444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Planned LNG market is experiencing significant growth and is poised to witness even greater expansion in the coming years. Liquefied Natural Gas (LNG) is a clean and versatile energy source that is gaining popularity across various sectors. It is produced by cooling natural gas to a liquid state, which reduces its volume and enables efficient transportation and storage. The Planned LNG market involves the construction and development of new LNG terminals and facilities to meet the growing demand for LNG worldwide.

Meaning

Planned LNG refers to the strategic initiatives taken by countries and companies to build new LNG infrastructure. These projects involve the construction of LNG liquefaction plants, regasification terminals, storage facilities, and transportation infrastructure. The purpose of planned LNG projects is to expand the LNG supply chain, enhance energy security, promote economic growth, and meet the increasing demand for natural gas in various sectors, including power generation, transportation, and industrial applications.

Executive Summary

The Planned LNG market is witnessing robust growth due to several factors such as the shift towards cleaner energy sources, the increasing demand for natural gas, and the globalization of LNG trade. Countries and companies are investing heavily in planned LNG projects to ensure a stable and reliable supply of LNG, diversify their energy mix, and reduce dependence on traditional fossil fuels. The market is characterized by intense competition among key players, technological advancements in LNG production and transportation, and supportive government policies.

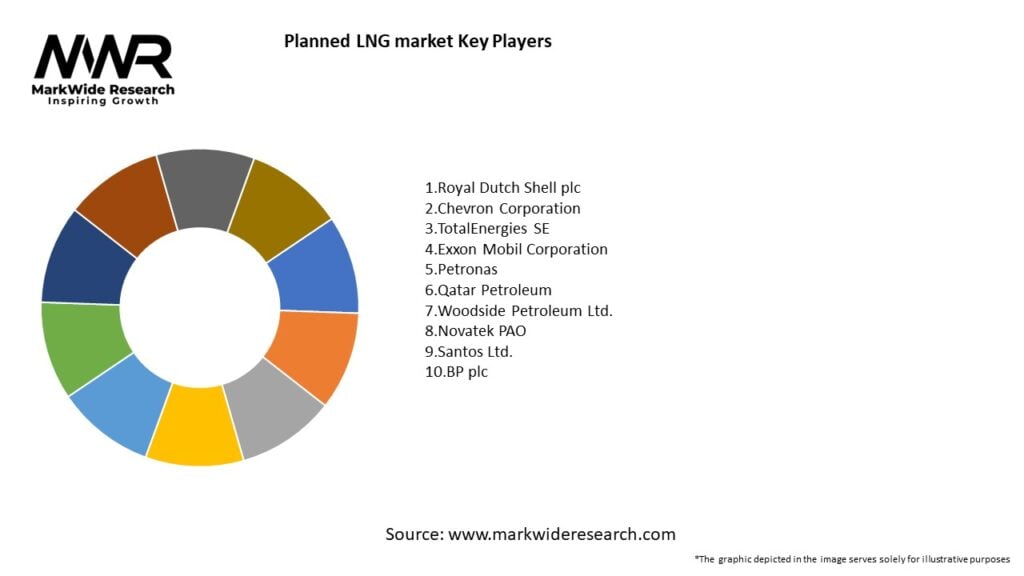

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Planned LNG market is characterized by dynamic and evolving trends. The industry is witnessing increased collaboration and partnerships among stakeholders to optimize costs, improve efficiency, and reduce environmental impact. Technological advancements, such as the use of modular construction techniques and floating LNG facilities, are enabling faster project implementation and reducing capital costs. The market is also influenced by geopolitical factors, including regional conflicts and trade disputes, which can impact LNG supply and demand dynamics.

Regional Analysis

The Planned LNG market exhibits significant regional variations. Asia Pacific is the largest market for planned LNG projects, driven by the growing energy demand in countries such as China, India, and Japan. North America is experiencing a shale gas revolution, leading to the construction of new LNG export terminals. Europe is investing in LNG infrastructure to diversify its gas supply and reduce dependence on pipeline imports. Middle Eastern countries are leveraging their natural gas reserves to become major LNG exporters. Africa and Latin America are also witnessing increasing investments in planned LNG projects.

Competitive Landscape

Leading Companies in the Planned LNG Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Planned LNG market can be segmented based on the type of infrastructure involved, including LNG liquefaction plants, regasification terminals, storage facilities, and transportation infrastructure. It can also be segmented based on the region, with each region having its unique market dynamics and project requirements. Additionally, the market can be segmented based on the scale of the project, such as large-scale LNG projects and small-scale LNG projects.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Planned LNG market. The restrictions on travel, lockdown measures, and economic slowdown resulted in a decline in global energy demand. This led to delays in planned LNG projects, disruptions in the global supply chain, and changes in demand patterns. However, as economies recover and energy demand rebounds, the long-term outlook for the Planned LNG market remains positive.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Planned LNG market is expected to witness significant growth in the coming years. The increasing demand for natural gas, the push for decarbonization, and the globalization of LNG trade are driving investments in planned LNG projects. The expansion of LNG infrastructure in emerging markets, the integration of LNG with renewable energy sources, and the development of small-scale LNG projects present new opportunities for industry participants. Despite challenges such as high capital requirements and regulatory complexities, the Planned LNG market is poised for a promising future.

Conclusion

In conclusion, the Planned LNG market is experiencing rapid growth and offers numerous opportunities for industry participants and stakeholders. The shift towards cleaner energy sources, the increasing demand for natural gas, and the globalization of LNG trade are driving investments in planned LNG projects worldwide. However, challenges such as high capital requirements, regulatory complexities, and competition from other energy sources need to be addressed. By leveraging technological advancements, fostering collaboration, and addressing environmental concerns, the Planned LNG market can achieve sustainable growth and contribute to the global energy transition.

What is Planned LNG?

Planned LNG refers to liquefied natural gas projects that are in the development or proposal stages. These projects typically involve the construction of LNG terminals, pipelines, and storage facilities aimed at enhancing natural gas supply and distribution.

What are the key players in the Planned LNG market?

Key players in the Planned LNG market include companies like Cheniere Energy, Shell, and TotalEnergies, which are involved in various stages of LNG project development and operation. These companies focus on expanding their LNG production capacity and infrastructure, among others.

What are the growth factors driving the Planned LNG market?

The growth of the Planned LNG market is driven by increasing global energy demand, the transition to cleaner energy sources, and the need for energy security. Additionally, investments in infrastructure and technology advancements are facilitating the development of new LNG projects.

What challenges does the Planned LNG market face?

The Planned LNG market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating natural gas prices. These factors can impact project feasibility and investment decisions, leading to delays or cancellations.

What opportunities exist in the Planned LNG market?

Opportunities in the Planned LNG market include the potential for new export terminals, increased demand from emerging economies, and advancements in LNG technology. These factors can create avenues for investment and collaboration in the sector.

What trends are shaping the Planned LNG market?

Trends shaping the Planned LNG market include a shift towards smaller-scale LNG projects, increased focus on sustainability, and the integration of digital technologies in operations. These trends are influencing how companies approach LNG development and investment.

Planned LNG market

| Segmentation Details | Description |

|---|---|

| Application | Power Generation, Industrial Heating, Marine Fuel, Transportation |

| Technology | Liquefaction, Regasification, Storage, Compression |

| End User | Utilities, Shipping Companies, Manufacturing, Residential |

| Distribution Channel | Direct Sales, Wholesale, Retail, Others |

Leading Companies in the Planned LNG Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at