Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

The shift toward extended oil-change intervals with synthetic lubricants is increasing the service life requirements for oil strainers, demanding more robust materials and corrosion-resistant coatings.

-

Turbocharged, direct-injection, and hybrid powertrains exhibit greater sensitivity to oil contamination, elevating the role of high-efficiency strainers in maintaining engine health.

-

Aftermarket performance and heavy-duty segments are fueling demand for stainless steel and composite-reinforced strainer assemblies that offer higher flow rates and durability.

-

OEM collaborations with material science firms are yielding patented mesh geometries and sintered media to balance flow characteristics with contaminant capture.

Market Drivers

Several factors are propelling the Automotive Oil Strainer market:

-

Growing Vehicle Production and Parc: As global light- and heavy-vehicle fleets expand, cumulative demand for oil-change components, including strainers, rises in both OEM and aftermarket channels.

-

Extended Oil-Change Practices: The widespread adoption of synthetic lubricants and oil monitoring technologies encourages longer service intervals, increasing strainers’ required lifespan and performance standards.

-

Advanced Engine Technologies: Modern engines—especially those with turbochargers or direct injection—operate at higher temperatures and pressures, necessitating improved contamination control at the oil pickup stage.

-

Emission and Fuel Economy Regulations: Strainers that minimize oil starvation and maintain consistent lubrication contribute to reduced friction losses, supporting OEM efforts to comply with stringent CO₂ and fuel-efficiency mandates.

-

Aftermarket Upgrades: Enthusiast and commercial vehicle owners seek high-flow, durable strainer assemblies to support performance modifications and heavy-duty applications, creating niche growth opportunities.

Market Restraints

Despite favorable trends, the market encounters a few challenges:

-

Design Integration Constraints: Engine packaging limitations and the proliferation of compact, integrated oil pan assemblies make it increasingly difficult to retrofit or upgrade strainers without redesigning adjacent components.

-

Cost Sensitivity: In price-competitive segments, OEMs may prefer lower-cost strainer materials and simplified designs, potentially compromising long-term durability in favor of upfront savings.

-

Component Consolidation: Trends toward integrated oil-pump and strainer modules simplify assembly but reduce the aftermarket’s ability to offer standalone upgrades or replacements.

-

Quality Variability: Wide differences in material grade and manufacturing precision among aftermarket suppliers can lead to performance inconsistencies, undermining customer confidence.

Market Opportunities

The Automotive Oil Strainer market presents several avenues for growth and innovation:

-

Advanced Materials and Coatings: Development of corrosion-resistant alloys, polymer-metal composites, and surface coatings can extend strainer life and enhance contaminant resistance.

-

Additive Manufacturing: 3D-printed strainer housings and mesh structures enable complex geometries that optimize flow dynamics and particulate capture.

-

Smart Strainers: Embedding sensors to monitor differential pressure or flow rate can provide real-time health diagnostics, alerting users to imminent clogs or maintenance needs.

-

Electric Vehicle Applications: Although EVs lack traditional engine oil, auxiliary systems and gearbox lubricants still require filtration—opening new markets for miniature strainer designs.

-

Sustainable Practices: Eco-friendly strainer designs—such as recyclable housings and bio-based polymer components—align with automotive industry sustainability goals.

Market Dynamics

The Automotive Oil Strainer market is shaped by evolving industry dynamics:

-

OEM–Supplier Collaboration: Closer partnerships between automakers and filter specialists accelerate the co-development of application-specific strainer solutions, ensuring seamless integration within complex powertrain architectures.

-

Regulatory Influences: Fuel-economy and emission standards indirectly drive strainer innovation, as optimized lubrication systems contribute to lower friction and reduced CO₂ emissions.

-

Digitalization of Service: Predictive maintenance platforms that track oil-condition data are prompting demand for strainers compatible with onboard sensors and telematics systems.

-

Consolidation in Aftermarket: Mergers among filter and fluid-handling component suppliers are streamlining product portfolios, fostering development of bundled oil-filter and strainer kits.

-

Tiered Market Segmentation: Premium vehicle segments mandate high-performance strainers, while mass-market tiers emphasize cost-effective, reliable designs—leading suppliers to tailor offerings accordingly.

Regional Analysis

Adoption and growth rates vary across geographies:

-

North America: A mature market with high per-vehicle maintenance expenditures and a large heavy-duty vehicle fleet supports robust aftermarket demand for performance and replacement strainers.

-

Europe: Stringent emission standards and emphasis on high-quality lubrication systems drive OEM integration of advanced strainer solutions, while enthusiasts fuel a niche aftermarket for performance upgrades.

-

Asia Pacific: Rapid vehicle parc growth—particularly in China and India—fuels volume demand for cost-effective strainers in both passenger and commercial vehicle segments; evolving emission norms lead to gradual adoption of higher-spec components.

-

Latin America: Price sensitivity constrains premium aftermarket penetration, but rising heavy-duty vehicle use and improving maintenance infrastructure create incremental growth opportunities.

-

Middle East & Africa: Harsh operating conditions—extreme heat and dust—underscore the importance of robust strainer performance, particularly in commercial and off-road vehicles, opening opportunities for specialized variants.

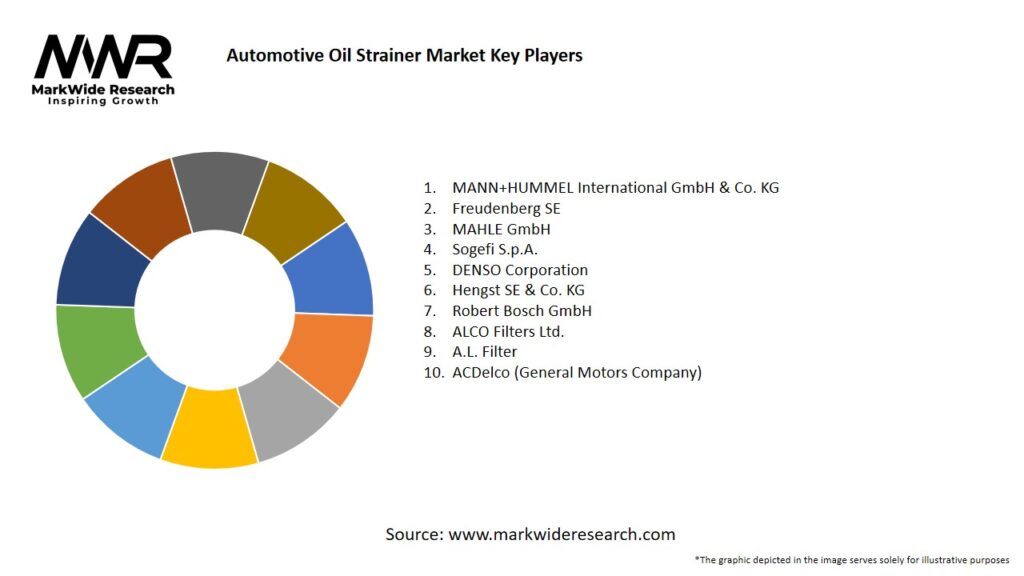

Competitive Landscape

Leading Companies in the Automotive Oil Strainer Market:

- MANN+HUMMEL International GmbH & Co. KG

- Freudenberg SE

- MAHLE GmbH

- Sogefi S.p.A.

- DENSO Corporation

- Hengst SE & Co. KG

- Robert Bosch GmbH

- ALCO Filters Ltd.

- A.L. Filter

- ACDelco (General Motors Company)

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented as follows:

-

By Vehicle Type: Passenger Cars, Light Commercial Vehicles, Heavy-Duty Trucks, Off-Highway Equipment

-

By Material: Stainless Steel Mesh, Perforated Steel, Composite-Reinforced Plastics, Sintered Fibers

-

By Distribution Channel: OEM, Aftermarket Direct, Aftermarket Retail (Automotive Parts Stores, E-Commerce)

-

By Application: Standard Service, Extended Service (Long-Life Oil), Performance/ Racing

Category-wise Insights

-

Stainless Steel Mesh Strainers: Highly corrosion-resistant and capable of fine filtration, ideal for high-temperature and long-life oil applications.

-

Perforated Steel Strainers: Cost-effective and robust, widely used in mass-market vehicles where service intervals are shorter.

-

Composite-Reinforced Plastic Strainers: Lightweight and corrosion-proof, increasingly adopted in modern engine covers and composite oil pan assemblies.

-

Sintered Fiber Strainers: Offer multi-layer filtration and high flow rates, suited for performance engines and heavy-duty service conditions.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Engine Protection: Early contaminant removal prevents premature wear, extending engine life and reducing warranty costs for OEMs.

-

Improved Maintenance Efficiency: Reliable strainer performance supports longer oil-change intervals and reduces unscheduled downtime for fleet operators.

-

Value-Added Upgrades: Aftermarket suppliers can leverage advanced materials and sensor integration to differentiate products and command premium pricing.

-

Regulatory Compliance Support: Optimized lubrication systems contribute to reduced friction losses and lower emissions, aiding OEM compliance with environmental standards.

-

Customer Satisfaction: Vehicle owners benefit from smoother engine operation, lower repair bills, and improved resale values when high-quality strainers are used.

SWOT Analysis

Strengths

-

Critical role in engine lubrication and protection.

-

Diverse material options catering to different vehicle segments.

-

Growth in both OEM and aftermarket channels.

Weaknesses

-

Increasing integration limits standalone retrofit opportunities.

-

Cost pressures in mass-market segments may compromise material quality.

-

Limited awareness of strainer technology differences among end users.

Opportunities

-

Sensor-embedded smart strainers for predictive maintenance.

-

Expansion into electric and hybrid drivetrain lubricant circuits.

-

Sustainable material innovations aligned with industry decarbonization goals.

Threats

-

OEM consolidation and vertical integration reducing aftermarket access.

-

Economic volatility affecting aftermarket sales volumes.

-

Emerging filtration alternatives—such as secondary pickup filters—could reduce reliance on primary strainers.

Market Key Trends

-

Smart Filtration: Integration of pressure and flow sensors into strainer assemblies for real-time diagnostics and maintenance alerts.

-

Material Innovation: Adoption of corrosion-resistant composites and hybrid polymer-metal structures for reduced weight and extended service life.

-

Additive Manufacturing: Use of 3D printing to create complex mesh geometries and bespoke strainer housings for limited-run or specialty applications.

-

Modular Designs: Standardized strainer modules that fit multiple engine platforms, enabling economies of scale and simplified inventory management.

-

Circular Economy Initiatives: Development of recyclable strainer components and remanufacturing programs to support sustainability commitments.

Covid-19 Impact

The Covid-19 pandemic disrupted global automotive production and maintenance schedules, temporarily reducing demand for oil-change components, including strainers. However, the shift toward contactless service models and extended service intervals accelerated adoption of longer-life lubricants and high-performance strainers. As OEM assembly lines resumed and aftermarket services rebounded, pent-up maintenance needs drove a surge in replacements, reaffirming the critical role of oil strainers in ensuring engine readiness post-lockdown.

Key Industry Developments

-

OEM Partnerships: Bosch and MANN+HUMMEL announced joint ventures to co-develop advanced mesh materials for next-generation engine platforms.

-

Aftermarket Alliances: Donaldson partnered with telematics providers to launch smart strainer kits that report clogging status directly to fleet management dashboards.

-

Regulatory Updates: New EU directives on vehicle maintenance intervals indirectly promote the use of premium strainers to meet extended service requirements.

-

Technology Showcases: At recent automotive expos, multiple suppliers unveiled 3D-printed strainer prototypes boasting optimized flow channels and integrated sensor ports.

Analyst Suggestions

-

Collaborate on Smart Solutions: Suppliers should partner with telematics and IoT firms to embed diagnostic sensors into strainers, offering predictive maintenance value propositions to fleets and OEMs.

-

Invest in R&D for Materials: Focus on lightweight, corrosion-proof composites and hybrid materials to meet the dual demands of durability and fuel-efficiency targets.

-

Expand Cross-Platform Modules: Develop modular strainer designs that fit multiple engine families, reducing tooling costs and simplifying aftermarket distribution.

-

Promote End-User Education: Launch marketing campaigns to raise awareness among service technicians and vehicle owners about the performance differences and benefits of advanced strainers.

Future Outlook

The Automotive Oil Strainer market is expected to maintain steady growth, driven by ongoing vehicle parc expansion, electric/hybrid powertrain adoption, and the rising importance of predictive maintenance. Innovations in smart strainers and sustainable materials will create new value streams for both OEMs and aftermarket players. As engine designs continue to evolve—embracing down-sizing, turbocharging, and alternative fuels—the demand for sophisticated oil filtration at the pickup stage will remain critical. Suppliers who anticipate these trends and invest in sensor integration, material science, and modular architectures will be best positioned to capture market share in this essential component segment.

Conclusion

Oil strainers, though often understated, are fundamental to engine longevity, efficiency, and performance. The Automotive Oil Strainer market stands at an inflection point where traditional mechanical designs intersect with digital diagnostics and sustainable materials. While cost pressures and integration complexities pose challenges, advancements in smart filtration, additive manufacturing, and cross-platform modularity offer compelling pathways for growth. By embracing innovation and forging strategic partnerships across the automotive value chain, industry participants can enhance product differentiation, support regulatory compliance, and deliver superior engine protection solutions to meet the evolving needs of OEMs and end users worldwide.