444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

China is known for its robust and dynamic economy, and its trade finance market plays a vital role in supporting its extensive import and export activities. Trade finance refers to the financial instruments and services that facilitate international trade transactions, ensuring smooth and secure movement of goods and services across borders. In recent years, the China trade finance market has witnessed significant growth, driven by various factors such as expanding international trade, increasing demand for credit facilities, and the country’s position as a major global player in manufacturing and exporting.

Meaning

Trade finance encompasses a range of financial products and services that assist businesses in conducting international trade. It involves various activities, including financing, risk mitigation, and payment facilitation. Trade finance instruments commonly used in China include letters of credit, bank guarantees, export credit insurance, and factoring services. These instruments provide security and assurance to both importers and exporters, enabling them to engage in cross-border trade with confidence.

Executive Summary

The China trade finance market has witnessed steady growth in recent years, driven by the country’s strong emphasis on international trade and its position as the world’s largest exporter. The market offers a wide range of financial products and services designed to support importers and exporters in conducting their business smoothly. With increasing globalization and the growing complexity of international trade transactions, the demand for trade finance solutions is expected to continue rising in the coming years.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

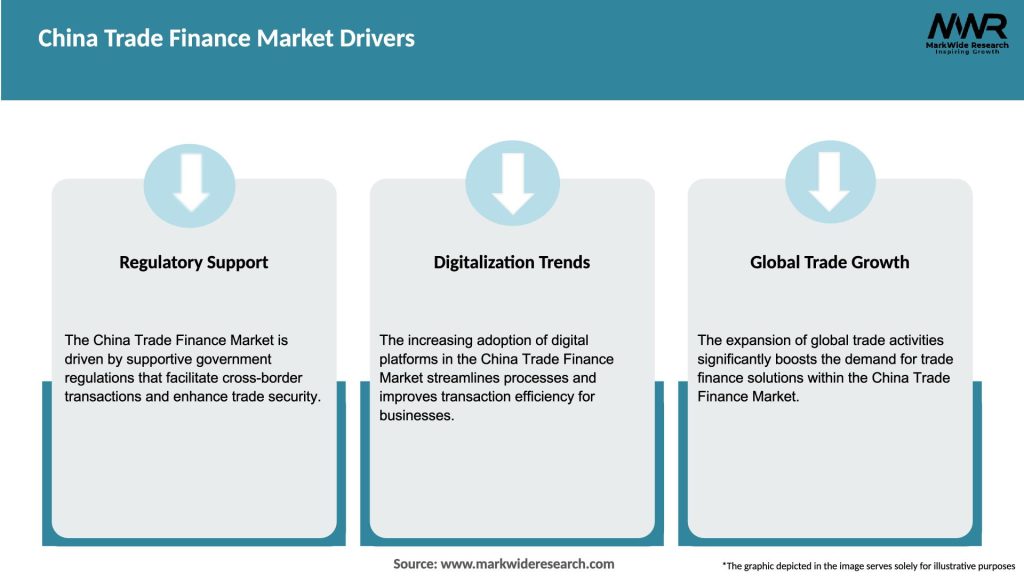

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The China trade finance market operates in a dynamic environment influenced by various factors. These dynamics include changing trade patterns, advancements in technology, evolving regulatory frameworks, and geopolitical developments. It is essential for market participants to stay informed about these dynamics and adapt their strategies accordingly to capitalize on emerging opportunities and mitigate potential risks.

Regional Analysis

The China trade finance market extends beyond the country’s borders, serving businesses engaged in international trade across different regions. Key regions involved in trade with China include North America, Europe, Asia-Pacific, and Africa. Each region has its unique trade dynamics, regulatory frameworks, and market characteristics. Understanding these regional nuances is crucial for trade finance providers to tailor their offerings and cater to the specific needs of businesses operating in these regions.

Competitive Landscape

Leading Companies in the China Trade Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

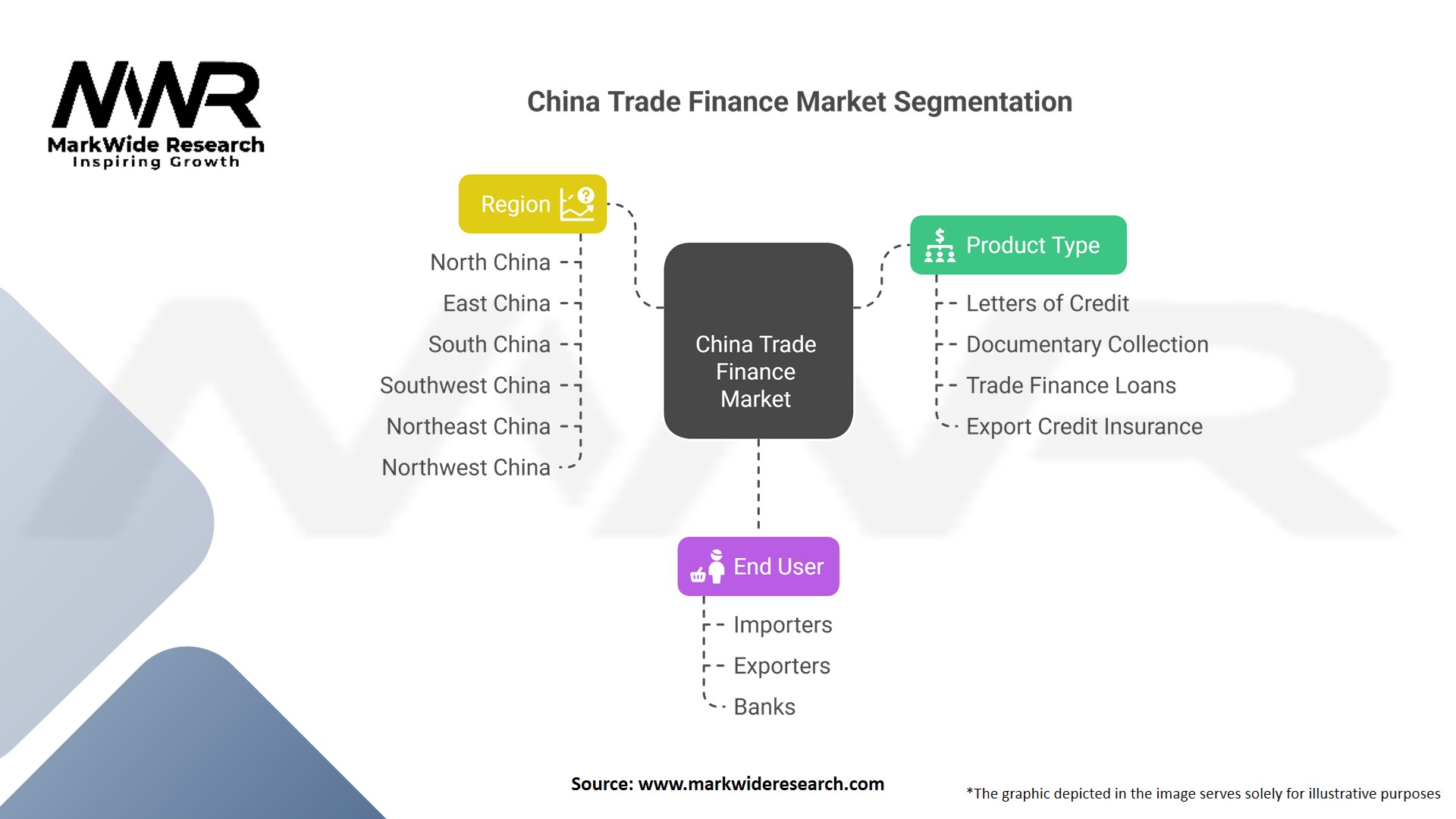

Segmentation

The China trade finance market can be segmented based on various criteria, including the type of financial product or service offered, industry sectors served, and the size of businesses served. Segmentation allows trade finance providers to focus on specific customer segments and tailor their offerings to meet the unique requirements of each segment. This approach enables better targeting, improved customer satisfaction, and enhanced market penetration.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the China trade finance market, as it has on global trade as a whole. The pandemic disrupted supply chains, caused a decline in trade volumes, and created uncertainties in international trade. However, it also accelerated the adoption of digital technologies in trade finance, as businesses sought to mitigate disruptions and maintain continuity. Digital platforms, contactless processes, and remote document verification became essential in facilitating trade finance transactions during lockdowns and travel restrictions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the China trade finance market looks promising, driven by factors such as increasing international trade, technological advancements, and government support. The market is expected to continue evolving, with a greater focus on digitalization, sustainability, and risk management. Emerging technologies, such as blockchain and artificial intelligence, will play a crucial role in shaping the future of trade finance, enabling secure and efficient cross-border transactions. To capitalize on these opportunities, industry participants need to embrace digital transformation, innovate their offerings, and adapt to changing market dynamics.

Conclusion

The China trade finance market is a vital component of the country’s extensive international trade activities. It provides businesses with the necessary financial instruments and services to facilitate secure and smooth cross-border transactions. The market is driven by factors such as expanding global trade, growing demand for credit facilities, and technological advancements. While facing challenges such as regulatory complexities and credit risks, the market also presents significant opportunities, including SME-focused solutions, technological advancements, and infrastructure development. By embracing digitalization, strengthening risk management practices, and fostering collaboration, industry participants can thrive in the evolving landscape of China’s trade finance market.

What is Trade Finance?

Trade finance refers to the financial instruments and products that companies use to facilitate international trade. It includes various services such as letters of credit, export financing, and trade credit insurance, which help mitigate risks and ensure smooth transactions between buyers and sellers across borders.

What are the key players in the China Trade Finance Market?

Key players in the China Trade Finance Market include major banks such as Bank of China and Industrial and Commercial Bank of China, as well as financial technology firms like Ant Financial and Tencent. These companies provide a range of trade finance solutions to support businesses engaged in international trade, among others.

What are the growth factors driving the China Trade Finance Market?

The China Trade Finance Market is driven by factors such as the increasing volume of international trade, the expansion of e-commerce, and the growing need for risk management solutions. Additionally, government initiatives to promote exports and enhance trade relationships contribute to market growth.

What challenges does the China Trade Finance Market face?

The China Trade Finance Market faces challenges such as regulatory compliance issues, geopolitical tensions affecting trade relationships, and the complexity of cross-border transactions. These factors can create uncertainties for businesses seeking trade finance solutions.

What opportunities exist in the China Trade Finance Market?

Opportunities in the China Trade Finance Market include the adoption of digital trade finance solutions, the rise of blockchain technology for secure transactions, and the increasing demand for sustainable trade practices. These trends can enhance efficiency and transparency in trade finance operations.

What trends are shaping the China Trade Finance Market?

Trends shaping the China Trade Finance Market include the integration of artificial intelligence for risk assessment, the growth of supply chain finance, and the emphasis on sustainability in trade practices. These innovations are transforming how businesses approach trade finance and manage their operations.

China Trade Finance Market

| Segmentation | Details |

|---|---|

| Product Type | Letters of credit, documentary collection, trade finance loans, export credit insurance, others |

| End User | Importers, exporters, banks, others |

| Region | North China, East China, South China, Southwest China, Northeast China, Northwest China |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the China Trade Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at