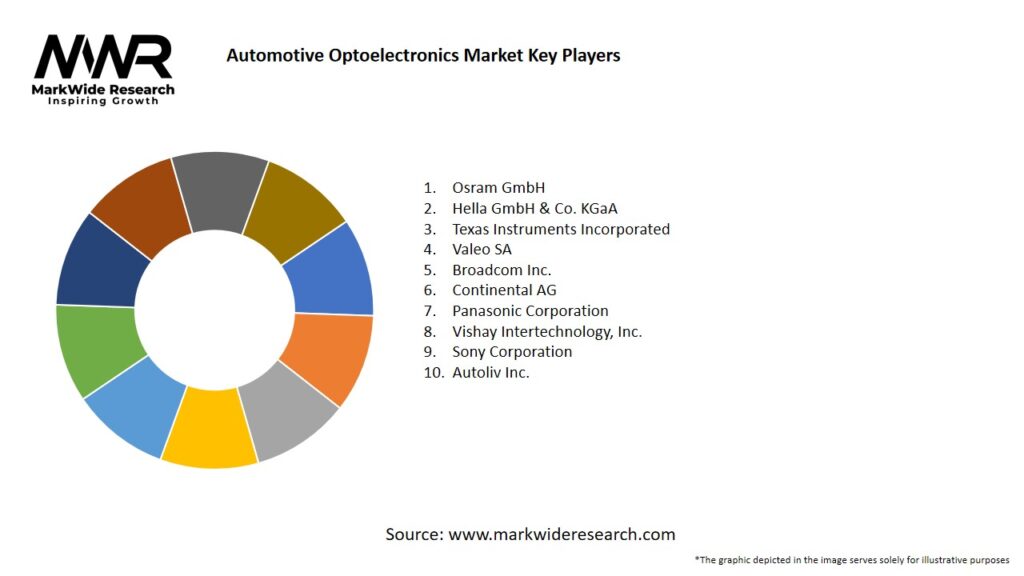

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

LEDs dominate exterior and interior lighting applications owing to superior energy efficiency, design versatility, and regulatory support for reduced emissions.

-

CMOS image sensors are foundational to camera-based ADAS features, with sensor resolutions and frame rates improving rapidly to support object detection and lane-keeping assistance.

-

Laser-based LIDAR systems, though still premium, are gaining traction as costs decline and integration with radar and ultrasonic sensors enhances autonomous driving performance.

-

Heads-up displays and digital instrument clusters increasingly rely on micro-LED and OLED technologies to deliver high-contrast, low-power visualizations.

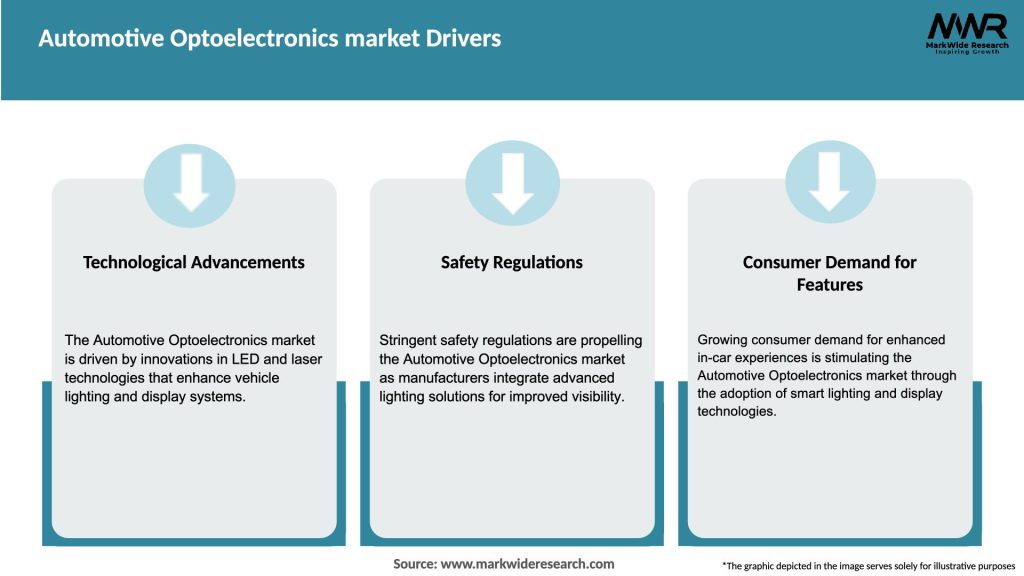

Market Drivers

Several factors are driving the growth of the Automotive Optoelectronics market:

-

Stringent Safety Regulations: Mandatory installation of ADAS features such as automatic emergency braking and lane departure warning across major markets is accelerating demand for high-performance image sensors and illumination systems.

-

Vehicle Electrification: Electric vehicles (EVs) require energy-efficient lighting and sensing components to maximize driving range, bolstering LED adoption and low-power photonic modules.

-

Autonomous Driving Development: Progressive rollout of Level 2+ and Level 3 autonomous systems is fueling investment in LIDAR, radar-optical fusion sensors, and infrared illumination for night-vision capabilities.

-

Enhanced User Experience: Rising consumer expectations for customizable ambient lighting, immersive HUDs, and large-format OLED displays are spurring integration of advanced optoelectronic components.

-

Miniaturization and Integration: Advances in semiconductor packaging and system-in-package (SiP) technologies enable compact, multi-functional modules that simplify vehicle architecture and reduce wiring complexity.

Market Restraints

Despite its potential, the Automotive Optoelectronics market faces several obstacles:

-

High Component Costs: Premium sensors (e.g., LIDAR diodes) and high-resolution displays carry significant price premiums, limiting adoption in cost-sensitive segments.

-

Thermal Management Challenges: High-power LEDs and laser modules generate heat that must be effectively dissipated to ensure reliability and longevity in harsh automotive environments.

-

Complex Supply Chains: Dependence on specialized semiconductor fabs and photonics foundries can lead to production bottlenecks and supply shortages.

-

Regulatory Fragmentation: Varying safety and lighting regulations across regions require manufacturers to certify multiple configurations, increasing time-to-market and certification costs.

-

Integration Complexity: Seamlessly merging optical, electronic, and mechanical subsystems demands cross-disciplinary expertise and raises system development costs.

Market Opportunities

The Automotive Optoelectronics market presents several avenues for expansion:

-

Next-Gen LIDAR Solutions: Development of solid-state and MEMS-based LIDAR modules promises lower costs and greater reliability, unlocking mass-market autonomous features.

-

Micro-LED Displays: Scaling micro-LED production for heads-up displays and digital cockpits offers superior brightness, contrast, and power savings compared to conventional LCDs.

-

Infrared Sensing: Integration of infrared LEDs and sensors for driver monitoring and night-vision systems can enhance safety and comfort, especially in premium vehicles.

-

Smart Lighting Systems: Adaptive matrix LED headlights with dynamic beam shaping and glare reduction present a high-value upgrade path for automakers.

-

Collaborative Ecosystems: Partnerships between automotive OEMs, semiconductor companies, and photonics startups can accelerate innovation and reduce development cycles.

Market Dynamics

The Automotive Optoelectronics market is defined by these dynamics:

-

Technological Convergence: Increasing overlap between lighting, sensing, and display technologies encourages integrated module development and multi-functional components.

-

Cost Reduction through Scale: Rising production volumes of EVs and ADAS-equipped models are driving economies of scale, reducing per-unit costs of LEDs, sensors, and displays.

-

Ecosystem Partnerships: Alliances among OEMs, tier-1 suppliers, and semiconductor vendors are becoming the norm to co-design custom optoelectronic solutions.

-

Software-Defined Lighting and Sensing: Firmware and AI-based calibration enable adaptive functionality, such as context-aware beam patterns and object classification in camera systems.

-

Lifecycle Sustainability: Emphasis on recyclable materials and low-power operation aligns optoelectronic component design with circular economy principles and emissions targets.

Regional Analysis

Adoption and growth rates vary across regions:

-

North America: Leading market for ADAS and autonomous driving technologies; significant R&D investments and early regulatory adoption of advanced lighting standards.

-

Europe: Rapid uptake of matrix LED headlights and stringent pedestrian safety regulations drive demand for adaptive lighting and camera systems; strong EV market further supports LED growth.

-

Asia Pacific: China and South Korea spearhead production of LEDs and image sensors; growing middle-class demand for premium features accelerates adoption in passenger cars.

-

Latin America: Gradual integration of basic ADAS features and LED lighting in premium vehicles; infrastructure constraints and cost sensitivity slow widespread rollout.

-

Middle East & Africa: Nascent market with focus on lighting upgrades; limited adoption of high-end ADAS and autonomous features due to regulatory lags and cost considerations.

Competitive Landscape

Leading Companies in the Automotive Optoelectronics Market:

- Osram GmbH

- Hella GmbH & Co. KGaA

- Texas Instruments Incorporated

- Valeo SA

- Broadcom Inc.

- Continental AG

- Panasonic Corporation

- Vishay Intertechnology, Inc.

- Sony Corporation

- Autoliv Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

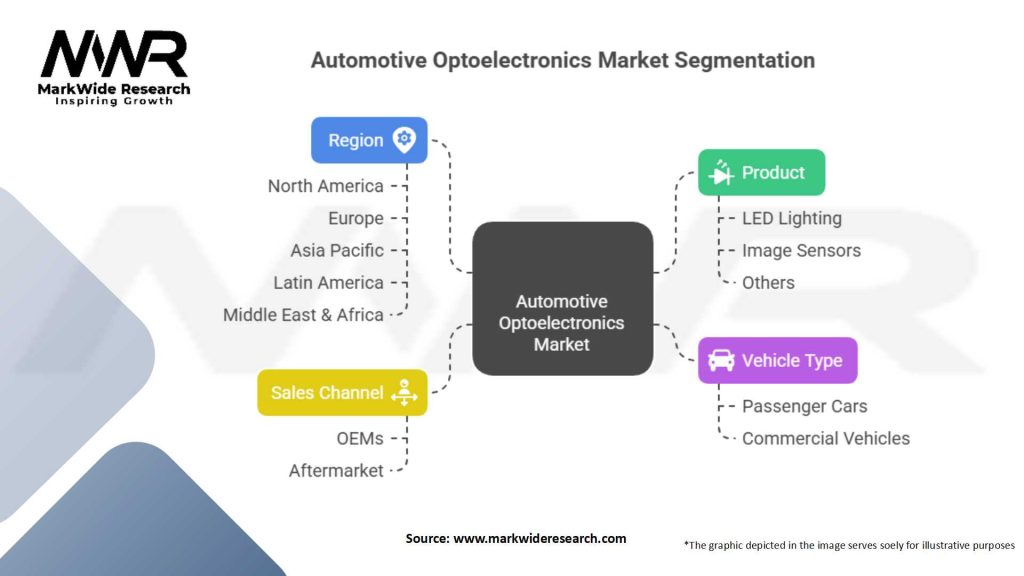

Segmentation

The Automotive Optoelectronics market can be segmented based on:

-

Component Type: LED Lighting, Image Sensors, Laser Diodes, Photodiodes, Display Modules

-

Application: Exterior Lighting, Interior Lighting, ADAS Cameras, LIDAR, HUD & Instrument Clusters

-

Vehicle Type: Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles

-

Sales Channel: OEM, Aftermarket

Category-wise Insights

-

LED Lighting: Exterior and interior LEDs dominate due to long lifespan, energy efficiency, and design flexibility; matrix LEDs enable advanced functionalities such as adaptive high-beam.

-

Image Sensors: CMOS sensors with HDR capability and wide dynamic range are critical for camera-based safety features, including pedestrian detection and traffic sign recognition.

-

Laser Diodes: High-power laser sources for LIDAR support long-range, high-resolution 3D mapping essential for autonomous driving; solid-state variants are reducing mechanical complexity.

-

Photodiodes: Infrared and visible-light photodiodes enable accurate light detection and communication between vehicle and infrastructure, supporting V2X (vehicle-to-everything) scenarios.

-

Display Modules: OLED and micro-LED displays in digital clusters and HUDs offer high contrast ratios, flexible form factors, and lower power consumption compared to LCDs.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Safety: High-precision sensors and adaptive lighting significantly reduce accident risks and improve nighttime driving visibility.

-

Energy Efficiency: LEDs and low-power photonic components extend EV range and reduce overall fuel consumption in ICE vehicles.

-

Superior User Experience: Immersive HUDs and customizable ambient lighting enhance driver comfort and brand differentiation.

-

Regulatory Compliance: Advanced lighting and sensing systems help automakers meet stringent global safety and emissions regulations.

-

Revenue Opportunities: Tier-1 suppliers and semiconductor vendors gain new revenue streams through aftermarket upgrades and bundled ADAS packages.

SWOT Analysis

Strengths

-

Proven reliability and long lifespan of LED and CMOS technologies

-

Strong R&D pipeline driving continuous innovation

Weaknesses

-

High initial integration and calibration costs

-

Thermal management requirements add system complexity

Opportunities

-

Rising EV penetration boosting demand for energy-efficient components

-

Growing autonomous vehicle pilots creating LIDAR and sensor opportunities

Threats

-

Intense competition driving price erosion

-

Supply chain disruptions affecting semiconductor availability

Market Key Trends

-

Integration of Lighting and Sensing: Combined modules that offer both illumination and environmental perception to streamline architectures and reduce wiring.

-

Shift to Solid-State LIDAR: MEMS and flash LIDAR variants replace mechanical spinning units, enhancing reliability and reducing costs.

-

Growth of OLED and Micro-LED Displays: Next-generation displays deliver higher brightness, contrast, and energy savings for HUDs and in-vehicle infotainment.

-

AI-Enhanced Vision Systems: On-board AI accelerators process image sensor data in real time for object classification and predictive safety functions.

-

Wireless Lighting Control: Over-the-air updates and multiplexed wiring reduce harness weight and enable dynamic lighting customization.

Covid-19 Impact

The Covid-19 pandemic briefly disrupted automotive production and supply chains, delaying some optoelectronic component deliveries. However, manufacturers swiftly adapted by localizing critical supply sources and increasing inventory buffers. The pandemic also reinforced the importance of contactless interfaces—driving increased interest in camera-based occupant monitoring and gesture-controlled lighting systems. As global automotive manufacturing recovers, the push for advanced safety and electrification has only intensified, positioning optoelectronics as a cornerstone of next-generation vehicle design.

Key Industry Developments

-

Strategic Alliances: Partnerships between semiconductor firms and automakers—such as Sony’s collaboration with Continental on camera modules—accelerate time-to-market for ADAS solutions.

-

Mergers & Acquisitions: Tier-1 suppliers acquiring photonics startups to integrate LIDAR and advanced lighting capabilities in-house.

-

Product Launches: Introduction of matrix LED headlights with over-the-air configurability and next-generation solid-state LIDAR sensors optimized for series production.

-

Standardization Efforts: Industry consortia defining common interfaces for sensor fusion and lighting control to simplify OEM integration.

Analyst Suggestions

-

Invest in Solid-State Technologies: Prioritize development of MEMS-based LIDAR and micro-LED displays to reduce costs and improve reliability.

-

Strengthen Supply Chains: Diversify semiconductor and photonics sourcing to mitigate risks from regional disruptions.

-

Embrace Modular Architectures: Design plug-and-play optoelectronic modules to enable faster vehicle platform updates and reduce development cycles.

-

Leverage AI and Software: Combine hardware innovation with AI-driven calibration and diagnostics to deliver adaptive, updatable lighting and sensing features.

Future Outlook

The Automotive Optoelectronics market is set to sustain double-digit growth as vehicles evolve toward higher levels of autonomy, electrification, and connected services. Continued miniaturization, integration of multi-functional modules, and reductions in component costs will drive broader adoption across vehicle segments. Advances in AI-accelerated vision processing and solid-state photonic devices will underpin next-generation safety and user-experience features. As regulatory mandates and consumer expectations converge around safety and sustainability, optoelectronics will remain a critical enabler of the future mobility ecosystem.

Conclusion

The Automotive Optoelectronics market stands at the forefront of automotive innovation, bridging the realms of lighting, sensing, and display technologies to enhance safety, efficiency, and driver experience. While challenges such as cost and supply-chain complexity persist, ongoing partnerships, technological breakthroughs, and evolving regulations will continue to propel market growth. Stakeholders who invest in integrated, energy-efficient, and software-driven optoelectronic solutions will be best positioned to capitalize on the transformative shift toward autonomous, electrified, and connected vehicles.