444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The coin collection market has experienced remarkable growth in recent years, attracting collectors and enthusiasts from all corners of the globe. This market offers a unique blend of historical significance, artistic appeal, and investment potential, making it an exciting and rewarding field for participants. In this comprehensive analysis, we delve into the various aspects of the coin collection market, examining its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, and more.

Coin collection, also known as numismatics, refers to the hobby or practice of collecting and studying coins. It involves the acquisition, preservation, and study of various coins, including those from different eras, countries, and denominations. Collectors are often drawn to coins due to their historical significance, cultural representation, unique designs, and potential investment value. Coin collecting is not only a passion for many individuals but also an avenue for preserving and appreciating the rich history of different civilizations.

Executive Summary

The coin collection market has witnessed significant growth in recent years, driven by several factors such as increasing interest in history, rising disposable income, and the allure of tangible assets. This market offers a wide range of opportunities for collectors, investors, and industry participants. However, it also faces certain challenges, including counterfeiting risks, market volatility, and changing consumer preferences. By understanding the key market insights, participants can capitalize on the growth prospects and navigate potential obstacles effectively.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

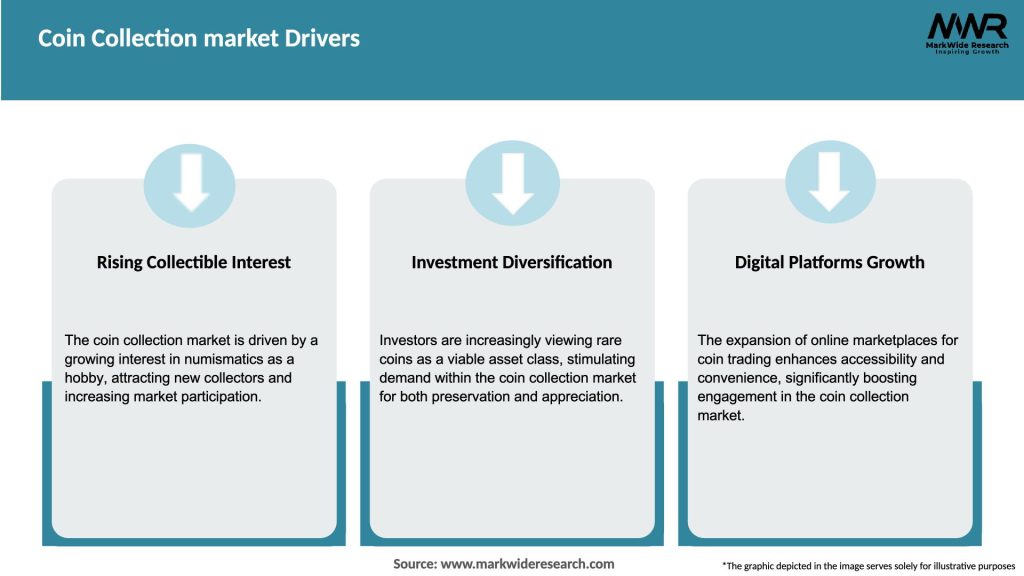

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The coin collection market operates within a dynamic environment, influenced by various factors that shape its growth and evolution. These dynamics include changing consumer preferences, technological advancements, market competition, economic conditions, geopolitical events, and regulatory frameworks. Industry participants must stay attuned to these dynamics to adapt their strategies, remain competitive, and capitalize on emerging opportunities.

Regional Analysis

The coin collection market exhibits a global presence, with enthusiasts and collectors located in various regions. Each region brings unique characteristics and historical significance to the market. The regional analysis explores the market trends, collector preferences, and key factors driving growth in different parts of the world, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape

Leading Companies in the Coin Collection Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The coin collection market can be segmented based on various factors, including coin type, historical period, country of origin, material composition, and collector demographics. Segmenting the market allows for a deeper understanding of specific market segments, their growth potential, and the preferences of target audiences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The coin collection market, like many other industries, experienced the impact of the COVID-19 pandemic. Temporary closures of mints, disruptions in the supply chain, cancellation of numismatic events, and shifting consumer priorities affected the market. However, the pandemic also accelerated digital transformation, driving increased online engagement, virtual auctions, and the growth of online coin marketplaces. Collectors adapted to the changing landscape by exploring new avenues for acquiring and trading coins, showcasing the market’s resilience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The coin collection market is poised for continued growth in the coming years, driven by factors such as increasing interest in history, the potential for tangible asset investments, and expanding online platforms. Technological advancements, including digitization and blockchain integration, will shape the market’s future, enhancing authentication, traceability, and collector engagement. While challenges such as counterfeit risks and market volatility persist, industry participants can leverage emerging opportunities and adapt to evolving trends to thrive in the ever-evolving coin collection market.

Conclusion

The coin collection market offers a captivating blend of history, culture, and investment potential. With its rich historical significance, growing interest in numismatics, and expanding online marketplaces, the industry presents a range of opportunities for collectors, investors, and industry participants. By understanding the market dynamics, key trends, regional insights, and category-wise preferences, stakeholders can navigate the challenges and capitalize on the market’s growth potential. The future outlook for the coin collection market remains promising, driven by technological advancements, education initiatives, and the continued appreciation for coins as tangible artifacts and investments.

What is Coin Collection?

Coin collection is the hobby of collecting coins, often for their historical, artistic, or monetary value. Collectors may focus on specific types of coins, such as rare coins, commemorative coins, or coins from particular eras or regions.

What are the key players in the Coin Collection market?

Key players in the Coin Collection market include companies like the American Numismatic Association, Heritage Auctions, and Stack’s Bowers Galleries, which provide resources, auctions, and educational materials for collectors, among others.

What are the growth factors driving the Coin Collection market?

The Coin Collection market is driven by factors such as increasing interest in numismatics, the rise of online auction platforms, and the growing appreciation for historical artifacts among collectors.

What challenges does the Coin Collection market face?

Challenges in the Coin Collection market include the risk of counterfeit coins, fluctuating market values, and the need for proper authentication and grading of coins to ensure their value.

What future opportunities exist in the Coin Collection market?

Opportunities in the Coin Collection market include the expansion of digital platforms for buying and selling coins, increased interest in educational resources about numismatics, and the potential for new collectors to enter the market through social media engagement.

What trends are currently shaping the Coin Collection market?

Current trends in the Coin Collection market include the growing popularity of themed collections, the use of technology for coin grading and valuation, and an increase in community-driven events and exhibitions that promote coin collecting.

Coin Collection market

| Segmentation Details | Description |

|---|---|

| Type | Gold Coins, Silver Coins, Rare Coins, Commemorative Coins |

| Material | Gold, Silver, Copper, Platinum |

| Condition | Uncirculated, Proof, Circulated, Damaged |

| Market Segment | Collectors, Investors, Dealers, Auction Houses |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Coin Collection Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at