444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global mortgage lender market is a dynamic and rapidly growing sector in the financial industry. Mortgage lenders play a crucial role in facilitating homeownership by providing individuals and businesses with the necessary funds to purchase real estate properties. These lenders act as intermediaries between borrowers and financial institutions, offering various mortgage products and services tailored to meet the diverse needs of consumers.

Meaning

The term “mortgage lender” refers to a financial institution or entity that provides loans to borrowers for the purpose of purchasing real estate properties. These loans are secured by the property itself, which means that if the borrower fails to repay the loan, the lender has the right to seize the property and sell it to recover their investment. Mortgage lenders generate revenue through interest payments on these loans, making it a profitable business model.

Executive Summary

The global mortgage lender market has witnessed significant growth in recent years, driven by factors such as increasing demand for real estate, low-interest rates, and favorable government policies. The market is highly competitive, with numerous players vying for market share. Key participants in this industry include banks, credit unions, mortgage companies, and online lenders.

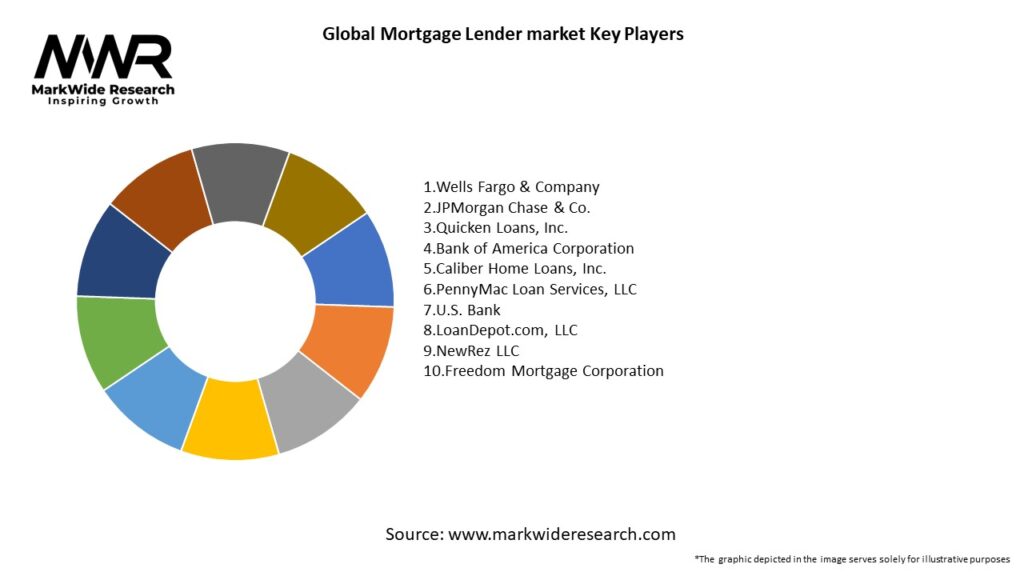

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

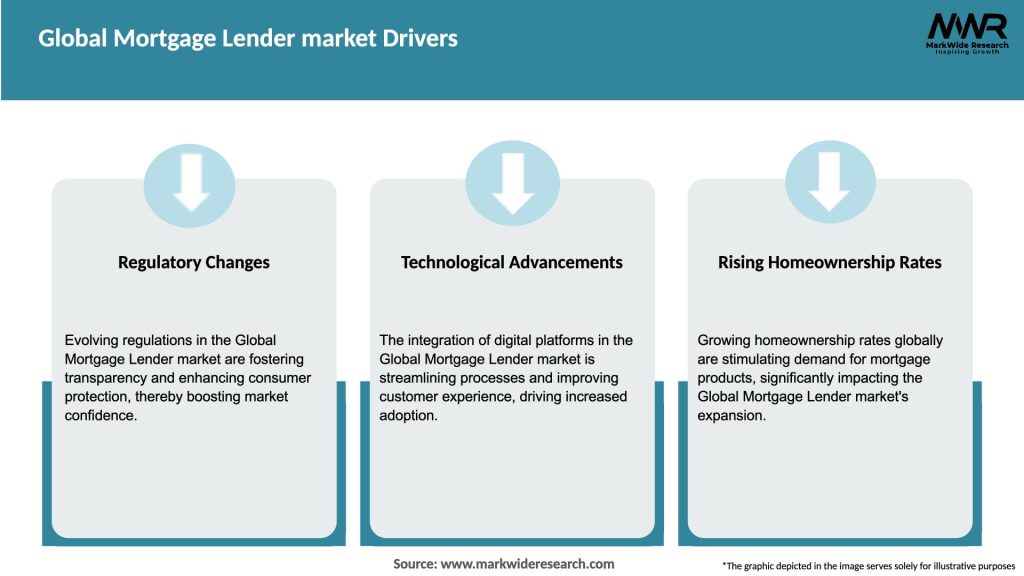

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global mortgage lender market operates in a dynamic environment influenced by various factors. The market dynamics are shaped by economic conditions, government policies, technological advancements, and changing consumer preferences. Lenders must stay agile and adapt to these dynamics to remain competitive and meet the evolving needs of borrowers.

Regional Analysis

The mortgage lender market varies across different regions due to variations in economic conditions, cultural norms, and regulatory frameworks. Developed economies, such as the United States, Canada, and European countries, have well-established mortgage markets. Emerging economies, including India, China, and Brazil, offer significant growth opportunities due to increasing urbanization and rising disposable incomes.

Competitive Landscape

Leading Companies in the Global Mortgage Lender Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

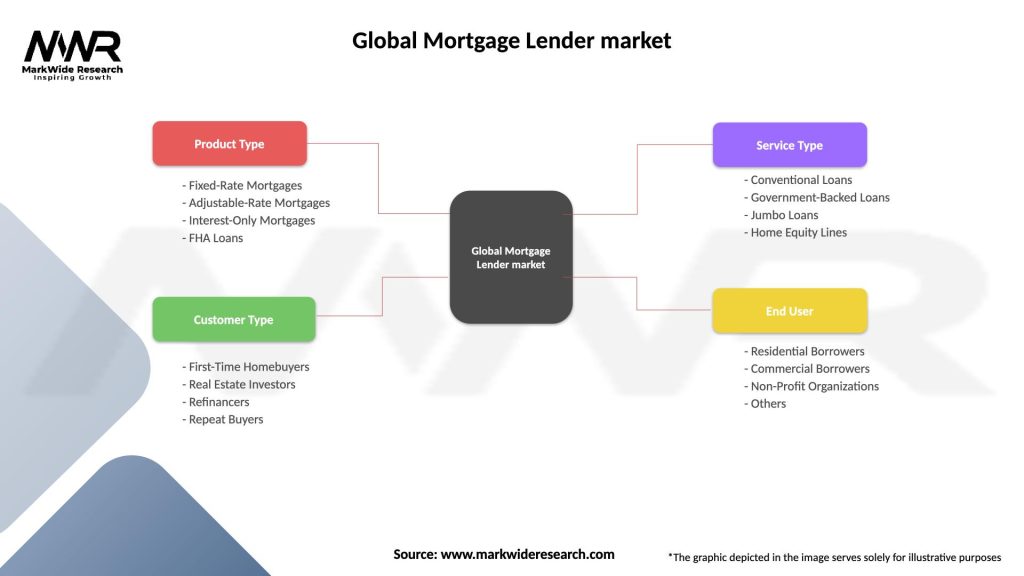

Segmentation

The mortgage lender market can be segmented based on the type of lenders and mortgage products offered. Lenders can be categorized as banks, credit unions, mortgage companies, and online lenders. Mortgage products can include fixed-rate mortgages, adjustable-rate mortgages, government-backed loans, and jumbo loans.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the mortgage lender market. The initial outbreak led to economic uncertainties, resulting in a temporary slowdown in mortgage lending activity. However, low-interest rates and government stimulus measures aimed at supporting the housing market helped drive a rebound in demand. The pandemic also accelerated the adoption of digital mortgage platforms as social distancing measures made in-person transactions challenging.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global mortgage lender market is expected to witness sustained growth in the coming years. Factors such as increasing urbanization, favorable government policies, and advancements in technology will continue to drive demand for mortgage loans. Lenders that adapt to changing market dynamics, leverage technology, and prioritize customer-centric approaches are likely to thrive in this competitive landscape.

Conclusion

The global mortgage lender market plays a vital role in facilitating homeownership and real estate investment. Mortgage lenders offer a range of loan products and services to meet the diverse needs of borrowers. The market is influenced by various factors, including economic conditions, government policies, and technological advancements. Adapting to market dynamics, embracing technology, and providing personalized experiences will be key for lenders to succeed in this rapidly evolving industry.

What is Mortgage Lender?

A Mortgage Lender is a financial institution or individual that provides loans to borrowers for purchasing real estate. These lenders assess the borrower’s creditworthiness and the value of the property to determine loan eligibility and terms.

Who are the key players in the Global Mortgage Lender market?

Key players in the Global Mortgage Lender market include Wells Fargo, JPMorgan Chase, and Bank of America, among others. These companies dominate the market by offering a variety of mortgage products and services to consumers.

What are the main drivers of growth in the Global Mortgage Lender market?

The main drivers of growth in the Global Mortgage Lender market include low interest rates, increasing homeownership rates, and a growing demand for refinancing options. Additionally, favorable economic conditions contribute to the expansion of this market.

What challenges does the Global Mortgage Lender market face?

The Global Mortgage Lender market faces challenges such as regulatory changes, rising interest rates, and economic uncertainty. These factors can impact lending practices and borrower confidence.

What opportunities exist in the Global Mortgage Lender market?

Opportunities in the Global Mortgage Lender market include the rise of digital mortgage platforms and the increasing demand for sustainable lending practices. Additionally, expanding into emerging markets presents new growth avenues.

What trends are shaping the Global Mortgage Lender market?

Trends shaping the Global Mortgage Lender market include the adoption of technology in loan processing, the growth of alternative lending solutions, and a focus on customer experience. These trends are transforming how lenders interact with borrowers.

Global Mortgage Lender market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed-Rate Mortgages, Adjustable-Rate Mortgages, Interest-Only Mortgages, FHA Loans |

| Customer Type | First-Time Homebuyers, Real Estate Investors, Refinancers, Repeat Buyers |

| Service Type | Conventional Loans, Government-Backed Loans, Jumbo Loans, Home Equity Lines |

| End User | Residential Borrowers, Commercial Borrowers, Non-Profit Organizations, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Mortgage Lender Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at