Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Over 85 million hydraulic filters were installed across new passenger and commercial vehicles globally in 2024, indicating a robust baseline demand.

-

Nanofiber filtration media is gaining share—projected to capture 18% of the media segment by 2028—thanks to its superior particulate retention at smaller micron ratings.

-

Asia Pacific dominates production and consumption, accounting for roughly 45% of global volume, driven by China, India, and Southeast Asian vehicle manufacturing hubs.

-

Fleet maintenance programs in logistics and construction sectors drive aftermarket filter replacements every 10,000–20,000 kilometers, ensuring recurring revenue streams.

-

Environmental regulations addressing hydraulic fluid disposal are prompting the introduction of biodegradable filter media and eco-friendly filter housings.

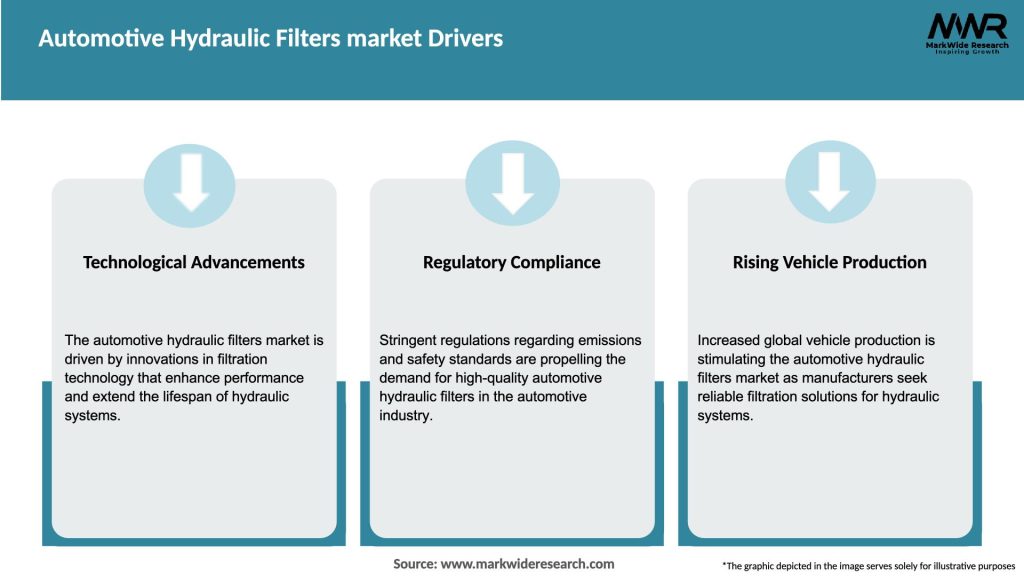

Market Drivers

-

Stringent Emission and Safety Regulations: Tighter standards for brake and steering performance drive OEMs to specify high-efficiency filters that maintain hydraulic system integrity.

-

Growth of Hydraulic-Assisted Technologies: Increasing penetration of electric power steering (EPS), hydrostatic braking, and hydraulic suspensions in passenger and commercial vehicles boosts filter requirements.

-

Fleet Expansion and Maintenance: Rising commercial-vehicle fleets in logistics, mining, and agriculture intensify demand for reliable filters to minimize downtime and maintenance costs.

-

Aftermarket Replacement Cycles: Scheduled hydraulic fluid service intervals, often mandated by OEM warranties, guarantee steady aftermarket filter sales.

-

Technological Innovation: Advances in filter media, such as multilayer nanofiber and hydrophobic coatings, enhance contaminant capture and extend service life.

Market Restraints

-

Price Sensitivity: In cost-competitive vehicle segments, lower-cost filters with simpler media compete aggressively, limiting premium media adoption.

-

Counterfeit and Unbranded Filters: The presence of low-quality imitators in certain regions undermines market credibility and may cause premature system failures.

-

Variable Maintenance Practices: In emerging markets, inconsistent adherence to service intervals reduces aftermarket opportunities.

-

Compatibility Challenges: Growing variation in hydraulic system architectures—especially with electrified drivetrains—complicates filter standardization.

-

Raw Material Fluctuations: Volatility in polymer and steel prices can affect filter manufacturing costs and supply chain stability.

Market Opportunities

-

Smart Filter Monitoring: Integration of sensors and IoT connectivity into filter housings enables predictive maintenance, reducing unexpected system failures.

-

Biodegradable Media Development: Eco-focused OEMs are exploring plant-based fibers that decompose safely, addressing environmental disposal concerns.

-

Emerging Market Penetration: Rapid vehicle parc growth in Africa, Latin America, and parts of Southeast Asia presents fresh aftermarket replacement demand.

-

Electric and Hybrid Vehicle Custom Solutions: New hydraulic circuits in e-axles and regenerative braking systems require filters optimized for lower-viscosity fluids.

-

Cross-Industry Applications: Off-road, marine, and rail sectors with hydraulic systems can be targeted with specialized filter variants, expanding total addressable market.

Market Dynamics

-

OEM vs. Aftermarket Balance: OEMs prefer validated, long-life filters, while independent shops often choose cost-effective alternatives, creating dual market channels.

-

Media Technology Shift: Adoption of high-performance nanofiber layers is transforming the competitive landscape, with early adopters charging premium prices.

-

Regulatory Influence: Guidelines on hydraulic fluid cleanliness (ISO 4406 ratings) drive filter specification and performance benchmarks.

-

Lifecycle Services: Manufacturers are bundling filters with hydraulic fluid analysis packages, creating value-added service offerings.

-

Supply Chain Consolidation: Strategic mergers and acquisitions among filter and media suppliers are streamlining R&D efforts and inventory management.

Regional Analysis

-

Asia Pacific: The largest volume market, led by China and India’s thriving automotive industries and growing public-transport fleets.

-

North America: High penetration of advanced SUVs, pickups, and commercial trucks necessitates premium filtration solutions and smart monitoring kits.

-

Europe: Strict Euro 6 and upcoming Euro 7 regulations favor high-efficiency media; established OEMs drive innovation in hydraulic filter design.

-

Latin America: Rising fleet replacement cycles in Brazil and Mexico boost aftermarket filter demand, though price sensitivity remains high.

-

Middle East & Africa: Infrastructure projects and mining operations in GCC countries and South Africa spur demand for robust off-road hydraulic filters.

Competitive Landscape

Leading Companies in the Automotive Hydraulic Filters Market:

- Parker Hannifin Corporation

- Donaldson Company, Inc.

- Eaton Corporation plc

- Mann+Hummel Group

- Cummins Inc.

- Freudenberg Group

- Baldwin Filters

- Mahle GmbH

- Sogefi S.p.A.

- Hengst SE & Co. KG

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

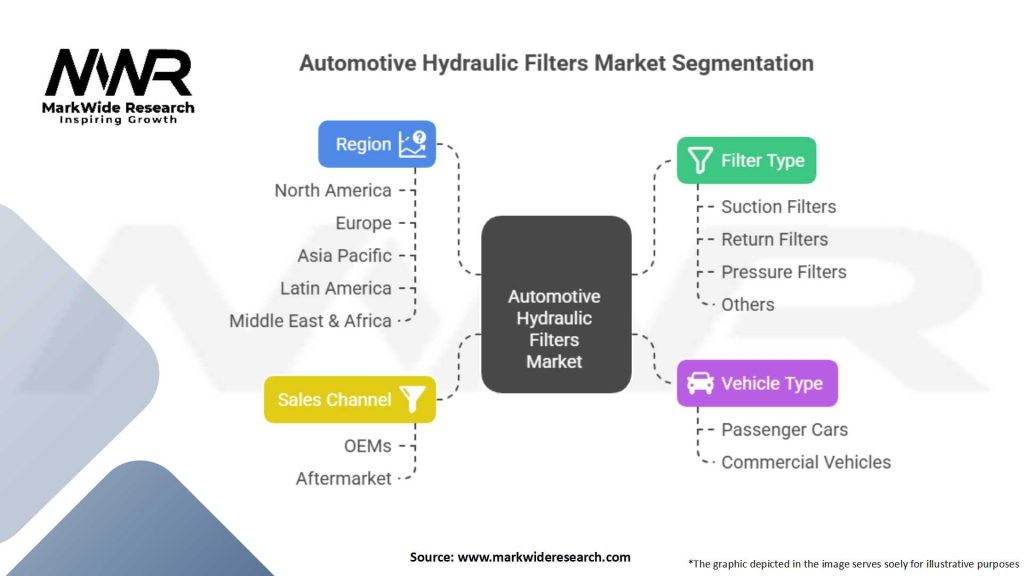

Segmentation

-

By Filter Type: Spin-on, Cartridge, In-Line, Suction, Return-Line

-

By Media Material: Cellulose, Fiberglass, Synthetic Polymers, Nanofiber Composite

-

By Vehicle Type: Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Off-Road Equipment

-

By Sales Channel: OEM, Aftermarket (Distributors, Service Centers, E-commerce)

Category-wise Insights

-

Spin-On Filters: Favored in passenger cars for ease of replacement and lower initial cost.

-

Cartridge Filters: Popular in commercial vehicles where environmental regulations encourage reduced metal waste.

-

Inline Filters: Common in hydraulic steering circuits of luxury and performance vehicles requiring compact installations.

-

Suction Filters: Installed upstream to protect pumps from large debris, critical in off-road machinery.

-

Return-Line Filters: Provide fine filtration before fluid returns to the reservoir, extending overall hydraulic system life.

Key Benefits for Industry Participants and Stakeholders

-

Extended Component Lifespan: Effective contaminant removal reduces wear on pumps and valves, lowering warranty claims.

-

Reduced Downtime: Routine filter changes are faster and less costly than repairing hydraulic system failures.

-

Enhanced System Efficiency: Clean fluid ensures consistent response in braking, steering, and suspension systems.

-

Regulatory Compliance: Meeting ISO 4406 cleanliness codes helps OEMs and fleets adhere to industry standards.

-

Cost Optimization: Predictive filter replacement schedules minimize over-servicing and inventory holding costs.

SWOT Analysis

Strengths:

-

Established filtration technology with well-understood benefits.

-

Recurring aftermarket revenue through scheduled replacements.

-

Continuous innovation in media performance.

Weaknesses:

-

Price competition from low-cost unbranded filters.

-

Dependence on vehicle production cycles.

-

Complexity in certifying new filter variants.

Opportunities:

-

Integration of condition-monitoring sensors.

-

Eco-friendly and biodegradable filter media.

-

Growth of hybrid and electric vehicle segments.

Threats:

-

Raw material supply chain disruptions.

-

Regulatory changes that alter maintenance intervals.

-

Technological shifts toward electronic rather than hydraulic systems.

Market Key Trends

-

Sensor-Equipped Filters: Smart filters reporting differential pressure and remaining life directly to vehicle ECUs.

-

Water-Separating Media: Combined water coalescer and particulate filter units for brake and steering clarity.

-

Modular Filter Systems: Standardized cartridges and housings allowing rapid customization.

-

Green Filtration: Adoption of plant-based media and recyclable housings to meet sustainability goals.

-

Digital Aftermarket Sales: Online platforms enabling fleets to subscribe to filter-and-fluid maintenance programs.

Covid-19 Impact

The pandemic temporarily slowed vehicle production and fleet operations, leading to reduced OEM filter demand in 2020. However, maintenance intervals extended, boosting aftermarket sales as fleets deferred full-system service in favor of filter-only replacements. Supply chain challenges prompted filter manufacturers to localize media sourcing and adopt digital sales channels, trends that continue to reshape distribution strategies.

Key Industry Developments

-

Mann+Hummel launched a smart filter module with built-in pressure and temperature sensors in 2024.

-

Donaldson introduced BioFibre™ media, a partially biodegradable filter material, in response to disposal regulations.

-

Eaton partnered with a telematics provider to offer subscription-based filter monitoring for logistics fleets.

-

Bosch Rexroth unveiled a modular cartridge system that reduces lead time for custom filter orders.

Analyst Suggestions

-

Invest in Smart Technologies: Integrate real-time monitoring to move from time-based to condition-based maintenance.

-

Expand Aftermarket E-Commerce: Leverage digital platforms to reach independent garages and small fleets directly.

-

Develop Sustainable Media: Prioritize research into biodegradable composites and recyclable housings to meet environmental mandates.

-

Target EV-Compatible Systems: Design filters for new hydraulic circuits in electric vehicles, such as hydraulic cooling loops.

-

Strengthen Counterfeit Mitigation: Educate end-users about genuine filter identification and collaborate with regulators to curb fakes.

Future Outlook

The Automotive Hydraulic Filters market is set to evolve toward smarter, greener, and more integrated solutions. As vehicles continue to blend hydraulic and electronic controls, filter manufacturers will need to adapt with media tailored for new fluids and with sensor capabilities that support predictive maintenance platforms. Emerging markets and the rapid electrification of transport fleets will fuel both OEM and aftermarket segments, ensuring continued demand for high-performance filtration technologies.

Conclusion

In summary, the Automotive Hydraulic Filters market remains a vital component of vehicle reliability and safety. Through ongoing innovation—in nanofiber media, sensor integration, and eco-friendly materials—manufacturers and service providers can capitalize on growing system complexities and maintenance needs. Stakeholders who align R&D with regulatory trends and digital service models will lead the market, delivering cleaner fluids, longer system life, and enhanced uptime in an increasingly competitive automotive landscape.