444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The Puerto Rico home mortgage finance market refers to the sector that deals with the financing of residential properties in Puerto Rico. It encompasses the various financial institutions, lenders, and services involved in providing mortgage loans to individuals and families for the purchase or refinancing of homes. The market plays a crucial role in facilitating homeownership and driving the real estate industry in Puerto Rico.

Meaning

Home mortgage finance in Puerto Rico involves the process of borrowing money from a financial institution or lender to purchase a residential property. The borrower enters into a mortgage agreement, which serves as collateral for the loan. The mortgage is typically secured by the property being purchased, and the borrower makes regular payments, including principal and interest, over a specified period of time.

Executive Summary

The Puerto Rico home mortgage finance market has experienced significant growth and transformation in recent years. The market has been driven by various factors, including favorable interest rates, government initiatives to promote homeownership, and a growing demand for residential properties. However, there are also challenges and opportunities that impact the market dynamics. This report provides key insights into the market drivers, restraints, opportunities, and trends, along with a comprehensive analysis of the competitive landscape, regional dynamics, and future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

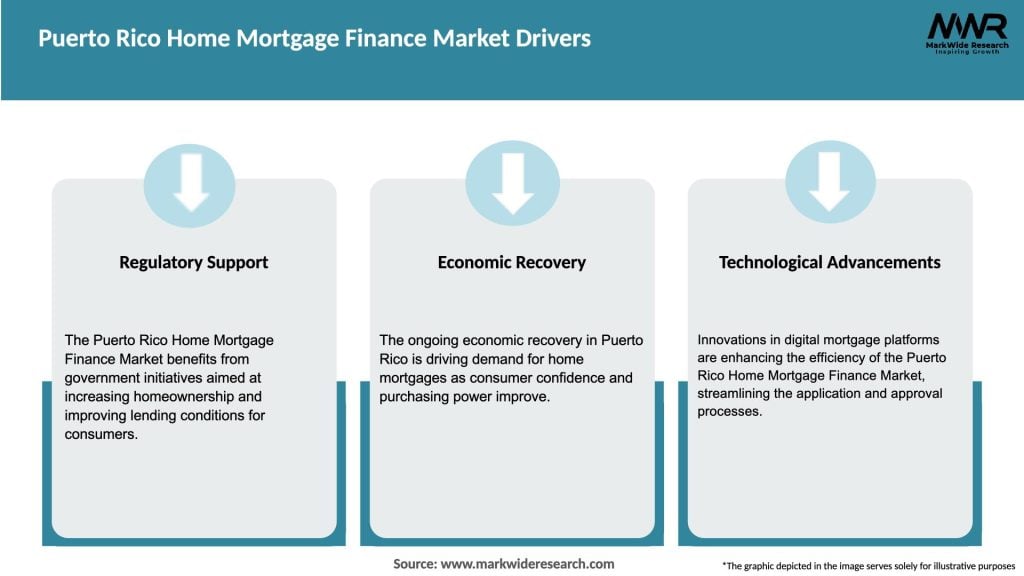

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Puerto Rico home mortgage finance market is influenced by various dynamics that shape its growth and development. These dynamics include economic factors, regulatory changes, demographic trends, and market competition. Understanding these dynamics is crucial for industry participants and stakeholders to make informed decisions and adapt to the evolving market landscape.

Regional Analysis

The Puerto Rico home mortgage finance market exhibits regional variations in terms of housing demand, market conditions, and economic factors. The market dynamics may differ between urban and rural areas, as well as across different municipalities in Puerto Rico. Regional analysis provides insights into these variations and helps identify specific opportunities and challenges in different parts of the country.

Competitive Landscape

Leading Companies in the Puerto Rico Home Mortgage Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The home mortgage finance market in Puerto Rico can be segmented based on various factors, including loan types, borrower profiles, property types, and geographical regions. Segmenting the market allows for a deeper understanding of specific customer needs, preferences, and market dynamics within each segment.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the Puerto Rico home mortgage finance market. It resulted in economic uncertainties, job losses, and changes in borrower behavior. Government relief programs, such as mortgage forbearance options and moratoriums on foreclosures, helped mitigate some of the immediate challenges. The pandemic also accelerated digital transformation in the industry, as remote transactions and virtual processes became the norm.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Puerto Rico home mortgage finance market is promising. Favorable interest rates, government support for homeownership, and a growing demand for housing are expected to drive market growth. Technological advancements and digital transformation will continue to reshape the industry, improving efficiency and customer experience. However, challenges related to economic stability, regulatory compliance, and affordability need to be addressed for sustainable market development.

Conclusion

The Puerto Rico home mortgage finance market plays a crucial role in facilitating homeownership and driving the real estate industry. It is influenced by factors such as interest rates, government initiatives, housing demand, and economic conditions. While the market presents opportunities for industry participants, challenges such as economic volatility, regulatory changes, and affordability concerns need to be navigated. Embracing technology, expanding mortgage product offerings, and focusing on customer satisfaction will be key to success in this evolving market.

What is Puerto Rico Home Mortgage Finance?

Puerto Rico Home Mortgage Finance refers to the processes and services involved in providing loans to individuals for purchasing homes in Puerto Rico. This includes various types of mortgage products, lending institutions, and regulatory frameworks that govern home financing in the region.

What are the key players in the Puerto Rico Home Mortgage Finance Market?

Key players in the Puerto Rico Home Mortgage Finance Market include Banco Popular, FirstBank Puerto Rico, and Oriental Bank, among others. These institutions offer a range of mortgage products tailored to the needs of local consumers.

What are the main drivers of the Puerto Rico Home Mortgage Finance Market?

The main drivers of the Puerto Rico Home Mortgage Finance Market include low interest rates, increasing demand for housing, and government incentives for first-time homebuyers. These factors contribute to a more accessible mortgage environment for residents.

What challenges does the Puerto Rico Home Mortgage Finance Market face?

The Puerto Rico Home Mortgage Finance Market faces challenges such as economic instability, high unemployment rates, and a declining population. These issues can affect the overall demand for mortgages and the ability of borrowers to qualify for loans.

What opportunities exist in the Puerto Rico Home Mortgage Finance Market?

Opportunities in the Puerto Rico Home Mortgage Finance Market include the potential for digital mortgage solutions and the expansion of affordable housing initiatives. These developments can enhance access to financing for a broader range of consumers.

What trends are shaping the Puerto Rico Home Mortgage Finance Market?

Trends shaping the Puerto Rico Home Mortgage Finance Market include the rise of online mortgage applications and the increasing use of technology in underwriting processes. Additionally, there is a growing focus on sustainable housing solutions and energy-efficient homes.

Puerto Rico Home Mortgage Finance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Rate, Adjustable Rate, Interest-Only, FHA Loans |

| Customer Type | First-Time Buyers, Investors, Refinancers, Repeat Buyers |

| Loan Purpose | Purchase, Refinance, Home Equity, Construction |

| Term Length | 15 Years, 20 Years, 30 Years, 40 Years |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Puerto Rico Home Mortgage Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at