Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Automation & Robotics: Integration of welding controllers with robotic arms is reshaping production lines in automotive, aerospace, and heavy equipment manufacturing.

-

Digitalization & Connectivity: Ethernet‑based communication and OPC UA standards are enabling real‑time monitoring, data logging, and integration into MES/ERP systems.

-

Energy Efficiency: Precise control of welding parameters reduces energy consumption and material waste, supporting sustainability targets.

-

Aftermarket Growth: Retrofit solutions for older welding power sources via modular controllers are emerging as a significant aftermarket segment.

-

Regional Variances: Mature markets in North America and Europe prioritize high‑end, feature‑rich controllers; Asia‑Pacific sees strong demand for cost‑effective, entry‑level systems.

Market Drivers

-

Industrial Automation Surge: Factories are automating welding tasks to boost throughput and consistency.

-

Quality & Traceability Standards: Aerospace and automotive OEMs mandate digital record‑keeping of welding parameters.

-

Labor Shortages & Skill Gaps: Controllers reduce reliance on highly skilled welders by encapsulating best‑practice programs.

-

IIoT & Industry 4.0 Adoption: Demand for networked controllers that feed welding data into analytics platforms.

-

Sustainability Goals: Controllers help optimize heat input and wire usage, minimizing scrap and reducing carbon footprint.

Market Restraints

-

High CapEx Requirements: Advanced systems with full digital control remain costly, especially for SMEs.

-

Cybersecurity Risks: Networked welding cells can be vulnerable to cyber‑attacks without robust protections.

-

Integration Complexity: Interfacing controllers with legacy power sources and robots can require extensive customization.

-

Operator Training Needs: Despite usability improvements, new controllers require training in programming and maintenance.

-

Supply Chain Disruptions: Semiconductors and advanced electronic components face periodic shortages.

Market Opportunities

-

Retrofit & Aftermarket Services: Converting analog welders to digital control with plug‑and‑play modules.

-

Software‑as‑a‑Service (SaaS): Subscription models for advanced analytics, remote support, and predictive maintenance.

-

Collaborations with Robotics OEMs: Bundled solutions targeting automotive, shipbuilding, and heavy machinery sectors.

-

Emerging Market Expansion: Affordable controller variants for growing manufacturing hubs in Southeast Asia, Latin America, and Africa.

-

Healthcare & Cleanroom Welding: Controllers optimized for specialized welding of medical implants and electronics packaging.

Market Dynamics

-

Supply Side: R&D investments focus on AI‑based adaptive control, miniaturization of electronics, and ruggedization for harsh environments.

-

Demand Side: End‑users seek turnkey controller‑robot packages, configurable parameter libraries, and remote troubleshooting capabilities.

-

Economic Factors: Global manufacturing indices, capital investment cycles in key industries (automotive, energy), and infrastructure spending influence demand.

Regional Analysis

-

North America:

-

Focus: High‑end controllers with full IIoT integration, strong aftermarket service networks.

-

Drivers: Automotive reshoring, energy & pipeline welding, defense manufacturing.

-

-

Europe:

-

Focus: Compliance with CE and EU digitalization initiatives; high adoption in automotive, aerospace, and rail.

-

Drivers: Industry 4.0 roadmaps, vocational training programs.

-

-

Asia‑Pacific:

-

Focus: Rapid industrial expansion in China, India, Southeast Asia; demand for mid‑range cost‑performance controllers.

-

Drivers: Government manufacturing incentives, rising domestic auto production.

-

-

Latin America:

-

Focus: Entry‑level and retrofit controllers; growth in oil & gas, mining equipment maintenance.

-

Drivers: Infrastructure development, natural resource processing.

-

-

Middle East & Africa:

-

Focus: Ruggedized controllers for oil & gas, shipyard, and heavy construction applications.

-

Drivers: Mega‑projects, oil & gas sector investments.

-

Competitive Landscape

Leading Companies in the Welding Controllers Market:

- Fronius International GmbH

- KUKA AG

- YASKAWA Electric Corporation

- Panasonic Corporation

- Lincoln Electric Holdings, Inc.

- Obara Corporation

- Daihen Corporation

- ABB Ltd.

- IDEAL-Werk C.+E. Jungeblodt GmbH + Co. KG

- GYS

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

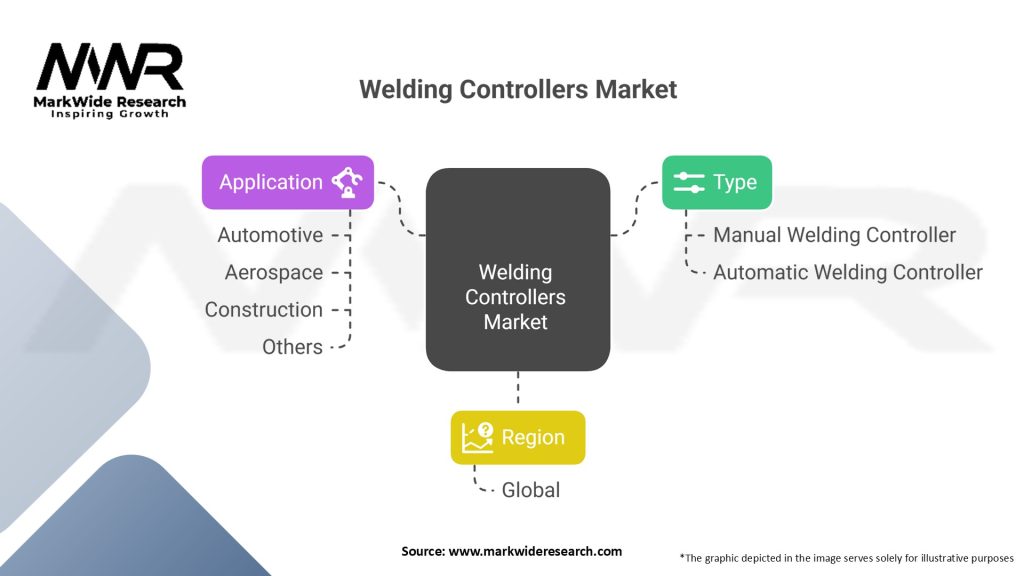

Segmentation

-

By Technology:

-

Digital Microprocessor‑Based Controllers

-

Analog Controllers

-

Hybrid (Analog‑Digital) Controllers

-

-

By Welding Process:

-

MIG/MAG (GMAW) Controllers

-

TIG (GTAW) Controllers

-

Plasma Controllers

-

Resistance Welding Controllers

-

-

By End User Industry:

-

Automotive & Transportation

-

Heavy Machinery & Construction

-

Oil & Gas

-

Aerospace & Defense

-

Shipbuilding

-

General Manufacturing

-

-

By Deployment Mode:

-

Integrated OEM Systems

-

Retrofits & Aftermarket Modules

-

Robotic Workcell Bundles

-

-

By Region:

-

North America

-

Europe

-

Asia‑Pacific

-

Latin America

-

Middle East & Africa

-

Category-wise Insights

-

Digital Controllers: Lead in high‑volume automotive and precision industries due to advanced data logging and network capabilities.

-

Analog Controllers: Remain dominant in cost‑sensitive markets and basic fabrication shops.

-

Hybrid Controllers: Provide a bridge for users transitioning from analog to fully digital systems.

Key Benefits for Industry Participants and Stakeholders

-

Operational Efficiency: Automated parameter control reduces rework and increases throughput.

-

Quality Consistency: Repeatable programs ensure uniform weld quality across shifts and facilities.

-

Data-Driven Insights: Logged parameters facilitate root‑cause analysis and continuous improvement.

-

Labor Optimization: Simplified interfaces allow semi‑skilled operators to run complex welding processes.

-

Sustainability: Optimized welding cycles minimize spatter, reduce wire consumption, and lower energy use.

SWOT Analysis

Strengths:

-

High Precision & Repeatability: Digital controllers deliver unparalleled consistency.

-

Integration Flexibility: Compatible with robots, PLCs, and IIoT platforms.

-

Service Ecosystem: Manufacturer training, global service networks enhance uptime.

Weaknesses:

-

Cost Barriers: Advanced systems can be prohibitively expensive for SMEs.

-

Complexity: Steep learning curve for programming and network setup.

-

Dependency on Electronics: Harsh shop environments can jeopardize sensitive electronics.

Opportunities:

-

SaaS & Subscription Models: Recurring revenue from software updates, analytics dashboards, and remote support.

-

Edge AI: Embedding machine learning at the controller level for real‑time weld defect detection.

-

5G Connectivity: Ultra‑low latency networks to support distributed, remote‑operated welding cells.

Threats:

-

Alternative Technologies: Laser welding and friction stir welding may bypass traditional controllers.

-

Cybersecurity Risks: Vulnerabilities in connected controllers could lead to IP theft or operational disruptions.

-

Economic Slowdowns: Automotive or construction downturns can sharply impact controller orders.

Market Key Trends

-

Edge Computing: Controllers with onboard analytics to reduce data loads on central servers.

-

Wireless Monitoring: Bluetooth® and Wi‑Fi enabled devices for in‑cell parameter monitoring via tablets.

-

Digital Twins: Virtual replicas of welding cells for offline programming and performance optimization.

-

Modular Architectures: Plug‑and‑play controller modules tailored to specific welding processes.

-

Sustainable Manufacturing: Integration of energy‑metering features to track and reduce power usage.

Covid-19 Impact

-

Acceleration of Automation: Labor shortages and safety concerns prompted rapid investment in robotic welding, necessitating advanced controllers.

-

Supply Chain Disruptions: Semiconductor shortages delayed controller deliveries and project deployments.

-

Remote Support Growth: Surge in demand for remote diagnostics, software updates, and virtual commissioning.

-

Shift in CapEx Priorities: Some firms deferred major investments, while others reallocated budgets from manual to automated welding systems.

Key Industry Developments

-

Launch of Cloud‑Connected Controllers: Real‑time dashboarding and alerting via cloud platforms.

-

Strategic Acquisitions: Large OEMs acquiring niche controller and software firms to expand digital offerings.

-

Open‑Source Protocols: Emergence of open communication standards—OPC UA Welding—for cross‑vendor interoperability.

-

Collaborative Robotics: Partnerships between controller makers and cobot manufacturers for safe, shared‑space welding.

-

Enhanced HMI Design: Touch interfaces with guided weld sequence menus and multi‑language support.

Analyst Suggestions

-

Diversify Product Lines: Offer both entry‑level and high‑end controllers to capture SMEs and large OEMs.

-

Invest in Cybersecurity: Build robust encryption and authentication into controller firmware.

-

Focus on Training: Expand educational programs and certification for integrators and end users.

-

Pursue Partnerships: Collaborate with cloud providers and AI startups to offer value‑added analytics services.

-

Localize Support: Strengthen regional service centers and spare‑parts distribution to minimize downtime.

Future Outlook

The Welding Controllers Market is set for continued expansion, underpinned by:

-

Broader adoption of robotics and automated welding cells

-

Integration of AI and edge computing for real‑time quality assurance

-

Evolution of 5G‑enabled, geographically dispersed manufacturing networks

-

Rise of subscription models for continuous software improvements and remote services

-

Increasing emphasis on sustainability and digital traceability in welding operations

Conclusion

Welding controllers are at the forefront of industrial transformation, enabling highly automated, data‑driven welding processes that meet stringent quality, speed, and sustainability goals. As technological innovation accelerates—from cloud‑connected controllers to AI‑powered edge analytics—the market will continue to offer new opportunities for providers and end users alike. By strategically investing in R&D, cybersecurity, service networks, and partnerships, stakeholders can capitalize on this dynamic market’s growth and drive the next generation of digital welding solutions.