Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

The proliferation of camera-based ADAS platforms is lowering per-vehicle costs for lane warning features, making them standard even in entry-level models.

-

Tier-1 suppliers such as Continental, Bosch, and Denso dominate with end-to-end sensor and ECU solutions, while startups focus on software and algorithm optimization.

-

Regulatory mandates in Europe, North America, and China are driving OEM integration of lane warning systems as a safety prerequisite for new models.

-

Aftermarket retrofit kits are gaining traction in regions with large existing vehicle stocks, offering cost-effective upgrades to enhance road safety.

Market Drivers

Several factors are fueling the Automotive Lane Warning System market:

-

Regulatory Requirements: EU Regulation 2019/2144 mandates lane support systems on new vehicle types sold in Europe from July 2022 and all new vehicles from 2024, spurring OEM adoption.

-

Safety Awareness: Rising road fatalities due to lane-departure crashes is prompting both fleet operators and individual consumers to prioritize vehicles equipped with lane warning technologies.

-

Cost Declines: Advances in CMOS camera modules and centralized ADAS ECUs are driving down the incremental cost of lane warning systems, enabling widespread deployment.

-

OEM Differentiation: Automakers leverage ADAS features, including lane warning, as selling points in increasingly competitive segments, boosting consumer purchase incentive.

-

Technological Innovation: AI-based image processing and sensor fusion techniques are enhancing system robustness under varied lighting and weather conditions.

Market Restraints

Despite strong growth prospects, the market faces challenges:

-

Complex Integration: Harmonizing lane warning functionalities with other ADAS features—such as adaptive cruise control and automatic emergency braking—requires sophisticated software calibration and vehicle bus architecture.

-

Environmental Limitations: Camera-based systems may struggle in heavy rain, snow, or poorly marked roads, leading to false alerts or reduced reliability.

-

Data Processing Demands: High-resolution imaging and real-time inference necessitate powerful ECUs, which can raise system cost and vehicle power consumption.

-

Consumer Trust: Drivers must understand system capabilities and limitations to avoid overreliance, requiring effective human-machine interface (HMI) design and user education.

-

Aftermarket Liability: Retrofit solutions can introduce safety and compatibility concerns, leading to regulatory scrutiny and warranty challenges.

Market Opportunities

The Automotive Lane Warning System market presents several avenues for expansion:

-

Tier-2 Software Providers: Demand for advanced lane detection algorithms and AI models creates opportunities for software specialists to partner with OEMs and Tier-1 suppliers.

-

Retrofitting Existing Fleets: In regions with high vehicle age, aftermarket lane warning kits offer a growth channel, supported by fleet safety programs and insurance incentives.

-

Motorcycle and Commercial Applications: Adapting lane warning technologies to two-wheeler dynamics and heavy trucks can address niche safety requirements in emerging markets.

-

Edge AI and Sensor Fusion: Integrating radar, lidar, and camera data on edge computing platforms enhances reliability and paves the way for Level 2+ automated driving functions.

-

Subscription-Based Upgrades: OTA software updates and feature unlock models create recurring revenue streams, allowing OEMs to monetize system enhancements post-sale.

Market Dynamics

The Automotive Lane Warning System market is shaped by the following dynamics:

-

Collaborative Ecosystems: Alliances between OEMs, semiconductor firms (e.g., NVIDIA, Mobileye), and mapping providers advance end-to-end ADAS solutions.

-

Regulatory Harmonization: Alignment of safety standards across regions (UNECE WP.29, NHTSA) simplifies global product development and certification.

-

Consumer Education: OEMs and dealerships invest in training materials and in-vehicle tutorials to ensure drivers correctly interpret lane warning alerts.

-

Cost-Performance Balance: Suppliers optimize hardware selection (single-lens cameras vs. multi-camera arrays) to meet price targets without compromising safety performance.

-

Evolution to Autonomous Driving: Lane warning systems serve as foundational building blocks for higher autonomy levels, driving R&D investment.

Regional Analysis

Adoption and maturity vary by region:

-

Europe: Market leader, driven by stringent ADAS mandates and high consumer safety awareness; strong OEM penetration of LDW/LKA features.

-

North America: Rapid growth supported by NHTSA guidelines encouraging lane departure prevention systems, with American OEMs integrating systems across model lineups.

-

Asia Pacific: China’s roadmap for intelligent vehicles and Japan’s focus on robo-taxis fuel demand, while India’s nascent ADAS market is emerging through premium segment uptake.

-

Latin America: Gradual adoption hindered by cost sensitivity, but fleet safety regulations in Brazil and Mexico are promoting ADAS retrofits.

-

Middle East & Africa: Luxury vehicle markets in GCC countries lead adoption; infrastructure challenges and regulatory gaps limit broader deployment.

Competitive Landscape

Leading Companies in the Automotive Lane Warning System Market:

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Valeo SA

- Mobileye (Intel Corporation)

- Aptiv PLC

- Magna International Inc.

- Panasonic Corporation

- Hella GmbH & Co. KGaA

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

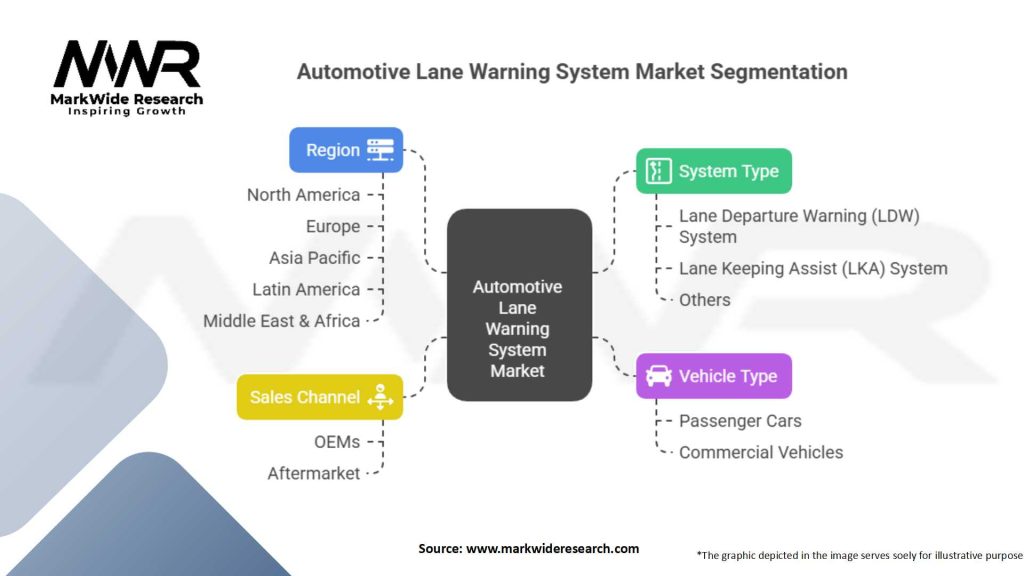

Segmentation

The market can be segmented as follows:

-

Technology Type: Camera-Based Systems, Radar-Assisted Systems, Sensor Fusion Solutions

-

Vehicle Type: Passenger Cars, Commercial Vehicles (Trucks & Buses), Two-Wheelers

-

Sales Channel: Original Equipment Manufacturer (OEM), Aftermarket Retrofit

-

Level of Autonomy: Level 1 (Warning Only), Level 2 (Steering Assist), Level 3 (Conditional Automation)

Category-wise Insights

-

Camera-Based Systems: Widely adopted for cost-efficiency and ease of integration; performance depends heavily on mounting position and calibration.

-

Radar-Assisted Systems: Enhance reliability in poor visibility but add cost and complexity; best suited for regions with frequent adverse weather.

-

Sensor Fusion Solutions: Combine camera, radar, and sometimes lidar data to deliver high accuracy and resilience, ideal for premium and commercial applications.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Road Safety: Reduction in single-vehicle lane departure accidents and associated injuries, leading to lower insurance premiums and societal costs.

-

Regulatory Compliance: Early adoption ensures alignment with evolving safety standards, avoiding penalties and facilitating market access.

-

Consumer Appeal: Safety features like lane warning increase vehicle desirability, supporting higher trim-level sales and brand differentiation.

-

Aftermarket Growth: New revenue streams from retrofit solutions serving older vehicle fleets and commercial operators focused on safety metrics.

-

Data-Driven Insights: Collected lane-departure event data can inform infrastructure planning and driver training programs.

SWOT Analysis

Strengths

-

Proven safety impact and high return on investment

-

Broad OEM support and integration expertise

-

Foundation for advanced autonomy levels

Weaknesses

-

Performance variability under challenging environmental conditions

-

Integration complexity and development lead times

-

User overreliance or misunderstanding of system capabilities

Opportunities

-

Expansion into emerging markets through cost-optimized retrofit kits

-

Advances in AI for improved lane marking recognition on damaged or faded roads

-

Monetization via OTA feature upgrades and data services

Threats

-

Evolving regulations that may require expensive hardware upgrades

-

Competition from integrated, vision-only ADAS suites

-

Liability concerns in the event of system failures or misinterpretation

Market Key Trends

-

Edge AI Deployment: Incorporating neural-network inference on ECU edge processors to deliver low-latency lane detection.

-

Wireless Calibration: Over-the-air calibration tools simplifying sensor alignment during vehicle assembly and servicing.

-

Driver Monitoring Integration: Pairing lane warning with driver-monitoring systems to prevent overreliance and encourage alertness.

-

Digital Twins: Virtual modeling of ADAS performance for faster validation and continuous improvement through software updates.

-

Shared Mobility Applications: Fleet operators including lane warning as standard on ride-hail and car-sharing vehicles to ensure passenger safety.

Covid-19 Impact

The Covid-19 pandemic initially slowed vehicle production and supply chains, delaying some ADAS rollouts. However, post-pandemic recovery saw accelerated adoption as OEMs reinstated safety priorities and consumers sought vehicles with enhanced health and safety features. Additionally, the shift toward contactless vehicle servicing increased interest in software-based calibration and OTA updates for lane warning systems.

Key Industry Developments

-

Strategic Alliances: Collaborations between automakers and technology firms (e.g., Ford–Mobileye) to co-develop next-gen lane support features.

-

M&A Activities: Tier-1 suppliers acquiring software startups specializing in machine-vision algorithms to strengthen competitive positioning.

-

Regulatory Milestones: UNECE WP.29 approvals for automated lane-change functions, paving the way for more advanced lane keeping assist.

-

Standardization Efforts: Industry consortia defining test protocols for lane warning system performance under diverse environmental scenarios.

Analyst Suggestions

-

Holistic ADAS Integration: Develop lane warning systems as part of a unified ADAS suite, ensuring seamless interaction with other safety functions.

-

Focus on Reliability: Invest in robust AI models and diverse training datasets that account for varied road geometries, weather, and lighting conditions.

-

Consumer Education: Design intuitive HMIs and provide clear guidance on system limitations to build user trust and proper usage.

-

Explore New Segments: Target commercial fleets and two-wheeler markets with tailored lane warning solutions, addressing unique operational needs.

Future Outlook

The Automotive Lane Warning System market is set to flourish, driven by continual regulatory tightening, consumer demand for safer vehicles, and rapid technological advances. As sensor and compute costs decline further, lane warning will transition from a premium option to a ubiquitous feature across all vehicle segments. Integration with broader autonomous driving functions and connected vehicle ecosystems will unlock additional capabilities—such as predictive lane keeping and coordinated lane changes—ushering in a new era of road safety and driver assistance.

Conclusion

The Automotive Lane Warning System market stands at a pivotal juncture, balancing regulatory imperatives, consumer expectations, and rapid technological progress. By building on proven safety benefits, leveraging AI and sensor fusion, and expanding into new vehicle classes and retrofit channels, stakeholders can capture significant growth opportunities. Addressing challenges around reliability, integration, and user education will be critical to maximizing system efficacy and fostering widespread adoption on Europe’s roads and beyond.