444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Satellite Based Augmentation Systems (SBAS) market is a rapidly expanding sector within the global satellite industry. SBAS refers to a technology that enhances the accuracy and reliability of positioning, navigation, and timing (PNT) services provided by global navigation satellite systems (GNSS) like GPS, GLONASS, and Galileo. The use of SBAS has become increasingly important in sectors such as aviation, maritime, transportation, agriculture, and surveying.

Meaning

Satellite Based Augmentation Systems (SBAS) are designed to improve the accuracy, integrity, and availability of GNSS signals. These systems utilize geostationary satellites to transmit correction messages to receivers on the ground, which then improve the positioning accuracy of the GNSS signals. SBAS works by measuring the errors in the GNSS signals and calculating correction factors that are transmitted to users in real-time.

Executive Summary

The Satellite Based Augmentation Systems (SBAS) market has witnessed substantial growth in recent years, driven by the increasing demand for precise and reliable positioning and navigation services across various industries. The market is expected to continue its upward trajectory, driven by technological advancements, expanding applications, and the need for enhanced safety and efficiency in critical sectors.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Satellite Based Augmentation Systems (SBAS) market is characterized by intense competition and rapid technological advancements. The market players are focused on developing innovative solutions to cater to the evolving needs of various industries. Collaboration and partnerships with GNSS system operators, technology providers, and industry stakeholders are key strategies adopted by market participants to expand their market presence and offerings.

The demand for SBAS technology is driven by the increasing need for precise positioning and navigation services in industries such as aviation, maritime, agriculture, and transportation. The agriculture sector is witnessing significant adoption of SBAS for precision farming practices, leading to improved crop yield and resource optimization. In the aviation sector, SBAS technology enables more accurate approach and landing procedures, enhancing flight safety and air traffic management.

Technological advancements in GNSS technology, including the development of new satellite constellations and signal improvements, are further fueling the demand for SBAS systems. These advancements contribute to enhanced positioning accuracy and reliability, driving the adoption of SBAS technology across industries.

However, the market faces certain challenges, including high implementation costs, technical complexities, limited coverage areas, and regulatory hurdles. The initial setup and maintenance costs of SBAS systems can be significant, which may deter some businesses from adopting the technology. Technical challenges such as satellite signal interference and atmospheric effects require expertise and specialized equipment for effective implementation and operation.

The limited coverage areas of SBAS systems and regulatory requirements in sectors like aviation can also restrict market growth to some extent. Overcoming these challenges requires continuous investments in R&D, collaboration among industry stakeholders, and partnerships to expand into new geographic regions and integrate SBAS technology with emerging technologies.

Regional Analysis

The SBAS market exhibits significant regional variations in terms of adoption and market size. North America is a leading market for SBAS, driven by the presence of key industry players, advanced infrastructure, and a high demand for precise positioning and navigation services. The Federal Aviation Administration’s (FAA) implementation of the Wide Area Augmentation System (WAAS) in the United States has been a major driver for the growth of SBAS in the region.

Europe is another prominent market for SBAS, with the European Geostationary Navigation Overlay Service (EGNOS) being widely used across various sectors. EGNOS provides SBAS coverage over Europe and supports applications in aviation, maritime, and land-based operations. The European Space Agency (ESA) and European GNSS Agency (GSA) have played pivotal roles in the development and deployment of SBAS technology in Europe.

Asia Pacific is witnessing rapid growth in the SBAS market, driven by the increasing investments in infrastructure development, particularly in countries like China and India. The demand for SBAS technology in agriculture, transportation, and surveying applications is also contributing to market growth in the region. The launch of the BeiDou Navigation Satellite System (BDS) in China has further boosted the adoption of SBAS technology.

Latin America and the Middle East and Africa are emerging markets for SBAS, with growing awareness and adoption of the technology in sectors such as aviation, agriculture, and transportation. The implementation of regional SBAS systems such as the Brazilian Satellite Navigation System (SBAS) in Latin America and the Middle East and Africa’s Satellite Augmentation System (MSAS) is driving market growth in these regions.

Competitive Landscape

Leading Companies in the Satellite Based Augmentation Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Satellite Based Augmentation Systems (SBAS) market can be segmented based on various factors, including application, end-user industry, and region.

By Application:

By End-user Industry:

By Region:

Segmentation based on application allows for a detailed analysis of the adoption and market size of SBAS systems in different sectors. The aviation sector is a major application area for SBAS, followed by maritime, agriculture, transportation, and surveying.

Segmentation by end-user industry provides insights into the specific industries driving the demand for SBAS technology. Aerospace and defense, agriculture, maritime, transportation and logistics, and construction are among the key industries utilizing SBAS systems to enhance their operations and improve efficiency.

Geographical segmentation helps in understanding the regional variations in market size, adoption, and growth opportunities. The North American region dominates the SBAS market, followed by Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The outbreak of the COVID-19 pandemic has had both positive and negative impacts on the Satellite Based Augmentation Systems (SBAS) market.

Positive Impact:

Negative Impact:

Despite the challenges posed by the pandemic, the long-term growth prospects of the SBAS market remain positive. The increasing need for accurate positioning and navigation services, coupled with technological advancements in satellite navigation systems, will continue to drive the adoption of SBAS technology in various industries.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Satellite Based Augmentation Systems (SBAS) market is poised for significant growth in the coming years. Factors such as the increasing demand for precise positioning and navigation services, advancements in satellite navigation systems, and the integration of SBAS with emerging technologies will drive market expansion.

The aviation sector will continue to be a major consumer of SBAS technology, with the need for enhanced safety and efficient air traffic management. The agriculture sector will witness substantial growth, driven by the adoption of precision farming practices and the need for optimized resource usage. Additionally, the transportation and logistics industry will increasingly utilize SBAS systems for fleet management and route optimization.

Geographically, the Asia Pacific region, particularly China and India, will exhibit substantial growth due to infrastructure development initiatives and the implementation of regional SBAS systems. Latin America and the Middle East and Africa will also witness significant market growth, driven by increasing awareness and adoption of SBAS technology in sectors such as aviation, agriculture, and transportation.

Conclusion

In conclusion, the Satellite Based Augmentation Systems (SBAS) market offers significant opportunities for industry participants and stakeholders. The continuous advancements in satellite navigation systems, the integration of SBAS with emerging technologies, and the increasing demand for accurate positioning and navigation services across various sectors will drive market growth. However, addressing cost barriers, technical complexities, and regulatory compliance requirements will be crucial for market players to capitalize on these opportunities and maintain a competitive edge.

What is Satellite Based Augmentation Systems?

Satellite Based Augmentation Systems (SBAS) are systems that enhance the accuracy and reliability of satellite navigation systems, such as GPS. They provide corrections to the satellite signals, improving positioning accuracy for various applications including aviation, maritime navigation, and land surveying.

What are the key players in the Satellite Based Augmentation Systems Market?

Key players in the Satellite Based Augmentation Systems Market include companies like Garmin, Raytheon Technologies, and Northrop Grumman. These companies are involved in developing and deploying SBAS technologies for various applications, among others.

What are the main drivers of the Satellite Based Augmentation Systems Market?

The main drivers of the Satellite Based Augmentation Systems Market include the increasing demand for accurate navigation solutions in aviation and maritime sectors, as well as the growing adoption of autonomous vehicles. Additionally, advancements in satellite technology are also contributing to market growth.

What challenges does the Satellite Based Augmentation Systems Market face?

The Satellite Based Augmentation Systems Market faces challenges such as high implementation costs and the need for continuous maintenance of the systems. Furthermore, regulatory hurdles and the integration of new technologies can also pose significant challenges.

What opportunities exist in the Satellite Based Augmentation Systems Market?

Opportunities in the Satellite Based Augmentation Systems Market include the expansion of smart city initiatives and the increasing use of SBAS in agriculture for precision farming. Additionally, the rise of Internet of Things (IoT) applications presents new avenues for growth.

What trends are shaping the Satellite Based Augmentation Systems Market?

Trends shaping the Satellite Based Augmentation Systems Market include the integration of artificial intelligence for enhanced data processing and the development of multi-constellation SBAS solutions. There is also a growing focus on improving cybersecurity measures to protect navigation data.

Satellite Based Augmentation Systems Market

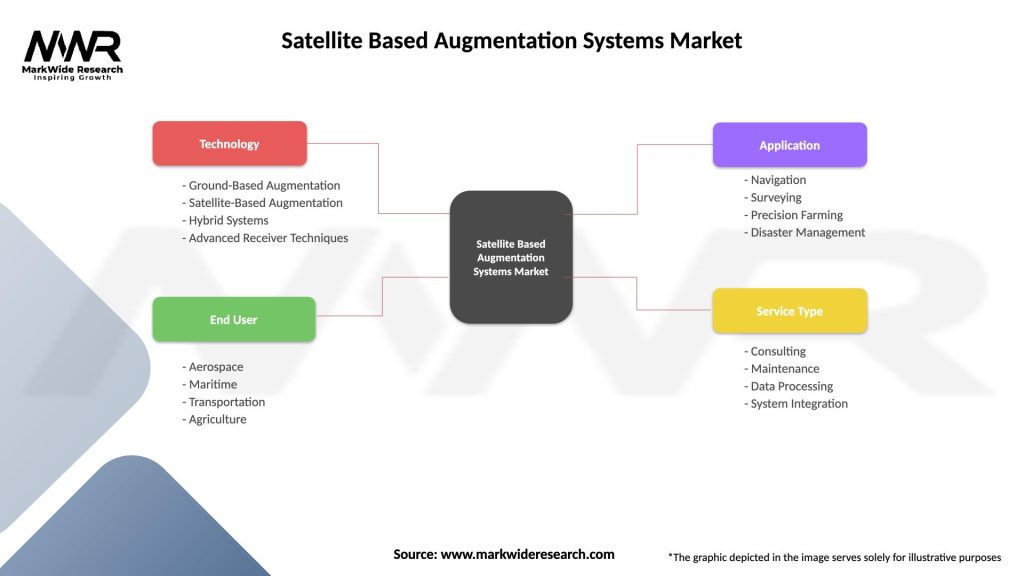

| Segmentation Details | Description |

|---|---|

| Technology | Ground-Based Augmentation, Satellite-Based Augmentation, Hybrid Systems, Advanced Receiver Techniques |

| End User | Aerospace, Maritime, Transportation, Agriculture |

| Application | Navigation, Surveying, Precision Farming, Disaster Management |

| Service Type | Consulting, Maintenance, Data Processing, System Integration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Satellite Based Augmentation Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at