444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The financial guarantee market plays a vital role in the global financial sector, offering a range of services to businesses and individuals. It serves as a means of protection and assurance, mitigating the risk associated with financial transactions. This market provides guarantees for various purposes, such as loans, investments, and contractual agreements. Financial guarantees act as a safety net for parties involved in these transactions, ensuring that obligations are fulfilled and potential losses are covered. The market operates on a global scale, with participants including financial institutions, insurance companies, and specialized guarantee providers.

Meaning

Financial guarantees are contractual agreements that offer assurance and protection to parties involved in financial transactions. They provide a guarantee to fulfill specific obligations or cover losses in case of default or non-performance by one of the parties. These guarantees can take various forms, such as performance bonds, payment guarantees, and surety bonds. The purpose of a financial guarantee is to instill confidence and mitigate risk, enabling smoother financial transactions and fostering trust among the parties involved.

Executive Summary

The financial guarantee market is witnessing significant growth, driven by the increasing demand for risk mitigation and financial security in various sectors. The market offers a wide range of guarantees tailored to the specific needs of businesses and individuals. Key players in the market include financial institutions, insurance companies, and specialized guarantee providers. The market is highly competitive, with players vying for market share through innovative products and services. However, challenges such as regulatory compliance and economic uncertainties pose potential restraints to market growth. Despite these challenges, the financial guarantee market presents ample opportunities for industry participants, including expansion into emerging markets and diversification of product offerings.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The financial guarantee market is characterized by intense competition, driven by the need to differentiate products and services. Market players focus on developing customer-centric solutions, leveraging technology, and ensuring regulatory compliance. Additionally, changing economic conditions, geopolitical factors, and evolving industry trends influence the market dynamics. Continuous monitoring of these factors and proactive adaptation to market changes are essential for sustained growth in this competitive landscape.

Regional Analysis

The financial guarantee market exhibits regional variations due to differences in economic development, legal systems, and cultural factors. Developed regions such as North America and Europe have well-established financial guarantee markets, driven by robust financial sectors and high levels of trade and investment. Emerging economies in Asia-Pacific, Latin America, and Africa offer significant growth potential, fueled by expanding infrastructure projects and increasing trade activities. Understanding regional dynamics is crucial for market participants aiming to expand their footprint and capitalize on the unique opportunities presented by each region.

Competitive Landscape

Leading Companies in the Financial Guarantee Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

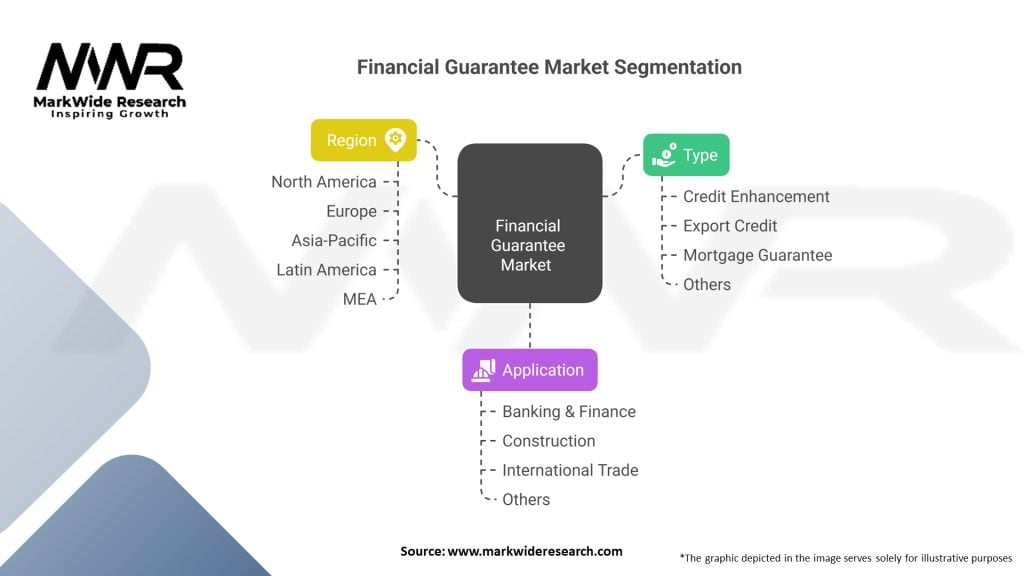

Segmentation

The financial guarantee market can be segmented based on the type of guarantees provided, industries served, and geographical regions. Common segments include performance bonds, payment guarantees, and surety bonds. Industries served by financial guarantees range from banking and finance to construction, real estate, and international trade. Geographically, the market can be segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the financial guarantee market. The economic disruptions caused by the pandemic have increased the demand for risk mitigation and financial security. Businesses and individuals have become more cautious in their financial dealings, seeking guarantees to ensure contractual obligations are met. However, the pandemic has also presented challenges, such as increased credit risk and uncertainty in financial markets. Guarantee providers have had to adapt to these changing conditions, implement stricter risk assessment measures, and offer support to affected industries.

Key Industry Developments

Analyst Suggestions

Future Outlook

The financial guarantee market is expected to experience steady growth in the coming years. Increasing awareness about the benefits of financial guarantees, coupled with the need for risk mitigation in complex financial transactions, will drive market demand. Technological advancements, such as blockchain integration and automation, will further streamline guarantee processes and enhance operational efficiency. Expansion into emerging markets and the development of customized guarantee solutions will present growth opportunities for market participants. However, economic uncertainties and regulatory challenges may pose risks and require proactive strategies to navigate successfully.

Conclusion

The financial guarantee market plays a vital role in mitigating risk and providing assurance in financial transactions. Financial guarantees serve as a safety net, protecting parties from potential losses and ensuring that obligations are fulfilled. The market is driven by the increasing demand for risk mitigation, complex financial transactions, and globalization of trade. While economic uncertainties and regulatory challenges pose potential restraints, opportunities exist in emerging markets, technological advancements, and customized guarantee solutions. Guarantee providers must adapt to changing market dynamics, leverage technology, and focus on customer-centric approaches to thrive in this competitive landscape. Overall, the future outlook for the financial guarantee market is optimistic, with steady growth expected in the coming years.

Financial Guarantee Market Segmentation

| Segmentation Details | Description |

|---|---|

| Type | Credit Enhancement, Export Credit, Mortgage Guarantee, Others |

| Application | Banking & Finance, Construction, International Trade, Others |

| Region | North America, Europe, Asia-Pacific, Latin America, MEA |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Financial Guarantee Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at