444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The India flat glass market is a rapidly growing sector within the country’s construction industry. Flat glass refers to a type of glass that is manufactured in a flat form and does not have any significant curvature or distortion. It is widely used in various applications such as windows, doors, partitions, facades, and automotive windshields, among others. The market for flat glass in India has witnessed substantial growth in recent years, driven by factors such as urbanization, increasing construction activities, and the growing automotive industry.

Flat glass is a versatile material that is produced by the process of floating molten glass on a bed of molten tin. This method results in the formation of a smooth and flat surface on both sides of the glass. The absence of any significant curvature makes flat glass suitable for a wide range of applications. It can be further processed through cutting, grinding, and polishing to meet specific requirements.

Executive Summary:

The India flat glass market has experienced significant growth over the past few years. The demand for flat glass is primarily driven by the construction sector, which accounts for a major share of the market. Additionally, the automotive industry is also a key consumer of flat glass products. The market is characterized by the presence of both domestic and international players, competing to capture a larger market share. The increasing emphasis on energy-efficient and sustainable buildings is expected to further propel the demand for flat glass in the coming years.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

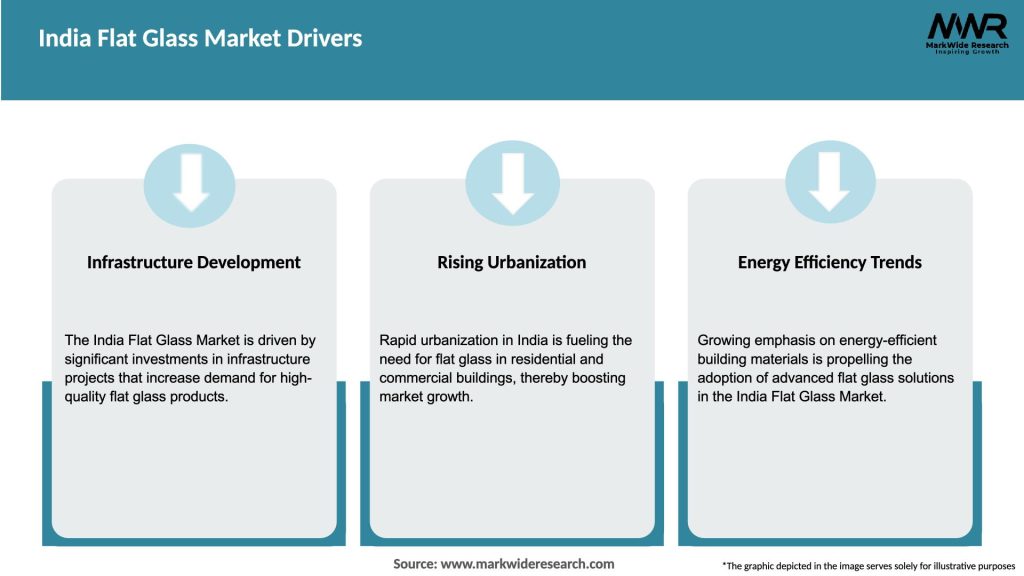

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The India flat glass market is influenced by various factors, including market drivers, restraints, and opportunities. The growing population and urbanization contribute to the demand for residential and commercial buildings, which drives the consumption of flat glass. However, the market faces challenges such as fluctuating raw material prices and high energy consumption during manufacturing. Technological advancements and the increasing focus on sustainability provide opportunities for market growth. The competitive landscape is characterized by the presence of both domestic and international players, leading to intense competition in the market.

Regional Analysis:

The flat glass market in India is geographically segmented into various regions, including North India, South India, East India, and West India. Each region has its own construction and automotive industries, contributing to the demand for flat glass. North India, with its major cities like Delhi and Jaipur, is a prominent region for the market. South India, with cities like Chennai and Bengaluru, also holds significant market potential. East India and West India, with emerging infrastructure projects, are witnessing increasing demand for flat glass.

Competitive Landscape:

Leading Companies in the India Flat Glass Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The India flat glass market can be segmented based on type, application, and end-user industry. By type, the market can be classified into annealed glass, toughened glass, laminated glass, and others. Based on application, the market can be categorized into windows, doors, partitions, facades, and automotive glass, among others. The end-user industries for flat glass include construction, automotive, solar energy, and others.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic had a significant impact on the India flat glass market. The nationwide lockdown and restrictions on construction activities and automotive production disrupted the demand for flat glass. However, as the economy gradually reopens and construction activities resume, the market is expected to recover. The increased focus on hygiene and safety measures may drive the demand for glass partitions and protective barriers in various industries.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future of the India flat glass market looks promising, with significant growth potential. The construction sector, driven by infrastructure development and urbanization, will continue to be a key driver for the market. The automotive industry’s demand for lightweight and advanced glass materials is expected to increase. Technological advancements, such as the development of smart glass and sustainable solutions, will shape the market’s future. Additionally, the focus on renewable energy sources and the adoption of solar panels will contribute to the growth of the flat glass market.

Conclusion:

The India flat glass market is witnessing steady growth, driven by the construction and automotive industries. The increasing demand for energy-efficient buildings, advancements in glass technologies, and rising environmental concerns are key factors shaping the market. Despite challenges such as raw material price fluctuations and intense competition, the market offers opportunities for manufacturers, suppliers, and end-users. The future outlook for the market remains positive, with sustainable and technologically advanced flat glass products expected to drive growth in the coming years.

What is Flat Glass?

Flat glass refers to glass that is produced in flat sheets, commonly used in windows, doors, and facades. It is characterized by its smooth surface and clarity, making it ideal for various architectural and automotive applications.

What are the key players in the India Flat Glass Market?

Key players in the India Flat Glass Market include Saint-Gobain, Asahi India Glass Ltd., and Gujarat Guardian Ltd. These companies are known for their extensive product ranges and innovations in flat glass manufacturing, among others.

What are the growth factors driving the India Flat Glass Market?

The growth of the India Flat Glass Market is driven by increasing urbanization, rising demand for energy-efficient buildings, and the expansion of the automotive sector. Additionally, advancements in glass technology are enhancing product offerings.

What challenges does the India Flat Glass Market face?

The India Flat Glass Market faces challenges such as fluctuating raw material prices and stringent regulations regarding environmental impact. These factors can affect production costs and operational efficiency.

What opportunities exist in the India Flat Glass Market?

Opportunities in the India Flat Glass Market include the growing trend towards smart glass technology and increased demand for sustainable building materials. These trends are likely to open new avenues for innovation and market expansion.

What trends are shaping the India Flat Glass Market?

Current trends in the India Flat Glass Market include the rise of energy-efficient glazing solutions and the integration of digital technologies in glass manufacturing. These trends are influencing product development and consumer preferences.

India Flat Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Float Glass, Laminated Glass, Tempered Glass, Coated Glass |

| End User | Construction, Automotive, Furniture, Solar Energy |

| Application | Windows, Facades, Interior Partitions, Shower Doors |

| Distribution Channel | Direct Sales, Retail, Online, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Flat Glass Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at