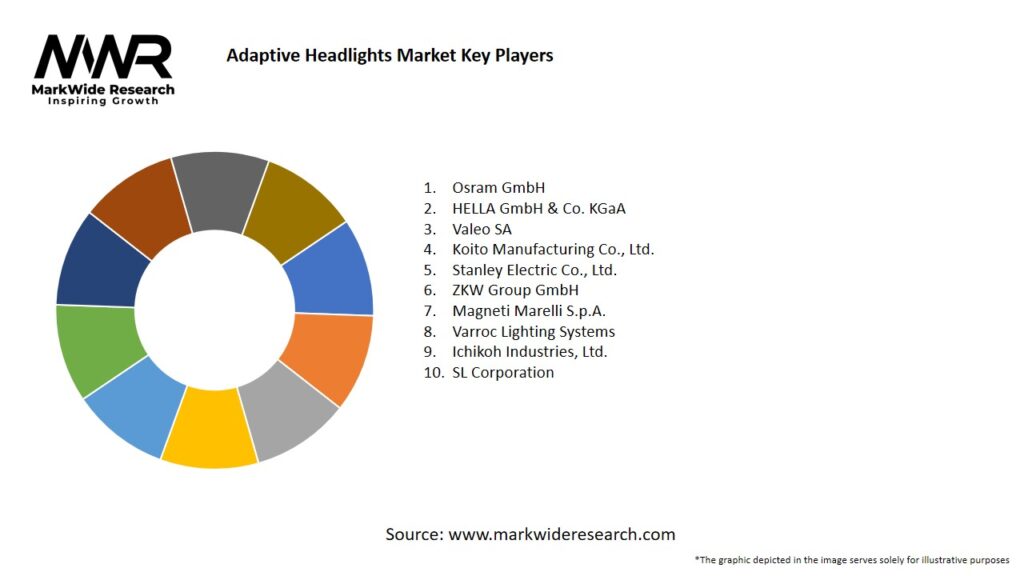

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

LED Matrix Dominance: LED matrix headlights, which consist of multiple individually controllable LED segments, are rapidly gaining market share due to their precision in dynamically shaping high and low beams without manual driver input.

-

Integration with ADAS: Adaptive headlights increasingly interface with camera-based lane-keeping assist and radar-based collision avoidance systems, enabling coordinated safety responses like glare-free high beam dipping when detecting oncoming or preceding vehicles.

-

Shift to Electrification: Electric vehicles (EVs) demand high-efficiency lighting to preserve battery range; adaptive LED solutions are lighter and consume less power than traditional HID modules.

-

Regulatory Evolution: The European New Car Assessment Programme (Euro NCAP) and the U.S. National Highway Traffic Safety Administration (NHTSA) are elevating headlight performance in safety rating criteria, incentivizing manufacturers to adopt advanced lighting systems.

-

Growing Aftermarket: Rising vehicle aging fleets in North America and Europe offer aftermarket retrofit opportunities for adaptive LED modules, particularly in luxury and premium vehicle segments.

Market Drivers

-

Safety Regulations: Stringent headlight performance requirements under Euro NCAP, UNECE Regulation 123 (which permits advanced lighting technologies), and NHTSA lighting standards are driving OEM adoption of adaptive systems.

-

Rising Vehicle Production: Growth in global light vehicle production, especially in emerging markets, expands the potential install base for advanced lighting solutions.

-

Premium Features Demand: Consumers purchasing mid- to high-end vehicles expect sophisticated lighting as part of overall vehicle safety and comfort package.

-

Technological Advancements: Decreasing costs and improved efficiencies in LEDs, optics, and sensors enhance viability across vehicle segments.

-

Urbanization & Night Driving: Increasing urban traffic and nighttime driving in developing economies elevate the need for better visibility and accident prevention measures.

Market Restraints

-

High Initial Cost: Adaptive LED systems can cost 3–5 times more than conventional halogen or static LED headlights, limiting uptake in entry-level vehicles.

-

Complex Integration: Properly integrating adaptive headlights with existing vehicle networks (CAN/LIN/FlexRay) and ADAS modules adds engineering complexity and development time.

-

Technical Reliability: Durability concerns around actuators and sensors—especially in extreme climates—necessitate rigorous testing, raising development costs.

-

Consumer Awareness Gaps: In some regions, drivers remain unfamiliar with the benefits of adaptive headlights, reducing aftermarket demand.

Market Opportunities

-

Aftermarket Retrofits: Large installed bases of older premium vehicles present opportunities for adaptive LED retrofit kits, especially in the U.S. and Europe.

-

Emerging Market Penetration: As costs decline, mass-market OEMs in China and India will integrate adaptive lighting into mid-range models.

-

Autonomous Vehicle Platforms: Fully autonomous and Level-3+ vehicles will require advanced lighting systems capable of coordinating with onboard perception and mapping systems.

-

Connected Lighting: Integration with V2X (vehicle-to-everything) networks for dynamic beam shaping based on real-time traffic data and pedestrian movement information.

-

Energy Efficiency: Further improvements in LED efficacy will support adoption in EVs and hybrids seeking every watt of savings.

Market Dynamics

-

Supply Side: Partnerships between lighting specialists and semiconductor firms (e.g., partnerships to develop GaN-on-SiC LED chips) are pushing performance and cost improvements.

-

Demand Side: Consumer surveys link improved lighting to enhanced perceptions of vehicle safety, driving OEMs to include adaptive lighting as part of standard safety bundles.

-

Economic & Policy: Government incentives for active safety feature integration—especially fleets and commercial vehicles—spur greater adoption.

Regional Analysis

-

North America: Early adopter region, strong aftermarket, stringent NHTSA regulations, high vehicle uptime.

-

Europe: Euro NCAP safety ratings include headlight performance; UNECE R123 allows matrix LED systems; strong aftermarket for premium vehicles.

-

Asia-Pacific: Rapid EV growth in China, India’s rising middle class demanding advanced features; local OEMs innovating cost-effective adaptive systems.

-

Latin America: Slower adoption due to cost sensitivity, but growing urbanization and safety awareness driving interest in premium features.

-

Middle East & Africa: Harsh driving conditions create demand for durable adaptive systems; market limited by lower premium segment penetration.

Competitive Landscape

Leading Companies in the Adaptive Headlights Market:

- Osram GmbH

- HELLA GmbH & Co. KGaA

- Valeo SA

- Koito Manufacturing Co., Ltd.

- Stanley Electric Co., Ltd.

- ZKW Group GmbH

- Magneti Marelli S.p.A.

- Varroc Lighting Systems

- Ichikoh Industries, Ltd.

- SL Corporation

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

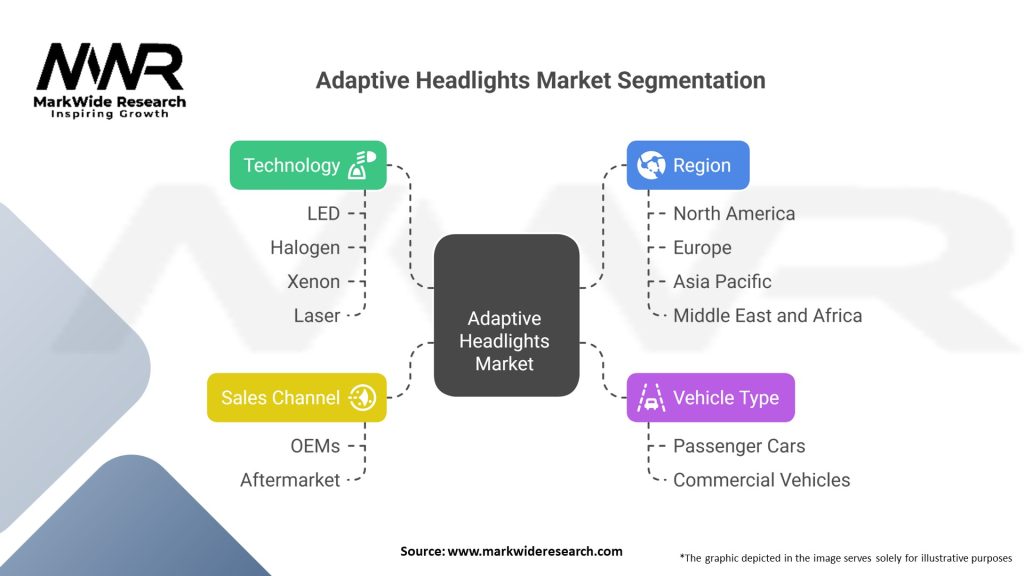

Segmentation

-

By Technology: Matrix LED, adaptive HID (xenon), laser headlights, OLED-based adaptive systems.

-

By Vehicle Type: Passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs).

-

By Sales Channel: OEM fitment, aftermarket retrofit.

-

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Category-wise Insights

-

Matrix LED: High precision, segment-level control, growing fastest among tech variants.

-

Adaptive HID: Still common in premium ICE vehicles but being supplanted by LED.

-

Laser & OLED: Emerging niche technologies for ultra-high-end vehicles, offering exceptional range and design flexibility.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Road Safety

-

Regulatory Compliance

-

Brand Differentiation

-

Synergies with ADAS & Autonomous Systems

-

Improved Customer Satisfaction & Loyalty

SWOT Analysis

-

Strengths: Proven safety benefits, regulatory momentum, premium positioning.

-

Weaknesses: High cost, integration complexity, durability concerns in harsh conditions.

-

Opportunities: Cost declines, EV penetration, aftermarket growth, smart lighting networks.

-

Threats: Economic downturns reducing consumer spend, competing ADAS tech, regulatory delays.

Market Key Trends

-

AI-Driven Beam Control: Using camera-based object detection to dynamically shape beam patterns around individual pedestrians or signs.

-

Adaptive High–Low Beam Integration: Seamless auto-switching combined with curve-adaptive illumination in a single unit.

-

Energy-Efficient LED Advances: 300 lm/W-class chips reducing power draw by >30%.

-

Smart City Integration: Connected headlights that communicate with roadside units to optimize street lighting networks.

Covid-19 Impact

-

Supply Chain Disruptions: Short-term LED chip and sensor shortages delayed product launches.

-

Production Slowdowns: Auto plant shutdowns led to lower OEM orders for adaptive systems.

-

Accelerated Digital Design: Virtual vehicle integration and remote calibration workflows matured.

-

Long-Term Resilience: Post-pandemic safety focus heightened interest in advanced driver assistance features, including adaptive headlights.

Key Industry Developments

-

Valeo–Lumileds Partnership on high-flux LED modules for matrix beam.

-

Hella–Bosch Collaboration integrating external camera data into headlight beam shaping.

-

Koito–Denso Joint Venture developing compact laser-based adaptive modules for EVs.

-

ZKW OLED Prototype showcased at auto shows, targeting premium EV interiors.

Analyst Suggestions

-

Invest in Cost Reduction: Pursue vertical integration of LED chip production to lower BOM costs.

-

Enhance Durability Testing: Develop robust validation for extreme climates (–40 °C to +60 °C).

-

Expand Aftermarket Channels: Tailor retrofit kits for popular premium models in North America and Europe.

-

Focus on Emerging Markets: Develop module bundles for Chinese EV makers and Indian mid-priced SUVs.

-

Collaborate on Standards: Engage with regulators on smart lighting and V2X protocols to shape favorable global standards.

Future Outlook

Adaptive headlights will become standard on most new vehicles by 2030, driven by safety mandates and consumer expectations. LED matrix systems will dominate, accounting for over 70% of units shipped. Integration with autonomous vehicle sensor suites and V2X networks will create entirely new functionality use cases—automated glare cancellation, proactive pedestrian illumination, and integrated road hazard marking. As costs decline and technologies converge, even mass-market microcars will feature adaptive LED headlights, transforming nighttime driving into a safer, more intuitive experience.

Conclusion

The global adaptive headlights market is undergoing rapid transformation, propelled by regulatory support, consumer safety awareness, and technological innovation. From matrix LEDs to smart, connected lighting ecosystems, adaptive headlamp systems are evolving into integral components of modern ADAS and autonomous driving platforms. While challenges around cost, integration, and durability remain, strategic investments in R&D, partnerships across the automotive value chain, and continued regulatory momentum will drive widespread adoption. By illuminating the road ahead—literally and figuratively—adaptive headlights will significantly reduce nighttime accident risk, enhance driver comfort, and pave the way for the next generation of intelligent transportation systems.