444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Capital Exchange Ecosystem Market represents a sophisticated network of financial institutions, technology platforms, and regulatory frameworks that facilitate the trading of securities, bonds, derivatives, and other financial instruments. This comprehensive ecosystem encompasses traditional stock exchanges, electronic communication networks (ECNs), alternative trading systems (ATS), and emerging digital trading platforms that collectively form the backbone of American capital markets.

Market dynamics within the US capital exchange ecosystem have evolved dramatically over the past decade, driven by technological advancement, regulatory changes, and shifting investor preferences. The ecosystem currently experiences robust growth with trading volumes increasing at a compound annual growth rate of 8.2%, reflecting the increasing sophistication of market participants and the integration of advanced trading technologies.

Digital transformation has become a defining characteristic of the modern capital exchange landscape, with electronic trading now accounting for approximately 85% of all equity transactions. This shift toward automation and algorithmic trading has fundamentally altered market structure, creating new opportunities for efficiency gains while introducing novel risk management challenges.

The ecosystem’s infrastructure supports diverse market participants ranging from institutional investors and hedge funds to retail traders and robo-advisors. Regulatory oversight by the Securities and Exchange Commission (SEC) and other federal agencies ensures market integrity while fostering innovation in trading technologies and market access mechanisms.

The US Capital Exchange Ecosystem Market refers to the comprehensive network of interconnected financial markets, trading platforms, clearing systems, and regulatory frameworks that facilitate the buying and selling of securities within the United States. This ecosystem encompasses both traditional centralized exchanges and modern decentralized trading venues that collectively enable price discovery, liquidity provision, and capital allocation across the American economy.

Core components of this ecosystem include primary exchanges such as the New York Stock Exchange (NYSE) and NASDAQ, regional exchanges, electronic communication networks, dark pools, and alternative trading systems. These platforms work in conjunction with clearing houses, settlement systems, and regulatory bodies to create a seamless trading environment that serves millions of investors daily.

The ecosystem’s significance extends beyond mere transaction facilitation, as it serves as the primary mechanism for capital formation, corporate financing, and wealth creation in the United States. Market efficiency within this system enables optimal resource allocation, supports economic growth, and provides investment opportunities for both institutional and retail participants.

Strategic positioning within the US capital exchange ecosystem has become increasingly competitive as traditional exchanges face pressure from alternative trading venues and technological disruptors. The market demonstrates remarkable resilience and adaptability, with trading volumes reaching unprecedented levels while maintaining operational efficiency and regulatory compliance.

Technology integration represents the most significant driver of ecosystem evolution, with artificial intelligence, machine learning, and blockchain technologies reshaping trading methodologies and market structure. These innovations have contributed to a 35% reduction in average trade execution times over the past five years, while simultaneously improving price discovery mechanisms.

The ecosystem’s response to regulatory changes, particularly those related to market transparency and investor protection, has demonstrated the industry’s capacity for adaptation and compliance. Regulatory technology (RegTech) adoption has increased substantially, with compliance-related technology spending growing at a rate of 12.4% annually across major market participants.

Market fragmentation continues to characterize the current landscape, with trading activity distributed across numerous venues and platforms. This fragmentation, while creating complexity, has also fostered innovation and competition, ultimately benefiting end investors through improved execution quality and reduced transaction costs.

Fundamental shifts in market structure have created new paradigms for trading, clearing, and settlement within the US capital exchange ecosystem. The following insights highlight critical developments shaping the market’s trajectory:

Technological advancement serves as the primary catalyst driving transformation within the US capital exchange ecosystem. The integration of artificial intelligence, machine learning algorithms, and advanced analytics has revolutionized trading strategies, risk management, and operational efficiency across all market segments.

Regulatory modernization initiatives have created new opportunities for market innovation while maintaining investor protection standards. Recent regulatory changes have facilitated greater market transparency, improved best execution requirements, and enabled new trading venue types to emerge and compete effectively.

The democratization of trading through commission-free platforms and mobile applications has significantly expanded market participation. Retail trading activity has increased by approximately 65% over the past three years, driven by improved accessibility and user-friendly trading interfaces that appeal to younger demographics.

Institutional demand for sophisticated trading solutions continues to drive ecosystem development. Asset managers, pension funds, and insurance companies require increasingly complex execution strategies, alternative data sources, and risk management tools to optimize portfolio performance and meet fiduciary obligations.

Global market integration has created demand for cross-border trading capabilities and international market access. US exchanges and trading platforms are expanding their global reach while foreign entities seek greater access to US capital markets, driving infrastructure development and regulatory harmonization efforts.

Regulatory complexity presents ongoing challenges for market participants, particularly smaller firms that may lack the resources to navigate evolving compliance requirements. The cost of regulatory compliance continues to increase, with some estimates suggesting compliance expenses have grown by 18% annually for mid-tier financial institutions.

Cybersecurity threats pose significant risks to market infrastructure and participant confidence. The increasing sophistication of cyber attacks targeting financial institutions requires substantial ongoing investment in security technologies and personnel, creating operational cost pressures across the ecosystem.

Market fragmentation while fostering competition, also creates operational complexity and potential inefficiencies. The proliferation of trading venues has made it increasingly difficult for investors to achieve optimal execution and for regulators to maintain comprehensive market oversight.

Technology infrastructure costs continue to escalate as market participants compete to maintain cutting-edge trading capabilities. The need for ultra-low latency systems, advanced analytics platforms, and robust backup systems requires substantial capital investment that may disadvantage smaller market participants.

Talent acquisition challenges in specialized areas such as quantitative analysis, regulatory technology, and cybersecurity have created competitive pressures and increased operational costs. The shortage of qualified professionals in these critical areas constrains growth and innovation capacity across the ecosystem.

Emerging technologies present substantial opportunities for ecosystem enhancement and new service development. Blockchain technology, distributed ledger systems, and smart contracts offer potential solutions for settlement efficiency, transparency, and operational cost reduction across multiple market functions.

Artificial intelligence applications in trading, risk management, and regulatory compliance continue to expand, creating opportunities for firms that can effectively leverage these technologies. AI-driven solutions are expected to improve execution quality, reduce operational risks, and enhance customer service capabilities.

The expansion of alternative assets trading, including cryptocurrencies, private equity, and real estate investment trusts, presents new revenue opportunities for exchanges and trading platforms. These asset classes require specialized infrastructure and regulatory frameworks that forward-thinking market participants can develop.

International expansion opportunities exist for US-based exchanges and technology providers seeking to export their expertise and platforms to emerging markets. The global demand for sophisticated trading infrastructure creates export opportunities for American financial technology companies.

Sustainable finance initiatives are creating new market segments focused on environmental, social, and governance (ESG) criteria. The development of ESG-focused trading products, analytics, and reporting capabilities represents a growing market opportunity with strong regulatory and investor support.

Competitive intensity within the US capital exchange ecosystem continues to increase as traditional boundaries between different types of market participants blur. Exchanges compete with alternative trading systems, while technology companies enter financial services and established financial institutions develop proprietary trading platforms.

Innovation cycles have accelerated significantly, with new technologies and trading methodologies being adopted at unprecedented rates. The time from concept to implementation for new trading technologies has decreased by approximately 40% over the past five years, reflecting the ecosystem’s enhanced agility and competitive pressures.

According to MarkWide Research analysis, market consolidation trends are emerging as smaller players struggle to compete with the technological capabilities and regulatory compliance resources of larger institutions. This consolidation is creating opportunities for strategic partnerships and technology sharing arrangements.

Regulatory dynamics continue to evolve in response to market structure changes and technological innovations. Regulators are balancing the need to foster innovation with requirements for market stability, investor protection, and systemic risk management, creating an environment of ongoing regulatory adaptation.

Client expectations have risen dramatically, with market participants demanding faster execution, lower costs, better analytics, and enhanced transparency. These evolving expectations drive continuous improvement initiatives and technology investments across the ecosystem.

Comprehensive analysis of the US capital exchange ecosystem requires multi-faceted research approaches that capture both quantitative market data and qualitative industry insights. Primary research methodologies include structured interviews with market participants, regulatory officials, and technology providers to understand current challenges and future opportunities.

Data collection encompasses trading volume analysis, market share assessments, technology adoption rates, and regulatory compliance metrics gathered from public filings, industry reports, and proprietary databases. This quantitative foundation provides statistical validation for market trends and competitive positioning analysis.

Industry expert consultation involves engagement with senior executives from major exchanges, alternative trading systems, clearing organizations, and regulatory bodies. These consultations provide strategic insights into market evolution, competitive dynamics, and regulatory developments that shape ecosystem development.

Technology assessment includes evaluation of emerging platforms, trading algorithms, risk management systems, and regulatory technology solutions. This technical analysis helps identify innovation trends and their potential impact on market structure and participant strategies.

Regulatory analysis involves comprehensive review of current and proposed regulations, enforcement actions, and policy statements from relevant regulatory bodies. This analysis provides context for understanding compliance requirements and their impact on market operations and competitive dynamics.

Northeast corridor dominance continues to characterize the US capital exchange ecosystem, with New York maintaining its position as the primary financial center. The region accounts for approximately 75% of total trading infrastructure and houses the majority of major exchanges, clearing organizations, and financial technology companies.

Chicago’s derivatives markets represent a significant regional concentration, with the Chicago Mercantile Exchange and Chicago Board of Trade serving as global centers for futures and options trading. The region’s expertise in derivatives trading and risk management creates specialized ecosystem clusters that serve national and international markets.

West Coast technology integration has become increasingly important as Silicon Valley firms develop financial technology solutions and trading platforms. California-based companies are driving innovation in areas such as algorithmic trading, alternative data analytics, and blockchain applications for capital markets.

Southeast regional growth is emerging as financial institutions seek operational cost advantages and regulatory arbitrage opportunities. States such as North Carolina, Georgia, and Florida are attracting back-office operations, data centers, and technology development facilities that support the broader ecosystem.

Midwest clearing and settlement operations provide critical infrastructure support for the national ecosystem. The region’s central location and cost advantages make it attractive for operational centers that require high reliability but not ultra-low latency connectivity to primary trading venues.

Market leadership within the US capital exchange ecosystem is distributed among several categories of participants, each serving distinct market segments and client needs. The competitive environment continues to evolve as traditional boundaries blur and new entrants challenge established players.

By Market Type:

By Participant Type:

By Technology Platform:

Equity trading platforms continue to dominate transaction volumes within the ecosystem, with electronic trading accounting for the vast majority of daily activity. The shift toward commission-free retail trading has fundamentally altered revenue models, forcing platforms to develop alternative income sources through payment for order flow, margin lending, and premium services.

Derivatives markets have experienced substantial growth driven by increased hedging demand and sophisticated trading strategies. The integration of electronic trading in derivatives has improved efficiency while maintaining the complex risk management capabilities required for these instruments. MWR data indicates that electronic derivatives trading has grown by 22% annually over the past three years.

Fixed income trading represents an area of significant technological transformation, with traditional voice-based trading giving way to electronic platforms and algorithmic execution. The corporate bond market, in particular, has seen increased electronification, improving transparency and execution quality for institutional investors.

Alternative trading systems have gained market share by offering specialized execution services, reduced market impact, and enhanced privacy for large institutional orders. These platforms serve as important alternatives to traditional exchanges, particularly for block trading and institutional portfolio transitions.

Market data services have become increasingly important revenue sources for exchange operators, with real-time and historical data commanding premium pricing from institutional users. The proliferation of alternative data sources has created new opportunities for exchanges to monetize their unique datasets and trading insights.

Enhanced market efficiency represents the primary benefit of the modern capital exchange ecosystem, with improved price discovery, reduced transaction costs, and increased liquidity benefiting all market participants. Electronic trading systems have significantly reduced bid-ask spreads and improved execution quality across most asset classes.

Operational cost reduction through automation and straight-through processing has enabled market participants to handle increased trading volumes while maintaining or reducing operational expenses. These efficiency gains have been passed on to end investors through lower fees and improved service quality.

Risk management capabilities have been substantially enhanced through real-time monitoring, advanced analytics, and automated risk controls. Market participants can now identify and respond to risk exposures more quickly and effectively than ever before, reducing systemic risks and improving market stability.

Market access democratization has enabled smaller investors and institutions to access sophisticated trading capabilities previously available only to large institutional players. This democratization has increased market participation and improved capital allocation efficiency across the economy.

Innovation acceleration within the ecosystem has created new products, services, and trading strategies that benefit both providers and users. The competitive environment encourages continuous improvement and technological advancement that enhances overall market quality and participant satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming trading strategies, risk management, and operational processes across the capital exchange ecosystem. Machine learning algorithms are increasingly used for market making, trade execution optimization, and regulatory compliance monitoring, with AI adoption rates increasing by 28% annually among major market participants.

Real-time settlement initiatives are gaining momentum as market participants seek to reduce counterparty risk and improve capital efficiency. The movement toward T+1 settlement and eventual same-day settlement represents a fundamental shift in market infrastructure that will require substantial technology investments and operational changes.

Environmental, social, and governance (ESG) integration has become a dominant trend affecting trading strategies, product development, and regulatory requirements. ESG-focused trading products and analytics services are experiencing rapid growth as institutional investors incorporate sustainability criteria into investment decisions.

Retail trading democratization continues to reshape market dynamics through commission-free platforms, fractional share trading, and mobile-first user interfaces. These developments have attracted new demographic groups to market participation and altered traditional revenue models across the ecosystem.

Cross-border market integration is expanding as exchanges and trading platforms seek global reach and investors demand international market access. Regulatory harmonization efforts and technological standardization are facilitating increased cross-border trading activity and market linkages.

Regulatory modernization initiatives have introduced new market structure rules, enhanced transparency requirements, and updated technology standards that affect all ecosystem participants. Recent SEC rule changes regarding market data distribution and access have created new competitive dynamics and operational requirements.

Technology infrastructure upgrades across major exchanges and trading platforms have improved system capacity, reduced latency, and enhanced reliability. These investments support increased trading volumes while maintaining operational stability during periods of market stress.

Strategic partnerships between traditional exchanges and financial technology companies have accelerated innovation and expanded service capabilities. These collaborations combine established market infrastructure with cutting-edge technology solutions to create enhanced trading and analytics platforms.

International expansion efforts by US-based exchanges and technology providers have created new revenue opportunities and competitive challenges. Cross-border partnerships and technology licensing agreements are extending the reach of American capital market expertise globally.

Alternative asset integration has expanded beyond traditional securities to include cryptocurrency trading, private market access, and tokenized assets. These developments require new regulatory frameworks and technology infrastructure while creating additional revenue opportunities for ecosystem participants.

Technology investment priorities should focus on artificial intelligence, machine learning, and advanced analytics capabilities that can provide competitive advantages in trading execution, risk management, and customer service. Market participants that fail to invest adequately in these technologies may find themselves at significant disadvantages.

Regulatory compliance strategies must evolve to address increasing complexity and changing requirements. Firms should invest in regulatory technology solutions and compliance automation to manage costs while ensuring adherence to evolving standards and expectations.

MarkWide Research recommends that market participants develop comprehensive cybersecurity strategies that address both current threats and emerging risks. The increasing sophistication of cyber attacks requires proactive defense measures and incident response capabilities.

Strategic partnerships and collaborative arrangements can help smaller market participants access advanced technologies and regulatory compliance resources that might otherwise be prohibitively expensive. These partnerships can provide competitive advantages while sharing development costs and risks.

International expansion opportunities should be evaluated carefully, considering regulatory requirements, competitive dynamics, and technology infrastructure needs. Successful international expansion requires substantial investment and local market expertise but can provide significant long-term growth opportunities.

Technological transformation will continue to drive ecosystem evolution, with artificial intelligence, blockchain technology, and quantum computing expected to create new capabilities and competitive advantages. These technologies will likely reshape trading strategies, settlement processes, and risk management approaches over the next decade.

Market structure evolution is expected to continue as regulatory changes, competitive pressures, and technological innovations alter the relationships between different types of market participants. The trend toward increased electronification and automation is projected to accelerate, with electronic trading potentially reaching 95% of total volume within the next five years.

Regulatory development will likely focus on maintaining market stability while fostering innovation and competition. Future regulations may address emerging technologies, cross-border trading, and systemic risk management while balancing the need for investor protection with market efficiency objectives.

Global integration trends suggest increased connectivity between US capital markets and international trading venues. This integration will create new opportunities for market participants while requiring enhanced risk management and regulatory compliance capabilities.

Sustainable finance growth is expected to accelerate as environmental and social considerations become increasingly important to investors and regulators. ESG-focused trading products and analytics services will likely experience continued strong growth, potentially representing 30% of total trading activity within the next decade.

The US Capital Exchange Ecosystem Market stands at a pivotal juncture characterized by rapid technological advancement, evolving regulatory frameworks, and changing participant expectations. The ecosystem’s ability to adapt to these challenges while maintaining market integrity and efficiency will determine its continued leadership in global capital markets.

Strategic positioning within this dynamic environment requires careful balance between innovation and stability, competition and collaboration, and efficiency and compliance. Market participants that successfully navigate these complexities while investing in appropriate technologies and capabilities will be best positioned for long-term success.

The ecosystem’s future development will be shaped by continued technological innovation, regulatory evolution, and changing market participant needs. Sustainable growth will depend on the industry’s ability to maintain investor confidence while embracing new technologies and market structures that enhance efficiency and accessibility. The ongoing transformation of the US capital exchange ecosystem represents both significant challenges and substantial opportunities for all stakeholders involved in American capital markets.

What is the US Capital Exchange Ecosystem Market?

The US Capital Exchange Ecosystem Market refers to the framework of institutions, technologies, and processes that facilitate the buying and selling of securities. It includes stock exchanges, brokerage firms, and various trading platforms that enable capital flow in the economy.

Which companies are key players in the US Capital Exchange Ecosystem Market?

Key players in the US Capital Exchange Ecosystem Market include established firms such as NYSE, NASDAQ, and electronic trading platforms like Robinhood and E*TRADE. These companies shape the market dynamics through their innovative services and technological advancements.

What are the main drivers of the US Capital Exchange Ecosystem Market?

Drivers of the US Capital Exchange Ecosystem Market include the growing demand for digital trading solutions, increased retail investor participation, and advancements in fintech. Additionally, the rise of algorithmic trading and mobile investment platforms enhances market accessibility.

What challenges does the US Capital Exchange Ecosystem Market face?

Challenges in the US Capital Exchange Ecosystem Market include regulatory compliance, cybersecurity threats, and market volatility. These factors can hinder investor confidence and impact trading activities.

What opportunities exist in the US Capital Exchange Ecosystem Market for future growth?

Opportunities in the US Capital Exchange Ecosystem Market include the integration of blockchain technology for secure transactions and the expansion of ESG-focused investment products. Additionally, the rise of decentralized finance (DeFi) presents new avenues for capital exchange.

What trends are shaping the US Capital Exchange Ecosystem Market?

Trends in the US Capital Exchange Ecosystem Market include the increasing use of artificial intelligence for trading decisions and the shift towards sustainable investing. The growth of mobile trading apps and peer-to-peer lending platforms also reflects changing consumer behaviors.

US Capital Exchange Ecosystem Market

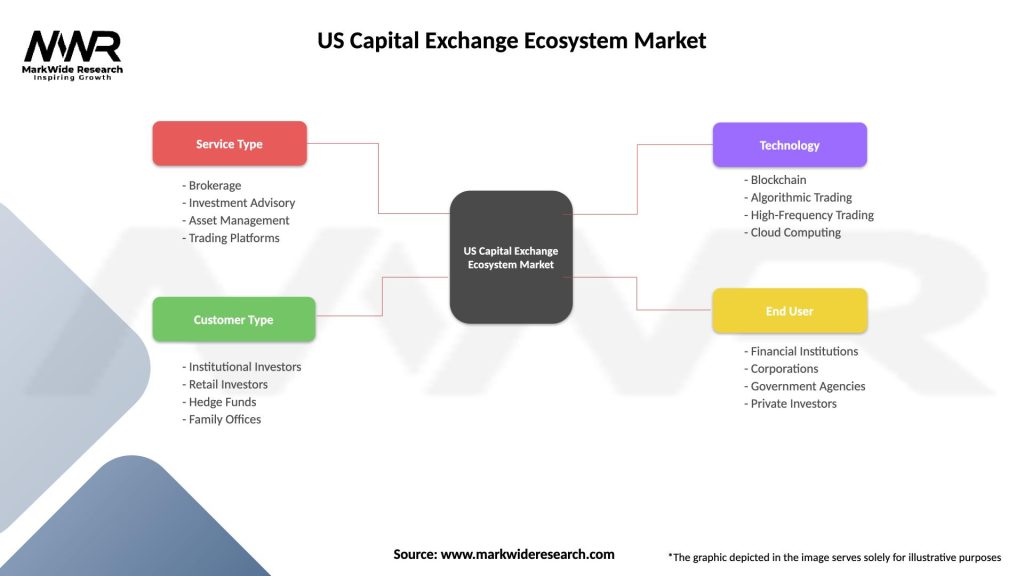

| Segmentation Details | Description |

|---|---|

| Service Type | Brokerage, Investment Advisory, Asset Management, Trading Platforms |

| Customer Type | Institutional Investors, Retail Investors, Hedge Funds, Family Offices |

| Technology | Blockchain, Algorithmic Trading, High-Frequency Trading, Cloud Computing |

| End User | Financial Institutions, Corporations, Government Agencies, Private Investors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Capital Exchange Ecosystem Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at