Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Flex fuel engines accounted for over 10% of new light-vehicle sales in Brazil in 2024, underscoring the model’s mainstream acceptance.

-

Ethanol blended at 85% delivers up to 8% more power per liter of gasoline equivalent, providing both environmental and performance benefits.

-

North America and Europe are witnessing pilot programs for high-concentration ethanol blends (E15–E20), potentially expanding flex-fuel compatibility beyond traditional E85 vehicles.

-

OEMs are reducing the cost gap by standardizing ethanol-compatible components—such as fuel pumps, seals, and injectors—across multiple vehicle lines.

-

Consumer incentives—tax credits, lower fuel taxes, and HOV‐lane access—are boosting test drives and sales in key metropolitan markets.

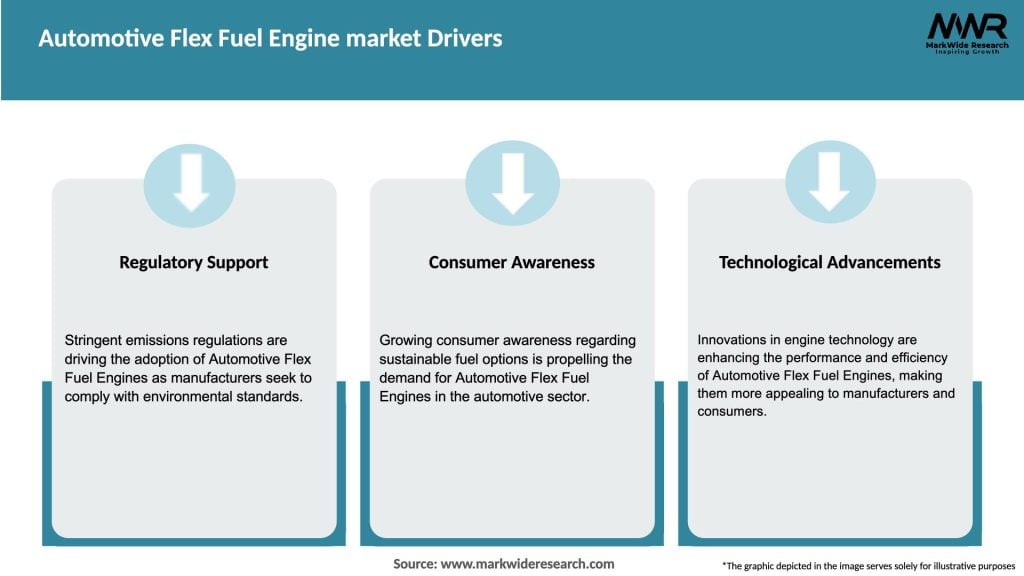

Market Drivers

-

Regulatory Mandates: National blending targets and emissions reduction goals compel automakers to offer flex-fuel variants.

-

Fuel Security: Diversification of fuel sources lessens vulnerability to oil price volatility and geopolitical supply disruptions.

-

Environmental Concerns: Ethanol’s life-cycle CO₂ footprint is up to 50% lower than gasoline, appealing to eco-conscious buyers.

-

Ethanol Production Growth: Expanding agricultural capacity for corn, sugarcane, and cellulose feedstocks increases biofuel availability.

-

Technological Advances: Improved engine calibration, corrosion-resistant materials, and software control unit updates ensure reliability across fuel blends.

Market Restraints

-

Infrastructure Gaps: Limited availability of high-blend ethanol pumps in many regions deters consumer adoption.

-

Cold-Start Issues: At low temperatures, ethanol’s lower vapor pressure can hamper engine starting without supplemental gasoline injection.

-

Fuel Economy Trade-Off: Higher ethanol blends have lower energy density, potentially reducing range per tank compared to pure gasoline.

-

Consumer Awareness: Many drivers remain unaware of flex-fuel benefits or how to locate ethanol fueling stations.

-

Feedstock Competition: Use of food crops for fuel raises concerns about agricultural land use and commodity price impacts.

Market Opportunities

-

Next-Gen Biofuels: Cellulosic ethanol from agricultural waste and algae‐based fuels promise greater sustainability and supply diversity.

-

Infrastructure Expansion: Investments in E85 and E20 pump networks will unlock new regional markets and drive volume sales.

-

Light-Duty Diesel Alternatives: Flex fuel engines can meet emissions standards without particulate filters, appealing in regions where diesel use is restricted.

-

Fleet Conversions: Municipal and corporate fleets present an opportunity for economies of scale in retrofitting or purchasing FFVs.

-

Public–Private Partnerships: Collaborations to develop rural fueling stations benefit both agriculture and transportation sectors.

Market Dynamics

-

OEM–Supplier Collaboration: Engine makers and component suppliers co-develop ethanol-resistant fuel systems to share R&D costs.

-

Policy Fluctuations: Shifts in renewable fuel mandates or subsidy levels can rapidly alter market demand and investment plans.

-

Competitive Landscape: As more manufacturers offer FFVs, price competition and feature differentiation (e.g., flex-fuel indicators, smartphone integration) intensify.

-

Consumer Engagement: Digital platforms and in-vehicle alerts educate drivers about blend ratios and optimal fueling practices.

-

Feedstock Innovation: Advances in genetically engineered crops and fermentation processes improve ethanol yield and cost competitiveness.

Regional Analysis

-

North America: The U.S. boasts over 21 million FFVs on the road, with E85 accessible at 3,500+ stations and state incentives in the Midwest.

-

Latin America: Brazil remains the leader with 95% of dealers offering ethanol, and FFVs making up 80% of all new passenger vehicles in 2024.

-

Europe: Adoption is nascent, focused in Sweden and France, where pilot E85 stations and flex-fuel taxis demonstrate feasibility.

-

Asia-Pacific: Thailand and India are exploring ethanol blending programs (E20–E30), creating future demand for flex-fuel engines.

-

Middle East & Africa: Early‐stage interest driven by energy diversification goals; limited by feedstock availability but supported by strategic government initiatives.

Competitive Landscape

Leading Companies in the Automotive Flex Fuel Engine Market:

- General Motors Company

- Ford Motor Company

- Fiat Chrysler Automobiles N.V.

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Volkswagen AG

- Nissan Motor Co., Ltd.

- Hyundai Motor Company

- BMW AG

- Mercedes-Benz AG

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

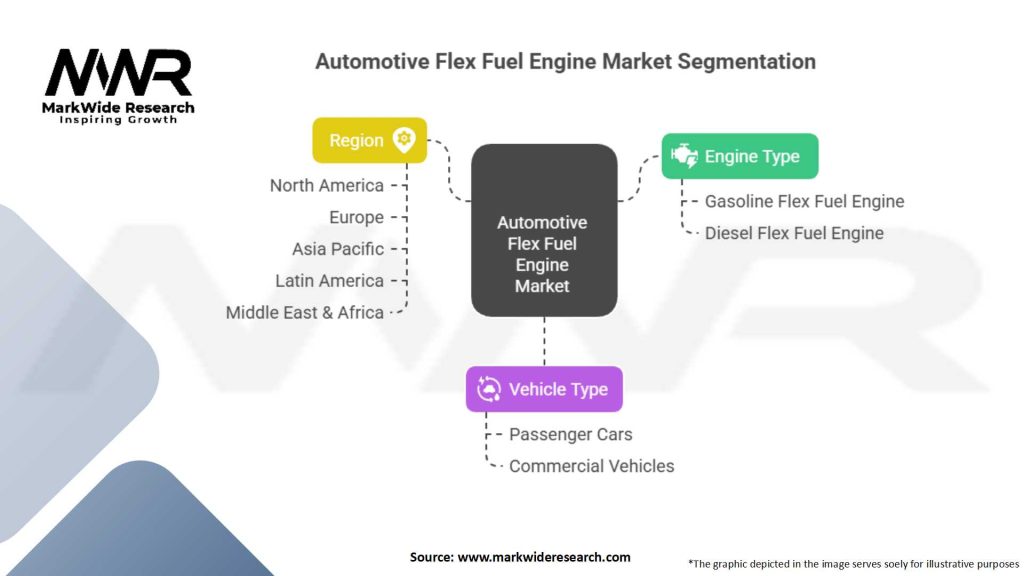

Segmentation

-

By Engine Type: Port-Fuel Injection, Direct Injection with Flex-Fuel Sensor, Turbocharged Flex-Fuel Engines

-

By Vehicle Type: Compact Cars, Sedans, SUVs, Light Trucks, Commercial Vans

-

By Fuel Blend: E20, E50, E85, Methanol Blends

-

By Sales Channel: OEM Factory-Built FFVs, Aftermarket Conversion Kits

Category-wise Insights

-

Port-Fuel Injection Flex-Fuel Engines: Simpler design, lower cost, widely adopted in early-generation FFVs.

-

Direct Injection FFVs: Offer improved power and efficiency at higher ethanol ratios; require advanced sensors and calibration.

-

Turbocharged Ethanol Engines: Capitalize on ethanol’s high octane for performance—used in sport-oriented flex-fuel models.

-

Commercial Van FFVs: Popular in delivery fleets to leverage bulk fueling at centralized ethanol stations.

-

Aftermarket Kits: Provide cost-effective conversions for standard engines, though durability and warranty support vary.

Key Benefits for Industry Participants and Stakeholders

-

Energy Independence: Reduces reliance on imported petroleum by utilizing domestically produced biofuels.

-

Emissions Reduction: Lowers tailpipe CO₂ and particulates, assisting automakers in meeting fleet-wide targets.

-

Market Differentiation: Offers a compelling selling point for environmentally minded consumers and fleet managers.

-

Rural Economic Growth: Stimulates agricultural sectors by creating demand for ethanol feedstocks.

-

Fuel Cost Savings: In regions with ethanol subsidies, operating costs can be significantly lower than pure gasoline.

SWOT Analysis

Strengths:

-

Proven technology with decades of deployment in Brazil and North America.

-

Tangible environmental benefits and supportive policy frameworks.

-

Flexibility to use conventional fuel when biofuel supply is inconsistent.

Weaknesses:

-

Lower energy density of ethanol reduces driving range.

-

Cold-start and evaporation losses at low temperatures.

-

Consumer confusion over blend levels and fueling logistics.

Opportunities:

-

Development of advanced cellulosic ethanol and next-gen biofuels.

-

Expansion of high-blend fueling infrastructure in Europe and Asia.

-

Hybrid FFVs combining ethanol capability with electrification for range optimization.

Threats:

-

Volatile biofuel policy environments that can change with new administrations.

-

Competition from electric vehicles and hydrogen fuel-cell technologies.

-

Agricultural feedstock price fluctuations impacting ethanol economics.

Market Key Trends

-

Hybridization of FFVs: Pairing flex-fuel engines with electric motors to offset ethanol’s lower energy density.

-

Smart Engine Management: Over-the-air software updates to optimize performance for regional blend variations.

-

Direct Ethanol Injection: Research into direct ethanol injection (DEI) systems to improve cold start and efficiency.

-

E20/E30 Pilots: Expansion of mid-range blend pilot programs in Europe and Asia to establish consumer confidence.

-

Digital Awareness Campaigns: OEMs and fuel providers collaborating on apps and in-vehicle guides to locate ethanol pumps.

Covid-19 Impact

The pandemic initially disrupted ethanol supply chains and temporarily closed many biofuel plants, leading to reduced availability of high-blend fuels in 2020–21. However, stimulus measures supporting agricultural sectors and a rebound in vehicle usage renewed interest in renewable fuels. OEMs tapped into recovery funds to accelerate flex-fuel R&D, while fleets prioritized cleaner fuels to meet emerging urban air-quality regulations as lockdowns eased.

Key Industry Developments

-

Brazil’s NextGen Ethanol Program: Announced incentives in 2024 to develop cellulosic ethanol from sugarcane bagasse, ensuring next-generation feedstocks for FFVs.

-

GM–POET Biofuels Alliance: Expanded capacity for Midwest E85 plants to supply flex-fuel pickups and SUVs across the U.S.

-

EU E20 Pilot: Launched by France and Sweden in 2023, testing E20 compatibility in select OEM models to gauge consumer acceptance.

-

Ford’s DEI Prototype: Unveiled at the2024 Detroit Auto Show, showcasing direct ethanol injection in a Mustang-based flex-fuel platform.

Analyst Suggestions

-

Accelerate Infrastructure Deployment: Collaborate with governments and fuel retailers to expand E85/E20 pump networks in urban and rural areas.

-

Educate End Users: Develop targeted marketing and in-vehicle education tools to reduce confusion and improve adoption.

-

Invest in Cold-Start Solutions: Prioritize research into dual‐fuel systems and heated fuel injectors to address low-temperature performance.

-

Pursue Strategic Feedstock Partnerships: Lock in supply agreements with cellulosic ethanol producers to hedge against commodity price swings.

-

Monitor Competitive Technologies: Track EV and hydrogen-fuel-cell adoption rates to adapt flex-fuel strategies accordingly.

Future Outlook

The Automotive Flex Fuel Engine market is expected to maintain moderate growth through 2030, driven by policy support, emerging biofuel technologies, and strategic OEM commitments. While electric powertrains gain share, flex-fuel vehicles will remain relevant—especially in regions where ethanol infrastructure is mature or where electricity grids are carbon-intensive. Hybrid flex-fuel platforms and next-gen ethanol from non-food feedstocks will further strengthen the value proposition, ensuring flex-fuel engines play a complementary role in the transition to sustainable mobility.

Conclusion

In conclusion, flex-fuel engines represent a proven, adaptable solution for reducing oil dependence and emissions today, even as the broader industry transitions toward electrification. Stakeholders—from automakers to fuel producers and policymakers—must align on infrastructure, education, and technology development to fully realize the benefits. By leveraging hybridization, next-generation biofuels, and smart engine controls, the Automotive Flex Fuel Engine market can deliver tangible environmental and economic gains over the next decade in a diversified mobility landscape.