444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The title insurance market is a crucial component of the real estate industry, providing financial protection to property owners and lenders against any potential losses due to title defects or disputes. This market plays a vital role in ensuring a smooth transfer of property ownership by guaranteeing the legitimacy and accuracy of property titles. In this comprehensive report, we delve into the meaning of title insurance, analyze key market insights, explore market drivers, restraints, and opportunities, discuss regional analysis, competitive landscape, and provide valuable industry suggestions for the future.

Meaning

Title insurance is a form of indemnity insurance that protects property owners and mortgage lenders from financial losses resulting from defects or issues with the title of a property. It provides coverage for potential risks such as undisclosed liens, encumbrances, conflicting ownership claims, or errors in public records. When a property is purchased or refinanced, title insurance ensures that the buyer or lender receives clear and marketable ownership rights, safeguarding them against unforeseen legal complications.

Executive Summary

The title insurance market has witnessed steady growth in recent years, driven by the increasing complexity of property transactions and the need for risk mitigation. Property owners, lenders, and real estate professionals rely on title insurance to safeguard their investments and ensure the legitimacy of property titles. This market report presents a comprehensive analysis of key market insights, including drivers, restraints, opportunities, and future trends that will shape the industry. Additionally, it provides a regional analysis, competitive landscape, and valuable suggestions for industry participants.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The title insurance market is propelled by several key drivers:

Market Restraints

Despite the positive growth prospects, the title insurance market faces some challenges:

Market Opportunities

The title insurance market presents several opportunities for growth and development:

Market Dynamics

The title insurance market operates within a dynamic landscape, influenced by various factors such as regulatory changes, economic conditions, and technological advancements. Understanding the market dynamics helps industry participants make informed decisions and adapt to evolving trends.

Regional Analysis

The title insurance market exhibits variations across different regions due to legal frameworks, real estate practices, and market maturity. A detailed regional analysis helps identify growth opportunities and tailor strategies accordingly. The report provides insights into key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, outlining market size, trends, and growth potential.

Competitive Landscape

Leading Companies in the Title Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

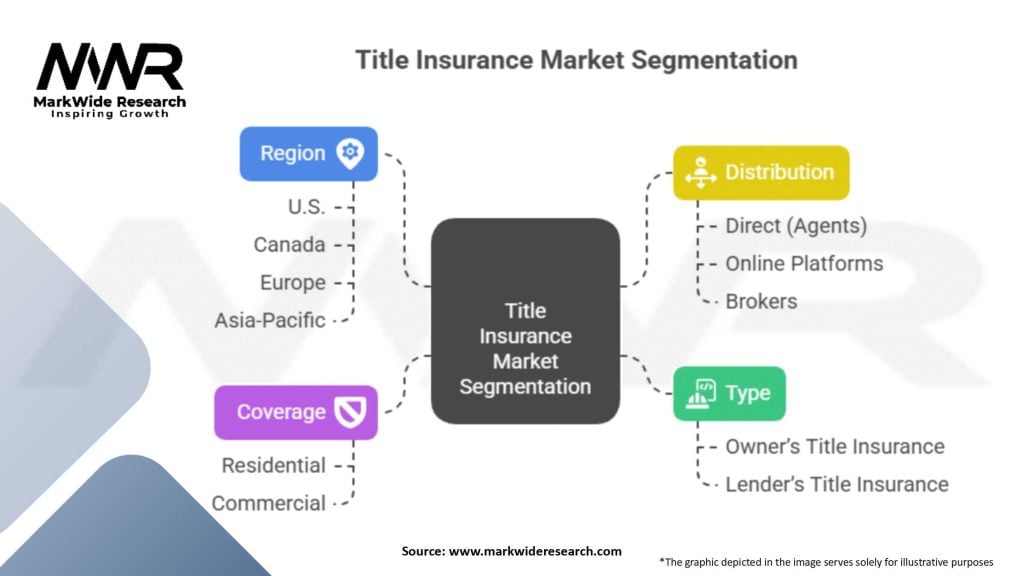

Segmentation

The title insurance market can be segmented based on the following criteria:

Category-wise Insights

The title insurance market can be analyzed based on different categories, providing valuable insights into specific aspects of the industry. These categories include market size, market share, growth rates, revenue analysis, and policy types.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the title insurance market can benefit from:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Staying updated with key market trends is crucial for industry participants. The report identifies and analyzes significant trends in the title insurance market, such as the adoption of blockchain technology, the emergence of remote online notarization, and the integration of artificial intelligence in underwriting processes.

Covid-19 Impact

The COVID-19 pandemic has had a substantial impact on the title insurance market. This section explores the effects of the pandemic on market dynamics, growth rates, consumer behavior, and industry responses. It also discusses the measures taken by industry players to adapt to the new normal and mitigate the pandemic’s effects.

Key Industry Developments

The title insurance market experiences continuous developments, including mergers and acquisitions, technological advancements, regulatory changes, and innovative product offerings. This section highlights recent industry developments and their implications for market players and stakeholders.

Analyst Suggestions

Based on thorough research and analysis, industry experts provide valuable suggestions and recommendations for title insurance companies, including strategies to enhance customer experience, optimize operational efficiency, leverage technology, and adapt to regulatory changes.

Future Outlook

The title insurance market is poised for growth, driven by increasing real estate transactions, regulatory mandates, and technological advancements. The report offers a comprehensive future outlook, discussing market projections, emerging trends, growth opportunities, and challenges that industry participants may encounter in the coming years.

Conclusion

The title insurance market plays a crucial role in ensuring the legitimacy and protection of property titles, providing financial security to property owners and lenders. With a comprehensive understanding of market dynamics, key trends, regional analysis, and competitive landscape, industry participants can navigate the market effectively, capitalize on growth opportunities, and contribute to the industry’s development and innovation. The future outlook for the title insurance market is promising, with advancements in technology and increasing awareness about the importance of title insurance driving market expansion.

What is Title insurance?

Title insurance is a form of indemnity insurance that protects real estate buyers and lenders against losses due to defects in a title to a property. It ensures that the title is clear of any liens, encumbrances, or legal issues that could affect ownership rights.

What are the key players in the Title insurance Market?

Key players in the Title insurance Market include Fidelity National Financial, First American Title Insurance Company, Old Republic Title Company, and Stewart Title Guaranty Company, among others.

What are the main drivers of growth in the Title insurance Market?

The growth of the Title insurance Market is driven by increasing real estate transactions, rising property values, and the need for secure property ownership. Additionally, the expansion of mortgage lending activities contributes to the demand for title insurance.

What challenges does the Title insurance Market face?

The Title insurance Market faces challenges such as regulatory changes, competition from alternative insurance products, and the complexity of title searches. These factors can impact the efficiency and cost-effectiveness of title insurance services.

What opportunities exist in the Title insurance Market?

Opportunities in the Title insurance Market include the adoption of technology for streamlined title searches and claims processing, as well as the potential for growth in underserved markets. Additionally, partnerships with real estate technology firms can enhance service offerings.

What trends are shaping the Title insurance Market?

Trends in the Title insurance Market include the increasing use of digital platforms for transactions, the rise of remote notarization, and a focus on customer experience. These innovations are transforming how title insurance services are delivered and accessed.

Title Insurance Market Segmentations

| Segment | Details |

|---|---|

| Type | Owner’s Title Insurance, Lender’s Title Insurance |

| Coverage | Residential, Commercial |

| Distribution | Direct (Agents), Online Platforms, Brokers |

| Region | U.S., Canada, Europe, Asia-Pacific |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Title Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at