444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The automotive fleet market refers to the commercial use of vehicles such as trucks, vans, and cars by organizations for business purposes. These fleets are generally managed and maintained by companies to support their daily operations, including transportation of goods and services, delivery of products, and movement of employees from one location to another.

With the increasing trend of e-commerce and online shopping, the demand for fleet services has surged over the years. Moreover, the rise of the sharing economy and the growing preference for car rentals and subscription models have further fuelled the growth of the automotive fleet market.

Executive Summary

The global automotive fleet market is expected to grow at a CAGR of 6.3% during the forecast period (2021-2026), driven by the increasing demand for fleet services from various industries such as e-commerce, logistics, and transportation. The growth of the market is also attributed to the growing need for efficient fleet management solutions and the adoption of electric vehicles (EVs) for commercial purposes.

The market is dominated by key players such as Ford Motor Company, General Motors Company, Toyota Motor Corporation, and Volkswagen AG, who have a strong presence across the globe. These players are actively engaged in strategic collaborations, partnerships, and product launches to strengthen their market position.

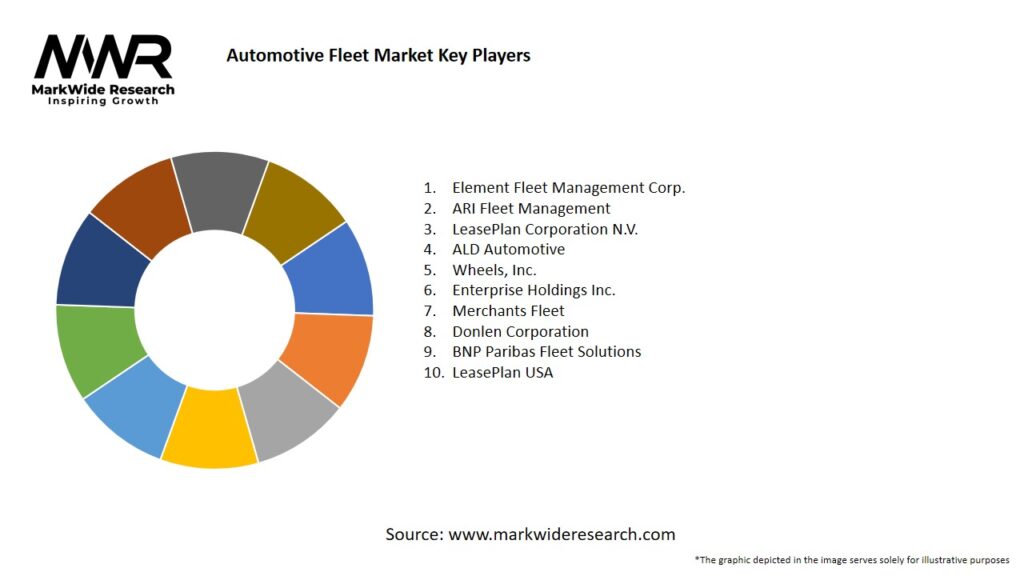

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Adoption of telematics solutions is near ubiquitous among large fleets, delivering reductions in fuel consumption by up to 15% and 20% fewer accidents through driver behavior monitoring.

Electric light-duty vehicles are projected to account for more than 25% of fleet purchases by 2030 in mature markets, driven by total cost of ownership advantages and regulatory incentives.

Fleet-as-a-service models—providing vehicles, maintenance, telematics, and disposal under a single subscription—are growing at a CAGR above 8%, appealing to SMEs without in-house fleet expertise.

Stricter emissions and safety regulations in regions such as Europe and North America are accelerating fleet renewal cycles, boosting demand for modern powertrains and advanced driver-assistance systems.

Market Drivers

Cost Efficiency Pressures: Corporations seek to minimize total cost of ownership through fuel management, preventive maintenance, and utilization optimization enabled by data analytics.

Regulatory Compliance: Emissions standards (e.g., Euro 7, EPA regulations) and safety mandates (e.g., telematics for hours-of-service tracking) compel fleets to modernize.

Technology Adoption: The proliferation of IoT, cloud platforms, and AI enables real-time tracking, predictive maintenance alerts, and automated reporting, improving uptime and reliability.

Shift to Electric Mobility: Incentives for EV adoption, rising fuel costs, and corporate sustainability targets are driving electrification of light-duty and last-mile delivery fleets.

Outsourcing Trends: Many organizations prefer outsourcing fleet management functions to specialists, reducing capital expenditures and focusing on core competencies.

Market Restraints

High Upfront Costs: Purchase or lease of advanced telematics-enabled vehicles and electric models requires significant initial investment, posing a barrier for smaller operators.

Infrastructure Limitations: Insufficient charging infrastructure in certain regions slows EV fleet adoption, requiring careful route planning and investment in depot charging.

Data Security Concerns: Connectivity and cloud-based platforms raise cybersecurity and data privacy issues, necessitating robust protections.

Fragmented Vendor Landscape: Lack of standardization among telematics providers can complicate integration with existing ERP and maintenance systems.

Driver Acceptance: Resistance to monitoring and new technologies among drivers can hinder full realization of efficiency gains.

Market Opportunities

Predictive Maintenance Services: Offering AI-driven maintenance forecasting to reduce downtime and extend vehicle lifecycles presents a high-value add-on service.

Subscription Models: Fleet subscription services bundling vehicles, maintenance, insurance, and telematics under a single monthly fee can attract new customers.

Micro-Mobility Integration: Incorporating e-bikes, scooters, and light commercial EVs into last-mile delivery solutions expands service portfolios.

Green Fleet Consulting: Advising customers on decarbonization strategies—route optimization, telematics benchmarking, and charging infrastructure planning—is an emerging niche.

Advanced Driver Assistance Systems (ADAS): Retrofitting ADAS for safety compliance and insurance premium reductions offers both cost savings and regulatory benefits.

Market Dynamics

Digital Transformation: Fleet operators are migrating from on-premise to cloud-native fleet management systems, enabling rapid deployment of new features and mobile access.

Sustainability Focus: Corporate ESG commitments and carbon-neutral pledges are driving electrification and utilization of low-emission vehicles.

Consolidation: Mergers and acquisitions among OEMs, leasing companies, and telematics vendors are creating vertically integrated fleet service providers.

API Ecosystems: Open telematics APIs and partnerships among software providers facilitate seamless integration with finance, insurance, and maintenance platforms.

Data-Driven Decision Making: Advanced analytics dashboards that combine telematics, fuel, maintenance, and driver data are becoming standard tools for fleet managers.

Regional Analysis

North America: Largest market share due to mature leasing industry, widespread telematics adoption, and early EV fleet pilots by delivery and utility companies.

Europe: Rapid electrification driven by EU Green Deal targets, strong leasing culture, and robust regulatory support for zero-emission zones in urban centers.

Asia Pacific: Fastest growth rate, led by China’s electric vehicle policy incentives and India’s push for commercial telematics to improve road safety and compliance.

Latin America: Moderate growth with opportunity in telematics and maintenance outsourcing as multinational corporations expand operations in the region.

Middle East & Africa: Emerging market with pilot digital fleet programs for government and logistics sectors; infrastructure investments are key to further growth.

Competitive Landscape

Leading Companies in the Automotive Fleet Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

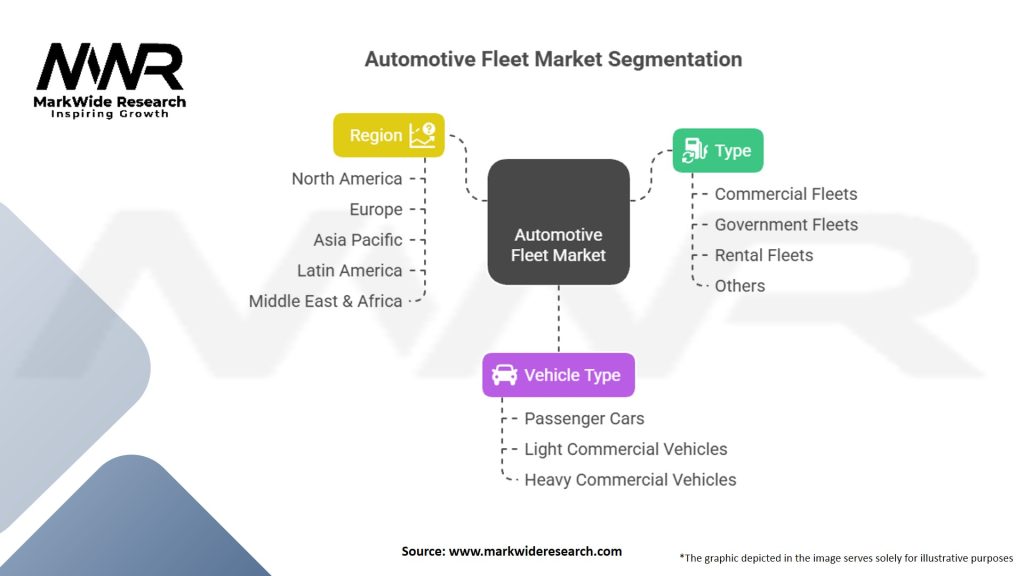

Segmentation

By Vehicle Type: Light-Duty (cars, vans), Medium & Heavy-Duty Trucks, Specialized Vehicles (refrigerated, tanker, emergency).

By Service Model: Full-Service Leasing, Rental, Subscription, Pay-Per-Use.

By Solution: Telematics & Tracking, Maintenance Management, Fuel Management, Driver Management, Safety & Compliance.

By End User: Logistics & Transportation, Oil & Gas, Utilities, Government & Public Sector, Retail & E-commerce, Healthcare.

Category-wise Insights

Telematics & Tracking: Core to real-time location monitoring, geofencing, and route optimization—reduces fuel use and unauthorized vehicle use.

Maintenance Management: Automated service scheduling and parts inventory optimization decrease breakdowns and extend vehicle lifespans.

Fuel Management: Integration with fuel cards and analytics to detect fraud, identify idle times, and optimize fuel consumption.

Driver Management: Scorecards and training modules based on driver behavior data enhance safety records and lower insurance premiums.

Safety & Compliance: Solutions for hours-of-service tracking, electronic logging, and roadside inspection readiness ensure regulatory adherence.

Key Benefits for Industry Participants and Stakeholders

Lower Operating Costs: Data-driven insights enable fuel savings, reduced maintenance expenses, and minimized downtime.

Improved Utilization: Centralized dashboards track fleet utilization, allowing right-sizing and redeployment of under-used assets.

Enhanced Safety: Monitoring and coaching based on driver behavior reduce accident rates and insurance claims.

Regulatory Peace of Mind: Automated compliance reporting for emissions, hours of service, and safety standards lowers audit risk.

Sustainability Gains: Transition to EVs and optimized routing support corporate carbon-reduction goals and improve public image.

SWOT Analysis

Strengths:

Comprehensive data platforms offering end-to-end visibility.

Strong aftermarket services networks for maintenance and repair.

Weaknesses:

High capital requirements for EV transition and telematics hardware rollout.

Complex integration environments in organizations with multiple legacy systems.

Opportunities:

Rising demand for subscription-based mobility models.

Regulatory incentives for zero-emission fleets and green leasing programs.

Threats:

Cybersecurity risks associated with connected vehicle platforms.

Competition from in-house fleet management as large corporations build internal capabilities.

Market Key Trends

Electrification Acceleration: Fleet operators piloting EV trucks and vans with smart charging schedules to minimize grid impact.

Mobility as a Service (MaaS): Bundling short-term rentals, car-sharing, and micro-mobility into unified platforms for urban fleets.

AI-Driven Optimization: Machine learning models forecasting maintenance needs and dynamically routing vehicles based on traffic patterns.

Blockchain for Compliance: Trial use of immutable ledgers to track vehicle history, leasing contracts, and emissions certificates.

Integrated Mobility Portals: Customer portals consolidating all fleet functions—procurement, telematics, invoicing—into a single user interface.

Covid-19 Impact

The pandemic initially reduced fleet utilization due to lockdowns but accelerated digital adoption as remote monitoring became essential. Many operators invested in contactless delivery solutions and adjusted route planning to accommodate shifting demand patterns. Fleet maintenance schedules shifted from fixed intervals to condition-based triggers, enabled by telematics. The crisis also underscored the need for business continuity plans incorporating flexible fleet arrangements and multi-vendor backups.

Key Industry Developments

LeasePlan’s EV100 Commitment: Pledge to transition its entire managed fleet to electric models by 2030, coupled with customer charging support.

Geotab’s Connected EV Ecosystem: Launch of EV-specific telematics modules providing state-of-charge monitoring and charger health diagnostics.

Element’s Subscription Service Expansion: Introduction of flexible-term subscriptions with full digital management for SMEs.

ALD Automotive’s MaaS Platform: Integration of car-sharing and short-term rental into its core fleet management offering for urban clients.

ARI’s Predictive Maintenance Rollout: AI engine that analyzes sensor data to forecast component failures up to 30 days in advance.

Analyst Suggestions

Adopt a Phased EV Strategy: Begin with light-duty routes where range anxiety is minimal, then scale to medium-duty as infrastructure matures.

Leverage Modular Platforms: Choose telematics solutions with open APIs to future-proof integrations with insurance, finance, and OEM portals.

Pilot Subscription Models: Offer small-scale fleet subscriptions to test market demand before full-scale rollouts.

Invest in Driver Training: Combine behavior monitoring with coaching programs to maximize safety and fuel-saving benefits.

Future Outlook

The Automotive Fleet market will continue its digital transformation, with AI-powered analytics, widespread electrification, and mobility-as-a-service offerings leading the next wave of disruption. Integrated platforms that unite vehicle acquisition, financing, telematics, maintenance, and disposal under one contract will become the norm, especially for SMEs. As sustainability and compliance pressures intensify, fleet operators who harness data and flexible service models will secure competitive differentiation and long-term profitability.

Conclusion

The Automotive Fleet market is evolving from a capital-intensive, asset-focused operation into a software-driven, service-oriented ecosystem. By embracing electrification, connectivity, and subscription-based models, stakeholders can reduce costs, improve safety, and meet stringent environmental regulations. Success will hinge on selecting interoperable platforms, forging strategic partnerships, and cultivating driver adoption—ultimately transforming fleets into intelligent, sustainable mobility networks.

What is Automotive Fleet?

Automotive Fleet refers to a collection of vehicles owned or leased by a business or organization for operational purposes. These fleets are typically used for transportation, logistics, and service delivery across various industries.

What are the key players in the Automotive Fleet market?

Key players in the Automotive Fleet market include companies like Enterprise Fleet Management, ARI Fleet Management, and LeasePlan, which provide fleet management services and solutions, among others.

What are the main drivers of growth in the Automotive Fleet market?

The growth of the Automotive Fleet market is driven by increasing demand for efficient transportation solutions, advancements in telematics technology, and the rising need for cost-effective fleet management practices across industries.

What challenges does the Automotive Fleet market face?

The Automotive Fleet market faces challenges such as rising fuel costs, regulatory compliance issues, and the need for sustainable practices, which can impact operational efficiency and profitability.

What opportunities exist in the Automotive Fleet market?

Opportunities in the Automotive Fleet market include the integration of electric vehicles, the adoption of advanced fleet management software, and the potential for enhanced data analytics to improve operational efficiency.

What trends are shaping the Automotive Fleet market?

Trends in the Automotive Fleet market include the increasing use of connected vehicle technology, a shift towards electric and hybrid vehicles, and the growing importance of sustainability initiatives in fleet operations.

Automotive Fleet Market:

| Segmentation | Details |

|---|---|

| Type | Commercial Fleets, Government Fleets, Rental Fleets, Others |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Fleet Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at