444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Actigraphy Sensors and Polysomnography Devices market is a rapidly growing sector within the healthcare industry. Actigraphy sensors are wearable devices that monitor and record physical activity and sleep patterns, while polysomnography devices are used to diagnose and assess sleep disorders. This market has gained significant traction due to the increasing prevalence of sleep-related disorders and the growing awareness of the importance of quality sleep for overall health and well-being.

Meaning

Actigraphy sensors are small, lightweight devices worn on the wrist or ankle that use accelerometers to measure movement and activity levels. These sensors can provide objective data on sleep patterns, circadian rhythms, and physical activity. Polysomnography devices, on the other hand, are medical devices used in sleep laboratories to monitor various physiological parameters during sleep, including brain activity, eye movement, muscle tone, and respiratory function. The data collected by these devices helps in the diagnosis and treatment of sleep disorders.

Executive Summary

The Actigraphy Sensors and Polysomnography Devices market is experiencing robust growth due to the increasing demand for accurate and non-invasive methods of assessing sleep quality and diagnosing sleep disorders. The market is witnessing a shift from traditional methods of sleep assessment, such as in-lab polysomnography, to home-based sleep monitoring using actigraphy sensors. This transition is driven by factors such as patient convenience, cost-effectiveness, and the ability to gather long-term sleep data in a natural environment.

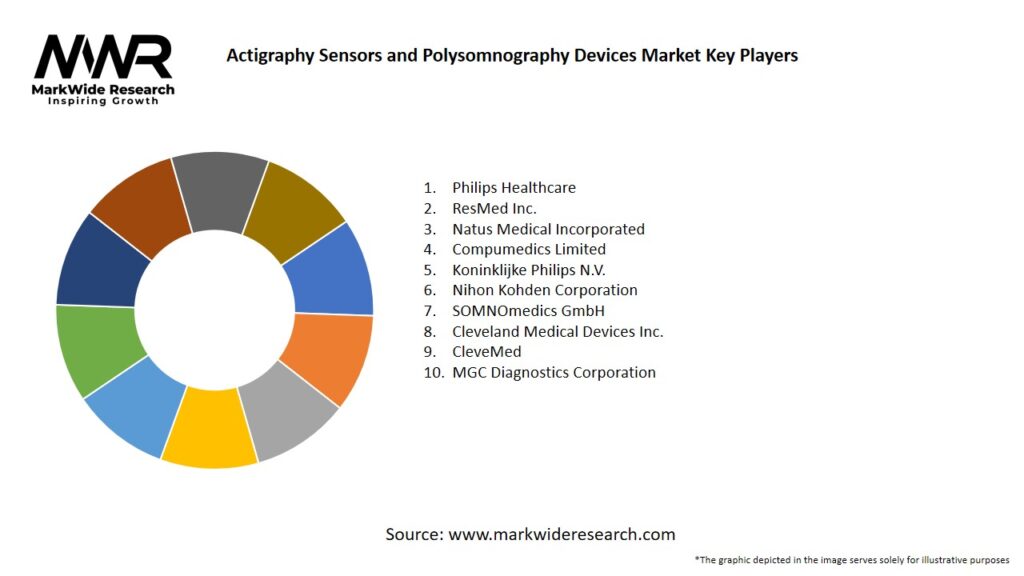

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Hybrid Devices Gain Traction: Multi‑sensor wearables that combine actigraphy with heart rate, SpO₂, and respiratory effort channels are emerging, offering more robust home sleep monitoring capabilities.

AI and Machine Learning: Advanced algorithms enable automated sleep stage classification, apnea detection, and sleep quality scoring, reducing the need for manual scoring by sleep technicians.

Telemedicine Integration: Cloud‑based platforms allow clinicians to review remote monitoring data, adjust treatment plans, and conduct virtual consultations, improving access to sleep care.

Home PSG Adoption: Simplified PSG systems with wireless, disposable sensors and user‑friendly interfaces are facilitating at‑home full‑channel sleep studies, alleviating lab bottlenecks.

Regulatory Approvals: Increasing FDA and CE approvals for actigraphy devices and home PSG systems are boosting clinician confidence and adoption.

Market Drivers

Prevalence of Sleep Disorders: Growing epidemiological burden of insomnia, sleep apnea, narcolepsy, and circadian rhythm disorders fuels demand for diagnostic monitoring.

Aging Population: Older adults have higher rates of sleep disturbances, driving increased utilization of both actigraphy and PSG in geriatric care.

Chronic Disease Management: Poor sleep is implicated in cardiovascular disease, diabetes, and mental health disorders; as integrated care models proliferate, sleep monitoring becomes essential.

Workforce Productivity: Recognition of sleep’s impact on performance encourages employer‑sponsored sleep health programs incorporating wearable monitors.

Consumer Wellness Market: Fitness trackers with sleep modules have popularized sleep monitoring, creating an entry point for more advanced medical‑grade devices.

Telehealth Expansion: Remote patient monitoring is supported by insurer reimbursement and regulatory frameworks post‑COVID, accelerating home‑based sleep studies.

Technological Convergence: Miniaturization, low‑power electronics, and waterproofing enable comfortable, multi‑night home monitoring.

Market Restraints

High Cost of PSG: Establishing and maintaining sleep labs with full PSG capabilities remains capital‑intensive, limiting access in resource‑constrained settings.

Reimbursement Limitations: Insurance coverage varies by region, with some payers not reimbursing for ambulatory actigraphy or home PSG, hindering adoption.

Data Overload and Validation: Large volumes of data require robust analytics; inconsistent algorithms across devices pose challenges for standardization and clinical decision‑making.

Patient Compliance: Overnight electrode placement for PSG and multi‑night adherence to actigraphy protocols can be burdensome, affecting data quality.

Regulatory Complexity: Navigating diverse device classification pathways (medical device, wellness device) and securing approvals can delay market entry.

Market Opportunities

Emerging Markets: Growth potential in Asia‑Pacific, Latin America, and Middle East/Africa due to rising healthcare infrastructure investment and awareness of sleep health.

Integrated Care Platforms: Partnerships with EHR providers and digital therapeutics companies to incorporate sleep data into comprehensive chronic disease management.

Hybrid Medical/Consumer Devices: Development of FDA‑cleared wearable sensors that bridge the gap between consumer trackers and prescription medical devices.

Remote CPAP Titration: Leveraging home PSG to optimize CPAP settings for obstructive sleep apnea patients without requiring lab visits.

Pediatric Sleep Monitoring: Specialized small‑form‑factor actigraphy and simplified PSG solutions tailored for children and infants.

Research Applications: Academic and pharmaceutical research on sleep and circadian biology driving demand for high‑fidelity monitoring tools.

AI‑Driven Diagnostics: Licensing of proprietary sleep staging and apnea detection algorithms to device manufacturers and digital health platforms.

Market Dynamics

Supply Side: Leading equipment vendors are investing in scalable manufacturing, modular designs, and partnerships with sensor OEMs to reduce cost and expand product portfolios.

Demand Side: Clinicians are increasingly adopting ambulatory technologies for initial screening and long‑term follow‑up, reserving lab PSG for complex cases.

Economic Factors: Value‑based care models incentivize cost‑effective remote monitoring; as sleep diagnostics move upstream to primary care, actigraphy’s role grows.

Policy and Regulation: National sleep health strategies and guidelines (e.g., AASM, NICE) drive standardized screening protocols, boosting device adoption.

Regional Analysis

North America: Market leader due to high healthcare spending, robust sleep disorder awareness, extensive sleep lab network, and rapid telehealth adoption.

Europe: Strong PSG infrastructure in Western Europe; growing home sleep apnea testing (HSAT) adoption in Central and Eastern Europe driven by reimbursement reforms.

Asia-Pacific: Fastest growth region, with expanding middle class, rising chronic disease prevalence, and expanding access to sleep clinics in China, India, Japan, and South Korea.

Latin America: Emerging adoption hindered by cost and infrastructure gaps; urban centers in Brazil and Mexico lead growth.

Middle East & Africa: Nascent market with niche adoption in private hospitals; growing healthcare investment presents future opportunity.

Competitive Landscape

Leading Companies in the Actigraphy Sensors and Polysomnography Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

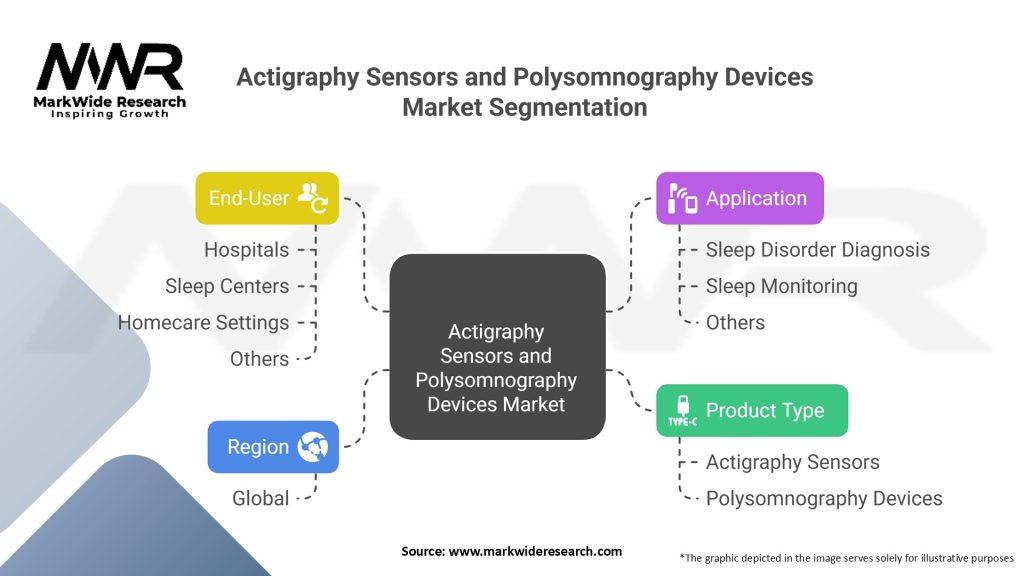

Segmentation

By Device Type:

Actigraphy Sensors (wrist‑worn, ring, patch)

Polysomnography Devices (in‑lab full channel, home sleep apnea testing, portable PSG)

By End-User:

Hospitals & Sleep Clinics

Home Healthcare Providers

Research & Academic Institutions

Consumer Wellness Segment

By Application:

Sleep Disorder Diagnosis (insomnia, sleep apnea, narcolepsy)

Circadian Rhythm Monitoring

Clinical Research & Drug Development

Consumer Sleep Tracking

By Price Tier:

Premium Medical-Grade Systems

Mid‑Range Portable Devices

Affordable Consumer-Grade Wearables

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Category-wise Insights

Medical‑Grade Actigraphy vs. Consumer Wearables: Clinical devices offer validated algorithms and regulatory clearance (e.g., FDA 510(k)), while consumer wearables focus on user engagement and lifestyle integration.

In‑Lab PSG vs. Home Sleep Testing: Full PSG remains gold standard but limited by cost and access; HSAT and portable PSG bridge the gap for obstructive sleep apnea screening.

Hybrid Approaches: Combining actigraphy with limited-channel cardiorespiratory monitoring offers a middle path—greater insight than pure actigraphy with less complexity than full PSG.

Key Benefits for Industry Participants and Stakeholders

Improved Access to Sleep Care: Home-based monitoring expands diagnostic reach beyond specialized sleep centers.

Cost Reduction: Ambulatory devices lower per‑study costs and reduce the need for overnight lab stays.

Patient Convenience: Wearable sensors enable sleep assessment in natural home environments, improving compliance and data quality.

Data‑Driven Insights: Rich longitudinal datasets support personalized treatment plans and early intervention.

Research Advancements: Enhanced tools accelerate sleep science and drug development.

Competitive Differentiation: Providers offering integrated tele‑sleep platforms gain market advantage.

SWOT Analysis

Strengths:

Proven clinical utility of PSG; widespread validation of actigraphy in diverse populations.

Continuous innovation in sensor technology and analytics.

Weaknesses:

High complexity and cost of full PSG infrastructure; variability in actigraphy algorithms.

Regulatory and reimbursement hurdles in some markets.

Opportunities:

Expansion of telehealth and home-based diagnostics post‑COVID.

Development of AI‑driven, hybrid monitoring solutions bridging consumer and clinical realms.

Threats:

Competitive pressure from low‑cost consumer wearables.

Data privacy and security concerns with remote monitoring platforms.

Market Key Trends

Shift to Home‑Based Diagnostics: Accelerated by telehealth initiatives and patient preference for in‑home care.

AI‑Powered Analytics: Automated sleep scoring and predictive models for sleep disorder risk stratification.

Multi‑Parameter Wearables: Integration of actigraphy, ECG, SpO₂, and respiratory sensors in single devices.

Health Platform Integration: Sleep data converged with other health metrics in digital wellness ecosystems.

Personalized Sleep Coaching: Systems offering actionable recommendations and behavioral interventions based on individual sleep profiles.

Covid-19 Impact

Telemedicine Surge: Lockdowns and social distancing drove rapid uptake of remote sleep monitoring.

Supply Chain Disruption: Temporary equipment shortages highlighted need for diversified sourcing and local manufacturing.

Increased Sleep Awareness: Pandemic‑related stress boosted consumer interest in sleep health, expanding the market for sleep trackers.

Key Industry Developments

Launch of At‑Home PSG Kits: Major players introduced wireless, user‑friendly home PSG systems with disposable sensors.

Acquisition of Sensor Startups: Large medical device companies acquired niche wearable sensor firms to bolster their actigraphy offerings.

Regulatory Clearances: FDA 510(k) approvals for hybrid wearable devices combining actigraphy with SpO₂ and heart rate.

Partnerships with Telehealth Providers: Integrations enabling direct data upload from devices into telemedicine platforms for clinician review.

Analyst Suggestions

Invest in Hybrid Solutions: Develop devices that pair actigraphy with a minimal set of physiological sensors to bridge consumer wellness and full PSG capabilities.

Enhance Data Standards: Collaborate on open data formats and validation studies to build clinician confidence in actigraphy-derived metrics.

Expand Reimbursement Codes: Work with payers and policy makers to establish clear coverage for home sleep testing and ambulatory monitoring.

Focus on Usability: Prioritize patient-centric design—ease of sensor application, comfort, and app‑based guidance—to improve adherence.

Foster Partnerships: Align with telehealth and digital therapeutics companies to embed sleep monitoring into broader chronic disease management programs.

Future Outlook

The actigraphy sensors and polysomnography devices market is poised for continued robust growth, driven by:

Ongoing Telehealth Momentum: Remote care models will cement home-based sleep diagnostics as standard practice.

Regulatory Evolution: Streamlined pathways for digital health devices will accelerate product launches.

AI and Precision Medicine: Predictive analytics and individualized sleep interventions will expand therapeutic impact.

Global Market Expansion: Emerging economies will invest in sleep infrastructure as part of broader healthcare upgrades.

Convergence of Consumer and Clinical Spheres: Blurring lines between wellness wearables and medically validated devices will create novel hybrid categories.

As sleep health becomes integral to overall well-being and chronic disease management, the integration of actigraphy and PSG technologies within interoperable digital ecosystems will redefine diagnosis, treatment, and prevention of sleep disorders, establishing these devices as indispensable tools in modern healthcare.

Conclusion

The global actigraphy sensors and polysomnography devices market stands at the nexus of healthcare innovation and consumer wellness, offering transformative capabilities to assess sleep health across clinical and everyday settings. While full‑scale PSG remains the diagnostic gold standard, the rise of advanced actigraphy wearables and simplified at‑home PSG systems is democratizing access to sleep care. Technological advancements—particularly AI‑driven analytics, hybrid sensor integration, and seamless telemedicine platforms—are shaping a future where sleep assessment is continuous, personalized, and embedded within holistic health management strategies.

What is Actigraphy Sensors and Polysomnography Devices?

Actigraphy sensors are devices used to monitor and record movement patterns, often to assess sleep quality and activity levels. Polysomnography devices are comprehensive tools used in sleep studies to measure various physiological parameters during sleep, including brain waves, oxygen levels, and heart rate.

What are the key companies in the Actigraphy Sensors and Polysomnography Devices Market?

Key companies in the Actigraphy Sensors and Polysomnography Devices Market include Fitbit, Inc., Philips Healthcare, and Garmin Ltd., among others. These companies are known for their innovative products that enhance sleep monitoring and health tracking.

What are the growth factors driving the Actigraphy Sensors and Polysomnography Devices Market?

The growth of the Actigraphy Sensors and Polysomnography Devices Market is driven by increasing awareness of sleep disorders, the rising prevalence of sleep apnea, and advancements in wearable technology. Additionally, the demand for home sleep testing solutions is contributing to market expansion.

What challenges does the Actigraphy Sensors and Polysomnography Devices Market face?

Challenges in the Actigraphy Sensors and Polysomnography Devices Market include regulatory hurdles, the need for accurate data interpretation, and competition from alternative sleep monitoring solutions. These factors can hinder market growth and product adoption.

What future opportunities exist in the Actigraphy Sensors and Polysomnography Devices Market?

Future opportunities in the Actigraphy Sensors and Polysomnography Devices Market include the integration of artificial intelligence for better data analysis, the development of more user-friendly devices, and expanding applications in mental health monitoring. These advancements could enhance user engagement and market reach.

What trends are shaping the Actigraphy Sensors and Polysomnography Devices Market?

Trends in the Actigraphy Sensors and Polysomnography Devices Market include the increasing popularity of telehealth services, the rise of personalized health monitoring, and the incorporation of advanced sensors for more accurate data collection. These trends are influencing product development and consumer preferences.

Actigraphy Sensors and Polysomnography Devices Market Segmentation

| Segment | Description |

|---|---|

| Product Type | Actigraphy Sensors, Polysomnography Devices |

| Application | Sleep Disorder Diagnosis, Sleep Monitoring, Others |

| End-User | Hospitals, Sleep Centers, Homecare Settings, Others |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Actigraphy Sensors and Polysomnography Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at