444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The automotive industry has seen significant growth over the years, leading to an increase in the use of electronic components in vehicles. With the growth of technology, these electronic components generate electromagnetic interference (EMI), which can cause malfunction and failure in the vehicle’s electronic system. As a result, automotive EMI shielding has become a critical requirement in the industry.

Automotive EMI shielding is the process of preventing the interference of electromagnetic fields by creating a barrier between the electronic components and the external environment. The automotive EMI shielding market involves the production and sale of various types of shielding solutions that are used to prevent electromagnetic interference in automobiles. These solutions include conductive coatings, laminates, and foils, among others.

The increasing demand for automotive EMI shielding solutions has led to the growth of the market. The market is expected to experience significant growth over the forecast period due to the increasing use of electronic components in vehicles.

Meaning

EMI refers to the disturbance caused by electromagnetic waves in the environment. Electromagnetic waves can interfere with electronic devices, causing them to malfunction or fail. In the automotive industry, EMI can lead to failures in the vehicle’s electronic systems, which can be dangerous for the driver and passengers.

Automotive EMI shielding is the process of preventing electromagnetic waves from interfering with the electronic components of a vehicle. EMI shielding involves creating a barrier that prevents electromagnetic waves from entering the vehicle’s electronic system.

Automotive EMI shielding solutions are designed to meet the specific requirements of the automotive industry. These solutions are used to shield electronic components in vehicles from electromagnetic interference, ensuring that the electronic components function correctly.

Executive Summary

The automotive EMI shielding market is expected to experience significant growth over the forecast period due to the increasing use of electronic components in vehicles. The market involves the production and sale of various types of shielding solutions that are used to prevent electromagnetic interference in automobiles.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Rising electronic content per vehicle—from ADAS sensors to V2X communication—has exponentially increased EMI risk, boosting demand for robust shielding solutions.

Electric vehicles and hybrids require specialized shielding for high-voltage battery systems and inverters, leading to growth in magnetically permeable gaskets and conductive housings.

Lightweight conductive polymers and metallized plastics are gaining market share over traditional metal foils due to weight reduction and design versatility.

Regional EMC regulations (e.g., UNECE R10 in Europe, CISPR 25) are becoming more rigorous, compelling automakers to integrate shielding early in the design process.

Market Drivers

Electrification of Powertrains: The surge in EV and hybrid vehicle production necessitates advanced shielding for high-voltage components to prevent interference with safety-critical electronics.

Autonomous and ADAS Systems: Proliferation of radar, lidar, ultrasonic sensors, and infotainment modules increases EMI sources and vulnerable assets, driving demand for comprehensive shielding.

Regulatory Compliance: Stricter international EMC standards require rigorous testing and certification, encouraging OEMs to invest in proven shielding technologies.

Lightweighting Initiatives: Automakers’ focus on reducing vehicle mass fuels adoption of polymer-based and composite shielding solutions that offer weight advantages over metals.

Miniaturization of Electronics: As electronic modules shrink and pack closer together, effective localized shielding becomes critical to maintain signal integrity.

Market Restraints

Cost Sensitivity: High-performance shielding materials and tooling can be expensive, putting pressure on suppliers to optimize cost-per-part.

Material Compatibility: Some conductive plastics and coatings may face durability or adhesion challenges under automotive temperature and humidity cycles.

Design Complexity: Integrating shielding into complex geometries—such as cable harnesses and irregular module enclosures—requires custom tooling and engineering resources.

Supply Chain Disruptions: Dependence on specialty materials (e.g., rare-earth metals for magnetic shielding) can be affected by geopolitical or logistic constraints.

Test and Validation Time: Achieving EMC certification can extend product development cycles, delaying time to market.

Market Opportunities

Nanotechnology-Enhanced Coatings: Graphene and carbon nanotube-infused coatings offer superior conductivity at minimal thickness, aligning with lightweighting goals.

Integrated Multi-Functional Parts: Combining shielding with structural components (e.g., chassis panels, sensor housings) reduces part count and assembly steps.

Retrofit and Aftermarket Solutions: Growth in connected car services presents demand for aftermarket EMI filters and shields for legacy fleets.

3D Printing of Conductive Materials: Additive manufacturing of custom shielding geometries allows rapid prototyping and on-demand parts.

Collaborations with Material Innovators: Partnerships between automotive OEMs and advanced materials firms can accelerate development of next-generation shielding solutions.

Market Dynamics

Consolidation Among Suppliers: Tier 1 electronics and material suppliers are acquiring niche shielding specialists to offer end-to-end EMC solutions.

Shift to Simulation-Driven Design: Virtual EMC modeling tools are reducing costly physical iterations, enabling shielding optimization early in the development cycle.

Sustainability Mandates: Demand for recyclable and low-VOC shielding materials is increasing under global environmental regulations.

Cross-Industry Technology Transfer: Solutions from aerospace, defense, and consumer electronics are being adapted for automotive EMI challenges.

Customization at Scale: Modular shielding kits for common platforms allow rapid deployment across multiple vehicle models.

Regional Analysis

Asia Pacific: Largest production hub with major OEMs in China, Japan, and South Korea; rapid EV adoption boosts demand for specialized EMI shields.

Europe: Strict EMC regulations and high penetration of luxury and EV segments drive advanced shielding technology uptake.

North America: Strong R&D investments by domestic automakers and semiconductor suppliers foster innovation in lightweight shielding solutions.

Latin America: Emerging aftermarket demand and gradual tightening of EMC standards create growth opportunities.

Middle East & Africa: Infrastructure modernization begins to include EMC considerations for rising EV and smart vehicle initiatives.

Competitive Landscape

Leading Companies in the Automotive EMI Shielding Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

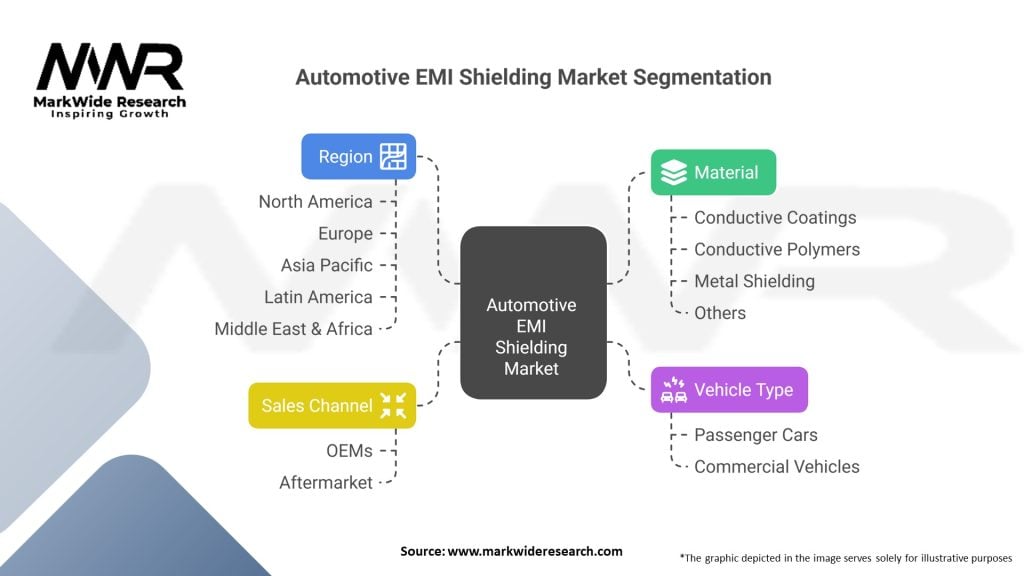

Segmentation

By Material: Metal Foils & Mesh, Conductive Plastics & Coatings, Magnetically Permeable Gaskets, Conductive Fabrics.

By Application: Powertrain Modules, ADAS & Sensor Housings, Infotainment Systems, Wiring Harnesses, Battery Packs.

By Vehicle Type: Passenger Cars, Commercial Vehicles, Electric & Hybrid Vehicles.

By Region: Asia Pacific, Europe, North America, Latin America, Middle East & Africa.

Category-wise Insights

Metal Foils & Mesh: Traditional solution offering high shielding effectiveness but challenged by weight and form limitations.

Conductive Plastics & Coatings: Lightweight and moldable, ideal for complex module housings and integrated components.

Magnetically Permeable Gaskets: Critical for sealing gaps in EV battery enclosures and inverter compartments to suppress low-frequency EMI.

Conductive Fabrics: Flexible solution for harness shielding, providing conformal coverage with minimal added bulk.

Key Benefits for Industry Participants and Stakeholders

Regulatory Compliance: Ensures vehicles meet global EMC standards, avoiding costly recalls and certification delays.

System Reliability: Minimizes electronic malfunctions and data corruption, enhancing vehicle safety and user experience.

Design Flexibility: Advanced materials allow seamless integration of shielding into modern, space-constrained vehicle architectures.

Weight Reduction: Polymer-based and nanomaterial solutions support automakers’ fuel-efficiency and EV range targets.

Cost Efficiency: Integrated multi-functional shielding parts reduce assembly complexity and overall bill of materials.

SWOT Analysis

Strengths:

Diverse material options covering broad frequency ranges.

Established suppliers with proven automotive track records.

Weaknesses:

Higher cost compared to generic materials without EMI properties.

Integration complexity requiring specialized design know-how.

Opportunities:

Rising EV penetration demanding tailored shielding solutions.

Growth of 5G and V2X communications increasing EMI exposure.

Threats:

Volatile raw material prices affecting metal-based solutions.

Rapid technology evolution necessitating continuous R&D investment.

Market Key Trends

Integration with Structural Parts: Embedding shielding within load-bearing components to save space and weight.

Use of Nanocomposites: Adoption of carbon-based nanofillers for ultra-thin, high-performance shielding.

Digital Twin for EMC: Virtual prototyping of shielding effectiveness to cut development time.

Sustainable Materials: Rising use of bio-based and recyclable conductive polymers.

Aftermarket Smart Shields: Sensor-embedded shields providing real-time EMI diagnostics.

Covid-19 Impact

The pandemic disrupted global supply chains, leading to temporary shortages of specialty shielding materials and longer lead times. However, the acceleration of EV and connectivity projects in the recovery phase renewed focus on EMC compliance, prompting OEMs and suppliers to localize supply and diversify material sources.

Key Industry Developments

3M’s Launch of Electrifi™ Conductive Filament for 3D printing of custom shielding parts directly on prototypes.

Aptiv’s Roll-out of Integrated Shielded Wiring Harnesses in leading EV platforms.

Laird Connectivity’s Expansion into High-Permeability Gaskets optimized for traction battery enclosures.

Analyst Suggestions

Invest in Material Innovation: Prioritize R&D in lightweight, high-conductivity composites to meet EV and ADAS requirements.

Leverage Simulation Tools: Adopt advanced EMC modeling early in development to optimize shielding geometry and material selection.

Build Strategic Alliances: Collaborate with nanomaterial specialists and additive manufacturers to accelerate next-gen solution deployment.

Future Outlook

The Automotive EMI Shielding market is expected to grow at a healthy CAGR over the next five years, driven by continued vehicle electrification, autonomous feature rollout, and stricter EMC regulations. Suppliers who can deliver lightweight, cost-effective, and easily integrated shielding solutions will capture the largest share, while digital design and sustainable material trends will define competitive differentiation.

Conclusion

As vehicles become increasingly electronic and connected, EMI shielding has transformed from a niche component to a critical system enabler. The convergence of electrification, autonomy, and connectivity necessitates robust, lightweight, and innovative shielding solutions. Industry participants that invest in cutting-edge materials, simulation-driven design, and strategic partnerships will lead the market, ensuring both regulatory compliance and optimal in-vehicle performance.

What is Automotive EMI Shielding?

Automotive EMI Shielding refers to the techniques and materials used to protect electronic components in vehicles from electromagnetic interference, ensuring reliable performance and compliance with regulatory standards.

What are the key players in the Automotive EMI Shielding market?

Key players in the Automotive EMI Shielding market include Laird Performance Materials, Parker Hannifin, and Henkel AG, among others.

What are the main drivers of growth in the Automotive EMI Shielding market?

The growth of the Automotive EMI Shielding market is driven by the increasing complexity of automotive electronics, the rise of electric vehicles, and the need for enhanced safety features in modern vehicles.

What challenges does the Automotive EMI Shielding market face?

Challenges in the Automotive EMI Shielding market include the high cost of advanced materials, the need for lightweight solutions, and the stringent regulatory requirements for electromagnetic compatibility.

What opportunities exist in the Automotive EMI Shielding market?

Opportunities in the Automotive EMI Shielding market include the development of innovative materials, the integration of shielding solutions in autonomous vehicles, and the expansion of electric vehicle production.

What trends are shaping the Automotive EMI Shielding market?

Trends in the Automotive EMI Shielding market include the increasing use of nanomaterials for better performance, the shift towards sustainable materials, and the growing demand for integrated shielding solutions in smart vehicles.

Automotive EMI Shielding Market:

| Segmentation | Details |

|---|---|

| Material | Conductive Coatings, Conductive Polymers, Metal Shielding, Others |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Sales Channel | OEMs, Aftermarket |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive EMI Shielding Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at