444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The accident-only pet insurance market provides coverage specifically for accidents and injuries that may occur to pets. Unlike comprehensive pet insurance policies that cover accidents, illnesses, and routine care, accident-only pet insurance focuses solely on providing financial protection for unexpected accidents and emergencies. This niche market segment caters to pet owners seeking affordable insurance options to help mitigate the costs associated with veterinary care for accidental injuries.

Meaning

Accident-only pet insurance offers coverage for veterinary expenses resulting from accidental injuries sustained by pets. These injuries may include fractures, lacerations, ingestion of foreign objects, and other unforeseen accidents. Accident-only policies typically exclude coverage for illnesses, pre-existing conditions, and routine care such as vaccinations and dental cleanings. This type of insurance provides pet owners with peace of mind knowing that they can afford emergency medical treatment for their pets in the event of an accident.

Executive Summary

The accident-only pet insurance market has witnessed steady growth as pet ownership rates continue to rise, and pet owners increasingly recognize the importance of financial protection for unexpected veterinary expenses. Market players are introducing innovative products and services to cater to the diverse needs of pet owners, including customizable coverage options, online claims processing, and telemedicine consultations. Despite challenges such as competition from comprehensive pet insurance policies and regulatory constraints, the accident-only pet insurance market presents opportunities for growth and expansion in the coming years.

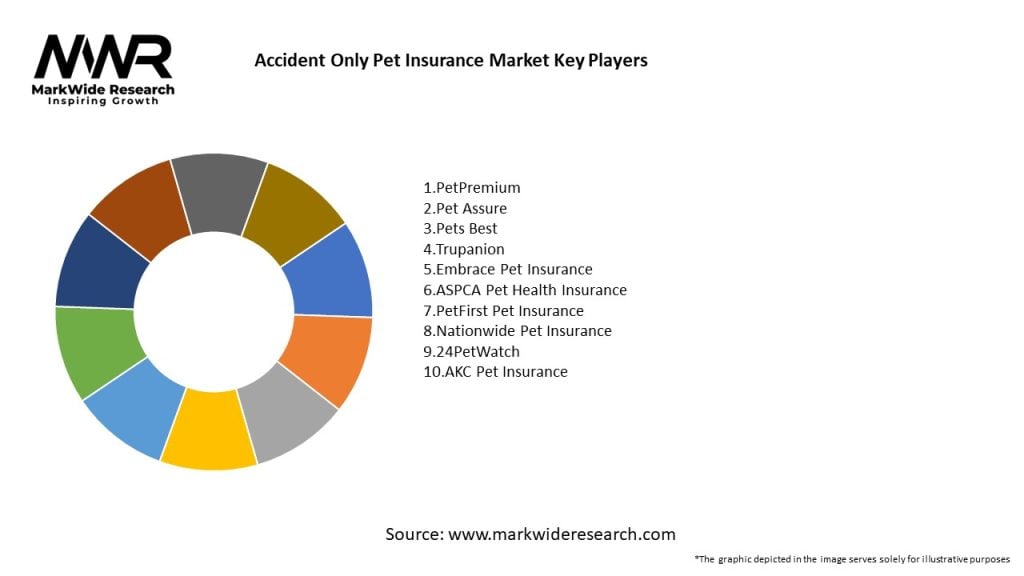

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The accident-only pet insurance market operates in a dynamic environment shaped by various factors, including pet ownership trends, affordability, product innovation, regulatory constraints, and competitive forces. Understanding these dynamics is essential for market players to identify opportunities, address challenges, and drive growth in the evolving pet insurance landscape.

Regional Analysis

The accident-only pet insurance market exhibits regional variations in terms of pet ownership rates, regulatory frameworks, consumer preferences, and competitive dynamics. Market performance and growth potential vary across different regions, presenting opportunities and challenges for market players seeking to expand their presence and capture market share.

Competitive Landscape

Leading Companies in the Accident Only Pet Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The accident-only pet insurance market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Pet Owners

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of accident-only pet insurance as pet ownership rates surged, and pet owners prioritized their pets’ health and well-being amidst the pandemic. The need for financial protection against unexpected veterinary expenses for accidental injuries and emergencies has driven demand for accident-only coverage, leading to market growth and expansion.

Key Industry Developments

Analyst Suggestions

Future Outlook

The accident-only pet insurance market is poised for continued growth and expansion in the coming years, driven by rising pet ownership rates, affordability, product innovation, digitalization, and increasing pet owner awareness. Market players that focus on innovation, market expansion, customer education, and digitalization are well-positioned to capitalize on growth opportunities and succeed in the dynamic pet insurance landscape.

Conclusion

The accident-only pet insurance market provides essential coverage for accidental injuries and emergencies, offering pet owners financial protection, peace of mind, and access to quality veterinary care for their beloved pets. Despite challenges such as limited coverage, regulatory constraints, and competition, the market presents opportunities for growth and expansion through innovation, market expansion, customer education, and digitalization. By staying agile, innovative, and customer-centric, accident-only pet insurance market players can thrive in the evolving pet insurance landscape and contribute to the health and well-being of pets worldwide.

What is Accident Only Pet Insurance?

Accident Only Pet Insurance is a type of insurance policy that covers veterinary expenses related to accidents involving pets. This can include injuries from falls, bites, or other unforeseen incidents, but does not cover illnesses or routine care.

What are the key players in the Accident Only Pet Insurance Market?

Key players in the Accident Only Pet Insurance Market include companies like Trupanion, Petplan, and Nationwide. These companies offer various plans tailored to pet owners seeking coverage for accidental injuries, among others.

What are the main drivers of growth in the Accident Only Pet Insurance Market?

The growth of the Accident Only Pet Insurance Market is driven by increasing pet ownership, rising awareness of pet health, and the growing costs of veterinary care. Additionally, more pet owners are seeking financial protection against unexpected accidents.

What challenges does the Accident Only Pet Insurance Market face?

The Accident Only Pet Insurance Market faces challenges such as limited coverage options compared to comprehensive plans and potential consumer misconceptions about the scope of coverage. Additionally, competition from other insurance types can impact market growth.

What opportunities exist in the Accident Only Pet Insurance Market?

Opportunities in the Accident Only Pet Insurance Market include the potential for product innovation, such as customizable plans and digital platforms for easier claims processing. There is also a growing trend towards integrating wellness services with accident coverage.

What trends are shaping the Accident Only Pet Insurance Market?

Trends in the Accident Only Pet Insurance Market include the rise of telemedicine for pets, increased use of technology in claims processing, and a focus on preventive care. These trends are influencing how insurance products are developed and marketed to pet owners.

Accident Only Pet Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cat Insurance, Dog Insurance, Exotic Pet Insurance, Multi-Pet Insurance |

| Coverage Level | Basic Coverage, Comprehensive Coverage, Customizable Plans, High Coverage |

| Distribution Channel | Online Sales, Pet Retailers, Veterinary Clinics, Insurance Brokers |

| Customer Type | Pet Owners, Breeders, Shelters, Rescue Organizations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Accident Only Pet Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at