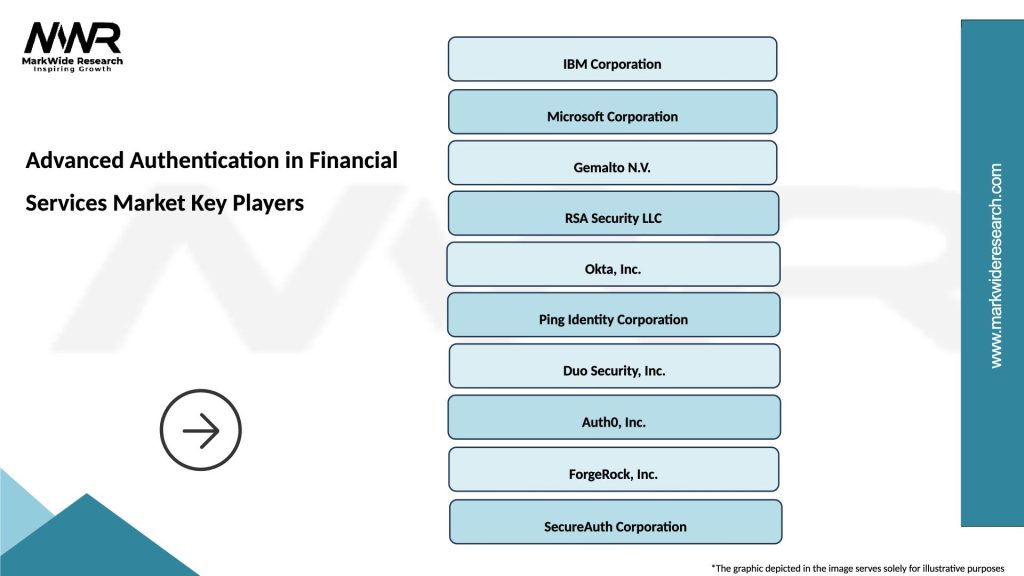

What are the key players in the Advanced Authentication in Financial Services Market?

Key players in the Advanced Authentication in Financial Services Market include companies like IBM, RSA Security, and Okta, which provide various authentication solutions tailored for financial institutions. These companies focus on enhancing security measures to combat fraud and identity theft, among others.

What are the main drivers of growth in the Advanced Authentication in Financial Services Market?

The main drivers of growth in the Advanced Authentication in Financial Services Market include the increasing frequency of cyberattacks, the rising demand for secure online transactions, and regulatory requirements for enhanced security measures. Financial institutions are adopting advanced authentication to protect customer data and maintain trust.

What challenges does the Advanced Authentication in Financial Services Market face?

Challenges in the Advanced Authentication in Financial Services Market include the complexity of integrating new technologies with existing systems, user resistance to adopting multi-factor authentication, and the ongoing evolution of cyber threats. These factors can hinder the implementation of effective authentication solutions.

What opportunities exist in the Advanced Authentication in Financial Services Market?

Opportunities in the Advanced Authentication in Financial Services Market include the growing adoption of artificial intelligence and machine learning for fraud detection, the expansion of mobile banking, and the increasing focus on customer experience. These trends encourage the development of more user-friendly and secure authentication methods.

What trends are shaping the Advanced Authentication in Financial Services Market?

Trends shaping the Advanced Authentication in Financial Services Market include the rise of biometric authentication methods, the integration of blockchain technology for secure transactions, and the shift towards passwordless authentication solutions. These innovations aim to enhance security while improving user convenience.

Advanced Authentication in Financial Services Market

| Segmentation Details | Description |

|---|---|

| Technology | Biometric Authentication, Multi-Factor Authentication, Passwordless Solutions, Behavioral Analytics |

| End User | Retail Banks, Investment Firms, Insurance Companies, Credit Unions |

| Deployment | On-Premises, Cloud-Based, Hybrid Solutions, Managed Services |

| Solution | Identity Verification, Fraud Detection, Access Management, Risk Assessment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Advanced Authentication in Financial Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at