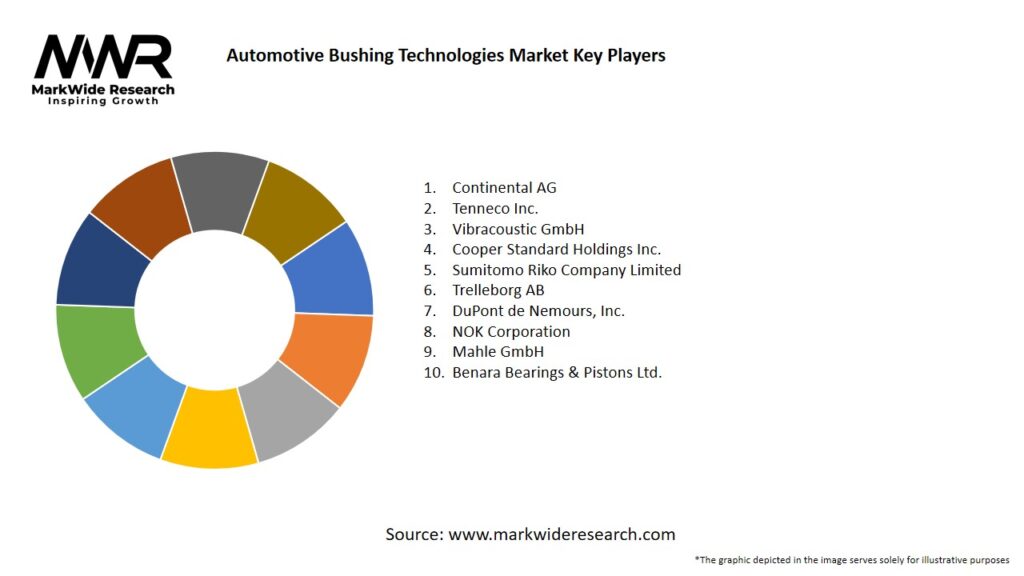

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Hydraulic and multi-compound bushings are gaining share as they deliver variable damping across low- and high-frequency vibrations, improving comfort without sacrificing handling.

-

Polyurethane bushings are preferred in performance and off-road applications for their durability and tunable stiffness, driving aftermarket demand.

-

Electric vehicles (EVs) emphasize NVH reduction, propelling adoption of advanced elastomeric compounds and sandwich-type bushing constructions.

-

Integrated modular suspension units with pre-assembled bushings simplify assembly and enhance quality control, favored by OEMs for production efficiency.

Market Drivers

Several factors are driving the growth of the Automotive Bushing Technologies market:

-

Ride Comfort Expectations: Increasing consumer demand for luxury-car comfort in mass-market segments spurs adoption of advanced bushings with improved NVH isolation.

-

Electrification and Autonomy: EVs and autonomous vehicles require ultra-quiet suspension systems, boosting demand for hydraulic and fluid-damped bushings.

-

Vehicle Production Growth: Rising global production of passenger cars and commercial vehicles expands OEM and aftermarket requirements for bushings.

-

Regulatory Safety Standards: Stricter vehicle safety and emissions regulations indirectly drive suspension optimization to improve handling stability and reduce energy loss.

-

Aftermarket Replacement Cycles: Aging vehicle fleets worldwide create steady demand for bushing replacements and performance upgrades, especially in regions with extended service intervals.

Market Restraints

Despite favorable trends, the market faces several challenges:

-

High Development Costs: R&D for novel elastomer compounds and hydraulic architectures demands significant investment, limiting smaller players.

-

Integration Complexity: Custom bushing geometries and bonded assemblies require precise tooling and quality control, increasing manufacturing complexity.

-

Material Degradation: Exposure to high temperatures, oils, and UV light can degrade elastomers over time, leading to variable service life and replacement unpredictability.

-

Supply-Chain Constraints: Dependence on specialty rubber and composite suppliers can lead to bottlenecks or price volatility in key raw materials.

Market Opportunities

The Automotive Bushing Technologies market presents several avenues for growth:

-

Advanced Elastomer Formulations: Development of thermoplastic elastomers and nanocomposites that offer superior durability, temperature resistance, and tunable stiffness.

-

Sensor-Embedded “Smart” Bushings: Integration of MEMS sensors to monitor deflection, load cycles, and temperature for predictive maintenance and performance tuning.

-

3D-Printed Tooling and Components: Additive manufacturing of complex bushing geometries or rapid-prototyped molds to accelerate product development.

-

Lightweight Composite Structures: Use of fiber-reinforced plastics and hybrid metal-composite housings to reduce unsprung mass and improve fuel efficiency.

-

Emerging Market Penetration: Targeting fast-growing markets in Asia Pacific and Latin America with cost-optimized aftermarket bushings tailored to local vehicle fleets.

Market Dynamics

The Automotive Bushing Technologies market is characterized by the following dynamics:

-

OEM–Supplier Collaboration: Close partnerships drive custom bushing integration into suspension modules, ensuring performance requirements are met at design stage.

-

Multi-Frequency Damping Trends: Demand for bushings that address both low-frequency ride comfort and high-frequency harshness encourages multi-chamber and layered designs.

-

Digital Twin and Simulation: Adoption of virtual prototyping accelerates material selection and performance validation, reducing time-to-market for new bushing technologies.

-

Aftermarket Fragmentation: The aftermarket features a wide array of grades—from entry-level replacement to high-performance kits—requiring robust distribution networks and technical support.

-

Sustainability Focus: Life-cycle assessments and recyclable elastomers are gaining importance as automakers pursue circular economy and carbon-neutrality goals.

Regional Analysis

Adoption and growth rates vary across geographies:

-

North America: High penetration of SUVs and pickup trucks with sophisticated suspension systems sustains demand for performance-oriented bushings; aftermarket is well developed.

-

Europe: Premium OEM preferences for comfort and NVH control drive adoption of hydraulic and multi-compound bushings; strict regulations encourage advanced materials.

-

Asia Pacific: Rapid vehicle parc expansion in China and India fuels volume demand for cost-effective OEM and aftermarket bushings; localizing production is key to competitiveness.

-

Latin America: Aging vehicle fleets and informal service sectors create steady replacement demand; price sensitivity favors basic rubber models with gradual penetration of premium grades.

-

Middle East & Africa: Harsh operating conditions—high heat and sand—boost demand for durable polyurethane and composite bushings in commercial and off-road vehicles.

Competitive Landscape

Leading Companies in the Automotive Bushing Technologies Market:

- Continental AG

- Tenneco Inc.

- Vibracoustic GmbH

- Cooper Standard Holdings Inc.

- Sumitomo Riko Company Limited

- Trelleborg AB

- DuPont de Nemours, Inc.

- NOK Corporation

- Mahle GmbH

- Benara Bearings & Pistons Ltd.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

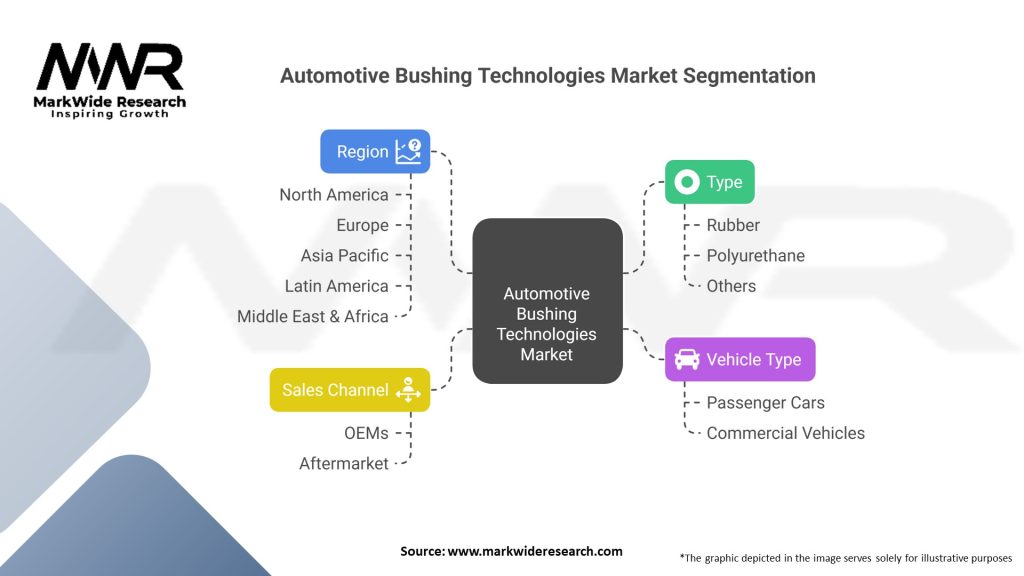

Segmentation

The market can be segmented as follows:

-

By Material: Natural Rubber, Synthetic Rubber (EPDM, NBR), Polyurethane, Hydraulic (Fluid-Filled)

-

By Vehicle Type: Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Off-Highway Equipment

-

By Application: Control Arms, Sway Bars, Engine Mounts, Transmission Mounts, Subframe Connections

-

By Sales Channel: OEM, Aftermarket Direct, Aftermarket Retail (Auto Parts Chains, E-Commerce)

Category-wise Insights

-

Natural and Synthetic Rubber Bushings: Cost-effective, widely used in entry-level and mid-range vehicles; EPDM rubber offers good weather resistance.

-

Polyurethane Bushings: High durability and performance, suited for sport-tuned suspensions and off-road applications; tunable stiffness for custom ride characteristics.

-

Hydraulic Bushings: Fluid-filled chambers deliver variable damping, ideal for luxury vehicles requiring comfort and handling balance.

-

Composite-Reinforced Bushings: Incorporate fiber-reinforced polymers and metal inserts to reduce weight and enhance load-bearing capacity in high-stress locations.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced NVH Performance: Advanced bushings significantly reduce cabin noise and vibration, improving perceived vehicle quality.

-

Improved Ride and Handling: Tunable stiffness profiles enable precise suspension tuning for targeted comfort or sport performance.

-

Extended Service Intervals: Durable materials reduce wear-out rates, lowering maintenance costs and increasing vehicle uptime.

-

Lightweighting Opportunities: Composite and polymer solutions help reduce unsprung mass, contributing to fuel efficiency and agility.

-

Aftermarket Revenue Streams: Broad vehicle parc and customization trends support aftermarket sales of performance and replacement bushings.

SWOT Analysis

Strengths

-

Essential role in ride comfort and suspension performance

-

Diverse material and design options for different segments

Weaknesses

-

Material degradation under harsh conditions can shorten lifespan

-

Complex integration in modular suspensions raises production costs

Opportunities

-

Smart sensor integration for predictive maintenance

-

Development of recyclable and bio-based elastomers

Threats

-

Volatility of raw material prices (rubber, polymers)

-

OEM vertical integration reducing third-party supply opportunities

Market Key Trends

-

Sensor-Embedded Bushings: Real-time monitoring of deflection and load for predictive maintenance alerts and performance tuning.

-

Virtual Prototyping: Use of FEA and digital twins to optimize bushing geometries and material combinations before physical trials.

-

Life-Cycle Sustainability: Adoption of recyclable elastomers and closed-loop material programs in line with circular economy targets.

-

Modular Suspension Units: Pre-assembled modules featuring integrated bushings streamline OEM assembly and quality control.

-

Customer-Tuned Products: Aftermarket growth of adjustable-durometer bushings allowing end-users to fine-tune ride characteristics.

Covid-19 Impact

The Covid-19 pandemic caused temporary disruptions in vehicle production and aftermarket services, leading to a short-term decline in bushing demand. However, the increasing focus on vehicle reliability and reduced service center visits accelerated interest in longer-life materials and predictive maintenance solutions. As global automotive manufacturing normalized, robust aftermarket replacement cycles and pent-up demand for comfort upgrades drove recovery in the bushing segment.

Key Industry Developments

-

Strategic Alliances: SKF and leading OEMs co-developed hydraulic bushing modules for next-generation EV platforms.

-

Material Breakthroughs: Freudenberg introduced a bio-based polyurethane compound with 30% lower carbon footprint and enhanced wear resistance.

-

Additive Manufacturing Pilots: Dana showcased 3D-printed bushing housings enabling rapid design iterations and weight savings.

-

Aftermarket Partnerships: Tenneco launched a direct-to-consumer program featuring performance bushings bundled with installation guides and tele-support.

Analyst Suggestions

-

Invest in Smart Technologies: Prioritize R&D for sensor-embedded bushings and connected-vehicle integration to offer predictive maintenance value propositions.

-

Diversify Material Sources: Secure multiple suppliers for key elastomers and composite inputs to mitigate price and supply risks.

-

Enhance Sustainability: Develop recyclable and bio-based material lines to meet tightening environmental regulations and OEM sustainability mandates.

-

Strengthen Aftermarket Channels: Build robust distribution and digital-commerce platforms to capture growing performance and replacement bushing demand.

Future Outlook

The Automotive Bushing Technologies market is projected to grow steadily as automakers and consumers alike prioritize ride comfort, NVH reduction, and suspension durability. Advances in material science, digital simulation, and sensor integration will drive the next wave of innovation, enabling bushings to evolve from passive vibration isolators into smart, adaptive components. The convergence of lightweight composites, predictive maintenance, and sustainability initiatives will define competitive positioning, ensuring that bushing technologies remain integral to future vehicle architectures, particularly in electric and autonomous mobility ecosystems.

Conclusion

In summary, the Automotive Bushing Technologies market occupies a critical niche in modern vehicle dynamics, balancing comfort, handling, and durability through engineered elastomeric solutions. While challenges around material longevity, production complexity, and supply volatility persist, emerging opportunities in smart sensing, additive manufacturing, and sustainable materials promise to elevate bushings from passive components to proactive contributors in the connected, electrified vehicles of tomorrow. Stakeholders who embrace these innovations and foster deep OEM collaborations will be best placed to capture value and drive market leadership in this essential automotive segment.