444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The automotive glass fiber composites market is expected to witness significant growth in the coming years. The increasing demand for lightweight materials in the automotive industry is driving the market growth. The automotive industry is constantly evolving, and the use of advanced materials is becoming essential to meet the demand for fuel-efficient vehicles. Glass fiber composites offer several benefits, such as high strength, stiffness, and lightweight, making them an ideal material for automotive applications.

Meaning

Glass fiber composites are materials made of glass fibers and a matrix material, typically a thermoset or thermoplastic resin. The glass fibers are made by melting glass and drawing it into thin fibers. These fibers are then woven together to form a fabric, which is then impregnated with resin and cured to form a rigid structure. Glass fiber composites are widely used in various industries, including aerospace, marine, construction, and automotive.

Executive Summary

The automotive glass fiber composites market is expected to grow significantly in the coming years due to the increasing demand for lightweight materials in the automotive industry. Glass fiber composites offer several benefits, such as high strength, stiffness, and lightweight, making them an ideal material for automotive applications. The market is driven by various factors, such as government regulations for fuel efficiency, increasing demand for electric vehicles, and the need for cost-effective materials. The market is expected to face some challenges, such as high production costs, limited availability of raw materials, and the need for skilled labor.

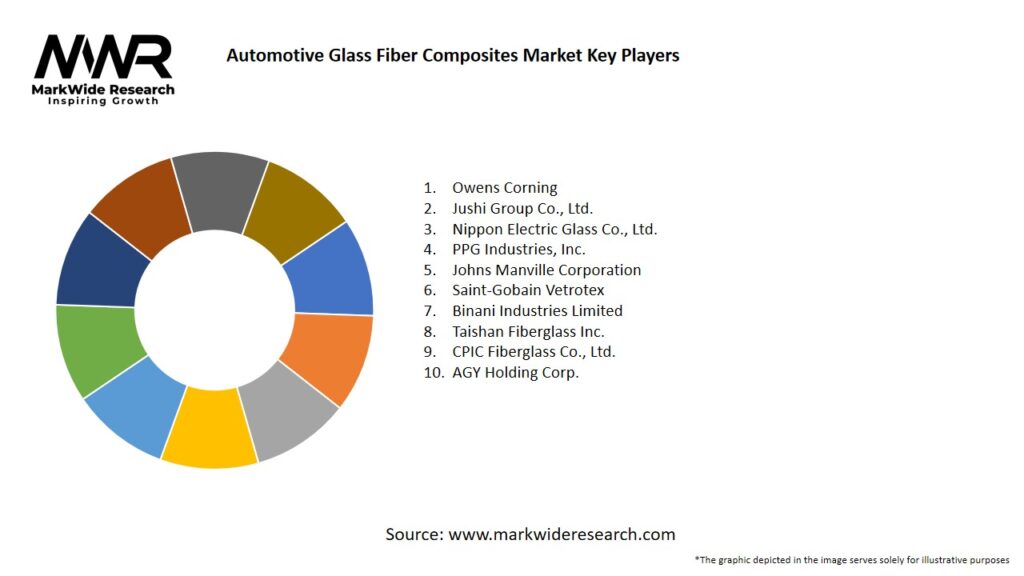

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Lightweighting mandates—such as CAFE standards in North America and CO₂ targets in Europe—are the primary drivers of glass fiber composite adoption.

Electric vehicle platforms, with a higher ratio of composite-to-metal parts, represent a rapidly growing segment, projected to account for one-third of auto composites by 2030.

Thermoplastic glass fiber composites (e.g., PA6, PBT, PP matrices) are gaining share over thermosets due to recyclability, faster processing, and better impact performance in cold climates.

Increasing use of one-shot molding techniques—like compression molding and resin transfer molding—reduces cycle time, making composites more competitive for high-volume production.

Asia Pacific leads consumption, driven by China’s EV boom and India’s growing passenger-vehicle market, while Europe emphasizes high-performance applications and closed-loop recycling initiatives.

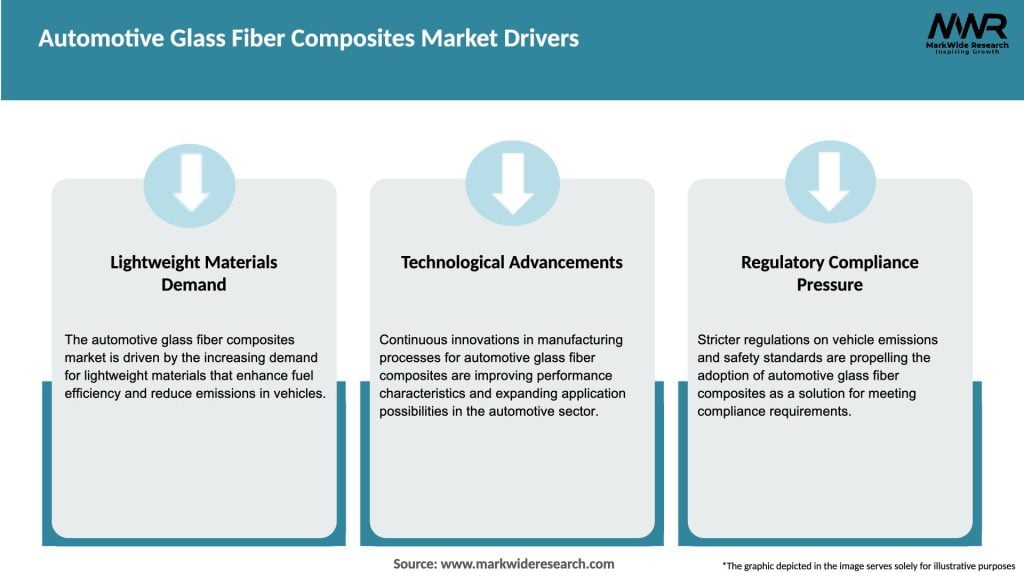

Market Drivers

Regulatory Compliance: Stringent fuel economy and emissions regulations compel automakers to lightweight vehicles, boosting composite usage.

Electrification Trend: EV manufacturers prioritize weight savings to extend battery range, creating a strong demand for glass fiber composites.

Design Freedom: Composites offer complex geometries and integrated functions (e.g., channels, mounting points), reducing part count and assembly costs.

Corrosion Resistance: Unlike metals, glass fiber composites resist rust and chemical exposure, extending component lifespan, especially in underbody applications.

Cost Reduction: Advances in low-cost glass fiber reinforcements and high-speed compression molding are narrowing the cost gap with metals.

Market Restraints

High Initial Tooling Costs: Mold design and fabrication for composite parts can be expensive, especially for low-volume series.

Cycle Time Challenges: Traditional thermoset processes (e.g., open-mold lay-up) are time-intensive, limiting throughput in mass production.

Repair Complexity: Composite repairs require specialized procedures and skills, leading to higher service costs and longer downtimes.

Recycling and End-of-Life: Thermoset composites are difficult to recycle, posing environmental and regulatory challenges as sustainability gains importance.

Material Variability: Inconsistent fiber distribution or resin curing can lead to quality defects, requiring stringent process controls.

Market Opportunities

Thermoplastic Development: Continued innovation in toughened, high-temperature thermoplastic composites offers rapid molding and recyclability advantages.

Automated Manufacturing: Robotics-based fiber placement and automated resin injection reduce labor costs and improve part consistency.

Integrated Sensor Embedding: Smart composites that monitor strain, temperature, and impact can enhance vehicle safety and predictive maintenance.

Circular Economy Initiatives: Chemical and mechanical recycling methods for glass fiber composites open new revenue streams and support regulatory compliance.

Aftermarket Customization: High-strength, lightweight composite panels for aftermarket body kits and performance upgrades present niche growth potential.

Market Dynamics

Shift to Thermoplastics: Growing environmental concerns and recycling mandates favor thermoplastic composites over traditional thermosets.

Consolidation Among Tier-One Suppliers: Mergers and partnerships allow shared R&D costs and expanded production capacities for composite components.

Localization of Supply Chains: OEMs are establishing regional composite manufacturing hubs to reduce lead times and tariffs.

Multi-Material Platforms: Automakers design vehicles with metal-composite hybrids, optimizing performance by using composites only where weight savings are most impactful.

Premium Brand Adoption: Luxury and performance brands pioneer novel composites, driving technology transfer to mainstream segments over time.

Regional Analysis

Asia Pacific: Largest regional market, spearheaded by China’s aggressive EV rollout and India’s ascending passenger-car demand. Local capacity expansion and government incentives support composite adoption.

Europe: Driven by CO₂ regulations, stringent end-of-life vehicle (ELV) directives, and high consumer acceptance of advanced materials. Germany and France lead in manufacturing innovation.

North America: The U.S. market focuses on pickup trucks and SUVs where composites reduce weight without compromising toughness. Investment tax credits and EV incentives boost composite content in new models.

Latin America: Emerging market with gradual composite uptake, primarily in aftermarket and commercial-vehicle segments; infrastructure investments and OEM joint ventures accelerate growth.

Middle East & Africa: Demand linked to commercial and off-road vehicles used in mining and construction; relatively nascent composite manufacturing, with potential for growth as local automotive industries mature.

Competitive Landscape

Leading Companies in the Automotive Glass Fiber Composites Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

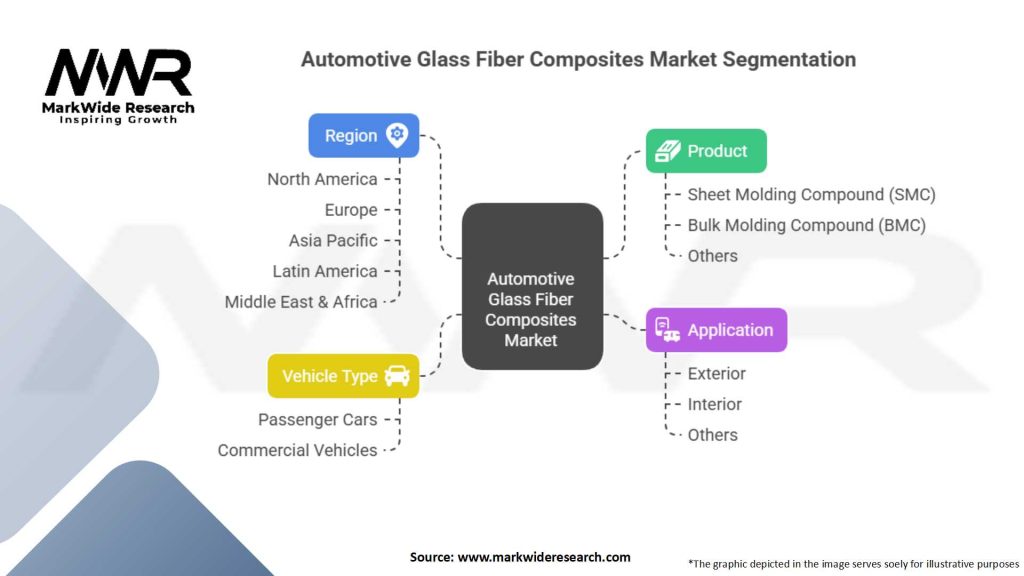

Segmentation

By Resin Type: Polyester, Epoxy, Vinyl Ester, Thermoplastic (PA, PBT, PP)

By Fiber Form: Chopped Strand Mat, Woven Roving, Continuous Roving, Unidirectional Tape

By Application: Exterior Body Panels, Structural Components, Underbody Shields, Interior Trim, Battery Housings

By Vehicle Type: Passenger Cars, Commercial Vehicles, Electric Vehicles, Off-Road & Specialty Vehicles

Category-wise Insights

Exterior Body Panels: Thermoplastic composites offer fast cycle times and paintable surfaces, gaining ground in hoods, fenders, and fascias.

Structural Components: Continuous-fiber laminates deliver high rigidity for chassis modules and subframe elements, reducing NVH (noise, vibration, harshness).

Underbody Shields: Glass fiber composites resist chemical exposure and road debris impact, replacing steel shields to save weight.

Interior Trim: Decorative panels and seat backs benefit from fiber-reinforced polymers for lightweight aesthetics and design flexibility.

Battery Housings (EVs): Composite enclosures protect battery modules while insulating thermally and electrically, enhancing safety and range.

Key Benefits for Industry Participants and Stakeholders

Weight Reduction: Lower vehicle mass improves fuel economy and EV driving range, enabling compliance with regulatory standards.

Design Flexibility: Molded composites allow complex shapes and integrated functions, reducing part count and assembly time.

Durability and Corrosion Resistance: Composites withstand harsh operating environments without rust or fatigue-related failures.

Lifecycle Cost Savings: Fewer maintenance interventions and rust-related repairs reduce total cost of ownership.

Brand Differentiation: OEMs leverage visible composite parts to signal innovation and premium craftsmanship to consumers.

SWOT Analysis

Strengths:

Superior strength-to-weight ratio compared to metals.

Corrosion and chemical resistance for long service life.

Compatibility with automated manufacturing processes.

Weaknesses:

Higher material and tooling costs than conventional metals.

Limited recycling infrastructure for thermoset composites.

Repair and end-of-life disposal complexity.

Opportunities:

Growth of EV platforms demanding lightweight materials.

Expansion of thermoplastic composite technologies and recycling methods.

Digital manufacturing and Industry 4.0 integration for quality control.

Threats:

Emerging alternative materials (light alloys, high-performance plastics).

Volatility in glass fiber and resin raw material prices.

Economic slowdowns impacting automotive production volumes.

Market Key Trends

Resin Systems Innovation: Low-viscosity epoxies and faster-curing vinyl esters reduce cycle times in high-pressure molding.

Hybrid Fiber Solutions: Combining glass fiber with natural fibers or carbon fiber for balanced cost and performance.

Recyclable Thermosets: Development of reversible or vitrimeric networks enables recyclability of previously “one-way” resins.

Digital Twin Modeling: Simulation tools predict composite behavior under load, accelerating design iteration and reducing physical prototyping.

Decentralized Composite Hubs: Small, localized production cells use modular tooling and robotics to serve regional OEM plants.

Covid-19 Impact

The pandemic caused temporary production halts in 2020, disrupting supply chains for glass fiber and resin. However, government stimulus packages aimed at accelerating EV adoption indirectly supported composite demand. In the recovery phase, OEMs prioritized lightweight solutions to meet stricter emissions targets, reinstating growth in glass fiber composite adoption. New protocols for workplace safety also accelerated automation investments in composite manufacturing.

Key Industry Developments

Solvay and Lanxess Joint Venture: Announced in 2024 to co-develop recyclable thermoplastic composites for automotive applications.

BASF’s Ultrafuse® Initiative: Launched continuous glass fiber-reinforced 3D printing filaments for rapid prototyping and custom part production.

Owens Corning Capacity Expansion: Investment in a new glass fiber plant in Southeast Asia to meet rising demand from Chinese and Indian OEMs.

Teijin’s Lightweight Vehicle Consortium: Collaboration with European automakers to standardize composite usage in next-gen vehicle platforms.

Analyst Suggestions

Prioritize Thermoplastic Adoption: Accelerate R&D in recyclable, high-impact thermoplastics to meet sustainability goals and reduce cycle times.

Invest in End-of-Life Solutions: Develop chemical recycling or energy-recovery processes to address downstream waste and regulatory pressures.

Enhance Digital Integration: Leverage Industry 4.0 tools—like AI-driven process monitoring—to ensure consistent composite quality and lower scrap rates.

Focus on EV-Specific Applications: Target battery housings and structural modules where weight savings directly translate to improved vehicle range.

Forge Collaborative Ecosystems: Partner with resin, fiber, and equipment suppliers to co-innovate and share capital investments in pilot production lines.

Future Outlook

The Automotive Glass Fiber Composites Market is set to maintain steady growth as the automotive industry balances electrification, sustainability, and cost pressures. While thermosets will continue to serve niche structural applications, thermoplastics and hybrid solutions are expected to outpace overall market expansion. Recycling innovations and digital manufacturing will further solidify composites’ role in mainstream vehicle architectures, making them a permanent fixture in tomorrow’s lighter, greener automobiles.

Conclusion

In conclusion, glass fiber composites offer a compelling solution for automakers striving to meet evolving regulatory, performance, and consumer demands. Their unique combination of lightweight strength, design flexibility, and durability positions them at the forefront of automotive materials innovation. Companies that invest strategically in recyclable composites, advanced manufacturing, and digital quality control will lead the transformation toward sustainable, high-performance vehicles. Stakeholders across the value chain—from fiber producers to OEMs—must collaborate to build a resilient, circular ecosystem that maximizes the benefits of glass fiber composites while addressing end-of-life and cost challenges.

What is Automotive Glass Fiber Composites?

Automotive Glass Fiber Composites are materials made from a combination of glass fibers and resin, used to enhance the strength and durability of automotive components. These composites are lightweight and offer excellent resistance to corrosion and impact, making them ideal for various applications in the automotive industry.

What are the key players in the Automotive Glass Fiber Composites Market?

Key players in the Automotive Glass Fiber Composites Market include companies like Owens Corning, BASF, and Teijin Limited, which are known for their innovative composite solutions. These companies focus on developing advanced materials that improve vehicle performance and fuel efficiency, among others.

What are the growth factors driving the Automotive Glass Fiber Composites Market?

The growth of the Automotive Glass Fiber Composites Market is driven by the increasing demand for lightweight materials to enhance fuel efficiency and reduce emissions. Additionally, the rising adoption of electric vehicles and advancements in composite manufacturing technologies are contributing to market expansion.

What challenges does the Automotive Glass Fiber Composites Market face?

The Automotive Glass Fiber Composites Market faces challenges such as high production costs and the complexity of composite recycling. Additionally, the need for specialized manufacturing processes can limit the widespread adoption of these materials in the automotive sector.

What opportunities exist in the Automotive Glass Fiber Composites Market?

Opportunities in the Automotive Glass Fiber Composites Market include the development of new composite materials that offer improved performance and sustainability. Furthermore, the growing trend towards electric and hybrid vehicles presents a significant opportunity for innovative composite applications.

What trends are shaping the Automotive Glass Fiber Composites Market?

Trends shaping the Automotive Glass Fiber Composites Market include the increasing use of bio-based resins and the integration of smart materials that can enhance vehicle functionality. Additionally, the focus on sustainability and reducing the carbon footprint of automotive manufacturing is driving innovation in composite materials.

Automotive Glass Fiber Composites Market:

| Segmentation | Details |

|---|---|

| Product | Sheet Molding Compound (SMC), Bulk Molding Compound (BMC), Others |

| Application | Exterior, Interior, Others |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Glass Fiber Composites Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at