Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

The global active purge pump market is projected to grow at a CAGR of approximately 5–7% through 2030, propelled by regulatory tightening and powertrain electrification.

-

Adoption in hybrid and plug-in hybrid electric vehicles (HEVs/PHEVs) is rising, as frequent engine off/on cycles increase evaporative emission loads.

-

Asia-Pacific leads volume demand due to expansive vehicle manufacturing, especially in China and India, where emission norms are converging with Euro 6 standards.

-

Regional OEM partnerships and qualification cycles mean long lead times, but also high barriers to entry—favoring established pump manufacturers.

-

Digital diagnostics integration (OBD-II readiness) is becoming standard, enabling real-time monitoring of purge performance and emission leak detection.

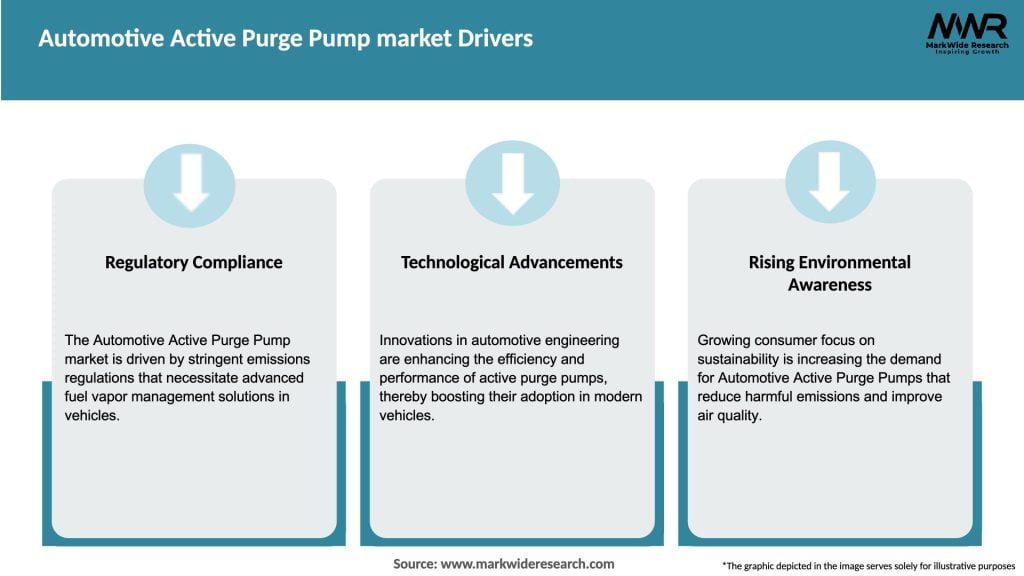

Market Drivers

-

Stringent Emissions Regulations: Euro 6d and impending Euro 7, along with EPA Tier 3 and China VI standards, mandate lower evaporative emissions, driving active purge adoption.

-

Engine Downsizing & Turbocharging: Smaller, high-pressure gasoline engines produce more vapor, necessitating active control to meet emission limits.

-

Hybridization & Stop-Start Systems: Frequent engine shutdowns elevate diurnal emissions; active purge pumps manage vapor release effectively across shutdown/startup cycles.

-

Aftermarket Compliance: Inspection and maintenance programs (e.g., OBD checks) require functional purge systems, fueling replacement part demand.

-

Improved Fuel Efficiency: Controlled purge scheduling optimizes air-fuel ratios, enhancing combustion efficiency and reducing fuel consumption.

Market Restraints

-

System Cost: Active purge pumps add component and calibration costs compared to passive valves, impacting vehicle BOM budgets.

-

Integration Complexity: ECU software updates and EVAP system tuning are required to accommodate active purge functionality.

-

Electrical Load Constraints: In mild-hybrid architectures, limited auxiliary power availability can restrict pump duty cycles.

-

Reliability Concerns: Exposure to fuel vapors and temperature extremes demands robust materials, driving up R&D and validation times.

-

OEM Qualification Hurdles: Long lead times and rigorous testing protocols slow new supplier entry into production.

Market Opportunities

-

Miniaturization & Integration: Combining purge pump and valve functions into a single module reduces packaging complexity and cost.

-

Next-Gen Materials: Advanced polymers and coatings enhance chemical resistance and lifespan.

-

Commercial Vehicle Electrification: As buses and light trucks adopt hybrid systems, demand for active purge pumps in medium-duty applications will rise.

-

Retrofit Solutions: In regions upgrading emission standards, retrofit kits offer aftermarket suppliers a fast-to-market opportunity.

-

Smart Diagnostics: Enhanced self-test and leak-detection capabilities improve maintenance intervals and consumer assurance.

Market Dynamics

-

Regulation-Driven Adoption: Emissions standards act as the primary catalyst for technology adoption, with each new regulation wave encouraging active over passive systems.

-

Powertrain Transformation: A shift toward electrified gasoline vehicles sustains demand even as full EV penetration grows.

-

Vertical Consolidation: Tier-1 system integrators are acquiring specialist pump manufacturers to deliver turnkey EVAP modules.

-

Customer Focus: OEMs prioritize products that minimize back-pressure and noise during purge, driving performance enhancements.

-

Supply-Chain Localization: Regional manufacturing in Asia and Eastern Europe reduces lead times and tariff exposure for key markets.

Regional Analysis

-

Asia-Pacific: Largest volume due to China and India’s expanding gasoline vehicle output and Euro 6/V standards enforcement. Local content rules favor domestic suppliers.

-

Europe: Early adopter of Euro 6d norms; strong R&D ecosystem supports advanced EVAP systems. High EV uptake partially offsets pure gasoline pump demand over time.

-

North America: EPA Tier 3 and California LEV III drive active purge proliferation in light vehicles; growing interest in hybrid pickup and SUV applications.

-

Latin America: Gradual adoption as markets like Brazil move to PROCONVE L7 (equivalent to Euro 6); aftermarket retrofit opportunity for older fleets.

-

Middle East & Africa: Premium OEMs introduce active purge in GCC assembly; limited aftermarket infrastructure constrains replacement volumes.

Competitive Landscape

Leading Companies in the Automotive Active Purge Pump Market:

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Magna International Inc.

- Delphi Technologies

- Valeo SA

- Hitachi Automotive Systems, Ltd.

- Aisan Industry Co., Ltd.

- Marelli Holdings Co., Ltd.

- Mahle GmbH

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

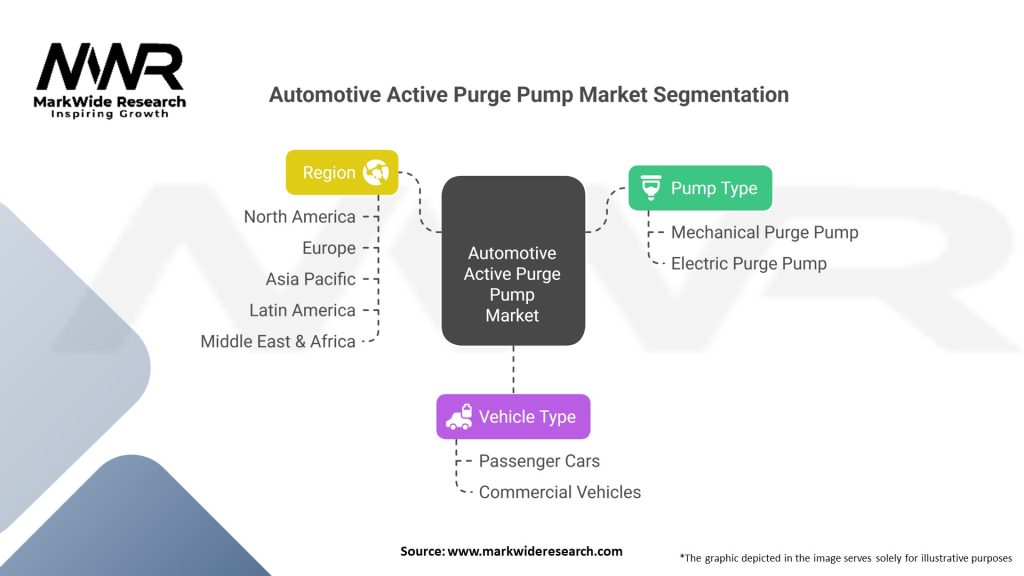

Segmentation

-

By Pump Type: Diaphragm, Vane, Piston, Brushless-DC

-

By Vehicle Type: Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Hybrid/Electric Vehicles

-

By Sales Channel: OEM Direct Supply, Aftermarket Distribution, Retrofit Kits

-

By Functionality: Basic Purge Control, Integrated Leak Detection, Diagnostics-Enabled Systems

Category-wise Insights

-

Diaphragm Pumps: Widely used for their simplicity and reliability; favored in economy and mid-segment vehicles.

-

Vane Pumps: Provide smoother flow at low RPMs; preferred in premium gasoline engines for noise and vibration reduction.

-

Brushless-DC Pumps: Offer precise flow control and long life; integral to hybrid and stop-start systems.

-

Integrated Modules: Combine purge pump, valve, and sensors into one compact unit, simplifying assembly and reducing leaks.

Key Benefits for Industry Participants and Stakeholders

-

Regulatory Compliance: Ensures adherence to evaporative emission standards, avoiding fines and recalls.

-

Enhanced Driveability: Active purge management maintains stable idle and throttle response during vapor purge events.

-

Improved Fuel Economy: Precise vapor injection reduces enrichment cycles and optimizes combustion.

-

Simplified Service: Diagnostics-enabled pumps aid in quick fault isolation and repair.

-

Aftermarket Growth: Reliable retrofit solutions offer additional revenue streams for parts distributors and service centers.

SWOT Analysis

Strengths:

-

Critical for meeting current and future emission norms.

-

High technical entry barriers ensure limited supplier base.

-

Benefits both OEM and aftermarket segments.

Weaknesses:

-

Added cost and system complexity.

-

Dependence on ECU integration and software calibration.

-

Sensitivity to fuel composition and vapor pressure variations.

Opportunities:

-

Expanding hybrid/commercial vehicle markets.

-

Development of universal retrofit kits.

-

Advanced diagnostics and connectivity features.

Threats:

-

Shift to full battery-electric vehicles reducing EVAP needs.

-

Emergence of alternative emission-control technologies (e.g., adsorbents).

-

Global supply-chain volatility impacting electronic components.

Market Key Trends

-

Pump-Valve Integration: Modular assemblies that reduce plumbing complexity and potential leak points.

-

Low-Power Designs: Motors and electronics optimized for minimal current draw in hybrid architectures.

-

Advanced Diagnostics: Onboard self-tests and leak detection complementing OBD regulations.

-

Sustainable Materials: Use of recycled plastics and low-VOC seals in pump housings.

-

Predictive Maintenance: Telematics-enabled health reporting guiding service intervals before failures occur.

Covid-19 Impact

Production shutdowns in 2020 temporarily disrupted supply and delayed new model launches, creating aftermarket backlog demand as vehicles returned to service. OEMs leveraged the downtime to accelerate EVAP system redesigns for next-generation powertrains, and digital supply-chain management improvements during the pandemic have since enhanced production resilience for active purge pumps.

Key Industry Developments

-

Pierburg introduced a CAN-enabled purge pump module in 2023, offering in-line leak detection and flow-rate diagnostics.

-

Mahle unveiled a brushless/DC hybrid purge pump for mild-hybrid SUVs, reducing idle-mode current draw by 30%.

-

Denso partnered with a leading ECU supplier to co-develop calibration software that simplifies active purge tuning across multiple engine maps.

-

Bosch launched a universal retrofit kit for emerging markets, enabling passive-to-active EVAP upgrades without ECU reprogramming.

Analyst Suggestions

-

Invest in Software Integration: Develop calibration tools and ECU interfaces that streamline OEM qualification and aftermarket programming.

-

Pursue Hybrid/Commercial Segments: Target growing fleets of mild- and full-hybrids, plus medium-duty vehicles undergoing electrification.

-

Enhance Diagnostics: Embed leak detection and flow monitoring to meet tightening OBD-II and global self-diagnosis mandates.

-

Expand Retrofit Offerings: Create plug-and-play kits for regions adopting stricter evaporative emission standards on legacy vehicles.

-

Monitor EV Penetration: Balance R&D investments as battery-electric vehicle volumes rise, potentially phasing out EVAP components over time.

Future Outlook

The Automotive Active Purge Pump market will remain vital through the next decade, balancing growth in hybrid and gasoline applications against gradual EV uptake. Continuous innovation—particularly in low-power brushless designs, integrated diagnostics, and turnkey retrofit solutions—will define market leaders. Suppliers who cultivate strong OEM relationships, invest in calibration software, and expand aftermarket portfolios will capture both near-term regulatory-driven demand and longer-term opportunities in commercial electrification.

Conclusion

In conclusion, the Automotive Active Purge Pump market represents a critical nexus between emissions compliance and powertrain evolution. As regulations tighten and vehicle architectures diversify, active purge technology will continue to deliver precise vapor management, optimized fuel efficiency, and robust diagnostics. Stakeholders who advance modular integration, diagnostic intelligence, and retrofit capabilities will secure competitive advantage in a landscape transitioning from traditional gasoline platforms toward electrified mobility.