444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The solar powered ATM market is witnessing significant growth as an increasing number of banks and financial institutions are adopting sustainable and eco-friendly solutions. Solar powered ATMs utilize solar energy as their primary power source, reducing dependency on conventional electricity and contributing to environmental conservation. These ATMs are equipped with photovoltaic panels that harness solar energy and convert it into usable electrical power.

Meaning

A solar powered ATM refers to an automated teller machine that operates primarily on solar energy. It combines the convenience of traditional ATMs with the benefits of renewable energy. These ATMs are designed to operate efficiently in areas where access to electricity may be limited or unreliable. By harnessing solar power, these ATMs offer a reliable banking service, even in remote locations, while reducing carbon emissions and promoting sustainable practices.

Executive Summary

The solar powered ATM market is experiencing steady growth due to several factors, such as increasing environmental concerns, government initiatives promoting renewable energy, and the need for reliable banking services in off-grid areas. Solar powered ATMs offer numerous advantages over their conventional counterparts, including reduced operational costs, enhanced energy efficiency, and a positive brand image for financial institutions adopting sustainable practices.

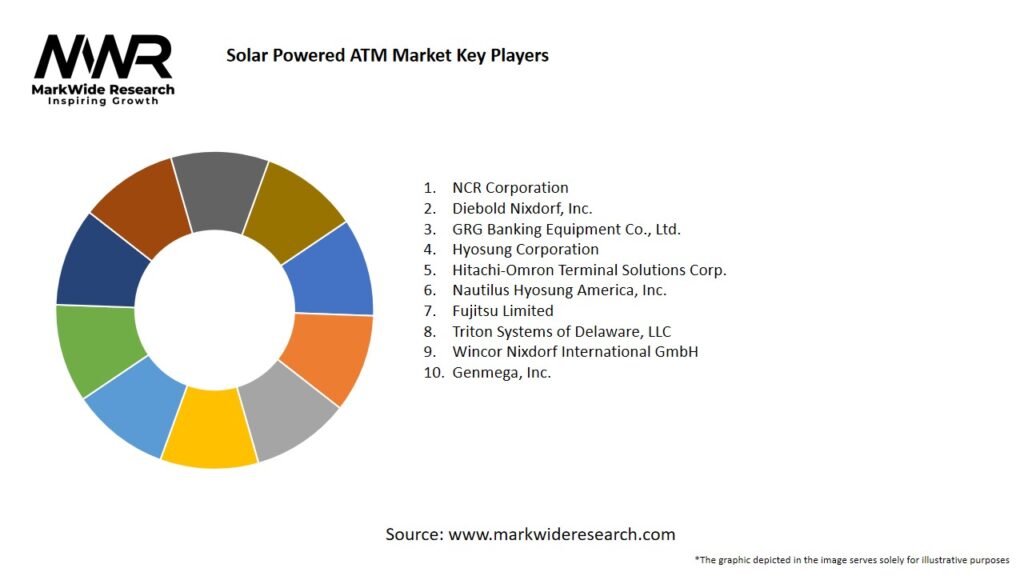

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The solar powered ATM market is driven by various factors that contribute to its growth and adoption:

Market Restraints

Despite the positive growth prospects, the solar powered ATM market faces certain challenges that may impede its progress:

Market Opportunities

The solar powered ATM market offers several opportunities for growth and expansion:

Market Dynamics

The solar powered ATM market operates in a dynamic environment influenced by various factors:

Regional Analysis

The solar powered ATM market exhibits regional variations based on factors such as solar potential, infrastructure, and market maturity. Here’s a brief analysis of key regions:

Competitive Landscape

Leading Companies in the Solar Powered ATM Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

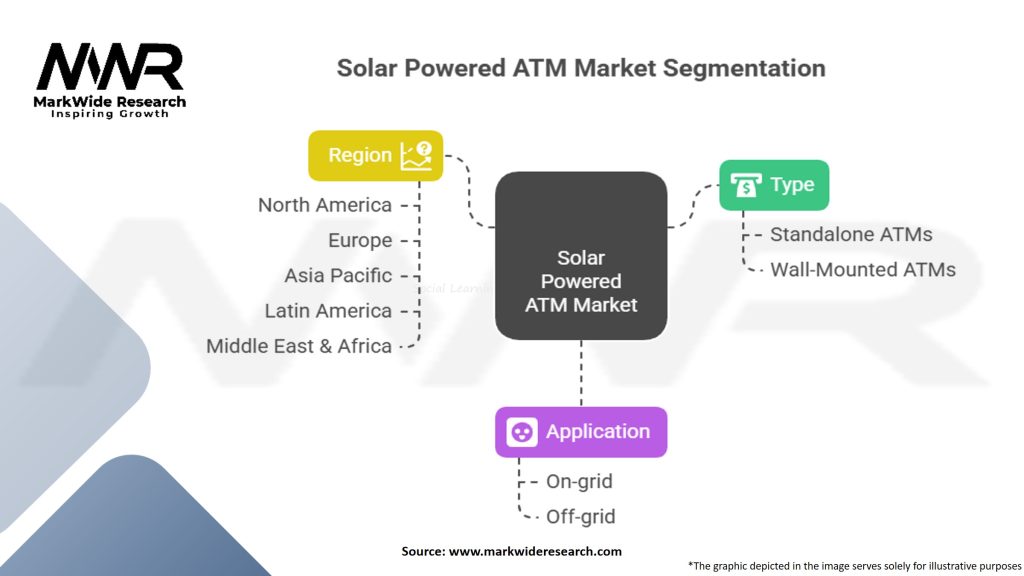

Segmentation

The solar powered ATM market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has affected various industries, including the solar powered ATM market. The lockdowns and travel restrictions imposed in many countries temporarily slowed down market growth. However, the pandemic also highlighted the importance of reliable and accessible banking services, especially in remote areas. Financial institutions are now increasingly considering solar powered ATMs as a resilient and sustainable solution.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the solar powered ATM market looks promising, with sustained growth expected. Factors such as increasing environmental concerns, government support for renewable energy, and the need for reliable banking services in underserved areas will drive market expansion. Technological advancements and collaborations will further enhance the efficiency and capabilities of solar powered ATMs.

Conclusion

The solar powered ATM market offers a sustainable and reliable solution for financial institutions seeking to reduce their carbon footprint and provide banking services in off-grid areas. With the advantages of cost savings, environmental sustainability, and financial inclusion, solar powered ATMs are gaining traction globally. The market’s future looks bright, driven by technological advancements, government support, and the growing demand for sustainable banking practices. Financial institutions willing to embrace solar powered ATMs can position themselves at the forefront of the industry and contribute to a greener future.

What is Solar Powered ATM?

Solar Powered ATMs are automated teller machines that utilize solar energy to operate, reducing reliance on traditional power sources. They are designed to function in remote areas where electricity supply is limited or unreliable.

What are the key players in the Solar Powered ATM Market?

Key players in the Solar Powered ATM Market include companies like NCR Corporation, Diebold Nixdorf, and GRG Banking among others. These companies are known for their innovative solutions and contributions to the development of solar-powered banking technologies.

What are the growth factors driving the Solar Powered ATM Market?

The growth of the Solar Powered ATM Market is driven by increasing demand for sustainable banking solutions, the need for financial inclusion in remote areas, and advancements in solar technology. Additionally, rising energy costs and environmental concerns are pushing banks to adopt greener alternatives.

What challenges does the Solar Powered ATM Market face?

The Solar Powered ATM Market faces challenges such as high initial installation costs, limited awareness among consumers, and potential technical issues related to solar energy storage. Additionally, varying regulations across regions can impact deployment strategies.

What opportunities exist in the Solar Powered ATM Market?

Opportunities in the Solar Powered ATM Market include expanding into emerging markets with limited banking infrastructure, partnerships with renewable energy providers, and the integration of advanced technologies like mobile banking. These factors can enhance accessibility and efficiency in financial services.

What trends are shaping the Solar Powered ATM Market?

Trends in the Solar Powered ATM Market include the increasing adoption of hybrid systems that combine solar power with traditional energy sources, advancements in battery storage technology, and a growing focus on sustainability in the banking sector. These trends are influencing how ATMs are designed and deployed.

Solar Powered ATM Market

| Segmentation | Details |

|---|---|

| Type | Standalone ATMs, Wall-Mounted ATMs |

| Application | On-grid, Off-grid |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Solar Powered ATM Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at