444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The venture capital funds market has witnessed significant growth in recent years, driven by the increasing demand for funding in innovative and high-potential startups. Venture capital funds are investment vehicles that provide capital to early-stage companies with high growth potential. These funds play a crucial role in fostering entrepreneurship, fueling innovation, and supporting economic growth.

Meaning

Venture capital funds are pools of capital raised from various investors, such as high-net-worth individuals, institutional investors, and corporations. These funds are managed by professional investment firms or venture capital firms, which carefully select and invest in startups that show promise and potential for substantial returns on investment.

Executive Summary

The venture capital funds market has experienced robust growth in recent years, with increasing investments flowing into startups across various industries. This report provides a comprehensive analysis of the market, highlighting key insights, drivers, restraints, opportunities, and trends that shape the industry landscape.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The venture capital funds market operates in a dynamic environment, influenced by various factors such as technological advancements, market trends, economic conditions, and investor sentiment. The market dynamics shape the investment landscape and determine the success of venture capital funds and their portfolio companies.

Regional Analysis

The venture capital funds market exhibits regional variations, with certain regions, such as Silicon Valley in the United States, leading in terms of investment activity. Other regions, including Europe, Asia Pacific, and Latin America, are also witnessing substantial growth in venture capital funding, driven by the emergence of startup ecosystems and supportive government initiatives.

Competitive Landscape

Leading companies in the Venture Capital Funds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

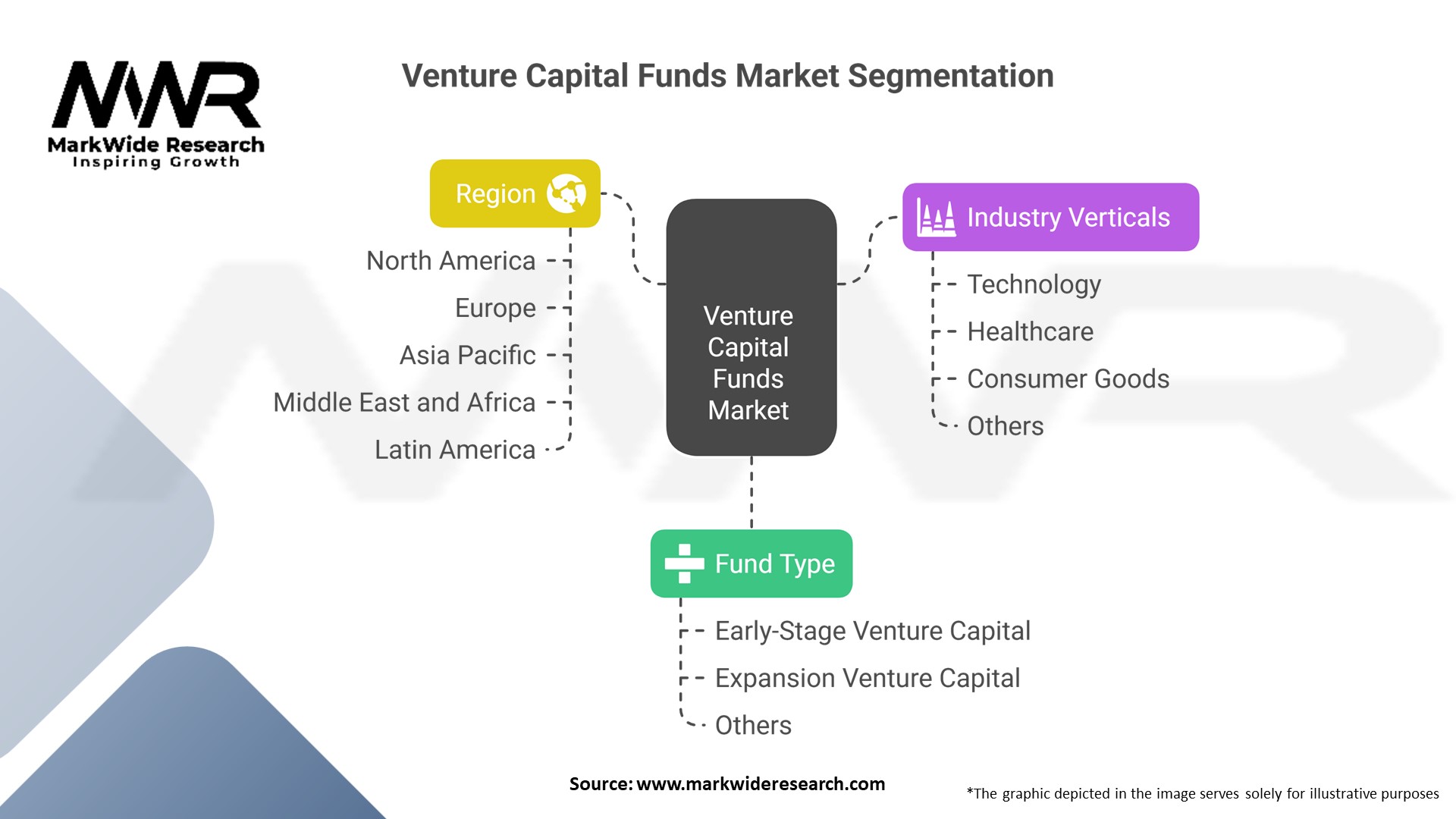

Segmentation

The venture capital funds market can be segmented based on various criteria, including investment stage, industry verticals, and geography. Segmentation allows investors and market participants to focus on specific segments that align with their investment strategies and preferences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the venture capital funds market. Initially, the market experienced a slowdown due to uncertainties and economic disruptions. However, as the pandemic progressed, venture capital investments rebounded strongly, driven by increased focus on digital transformation, healthcare innovation, and remote work solutions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the venture capital funds market appears promising, driven by ongoing technological advancements, increasing entrepreneurial activities, and the emergence of new industry sectors. The market is expected to witness continued growth, with venture capital funds playing a vital role in supporting the development and success of innovative startups.

Conclusion

The venture capital funds market is a dynamic and competitive space that provides crucial funding and support to startups. Despite the inherent risks, venture capital investments have the potential to generate significant returns and drive innovation. Understanding market dynamics, identifying key trends, and adapting to changing circumstances are crucial for venture capital funds to thrive in this evolving landscape.

What is Venture Capital Funds?

Venture Capital Funds are investment funds that provide capital to startups and small businesses with high growth potential in exchange for equity or convertible debt. These funds typically focus on innovative sectors such as technology, healthcare, and clean energy.

What are the key players in the Venture Capital Funds Market?

Key players in the Venture Capital Funds Market include firms like Sequoia Capital, Andreessen Horowitz, and Accel Partners, which are known for their significant investments in early-stage companies. These firms often specialize in specific sectors, such as fintech or biotech, among others.

What are the main drivers of growth in the Venture Capital Funds Market?

The main drivers of growth in the Venture Capital Funds Market include the increasing number of startups seeking funding, the rise of technology-driven innovations, and the growing interest from institutional investors in high-risk, high-reward opportunities. Additionally, favorable regulatory environments in many regions support venture capital activities.

What challenges does the Venture Capital Funds Market face?

The Venture Capital Funds Market faces challenges such as market volatility, which can affect investor confidence, and the high failure rate of startups, which poses risks to fund returns. Additionally, competition among venture capitalists for quality deals can drive up valuations, making it harder to achieve desired returns.

What opportunities exist in the Venture Capital Funds Market?

Opportunities in the Venture Capital Funds Market include investing in emerging technologies like artificial intelligence and blockchain, as well as sectors that address sustainability and social impact. The increasing globalization of startups also presents new avenues for investment across different regions.

What trends are shaping the Venture Capital Funds Market?

Trends shaping the Venture Capital Funds Market include a growing focus on diversity and inclusion in funding, the rise of impact investing, and the increasing use of data analytics to inform investment decisions. Additionally, the shift towards remote work has opened up new opportunities for tech startups.

Venture Capital Funds Market

| Segmentation | Details |

|---|---|

| Fund Type | Early-Stage Venture Capital, Expansion Venture Capital, Others |

| Industry Verticals | Technology, Healthcare, Consumer Goods, Others |

| Region | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Venture Capital Funds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at