444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The 3D printing technology has revolutionized various industries, and the aerospace and defense sector is no exception. 3D printing in aerospace and defense refers to the application of additive manufacturing techniques in the production of aircraft and defense equipment. This technology enables the creation of complex and lightweight parts with improved precision and reduced lead time. The aerospace and defense market has recognized the potential of 3D printing to streamline manufacturing processes, enhance customization capabilities, and reduce costs. As a result, the adoption of 3D printing in this industry has been on the rise.

Meaning

3D printing, also known as additive manufacturing, is a process of creating three-dimensional objects by adding successive layers of material based on a digital model. It involves the use of various materials, such as plastics, metals, and composites, which are deposited layer by layer to form a final product. In the aerospace and defense sector, 3D printing offers numerous advantages, including the ability to produce complex geometries, reduce weight, optimize part performance, and achieve cost savings.

Executive Summary

The aerospace and defense industry has witnessed significant advancements with the integration of 3D printing technology. This technology has transformed traditional manufacturing approaches by enabling the production of intricate parts that were previously challenging to manufacture. With 3D printing, aerospace and defense companies can enhance their manufacturing processes, reduce material waste, and achieve greater design flexibility. This executive summary provides an overview of the key insights, market drivers, restraints, opportunities, and trends in the 3D printing in aerospace and defense market.

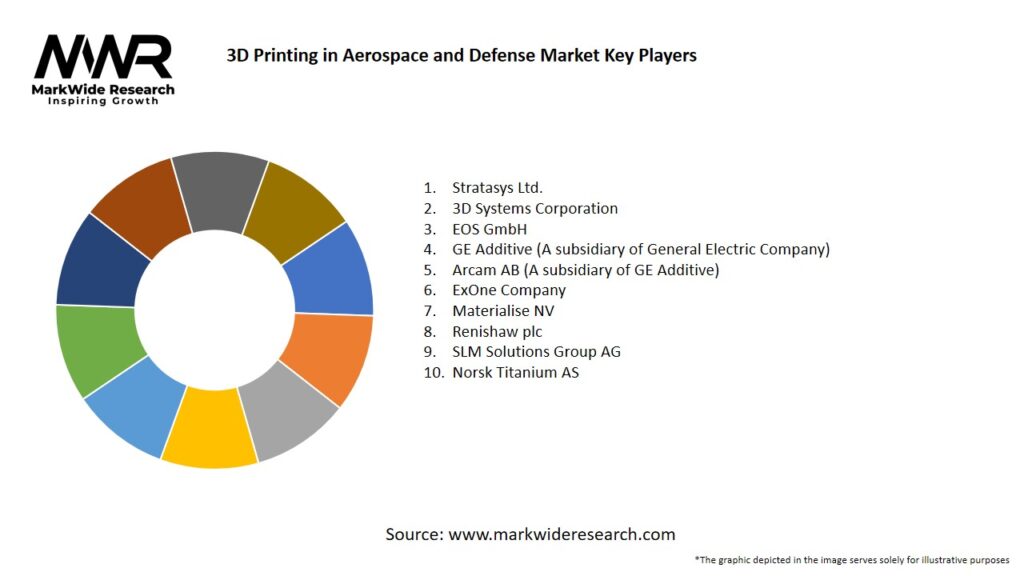

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Regulatory Approvals: FAA’s first certified 3D‑printed titanium bracket on a commercial jet in 2016 paved the way; EU’s EASA and defense agencies are issuing guidelines for AM qualification.

Material Advancements: Development of high-performance alloys (Maraging steel, Ti-6Al-4V) and polymer composites enhances part performance in extreme aerospace and defense environments.

Economies of Scale: As AM machine installations increase and production volumes rise, per-part costs are declining.

Supply Chain Resilience: On-site AM depots reduce dependency on long supply chains, critical for defense readiness and remote aerospace operations.

Digital Integration: Coupling AM with digital twins, AI-driven process monitoring, and blockchain for part traceability is becoming standard practice.

Market Drivers

Weight Reduction Imperative: Every 1% reduction in aircraft weight can yield up to 0.75% fuel savings; AM’s topology optimization drives this benefit.

Complex Geometry Fabrication: AM enables conformal cooling channels, lattices, and integrated sensors in turbine blades and rocket engine components.

Rapid Prototyping & Iteration: Defense R&D cycles shorten dramatically when physical prototypes can be printed in hours rather than machined over weeks.

On-Demand Spare Parts: Field-deployed AM units allow military bases and aircraft carriers to print critical spares, reducing downtime and logistics footprint.

Lifecycle Cost Savings: Part consolidation and reduced tooling investment lower total cost of ownership despite higher per-unit material costs.

Market Restraints

High Capital Expenditure: Industrial AM machines range from USD 500,000 to over USD 5 million, limiting SMEs’ adoption.

Material Certification Complexity: Rigorous testing is required to certify AM materials and processes for flight-critical and defense applications.

Skill Gaps: There is a shortage of engineers and operators trained in AM design-for-manufacturing, machine operation, and post-processing techniques.

Post-Processing Requirements: Printed parts often require heat treatment, machining, or surface finishing, adding time and cost.

Intellectual Property Concerns: Secure handling of digital part files is critical to prevent unauthorized reproduction of sensitive aerospace and defense components.

Market Opportunities

Ceramic Matrix Composites (CMCs): Research into 3D printing of CMCs for high-temperature turbine and hypersonic applications.

Distributed Manufacturing Networks: Defense agencies are piloting AM networks across bases to share digital inventories and manufacturing capacity.

Hybrid Manufacturing: Integration of AM with CNC and subtractive processes for enhanced part integrity and dimensional accuracy.

Multi‑Material Printing: Development of printers capable of depositing metal and polymer materials in a single build for integrated multi-functional parts.

AM Service Bureaus: Expansion of specialized service providers offering end-to-end AM solutions—design, printing, post-processing, and certification.

Market Dynamics

Supply Side: Increased machine throughput, better powder recycling, and multi-laser PBF systems are boosting output and reducing unit costs.

Demand Side: OEMs and Tier‑1 suppliers are issuing bid requests specifying AM for next‑gen aircraft and military platforms.

Economic Factors: Fluctuating aerospace defense budgets and post‑pandemic production slowdowns can impact AM investments.

Regulatory Shifts: Streamlining of AM qualification pathways by aviation and defense authorities will accelerate market growth.

Regional Analysis

North America: Largest market share due to leading OEMs, defense spending, and early regulatory approvals.

Europe: Strong growth driven by Airbus, Rolls‑Royce, and MBDA; EU funding programs support AM research.

Asia‑Pacific: Rapid adoption in China, Japan, and India—expanding commercial aviation and indigenous defense programs fuel demand.

Latin America & Middle East: Emerging interest; local service bureaus and partnerships with global OEMs are gaining traction, particularly in Brazil, Mexico, UAE, and Saudi Arabia.

Competitive Landscape

Leading Companies in the 3D Printing in Aerospace and Defense Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

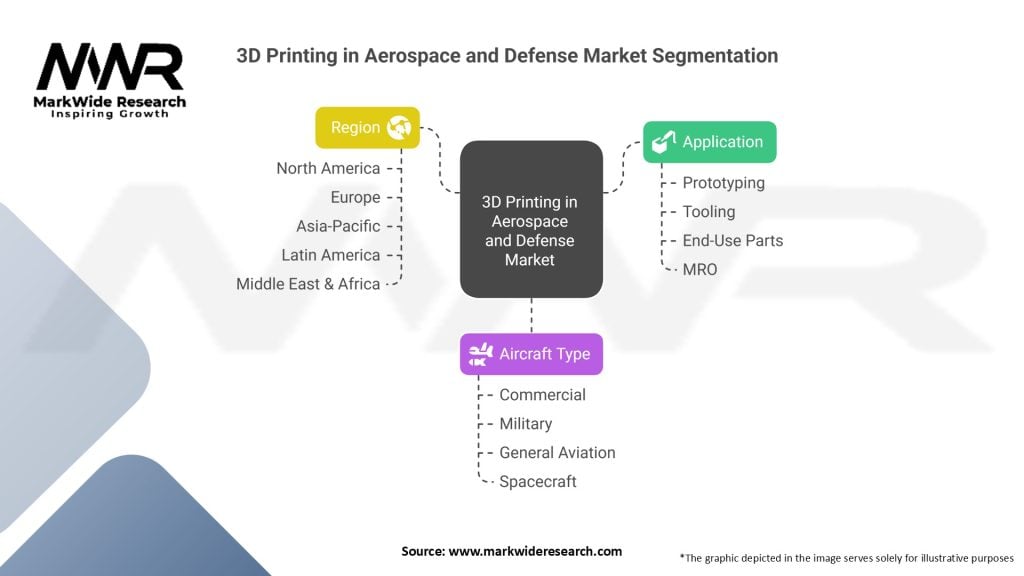

Segmentation

By Technology: Powder Bed Fusion, Directed Energy Deposition, Material Extrusion, Binder Jetting, Sheet Lamination.

By Material: Metals (Titanium, Aluminum, Nickel alloys), Polymers (PEEK, Ultem), Composites, Ceramics.

By Application:

Aerospace: Structural airframe parts, engine components, UAVs.

Defense: Weapon mounts, drone airframes, tactical vehicle parts, CBRN training tools.

Maintenance, Repair & Overhaul (MRO): Spare parts on demand, tooling, fixtures.

By End User: OEMs, Tier 1/2 Suppliers, Defense Contractors, MRO Providers, Service Bureaus.

By Region: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa.

Category-wise Insights

Aerospace Structural Parts: Lattice‑optimized brackets and ducts achieving 30–40% weight reductions.

Engine Components: Blisks, fuel nozzles with integrated cooling channels, reducing part counts from 40 to 1.

Defense Field Deployable Units: Portable AM units (e.g., “Gryphon III”) for forward‑operating base repairs.

MRO Applications: Digital inventories reduce inventory carrying costs by 20–30%; custom jigs and fixtures cut repair times by 50%.

Key Benefits for Industry Participants and Stakeholders

Reduced Time to Market: Prototyping cycles cut from months to days.

Supply Chain Optimization: Digital warehousing reduces physical inventory needs.

Cost Savings: Consolidation of assembly and lower material waste (powder usage >95% efficient).

Customization & Rapid Iteration: Tailored parts for niche platforms and retrofits.

Strategic Resilience: Distributed manufacturing mitigates geopolitical or logistical disruptions.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of 3D printing in aerospace and defense provides a comprehensive evaluation of the market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the 3D printing in aerospace and defense market. Firstly, there is a focus on the development of high-performance materials specifically tailored for aerospace and defense applications. These materials offer improved strength, heat resistance, and other desired properties, expanding the possibilities for 3D printing in this sector.

Secondly, the industry is witnessing a shift towards larger-scale 3D printing capabilities. Companies are investing in larger printers to accommodate the production of bigger components, such as aircraft fuselages and wings. This trend enables the creation of fully 3D printed structural elements, reducing the need for traditional assembly methods.

Another notable trend is the integration of multi-material 3D printing. This enables the simultaneous printing of different materials within a single component, enhancing its functionality and performance. For example, it allows for the incorporation of conductive materials or embedded sensors within printed parts.

Additionally, advancements in post-processing techniques are improving the surface finish and overall quality of 3D printed components. This is crucial for aerospace and defense applications that require strict adherence to quality standards and specifications.These collaborations aim to leverage the expertise of each party and drive innovation in 3D printing solutions for aerospace and defense. Joint research and development initiatives are focused on pushing the boundaries of additive manufacturing, exploring new materials, optimizing processes, and enhancing the overall capabilities of 3D printing technology.

Moreover, the adoption of 3D printing for on-site manufacturing and maintenance operations is gaining traction. This approach allows aerospace and defense companies to produce parts directly at the point of use, reducing lead times and transportation costs. It also enables the rapid replacement of damaged or obsolete components, minimizing downtime for critical equipment.

Another emerging trend is the exploration of bio-inspired designs and structures in 3D printing for aerospace and defense. By taking inspiration from nature, such as the lightweight and strong structures found in bones or shells, designers and engineers can optimize the performance of printed components. This trend highlights the potential of biomimicry in unlocking new design possibilities and achieving greater efficiency in aerospace and defense applications.

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the 3D printing in aerospace and defense market. While the industry experienced disruptions in supply chains and production due to lockdown measures and reduced demand for air travel, the pandemic also underscored the value and agility of 3D printing technology.

During the crisis, 3D printing played a crucial role in manufacturing personal protective equipment (PPE), such as face shields and mask components, for healthcare workers. This demonstrated the rapid response capability of 3D printing in addressing urgent needs and mitigating supply chain disruptions. The experience gained from producing essential medical supplies during the pandemic has further highlighted the potential of 3D printing for aerospace and defense applications.

The pandemic has also accelerated the adoption of digital technologies and automation in manufacturing processes. This includes the increased use of 3D printing as a reliable and flexible manufacturing solution. Companies have recognized the benefits of localized production, reduced reliance on global supply chains, and the ability to quickly adapt to changing demands. These factors are expected to drive the long-term growth of 3D printing in the aerospace and defense industry beyond the pandemic.

Key Industry Developments

The 3D printing in aerospace and defense market has witnessed several key industry developments that have shaped its trajectory. Major aerospace companies and defense contractors have made strategic investments in additive manufacturing technologies and facilities. They have established dedicated 3D printing centers and labs to foster innovation, research, and development in the field of aerospace and defense applications.

Collaborations between aerospace manufacturers and 3D printing technology providers have resulted in the development of specialized materials and processes tailored for the industry’s unique requirements. These collaborations aim to overcome the challenges associated with material selection, quality control, and certification of 3D printed aerospace components.

Moreover, regulatory bodies and organizations in the aerospace and defense sector have been actively involved in establishing standards and certifications for 3D printed parts. This ensures the safety, reliability, and compliance of 3D printed components with industry regulations. Standardization efforts contribute to building confidence in the use of 3D printing technology in critical aerospace and defense applications.

Additionally, research and development efforts have focused on expanding the range of printable materials suitable for aerospace and defense. This includes the development of high-temperature alloys, advanced composites, and lightweight polymers with superior mechanical properties. These material advancements further enhance the capabilities of 3D printing technology and enable the production of components with increased performance and durability.

Analyst Suggestions

Based on market analysis and industry insights, analysts suggest several strategies and considerations for stakeholders in the 3D printing in aerospace and defense market. First and foremost, continued investment in research and development is crucial to drive innovation, improve printing processes, and expand the range of printable materials. This will enable the industry to address the specific requirements of aerospace and defense applications, such as high-temperature resistance, mechanical strength, and lightweight properties.

Furthermore, companies should focus on building strategic partnerships and collaborations. By working together with additive manufacturing technology providers, aerospace manufacturers can leverage their expertise and access cutting-edge 3D printing solutions. Collaborations also facilitate knowledge sharing, joint research, and the development of industry standards, ensuring the scalability and reliability of 3D printing in aerospace and defense.

Investing in workforce training and development is another key recommendation. As the adoption of 3D printing technology expands, there is a growing demand for skilled professionals who can design, operate, and maintain 3D printers. Companies should invest in training programs and upskilling initiatives to equip their workforce with the necessary expertise to fully utilize the potential of 3D printing.

Additionally, staying abreast of regulatory developments is essential. The aerospace and defense industry operates under stringent regulations and certifications to ensure safety and compliance. It is important for stakeholders to actively engage with regulatory bodies, contribute to the development of standards, and maintain a thorough understanding of the evolving regulatory landscape to ensure adherence to industry requirements.

Moreover, companies should explore new applications and market segments. While aerospace and defense have been at the forefront of adopting 3D printing, there are opportunities to expand into other industries, such as automotive, healthcare, and consumer goods. By diversifying their market presence, companies can leverage their expertise and technology to capture new revenue streams and drive overall growth.

Finally, it is crucial to monitor emerging technologies and trends that intersect with 3D printing. Advancements in artificial intelligence, robotics, and advanced materials offer synergistic opportunities for further enhancing the capabilities of 3D printing in aerospace and defense. By embracing these technologies and staying innovative, companies can maintain a competitive edge in the market.

Future Outlook

The future outlook for 3D printing in the aerospace and defense market is highly promising. The increasing adoption of 3D printing technology and the continuous advancements in materials, processes, and design capabilities are expected to drive significant growth in the industry.

With ongoing research and development efforts, the range of printable materials will expand, enabling the production of more advanced and specialized aerospace components. This will further improve the performance, efficiency, and durability of aircraft and defense equipment.

As 3D printing technologies mature and become more cost-effective, they will penetrate deeper into the aerospace and defense supply chains. Companies will increasingly integrate 3D printing into their manufacturing processes, resulting in reduced lead times, optimized inventory management, and enhanced overall operational efficiency.

The ongoing digitization of the aerospace and defense industry will also contribute to the growth of 3D printing. The integration of digital design tools, simulation software, and data analytics will streamline the design-to-print workflow, enabling faster iterations, better optimization, and improved quality control.

Additionally, as sustainability becomes a priority in the aerospace and defense sector, 3D printing will play a crucial role. The lightweight designs and material-efficient production methods offered by 3D printing contribute to reducing fuel consumption and environmental impact.

Overall, the future of 3D printing in aerospace and defense is expected to be characterized by continued innovation, increased adoption, and broader applications. The industry will witness collaborations, advancements in materials and processes, and a deeper integration of 3D printing into the overall manufacturing ecosystem.

Conclusion

The 3D printing in aerospace and defense market is witnessing steady growth and is poised for further expansion. The technology offers numerous benefits, including lightweight component production, customization capabilities, and supply chain flexibility. Despite challenges such as material limitations and initial investment costs, the market presents significant opportunities for industry participants.

3D Printing in Aerospace and Defense Market Segmentation Details:

| Segmentation | Details |

|---|---|

| Application | Prototyping, Tooling, End-Use Parts, Maintenance, Repair, and Overhaul (MRO), Others |

| Aircraft Type | Commercial, Military, General Aviation, Spacecraft |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the 3D Printing in Aerospace and Defense Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at