Market Overview

The Australia pet food market has witnessed significant growth in recent years. Pet owners in the country are increasingly becoming conscious about the health and well-being of their pets, leading to a surge in demand for high-quality and nutritious pet food. The market is characterized by a wide range of pet food products, including dry food, wet food, treats, and snacks, catering to the diverse dietary requirements of pets. With a growing population of pets and rising disposable incomes, the Australian pet food market presents lucrative opportunities for manufacturers and retailers.

Meaning

The Australia pet food market refers to the industry involved in the production, distribution, and sale of food products specifically formulated for pets, including dogs, cats, birds, and small mammals. Pet food is designed to provide essential nutrients, vitamins, and minerals to support the overall health and development of pets. The market encompasses various product categories, packaging formats, and distribution channels to meet the specific dietary needs and preferences of pet owners.

Executive Summary

The Australia pet food market is experiencing robust growth, driven by factors such as increasing pet ownership, changing consumer preferences, and a greater focus on pet health and wellness. The market offers a wide range of pet food products, including premium and specialized options, catering to different age groups and breeds of pets. While dry food remains the dominant segment, wet food and treats/snacks are also gaining traction. Key players in the market are focusing on product innovation, strategic partnerships, and marketing initiatives to gain a competitive edge.

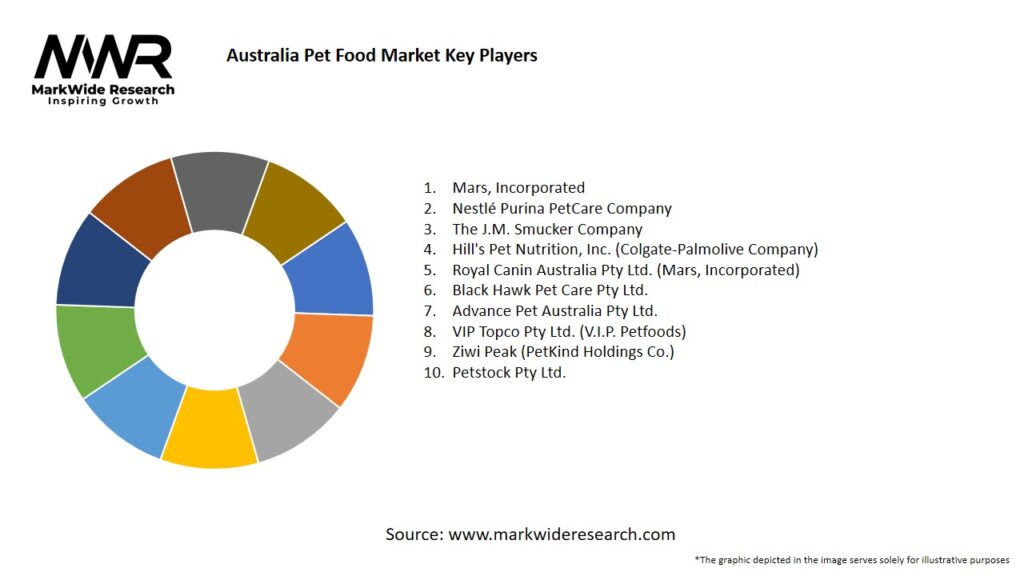

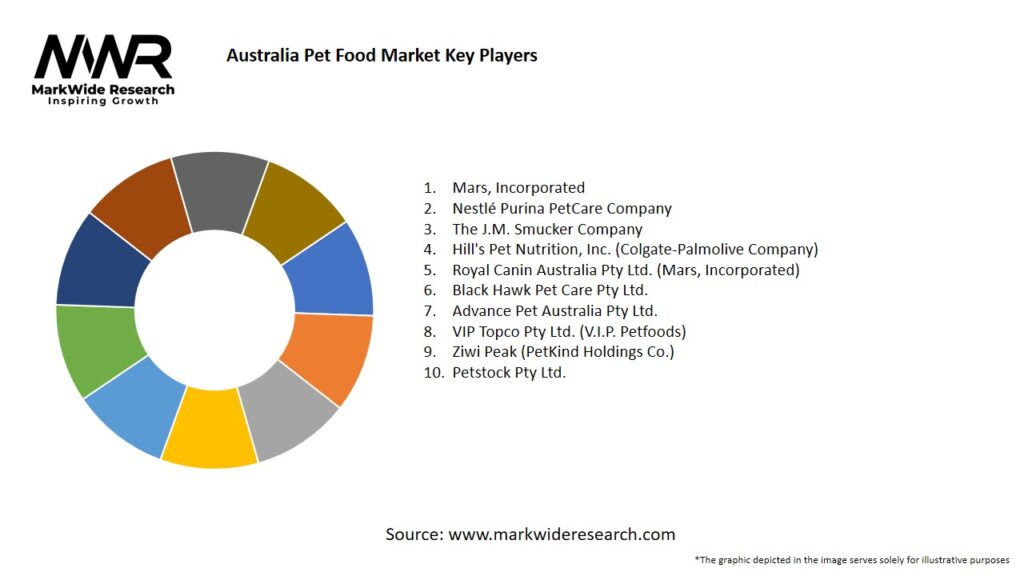

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

- Growing Pet Ownership: The number of pet owners in Australia is on the rise, leading to increased demand for pet food products. Pets are considered part of the family, and owners are willing to spend more on high-quality food options for their beloved companions.

- Premiumization and Personalization: Pet owners are increasingly seeking premium and specialized pet food products that address specific dietary requirements and cater to the unique needs of their pets. This trend has opened up new avenues for product innovation and customization in the market.

- Health and Wellness Focus: Pet owners are becoming more health-conscious and are looking for pet food products that promote overall well-being, including ingredients that support digestion, joint health, and a shiny coat. Nutritional value and natural ingredients are key factors driving purchasing decisions.

- E-commerce Boom: The rapid growth of e-commerce platforms has revolutionized the pet food market in Australia. Online retailers offer convenience, a wide range of options, and doorstep delivery, attracting a large consumer base and boosting market growth.

Market Drivers

Several factors are driving the growth of the Australia pet food market:

- Increasing Pet Population: The rising number of pets, including dogs, cats, and birds, is a primary driver of the market. As more households adopt pets and embrace pet ownership, the demand for pet food continues to surge.

- Humanization of Pets: Pets are now considered part of the family, and owners are willing to invest in their well-being. This shift has led to an increased focus on premium and specialized pet food products that offer health benefits and cater to specific dietary needs.

- Growing Disposable Incomes: With a strong economy and rising disposable incomes, Australians have more purchasing power to spend on pet-related products. This financial capacity enables pet owners to afford higher-priced pet food options.

- Urbanization and Changing Lifestyles: Urbanization has resulted in smaller living spaces and busier lifestyles, leading to a preference for pets that are easier to manage, such as cats and small dogs. This shift has influenced the demand for pet food suitable for these pets’ specific needs.

Market Restraints

Despite the positive growth trajectory, the Australia pet food market faces certain challenges:

- Stringent Regulations: The pet food industry is subject to strict regulations to ensure product safety and quality. Compliance with these regulations can increase production costs for manufacturers, which may be passed on to consumers.

- Concerns Over Ingredient Sourcing: Pet owners are becoming increasingly cautious about the sourcing and quality of ingredients used in pet food products. Any negative publicity or concerns about ingredient safety can significantly impact consumer trust and brand reputation.

- Intense Competition: The pet food market in Australia is highly competitive, with a large number of players vying for market share. This intense competition puts pressure on manufacturers to continually innovate, invest in marketing, and differentiate their products to stay ahead.

- Price Sensitivity: While premium and specialized pet food options are gaining popularity, price sensitivity remains a factor for some consumers. Affordability plays a crucial role in the purchasing decisions of pet owners, especially in a price-conscious market.

Market Opportunities

The Australia pet food market presents several opportunities for growth and expansion:

- Product Innovation: There is immense scope for product innovation in the pet food market. Manufacturers can focus on developing novel flavors, formulations, and packaging to cater to evolving consumer preferences. Options such as organic, grain-free, and natural pet food have gained traction and offer potential for further exploration.

- E-commerce Expansion: The online retail channel has witnessed significant growth in recent years, and the pet food market can leverage this trend. Manufacturers and retailers can invest in robust e-commerce platforms, provide a seamless shopping experience, and target a wider consumer base beyond traditional brick-and-mortar stores.

- Functional and Therapeutic Foods: The market for functional and therapeutic pet food is still relatively untapped in Australia. Manufacturers can explore this segment by offering products that address specific health concerns, such as weight management, dental health, and joint support, to meet the growing demand for pet wellness solutions.

- Export Potential: Australia has a strong reputation for producing high-quality food products, and the pet food market is no exception. Manufacturers can tap into export opportunities and cater to the growing demand for Australian-made pet food in international markets.

Market Dynamics

The Australia pet food market is driven by various dynamics that shape its growth and competitiveness:

- Changing Consumer Preferences: Pet owners’ preferences are evolving, influenced by factors such as health consciousness, convenience, and the desire to provide the best care for their pets. Manufacturers need to stay attuned to these changing preferences and tailor their products accordingly.

- Retail and Distribution Channels: The pet food market is characterized by a diverse range of retail and distribution channels, including pet specialty stores, supermarkets, veterinary clinics, and online platforms. Manufacturers must adopt a multi-channel approach to ensure maximum product visibility and accessibility.

- Marketing and Branding: Effective marketing and branding strategies play a crucial role in standing out in the highly competitive pet food market. Building strong brand equity, leveraging social media platforms, and educating consumers about the nutritional benefits of products are key to success.

- Product Pricing and Promotions: Price positioning and promotional activities are critical to capturing market share. Manufacturers must strike a balance between affordability and perceived value, offering attractive promotions and discounts without compromising on product quality.

Regional Analysis

The Australia pet food market exhibits regional variations in terms of consumer preferences and market dynamics:

- Urban Areas: Urban regions, such as Sydney, Melbourne, and Brisbane, have a higher concentration of pet owners and greater access to pet specialty stores. These areas offer a diverse range of pet food options, including premium and specialized products, to cater to the affluent and health-conscious consumer base.

- Suburban and Rural Areas: Suburban and rural areas also contribute to the pet food market, with a focus on more affordable options. Supermarkets and online platforms are key distribution channels in these regions, providing convenience and competitive pricing to a wider consumer base.

- Tourist Destinations: Australia’s popular tourist destinations, such as the Gold Coast and Cairns, experience a seasonal influx of tourists with pets. Pet food options in these areas need to cater to both local residents and tourists, with an emphasis on convenience and ease of travel.

- Regional Preferences: Regional preferences may vary based on factors such as climate, cultural background, and pet ownership rates. For example, in warmer regions, there may be a higher demand for pet food options that cater to hydration and cooling, while in colder regions, energy-dense and warming food may be preferred.

Competitive Landscape

Leading companies in the Australia Pet Food Market:

- Mars, Incorporated

- Nestlé Purina PetCare Company

- The J.M. Smucker Company

- Hill’s Pet Nutrition, Inc. (Colgate-Palmolive Company)

- Royal Canin Australia Pty Ltd. (Mars, Incorporated)

- Black Hawk Pet Care Pty Ltd.

- Advance Pet Australia Pty Ltd.

- VIP Topco Pty Ltd. (V.I.P. Petfoods)

- Ziwi Peak (PetKind Holdings Co.)

- Petstock Pty Ltd.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

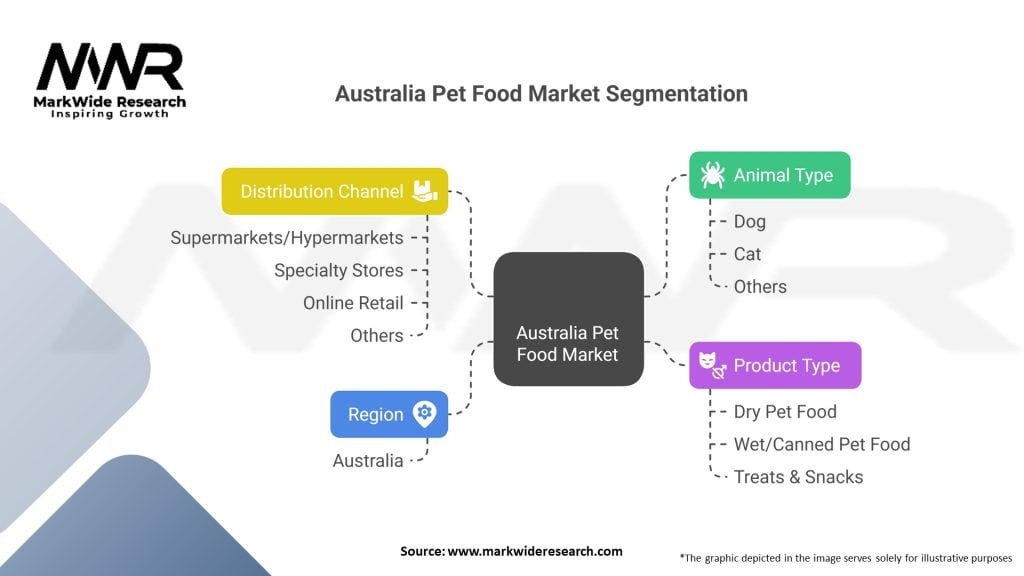

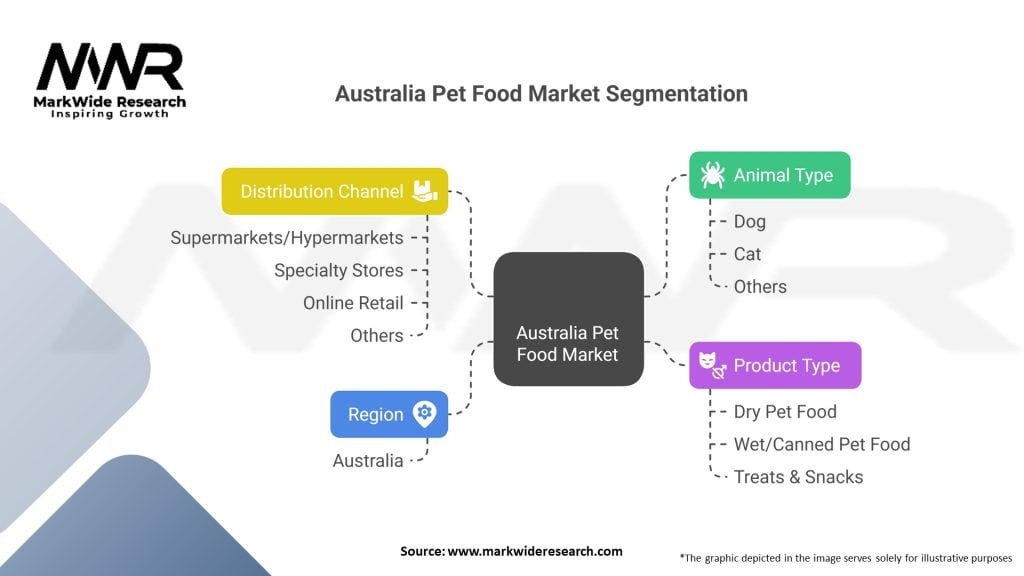

Segmentation

The Australia pet food market can be segmented based on various factors, including:

- Product Type: The market comprises different types of pet food, such as dry food, wet food, treats, and snacks. Each segment offers unique characteristics and caters to specific pet dietary preferences.

- Pet Type: Pet food is formulated for various types of pets, including dogs, cats, birds, and small mammals. Different pets have distinct nutritional needs, and manufacturers develop specific products for each category.

- Age Group: Pet food products are often categorized by age groups, such as puppy/kitten food, adult food, and senior food. Each age group has specific nutrient requirements to support growth, maintenance, and overall health.

- Distribution Channel: The market can be segmented based on distribution channels, including pet specialty stores, supermarkets, online retailers, and veterinary clinics. The choice of distribution channel can influence product availability, pricing, and consumer reach.

Category-wise Insights

- Dry Food: Dry food remains the largest category in the Australia pet food market. It offers convenience, longer shelf life, and cost-effectiveness. Dry food options range from basic formulations to premium and specialized variants, catering to a wide range of pet owners.

- Wet Food: Wet food is gaining popularity, especially among pet owners who prioritize hydration and prefer high-moisture diets for their pets. Wet food options include canned food, pouches, and trays, offering different flavors and textures.

- Treats and Snacks: Treats and snacks are an essential category within the pet food market. These products are used for training, rewarding, or simply as indulgences for pets. Healthy and natural ingredient options are in high demand in this category.

- Specialty and Prescription Diets: Specialty and prescription diets cater to pets with specific health conditions or dietary restrictions. These diets are often recommended by veterinarians and require a higher level of customization and quality control.

Key Benefits for Industry Participants and Stakeholders

The Australia pet food market offers several benefits for industry participants and stakeholders:

- Revenue Growth: The market’s consistent growth and increasing pet ownership provide ample opportunities for revenue generation. Manufacturers, retailers, and distributors can tap into this market to expand their businesses and enhance profitability.

- Product Differentiation: The diverse range of pet food categories allows industry participants to differentiate their products based on quality, ingredients, formulations, and packaging. Unique offerings can help companies stand out in the competitive landscape and attract loyal customers.

- Brand Loyalty and Repeat Purchases: Building strong brand equity and delivering high-quality products can foster brand loyalty among pet owners. Satisfied customers are more likely to make repeat purchases, contributing to long-term business sustainability.

- Collaboration and Partnerships: Industry participants can explore collaborations and partnerships to leverage each other’s strengths and expand their market presence. Collaborative efforts can include co-branding, cross-promotions, and joint research and development initiatives.

SWOT Analysis

Strengths:

- Strong pet ownership culture and increasing pet population

- Growing disposable incomes and willingness to spend on pet-related products

- Reputation for high-quality and safe food production

- Diverse range of pet food options catering to various dietary preferences and health concerns

Weaknesses:

- Stringent regulations and compliance requirements

- Price sensitivity among some consumer segments

- Challenges in ingredient sourcing and quality control

- Intense competition from established brands and private label products

Opportunities:

- Product innovation and customization to cater to evolving consumer preferences

- Expansion of e-commerce platforms and online retail channels

- Focus on functional and therapeutic pet food offerings

- Export opportunities to meet international demand for Australian-made pet food

Threats:

- Negative publicity and concerns regarding ingredient safety

- Price wars and aggressive promotional activities impacting profit margins

- Potential disruptions in the supply chain and logistics

- Changing consumer trends and preferences impacting market demand

Market Key Trends

- Premiumization and Personalization: Pet owners are increasingly willing to invest in premium and specialized pet food options that offer health benefits and meet specific dietary needs. Customization and personalization options, such as breed-specific or age-specific formulations, are gaining traction.

- Natural and Organic Ingredients: The demand for natural and organic pet food is on the rise. Pet owners are seeking products with high-quality ingredients, free from artificial additives, preservatives, and fillers. Brands that emphasize natural and organic offerings are gaining consumer trust.

- Sustainability and Ethical Practices: Consumers are increasingly concerned about the environmental impact of pet food production. Brands that prioritize sustainability, ethical sourcing, and packaging initiatives are resonating with environmentally conscious pet owners.

- Alternative Protein Sources: As pet owners explore alternative diets for themselves, they are also looking for pet food options that incorporate alternative protein sources. Plant-based and insect-based pet food products are gaining traction as sustainable alternatives to traditional animal-based proteins.

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative effects on the Australia pet food market:

Positive Impact:

- Increased Pet Adoption: The pandemic led to a surge in pet adoptions as people sought companionship during lockdowns and social distancing measures. This resulted in a larger pet owner base and increased demand for pet food.

- Homebound Consumers: With people spending more time at home, pet owners had the opportunity to observe their pets’ dietary needs and invest in high-quality pet food options. This trend led to an increased focus on pet health and well-being.

Negative Impact:

- Disruptions in the Supply Chain: The pandemic caused disruptions in the global supply chain, affecting the availability of certain pet food ingredients. Manufacturers faced challenges in sourcing raw materials, leading to potential product shortages.

- Economic Uncertainty: The economic downturn caused by the pandemic resulted in financial constraints for some pet owners. This led to a shift towards more price-sensitive purchasing decisions and a potential decline in demand for premium pet food products.

Key Industry Developments

- Introduction of Novel Ingredients: Manufacturers are incorporating novel ingredients in pet food formulations, such as superfoods, probiotics, and functional additives. These ingredients offer specific health benefits and cater to the growing demand for natural and holistic pet nutrition.

- Rise of Direct-to-Consumer Brands: Direct-to-consumer pet food brands have gained momentum, leveraging e-commerce platforms to reach consumers directly. These brands offer convenience, customization, and transparency in product sourcing and quality.

- Mergers and Acquisitions: Several mergers and acquisitions have taken place in the Australia pet food market, enabling companies to expand their product portfolios, enter new market segments, and enhance their distribution networks.

- Sustainability Initiatives: Companies are increasingly adopting sustainable practices, such as using recyclable packaging materials, reducing carbon footprints, and supporting animal welfare initiatives. These initiatives resonate with environmentally conscious pet owners.

Analyst Suggestions

- Focus on Product Differentiation: To stand out in the competitive market, manufacturers should invest in product differentiation through innovative formulations, unique ingredients, and customized offerings. Understanding and catering to specific pet health concerns can be a key strategy.

- Enhance Online Presence: Given the significant growth of e-commerce, companies should strengthen their online presence and optimize their websites and e-commerce platforms. This includes providing detailed product information, engaging with customers through social media, and offering seamless online purchasing experiences.

- Collaborate with Veterinarians and Pet Professionals: Building strong relationships with veterinarians and pet professionals can help enhance brand credibility and recommendation. Collaborative efforts can include joint educational programs, product endorsements, and personalized recommendations for pet owners.

- Prioritize Sustainability and Ethical Practices: Consumers are increasingly concerned about the environmental impact of pet food production. Manufacturers should focus on sustainability initiatives, ethical sourcing, and transparent communication to align with consumer values and enhance brand reputation.

Future Outlook

The future outlook for the Australia pet food market is promising, driven by ongoing pet ownership trends, changing consumer preferences, and a focus on pet health and wellness. Key factors shaping the future of the market include:

- Continued Growth in Pet Ownership: The number of pet owners in Australia is expected to continue growing, driven by factors such as companionship, emotional well-being, and the rise of nuclear families. This will fuel the demand for pet food products.

- Increased Emphasis on Health and Wellness: Pet owners will continue to prioritize the health and well-being of their pets, leading to a higher demand for premium, natural, and functional pet food options. Brands that can address specific health concerns and offer tailored nutrition will have a competitive edge.

- Technological Advancements: Technology will play a significant role in the future of the pet food market. This includes advancements in manufacturing processes, packaging innovations, and personalized nutrition through data-driven approaches.

- Focus on Sustainability and Ethical Practices: Sustainability will remain a key concern for consumers, and pet food manufacturers will need to adopt eco-friendly practices, promote responsible sourcing, and reduce their environmental impact.

Conclusion

The Australia pet food market is witnessing substantial growth, driven by factors such as increasing pet ownership, changing consumer preferences, and a focus on pet health and wellness. The market offers a wide range of pet food products, including dry food, wet food, treats, and snacks, catering to the diverse dietary needs of pets. With the ongoing emphasis on premiumization, personalization, and natural ingredients, manufacturers have the opportunity to innovate, collaborate, and differentiate their offerings. The market’s future outlook is positive, with continued growth expected in pet ownership and a rising demand for high-quality and customized pet food options.