444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Nigeria Oil and Gas Market is a dynamic and essential component of Nigeria’s economy, driving growth, revenue generation, and energy sustainability. In this comprehensive market overview, we delve into the pivotal role of Nigeria’s oil and gas sector, offering insights into its impact on the nation’s economy, energy landscape, and global energy markets. This report includes an executive summary and key market insights, analysis of the drivers and restraints shaping the market, exploration of emerging opportunities, and scrutiny of the dynamic forces at play. Moreover, we provide a regional analysis, competitive landscape, segmentation, and category-wise insights. Energy companies, policymakers, investors, and stakeholders will discover key benefits, a SWOT analysis, recent trends, the impact of technological advancements, notable industry developments, analyst suggestions, and a future outlook, ultimately concluding with a thought-provoking summary of the market’s potential.

Meaning

The Nigeria Oil and Gas Market encompasses the exploration, production, refining, and distribution of petroleum products and natural gas. This market overview delves into the significance of the oil and gas sector in Nigeria, driving economic growth, energy security, and global energy market participation.

Executive Summary

The Nigeria Oil and Gas Market is a cornerstone of the nation’s economy, contributing significantly to government revenue and foreign exchange earnings. This executive summary provides a concise overview of the market’s key highlights, offering a snapshot of its current status and future potential. Energy companies, policymakers, and investors are instrumental in shaping the sector’s future and driving Nigeria’s energy sustainability.

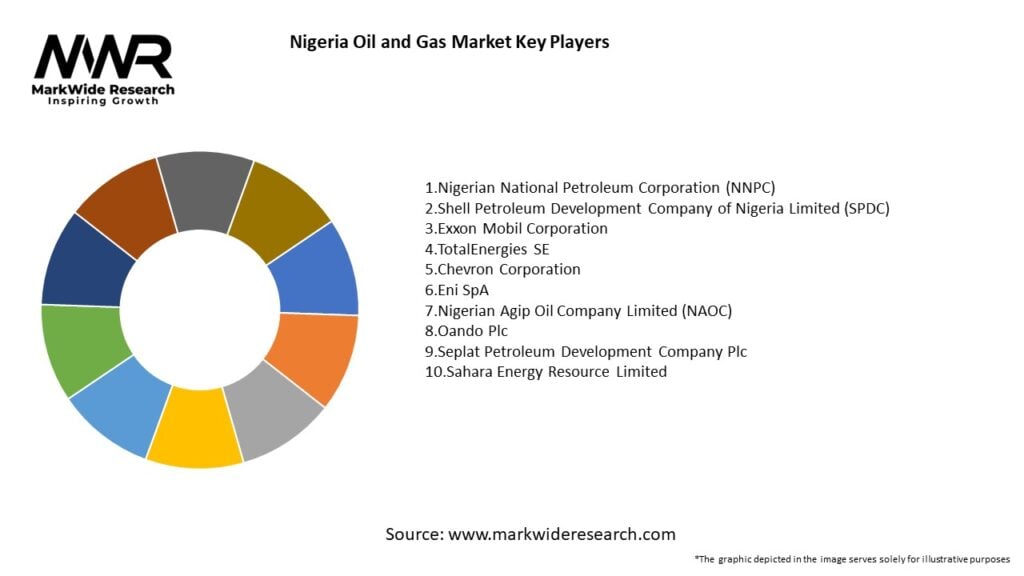

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Nigeria Oil and Gas Market is characterized by several key insights:

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The dynamics of the Nigeria Oil and Gas Market are influenced by several factors:

Regional Analysis

The Nigeria Oil and Gas Market shows diverse trends across different regions of the country:

Competitive Landscape

Leading companies in the Nigeria Oil and Gas market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Nigeria Oil and Gas Market can be segmented as follows:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic caused disruptions to oil production and demand, leading to decreased oil prices and reduced global trade. However, as the global economy recovers, demand for energy is expected to rise, providing a recovery path for the oil and gas market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Nigeria Oil and Gas Market is pivotal, with a multitude of growth opportunities and energy sustainability goals on the horizon. This section provides a forward-looking perspective on market trends, technological advancements, and emerging energy solutions. Energy companies, investors, policymakers, and stakeholders can use this outlook to chart their course for future success in fueling Nigeria’s growth and energy sustainability.

Conclusion

In conclusion, the Nigeria Oil and Gas Market plays a pivotal role in driving economic growth, revenue generation, and energy sustainability for the nation. As energy companies, investors, policymakers, and stakeholders navigate the market’s dynamic landscape, they must remain adaptable and committed to Nigeria’s energy sustainability goals. The market’s potential is vast, and those who embrace technological innovations, address energy challenges, and promote sustainability will undoubtedly shape the future of Nigeria’s energy sector. With a commitment to energy efficiency, diversification, and environmental responsibility, the Nigeria Oil and Gas Market is poised for continued growth and a significant impact on Nigeria’s energy landscape and global energy markets.

What is Nigeria Oil and Gas?

Nigeria Oil and Gas refers to the exploration, extraction, refining, and distribution of oil and natural gas resources in Nigeria, which is one of the largest producers of oil in Africa.

What are the key companies in the Nigeria Oil and Gas Market?

Key companies in the Nigeria Oil and Gas Market include Nigerian National Petroleum Corporation (NNPC), Shell Nigeria, TotalEnergies Nigeria, and Eni Nigeria, among others.

What are the main drivers of the Nigeria Oil and Gas Market?

The main drivers of the Nigeria Oil and Gas Market include the country’s vast oil reserves, increasing global demand for energy, and ongoing investments in infrastructure and technology.

What challenges does the Nigeria Oil and Gas Market face?

The Nigeria Oil and Gas Market faces challenges such as regulatory uncertainties, security issues in oil-producing regions, and environmental concerns related to oil spills and gas flaring.

What opportunities exist in the Nigeria Oil and Gas Market?

Opportunities in the Nigeria Oil and Gas Market include the potential for renewable energy integration, enhanced oil recovery techniques, and the development of natural gas as a cleaner energy source.

What trends are shaping the Nigeria Oil and Gas Market?

Trends shaping the Nigeria Oil and Gas Market include the shift towards cleaner energy solutions, increased investment in technology for efficiency, and a focus on sustainability and corporate social responsibility.

Nigeria Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Service Type | Exploration, Production, Refining, Distribution |

| End User | Utilities, Industrial, Commercial, Residential |

| Technology | Drilling, Extraction, Processing, Transportation |

| Product Type | Crude Oil, Natural Gas, Petrochemicals, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nigeria Oil and Gas market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at