444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The autonomous construction equipment market is witnessing significant growth and technological advancements, revolutionizing the construction industry. Autonomous construction equipment refers to machinery and vehicles that operate without human intervention, utilizing advanced technologies such as artificial intelligence (AI), machine learning (ML), and sensors. These autonomous machines are capable of performing various tasks, including excavation, grading, concrete pouring, and material handling.

Meaning

Autonomous construction equipment is a category of machinery and vehicles that can operate without human intervention. These machines utilize cutting-edge technologies like AI, ML, and sensors to perform tasks traditionally carried out by human operators. By eliminating the need for human intervention, autonomous construction equipment offers numerous benefits, including increased efficiency, enhanced safety, and improved productivity.

Executive Summary

The autonomous construction equipment market is experiencing robust growth due to the rising demand for advanced machinery in the construction industry. The deployment of autonomous machines has significantly transformed the construction landscape, enabling efficient and precise operations. This market report provides a comprehensive analysis of the key trends, market dynamics, regional insights, competitive landscape, and future outlook of the autonomous construction equipment market.

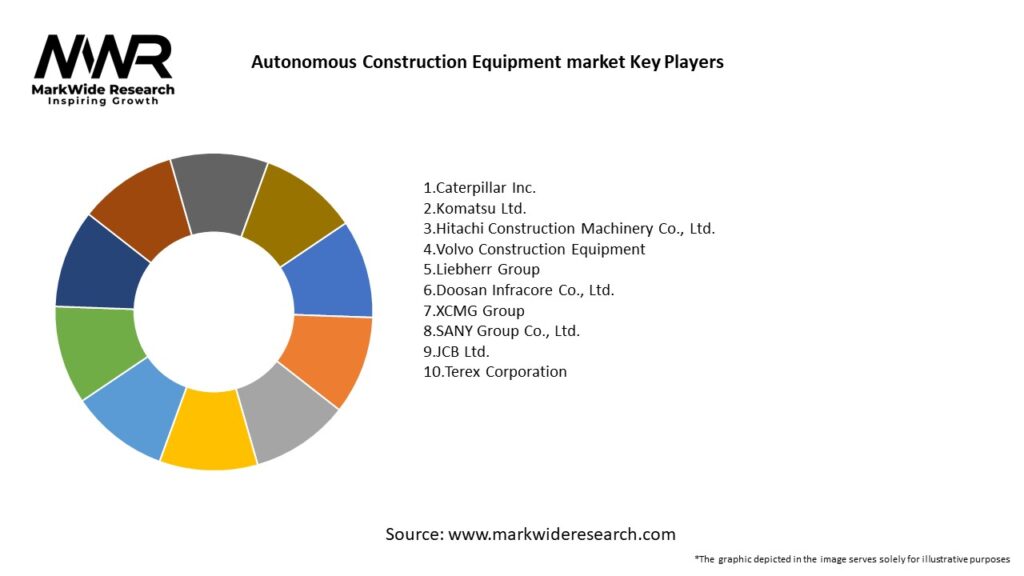

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The autonomous construction equipment market is driven by a combination of various dynamics that shape its growth trajectory. Technological advancements play a crucial role in propelling the market forward. The continuous development of AI, ML, and sensor technologies enables the integration of intelligent and autonomous features into construction equipment.

The market is also driven by the pressing need for increased construction efficiency. With autonomous machines capable of working continuously and with precision, construction projects can be completed faster and more accurately. This not only reduces project timelines but also improves overall productivity and cost-effectiveness.

Another significant driver is the emphasis on safety improvements. Construction sites are inherently hazardous environments, and accidents can have severe consequences. By deploying autonomous construction equipment, the risks associated with human error are minimized, ensuring a safer working environment for construction workers.

Despite these drivers, there are several challenges that impede the widespread adoption of autonomous construction equipment. The high initial investment required for acquiring and integrating autonomous systems can be a deterrent, especially for small and medium-sized construction companies with limited financial resources.

Data security concerns are another factor to consider. Autonomous machines generate vast amounts of data, which raises concerns about data security and privacy. Robust cybersecurity measures must be in place to protect sensitive information and ensure the integrity of the autonomous systems.

Amidst these challenges, the market presents promising opportunities. The increasing focus on infrastructure development projects, particularly in emerging economies, creates a favorable environment for the adoption of autonomous construction equipment. The construction industry’s ongoing digitization also provides opportunities for seamless integration of autonomous systems, enabling efficient data exchange and workflow optimization.

Rental and leasing services can play a pivotal role in expanding market opportunities. Offering autonomous construction equipment through rental and leasing services allows smaller construction companies to access advanced machinery without incurring substantial upfront costs. This approach democratizes the adoption of autonomous systems, promoting their widespread use.

Partnerships and collaborations are essential for driving innovation and accelerating the adoption of autonomous construction equipment. Construction companies, technology providers, and equipment manufacturers can collaborate to develop customized solutions and overcome barriers to implementation. These collaborations foster knowledge sharing and create a supportive ecosystem for autonomous construction equipment.

In summary, the autonomous construction equipment market is driven by technological advancements, the need for increased construction efficiency, safety improvements, and labor cost reductions. However, challenges such as high initial investment, limited skilled workforce, regulatory hurdles, and data security concerns must be addressed. Promising opportunities lie in infrastructure development, industry digitization, rental and leasing services, and partnerships. By navigating these dynamics effectively, the market for autonomous construction equipment can flourish.

Regional Analysis

The adoption and growth of autonomous construction equipment vary across different regions. The following regional analysis provides insights into the market dynamics and trends in key geographical areas:

North America: North America is at the forefront of autonomous construction equipment adoption. The region’s advanced infrastructure, supportive regulatory environment, and focus on technological innovation contribute to its market leadership. The United States, in particular, is a significant contributor to the growth of autonomous construction equipment, with construction companies embracing these advanced technologies to enhance operational efficiency and safety.

Europe: Europe is another leading region in the autonomous construction equipment market. The presence of established construction industries and a strong focus on sustainability drive the demand for autonomous construction equipment in Europe. Countries like Germany, France, and the United Kingdom are actively investing in smart construction practices and infrastructure development, creating a conducive environment for the adoption of autonomous machinery.

Asia Pacific: The Asia Pacific region holds immense potential for the growth of the autonomous construction equipment market. Rapid urbanization, population growth, and infrastructure development projects in countries like China, India, and Japan are driving the demand for advanced construction machinery. Additionally, the push for digitalization and the adoption of smart technologies in the construction sector further contribute to the market’s expansion in this region.

Latin America: Latin America is witnessing a gradual increase in the adoption of autonomous construction equipment. The region’s growing construction industry, coupled with the need for improved productivity and safety, fuels the demand for autonomous machinery. Countries like Brazil and Mexico are key contributors to market growth in Latin America.

Middle East and Africa: The Middle East and Africa region are experiencing steady growth in the autonomous construction equipment market. The construction activities associated with infrastructural development projects in countries like Saudi Arabia, the United Arab Emirates, and South Africa drive the demand for advanced construction machinery. The region’s focus on technological advancements and improving construction productivity further supports the adoption of autonomous systems.

Competitive Landscape

Leading Companies in the Autonomous Construction Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

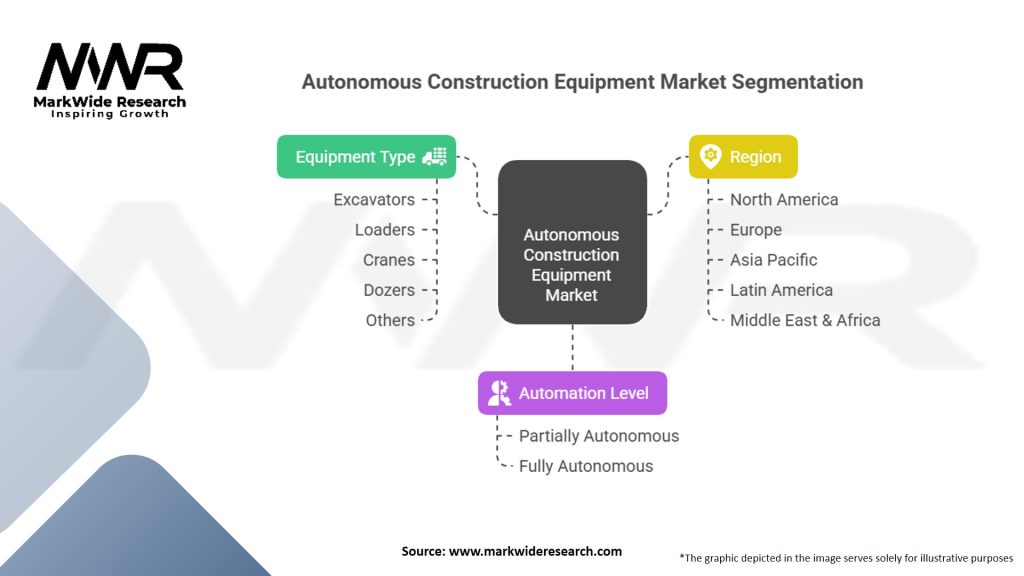

Segmentation

The autonomous construction equipment market can be segmented based on equipment type, application, and region.

By Equipment Type:

By Application:

By Region:

Segmenting the market helps to analyze the specific needs and preferences of different customer segments and tailor strategies accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of autonomous construction equipment provides numerous benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides a comprehensive overview of the autonomous construction equipment market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the autonomous construction equipment market. While the initial phase of the pandemic led to disruptions in the construction industry, with project delays and shutdowns, it also highlighted the need for increased automation and reduced reliance on human labor.

The pandemic served as a catalyst for the adoption of autonomous construction equipment as it offered a solution to maintain productivity while adhering to social distancing and safety guidelines. Autonomous machines could continue working without the need for human operators, reducing the risk of virus transmission and ensuring uninterrupted operations.

Moreover, the pandemic emphasized the importance of efficiency and cost savings in the construction industry. Autonomous construction equipment, with its ability to optimize operations and reduce labor costs, became even more appealing to construction companies striving to recover from the economic impact of the pandemic.

However, the pandemic also posed challenges for the market. The disruptions in the global supply chain affected the production and delivery of autonomous construction equipment components, leading to delays in project timelines and equipment availability.

Additionally, the financial strain caused by the pandemic may have limited the investment capacity of some construction companies, impacting their ability to invest in autonomous machinery. However, as economies recover and construction activities resume, the market is expected to regain momentum and continue its growth trajectory.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the autonomous construction equipment market appears promising, with continued growth expected in the coming years. Technological advancements, including AI, ML, sensor technologies, and data analytics, will drive further innovation in autonomous systems, making them more intelligent, efficient, and capable.Data analytics and AI will play a crucial role in enhancing the performance of autonomous construction equipment. Companies will focus on harnessing the power of data generated by these machines to optimize operations, enable predictive maintenance, and improve overall efficiency.

The future outlook of the autonomous construction equipment market is optimistic. The market will expand globally, with a focus on emerging economies and infrastructure development projects. The continued collaboration among industry participants, ongoing research and development, and the increasing awareness of the benefits of autonomous systems will drive innovation and fuel market growth.

Conclusion

The autonomous construction equipment market is experiencing rapid growth and is poised for further expansion. The integration of advanced technologies such as AI, ML, and sensors has transformed the construction industry by enabling machines to operate autonomously, reducing the reliance on human intervention. The market offers a range of autonomous equipment, including excavators, loaders, cranes, dozers, and others, catering to various construction applications.

The competitive landscape is characterized by intense competition among major players who focus on product innovation, partnerships, and mergers and acquisitions to gain a competitive edge. The segmentation of the market based on equipment type, application, and region provides valuable insights for targeted strategies and market understanding.

In conclusion, the autonomous construction equipment market is revolutionizing the construction industry by offering advanced, efficient, and safer machinery. Embracing autonomous systems presents significant opportunities for construction companies to improve productivity, reduce costs, and enhance project outcomes. With the right strategies and a focus on innovation and collaboration, stakeholders can capitalize on the immense potential of autonomous construction equipment and drive success in this evolving market.

What is Autonomous Construction Equipment?

Autonomous Construction Equipment refers to machinery and tools used in construction that operate with minimal or no human intervention. This includes vehicles like excavators, bulldozers, and drones that utilize advanced technologies such as AI and robotics to perform tasks efficiently.

What are the key players in the Autonomous Construction Equipment market?

Key players in the Autonomous Construction Equipment market include Caterpillar, Komatsu, and Volvo, which are known for their innovative machinery and technology solutions. These companies are actively developing autonomous systems to enhance productivity and safety on construction sites, among others.

What are the growth factors driving the Autonomous Construction Equipment market?

The growth of the Autonomous Construction Equipment market is driven by the increasing demand for automation in construction, the need for improved safety, and the rising labor costs. Additionally, advancements in technology, such as AI and machine learning, are enabling more efficient operations.

What challenges does the Autonomous Construction Equipment market face?

The Autonomous Construction Equipment market faces challenges such as high initial investment costs, regulatory hurdles, and the need for skilled personnel to operate and maintain advanced machinery. Additionally, concerns regarding safety and reliability in diverse construction environments can hinder adoption.

What opportunities exist in the Autonomous Construction Equipment market?

Opportunities in the Autonomous Construction Equipment market include the potential for increased efficiency and reduced operational costs, as well as the expansion into emerging markets. The integration of IoT and data analytics also presents avenues for innovation and enhanced decision-making in construction projects.

What trends are shaping the Autonomous Construction Equipment market?

Trends in the Autonomous Construction Equipment market include the growing adoption of electric and hybrid machinery, the use of drones for site surveying, and the implementation of telematics for real-time monitoring. These innovations are transforming how construction projects are managed and executed.

Autonomous Construction Equipment Market:

| Segmentation | Details |

|---|---|

| Equipment Type | Excavators, Loaders, Cranes, Dozers, Others |

| Automation Level | Partially Autonomous, Fully Autonomous |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Autonomous Construction Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at