444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Commercial lending is a vital component of the global financial system, serving as a catalyst for business growth and economic development. This market encompasses various financial products and services provided by banks, credit unions, and non-banking financial institutions to enterprises of all sizes. These lending solutions are specifically designed to meet the diverse financing needs of businesses, including working capital loans, equipment financing, commercial mortgages, trade finance, and more.

Commercial lending refers to the process of providing funds to businesses to support their operations, expansion, and investment activities. It enables enterprises to access the capital necessary to fuel their growth, manage cash flow, and seize new opportunities. Commercial lenders assess the creditworthiness of borrowers based on their financial history, collateral, and future prospects, enabling them to mitigate risks while offering competitive interest rates and flexible repayment terms.

Executive Summary

The commercial lending market has witnessed significant growth in recent years, driven by globalization, technological advancements, and increasing demand for business financing. With businesses expanding their operations, entrepreneurs launching startups, and existing enterprises seeking capital for innovation, the commercial lending market has become a critical enabler of economic progress.

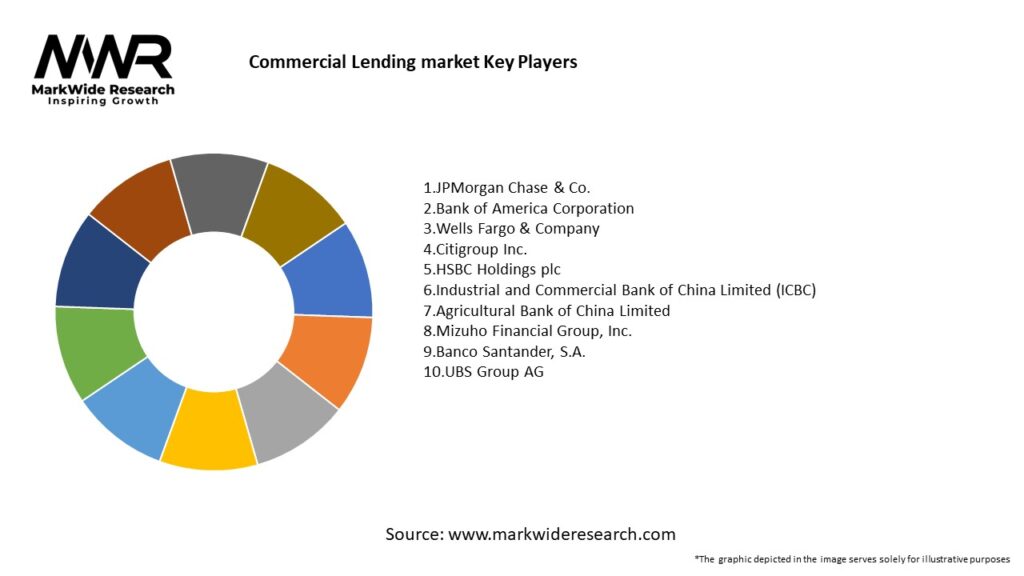

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Diversified Lending Products: Term loans, lines of credit, equipment financing, and SBA loans serve various needs.

Risk-Based Pricing: Credit scoring models and AI-driven underwriting optimize interest rates.

Fintech Competition: Online lenders and marketplaces erode traditional bank market share.

Regulatory Oversight: Basel III and local capital requirement rules shape bank lending capacities.

SME Focus: Small-business financing remains an underserved segment with robust growth potential.

Market Drivers

Economic Expansion: Business growth forecasts encourage capital investment through lending.

Digital Application Processes: Streamlined online portals reduce approval times and costs.

Government Stimulus Programs: Subsidized loan schemes and guarantees expand commercial lending.

Data Analytics Adoption: Real-time cash flow monitoring improves credit decisioning.

Alternative Lenders Rise: P2P and marketplace lenders offer niche products to specialized segments.

Market Restraints

Credit Risk Concerns: Economic downturns increase default rates and tighten lending standards.

Interest Rate Volatility: Rate hikes can dampen borrowing appetite for fixed-rate loans.

Regulatory Compliance Costs: KYC/AML and reporting requirements raise operational expenses.

Collateral Requirements: Asset-based lending limits access for asset-lite companies.

Technology Integration Challenges: Legacy banking systems can slow fintech partnership rollouts.

Market Opportunities

Embedded Finance Solutions: Lending APIs integrated into ERP and accounting platforms for seamless credit.

Green and Sustainable Loans: Preferential terms for eco-friendly projects and ESG-compliant businesses.

Supply-Chain Finance: Invoice financing and dynamic discounting solutions for B2B ecosystems.

AI-Driven Loan Monitoring: Continuous risk assessment via transaction data and predictive analytics.

SME-Focused Fintech Partnerships: Banks teaming with online lenders to expand SME outreach.

Market Dynamics

The commercial lending market is characterized by dynamic interactions between lenders, borrowers, and external factors. These dynamics shape the landscape, influence lending practices, and impact market growth.

Regional AnalysisThe commercial lending market exhibits regional variations due to economic conditions, regulatory frameworks, and cultural factors. North America and Europe dominate the market, driven by developed financial systems and robust SME sectors. Asia-Pacific is experiencing rapid growth, fueled by emerging economies, a burgeoning startup ecosystem, and government initiatives to promote entrepreneurship.

Competitive Landscape

Leading Companies in the Commercial Lending Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

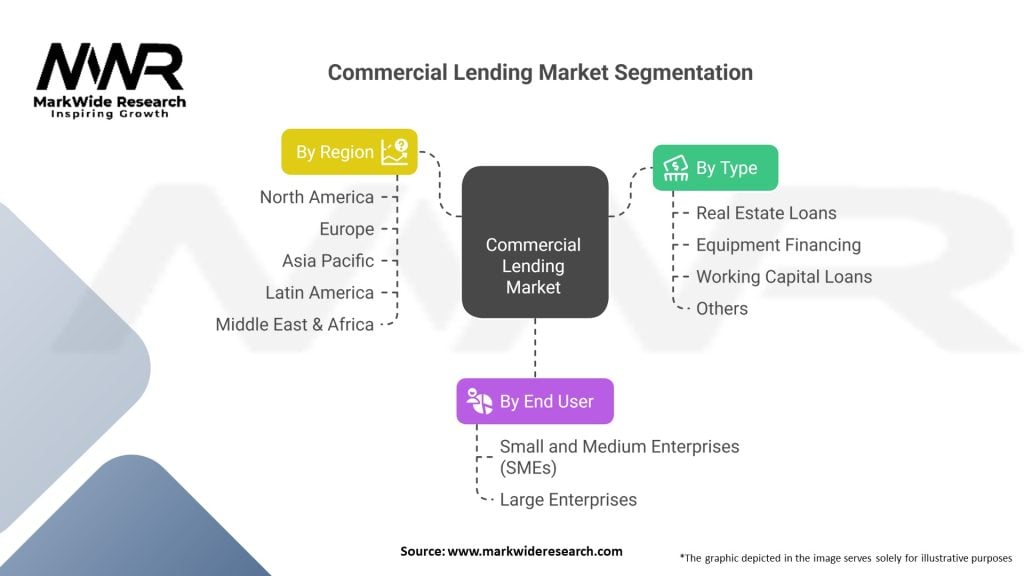

SegmentationThe commercial lending market can be segmented based on loan type, borrower profile, and industry verticals. Loan types include working capital loans, equipment financing, asset-based lending, and trade finance. Borrower profiles range from small businesses to large corporations, with each segment having specific financing requirements. Industry verticals such as manufacturing, retail, healthcare, and construction have unique lending needs driven by their respective business models.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on the commercial lending market. Economic uncertainties, disruptions in supply chains, and reduced consumer spending have affected businesses’ ability to repay loans. Lenders have responded by implementing loan forbearance programs, providing financial relief, and adopting flexible repayment options. The pandemic has accelerated digital transformation in lending processes, making online applications and remote loan processing the new norm.

Key Industry Developments

Analyst Suggestions

Future Outlook

The commercial lending market is poised for continued growth, driven by the ongoing need for business financing, technological advancements, and evolving lending practices. The integration of AI, machine learning, and blockchain technology is expected to revolutionize the lending landscape, improving efficiency, risk assessment, and customer experience. As economies recover from the impacts of the pandemic, the demand for commercial loans is projected to rebound, presenting new opportunities for lenders and borrowers alike.

Conclusion

The commercial lending market plays a crucial role in fueling business growth and economic development globally. With a wide range of lending solutions and a competitive landscape, financial institutions are adapting to technological advancements and evolving customer expectations. Despite challenges and uncertainties, the market presents numerous opportunities for lenders to expand their offerings, cater to the diverse needs of businesses, and contribute to economic progress in the years to come.

What is Commercial Lending?

Commercial lending refers to the process of providing loans to businesses for various purposes, including purchasing equipment, financing operations, or expanding facilities. These loans are typically secured by the assets of the business and are essential for supporting business growth and development.

What are the key players in the Commercial Lending market?

Key players in the Commercial Lending market include major banks such as JPMorgan Chase, Bank of America, and Wells Fargo, as well as alternative lenders like Kabbage and OnDeck. These companies offer a range of lending products tailored to meet the needs of different businesses, among others.

What are the main drivers of growth in the Commercial Lending market?

The growth of the Commercial Lending market is driven by factors such as increasing demand for business financing, favorable interest rates, and the expansion of small and medium-sized enterprises. Additionally, technological advancements in lending processes are making it easier for businesses to access funds.

What challenges does the Commercial Lending market face?

The Commercial Lending market faces challenges such as regulatory compliance, credit risk assessment, and competition from alternative financing sources. These factors can impact lenders’ ability to provide loans and manage their portfolios effectively.

What opportunities exist in the Commercial Lending market?

Opportunities in the Commercial Lending market include the rise of fintech companies offering innovative lending solutions and the increasing focus on sustainable business practices. Additionally, there is potential for growth in underserved markets and sectors that require specialized financing.

What trends are shaping the Commercial Lending market?

Trends in the Commercial Lending market include the adoption of digital lending platforms, increased use of data analytics for credit scoring, and a growing emphasis on customer experience. These trends are transforming how businesses access financing and interact with lenders.

Commercial Lending Market

| Segmentation | Details |

|---|---|

| By Type | Real Estate Loans, Equipment Financing, Working Capital Loans, Others |

| By End User | Small and Medium Enterprises (SMEs), Large Enterprises |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Commercial Lending Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at