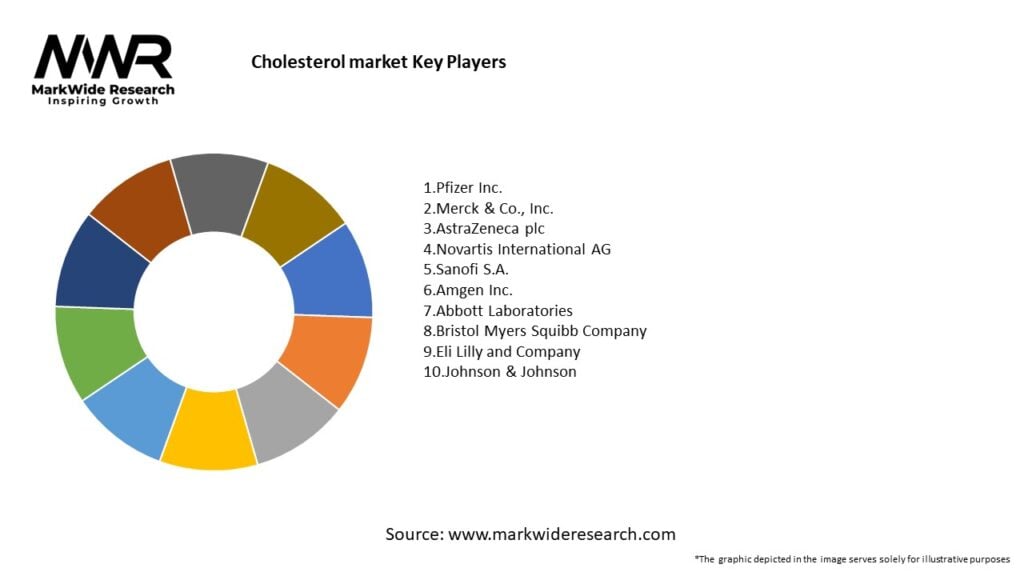

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Statins account for the largest share of lipid-lowering prescriptions globally, supported by extensive clinical data and inclusion in standard treatment guidelines.

-

PCSK9 inhibitors and siRNA therapies are rapidly gaining uptake among high-risk patient groups due to their potent LDL-C reduction (>50%) and favorable safety profiles.

-

Over-the-counter supplements, including omega-3 concentrates and plant sterols, are experiencing double-digit growth as consumers pursue preventive wellness strategies.

-

Digital therapeutics and remote lipid monitoring platforms are emerging as key enablers for patient adherence and real-time risk stratification.

-

Diagnostic testing innovations—such as point-of-care lipid panels and genomics-based risk assessments—are enhancing early detection and personalized therapy selection.

Market Drivers

-

Cardiovascular Disease Burden: Rising global prevalence of cardiovascular diseases (CVD) drives demand for effective cholesterol management therapies to reduce morbidity and mortality.

-

Aging Population: Growing proportion of individuals aged 65 and above—who are at higher risk for hypercholesterolemia—fuels market expansion in developed regions.

-

Guideline Updates: Frequent revisions of lipid-management guidelines by bodies like ACC/AHA and ESC promote intensified LDL-C targets, boosting prescription volumes for novel agents.

-

Wellness Trend: Increased consumer focus on preventive health accelerates adoption of supplements and lifestyle interventions to manage cholesterol levels.

-

Technological Innovation: Advances in drug delivery systems (e.g., long-acting injectables) and precision diagnostics support tailored therapies and improved patient outcomes.

Market Restraints

-

High Therapy Costs: Novel biologics and RNA-based therapies carry premium pricing, limiting access in cost-conscious healthcare systems and emerging markets.

-

Adherence Challenges: Long-term daily dosing regimens for some lipid-lowering drugs can lead to poor patient compliance and suboptimal clinical benefits.

-

Side-Effect Concerns: Statin-associated muscle pain and rare adverse events with newer agents may deter prescribing and patient uptake.

-

Regulatory Hurdles: Complex approval pathways for innovative therapies can delay market entry and commercialization timelines.

-

Reimbursement Constraints: Stringent payer requirements for cost-effectiveness evidence limit formulary access for high-cost treatments.

Market Opportunities

-

Emerging Markets: Expanding healthcare infrastructure in Asia Pacific and Latin America creates opportunities for both generic statins and advanced lipid-lowering agents.

-

Combination Therapies: Fixed-dose combinations (e.g., statin + PCSK9 inhibitor) offer potential to simplify regimens and enhance patient adherence.

-

Digital Health Integration: Telemedicine platforms and mobile health apps for cholesterol monitoring can drive patient engagement and long-term treatment success.

-

Biomarker-Driven Care: Adoption of genomics and proteomics biomarkers enables risk stratification and personalized therapy selection.

-

Over-the-Counter Innovation: Development of novel nutraceutical formulations with clinical-grade efficacy can capture health-conscious consumers.

Market Dynamics

-

R&D Collaboration: Partnerships between biotech firms and academic centers accelerate discovery of next-generation lipid-lowering molecules.

-

Pricing Pressures: Increased competition from generics and biosimilars drives pricing strategies and market consolidation.

-

Value-Based Care: Payers and providers shift to outcome-driven reimbursement models, emphasizing cost-effectiveness and real-world evidence.

-

Regulatory Evolution: Accelerated approval pathways and adaptive licensing frameworks facilitate earlier access for breakthrough therapies.

-

Digital Adoption: Integrating wearables and remote monitoring devices into patient care pathways enhances data collection and therapy optimization.

Regional Analysis

-

North America: Largest market share driven by high CVD prevalence, advanced healthcare infrastructure, and strong reimbursement environment for novel therapies.

-

Europe: Significant uptake of PCSK9 inhibitors and digital health solutions, tempered by stringent pricing negotiations and health technology assessments.

-

Asia Pacific: Fastest growth region owing to expanding healthcare access, rising middle-class incomes, and increasing awareness of cholesterol-related risks.

-

Latin America: Emerging market potential constrained by reimbursement gaps but growing interest in generics and OTC supplements.

-

Middle East & Africa: Nascent market with opportunities in urban centers for both prescription therapies and preventive nutraceuticals, supported by government health initiatives.

Competitive Landscape

Leading Companies in the Cholesterol Market:

- Pfizer Inc.

- Merck & Co., Inc.

- AstraZeneca plc

- Novartis International AG

- Sanofi S.A.

- Amgen Inc.

- Abbott Laboratories

- Bristol Myers Squibb Company

- Eli Lilly and Company

- Johnson & Johnson

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

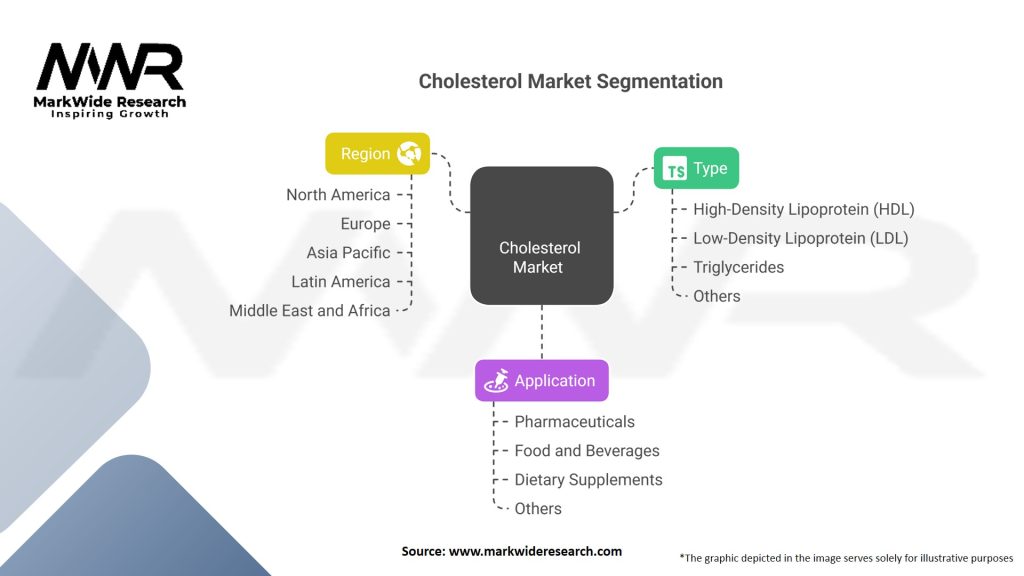

Segmentation

-

By Therapy Class: Statins, PCSK9 Inhibitors, siRNA Therapies, Bempedoic Acid, Nutraceuticals.

-

By Distribution Channel: Retail Pharmacies, Hospital Pharmacies, Online Pharmacies, OTC Retail.

-

By End-User: Hospitals, Clinics, Home Care, Specialty Centers.

-

By Geography: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Category-wise Insights

-

Statins: Remain first-line therapy; generic availability drives volume, while branded options focus on improved tolerability and dosing convenience.

-

PCSK9 Inhibitors: Offer substantial LDL reduction (>60%), gaining traction in high-risk patients non-responsive to statins or with familial hypercholesterolemia.

-

siRNA Therapies: Inclisiran’s twice-yearly dosing improves adherence; pipeline includes next-generation RNA modalities targeting lipid metabolism.

-

Bempedoic Acid: Oral ACL inhibitor providing moderate LDL-C lowering; potential combination with ezetimibe enhances efficacy in statin-intolerant patients.

-

Nutraceuticals: Omega-3 concentrates and plant sterols support mild lipid improvement and cardiovascular wellness, appealing to preventive care segment.

Key Benefits for Industry Participants and Stakeholders

-

Improved Patient Outcomes: Advanced therapies reduce cardiovascular events and healthcare costs by effectively managing cholesterol levels.

-

Market Diversification: Pharmaceutical and nutraceutical companies benefit from multiple product classes and delivery models.

-

Data-Driven Care: Integration of digital monitoring tools facilitates personalized treatment plans and real-world evidence generation.

-

Revenue Growth: High-value biologics and combination regimens present significant revenue opportunities despite premium pricing.

-

Healthcare System Efficiency: Preventive strategies and remote monitoring reduce hospitalizations and support value-based care initiatives.

SWOT Analysis

Strengths:

-

Broad portfolio of established and novel lipid-lowering therapies.

-

Strong clinical evidence supporting cardiovascular risk reduction.

Weaknesses:

-

High treatment costs for biologics and advanced modalities.

-

Patient adherence challenges with chronic daily dosing.

Opportunities:

-

Expansion into emerging markets through generics and OTC products.

-

Growth of digital health platforms for remote lipid management.

Threats:

-

Pricing and reimbursement pressures in mature markets.

-

Potential safety concerns and regulatory setbacks for new therapies.

Market Key Trends

-

Combination Therapies: Fixed-dose combinations of lipid-lowering agents to improve adherence and efficacy.

-

Long-Acting Modalities: Development of extended-release injectables and RNA-based therapies requiring infrequent dosing.

-

Digital Therapeutics: Use of apps and wearables to monitor lipid profiles, encourage lifestyle changes, and track medication adherence.

-

Precision Medicine: Biomarker-driven patient stratification for targeted therapy selection and dose optimization.

-

Sustainable Formulations: Eco-friendly manufacturing and packaging of nutraceuticals in response to environmental concerns.

Covid-19 Impact

The Covid-19 pandemic underscored the vulnerability of patients with cardiovascular comorbidities, driving renewed emphasis on cholesterol control as part of holistic risk mitigation strategies. Telehealth adoption surged, enabling remote lipid monitoring and virtual consultations. Supply chain disruptions accelerated the shift toward digital pharmacy services and home delivery of both prescription and OTC lipid-lowering products. Post-pandemic, healthcare systems continue to integrate cholesterol management into broader chronic care frameworks to enhance resilience and patient engagement.

Key Industry Developments

-

Inclisiran Launch Expansion: Novartis extends Leqvio availability to new markets and indications, backed by long-term safety data.

-

PCSK9 Inhibitor Label Updates: Amgen secures indications for high-risk primary prevention, broadening Repatha’s clinical use.

-

Digital Platform Partnerships: Pharma companies collaborate with tech firms to integrate lipid tracking apps with electronic health records.

-

Biosimilar Approvals: Entry of PCSK9 biosimilars in certain regions introduces competitive pricing and expands patient access.

-

Nutraceutical Innovation: Launch of next-generation plant sterol esters with enhanced bioavailability and clinical efficacy data.

Analyst Suggestions

-

Value Demonstration: Payers and providers should collaborate on real-world evidence studies to showcase cost savings and health outcomes associated with novel therapies.

-

Market Access Strategies: Manufacturers must engage early with health technology assessment bodies to secure favorable reimbursement and formulary placement.

-

Patient Engagement Programs: Deploy digital tools and support services to improve medication adherence and lifestyle modification adherence.

-

Emerging Market Focus: Tailor pricing and distribution models for price-sensitive regions, leveraging generics and OTC products.

-

Innovation Partnerships: Invest in co-development agreements with biotech startups and academic centers to accelerate next-generation cholesterol therapeutics.

Future Outlook

The Cholesterol market is set to transform over the next decade as novel therapies, digital health integration, and personalized medicine converge. Extended-release and gene-silencing modalities will complement traditional statins, while digital therapeutics enhance patient engagement. Emerging markets will drive volume growth through generics and nutraceuticals, and value-based care models will reward demonstrable health outcomes. With continued innovation and collaborative ecosystem approaches, the global Cholesterol market will deliver improved cardiovascular health at scale.

Conclusion

Managing cholesterol levels remains a cornerstone of cardiovascular disease prevention and treatment. The evolving landscape—from well-established statins to cutting-edge RNA therapies and digital monitoring platforms—offers multiple avenues to optimize lipid control and patient outcomes. Stakeholders who embrace innovation, prioritize patient adherence, and navigate regulatory and reimbursement complexities will lead the market forward. As the global burden of cardiovascular disease persists, the Cholesterol market will remain a vital arena for therapeutic advancement, preventive care, and sustainable health system impact.