444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The single trip travel insurance market is a segment of the insurance industry that provides coverage for individuals undertaking a single trip or vacation. This type of insurance offers financial protection against unforeseen events, such as medical emergencies, trip cancellations, lost baggage, and other travel-related risks. Travel insurance has become increasingly popular as more people are venturing out to explore new destinations and seek leisure experiences. It provides peace of mind to travelers, ensuring they are protected against potential financial losses during their trips.

Meaning

Single trip travel insurance refers to a policy that covers a specific journey or vacation. Unlike annual travel insurance, which provides coverage for multiple trips within a specified time period, single trip insurance is designed for individuals who only plan to travel once. This type of insurance can be purchased for various types of trips, including leisure travel, business travel, or even adventure vacations. It typically offers a range of coverage options, allowing travelers to customize their policies based on their specific needs and preferences.

Executive Summary

The single trip travel insurance market has experienced significant growth in recent years. This can be attributed to several factors, including the increasing number of people traveling globally, rising awareness about the benefits of travel insurance, and the availability of comprehensive coverage options. The market is highly competitive, with numerous insurance providers offering a wide range of policies to cater to different customer segments. However, despite the positive growth trajectory, there are challenges and opportunities that need to be considered by industry participants and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The single trip travel insurance market is dynamic and influenced by various factors. Changing consumer preferences, regulatory developments, and advancements in technology significantly impact the market’s growth and competitiveness. Insurance providers need to adapt to these dynamics, continuously innovate, and stay abreast of market trends to maintain a competitive edge.

Regional Analysis

The single trip travel insurance market exhibits regional variations based on factors such as travel patterns, economic conditions, and regulatory frameworks. North America, Europe, and Asia Pacific are the key regions driving the market’s growth. North America, particularly the United States, has a well-established travel insurance industry due to high travel volumes. Europe, with its extensive network of destinations and diverse travel options, also presents significant opportunities. In Asia Pacific, rising disposable incomes, increasing outbound travel, and growing awareness about travel insurance contribute to market growth.

Competitive Landscape

Leading Companies in the Single Trip Travel Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

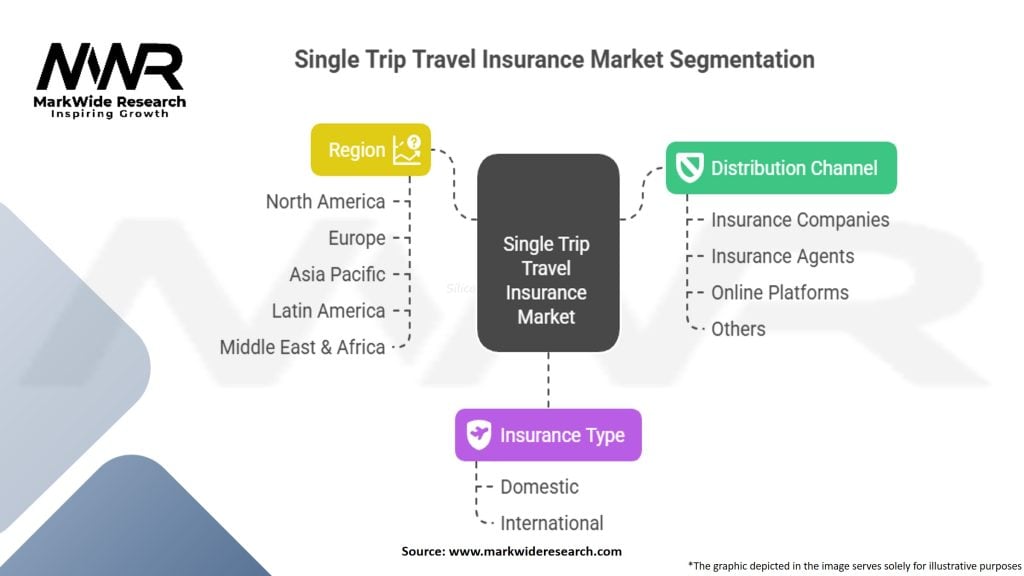

Segmentation

The single trip travel insurance market can be segmented based on various factors, including coverage type, distribution channel, end-user, and geography. Coverage types may include medical expenses, trip cancellation/interruption, baggage loss, and personal liability. Distribution channels can range from direct sales through insurance company websites to online aggregators, travel agencies, and financial institutions. End-users can be categorized as individual travelers, families, business travelers, and senior citizens.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the single trip travel insurance market. Travel restrictions, lockdowns, and widespread health concerns resulted in a significant decline in travel demand. Insurance providers faced challenges related to claim settlements, policy cancellations, and adapting to new coverage requirements. However, the pandemic also highlighted the importance of travel insurance, with individuals seeking coverage specifically tailored to pandemic-related risks. As travel resumes and restrictions ease, the market is expected to recover gradually, with a renewed emphasis on comprehensive coverage and pandemic-specific protection.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the single trip travel insurance market is positive, driven by factors such as increasing travel volumes, rising awareness about the benefits of travel insurance, and technological advancements. The market is expected to witness continued innovation, with insurance providers offering personalized coverage, seamless digital experiences, and additional value-added services. The recovery from the COVID-19 pandemic and the resumption of international travel are likely to contribute to the market’s growth. However, companies must remain agile, adaptable, and customer-centric to thrive in this competitive landscape.

Conclusion

The single trip travel insurance market plays a crucial role in providing financial protection and peace of mind to travelers. With the increasing number of people traveling globally, the demand for comprehensive coverage against unforeseen events has grown significantly. Insurance providers are continuously innovating, leveraging technology, and offering personalized solutions to cater to the evolving needs and preferences of travelers. While challenges such as price sensitivity and limited awareness exist, the market presents significant opportunities, particularly in emerging markets and through strategic partnerships. The future outlook for the market is positive, with a focus on comprehensive coverage, digitalization, and customer-centric approaches.

What is Single Trip Travel Insurance?

Single Trip Travel Insurance is a type of insurance that provides coverage for travelers on a single journey. It typically includes protection against trip cancellations, medical emergencies, lost luggage, and other unforeseen events during the trip.

What are the key players in the Single Trip Travel Insurance Market?

Key players in the Single Trip Travel Insurance Market include Allianz Global Assistance, AXA Assistance, and Travel Guard, among others. These companies offer various plans tailored to different travel needs and destinations.

What are the main drivers of growth in the Single Trip Travel Insurance Market?

The growth of the Single Trip Travel Insurance Market is driven by increasing global travel, rising awareness of travel risks, and the growing demand for comprehensive travel protection. Additionally, the expansion of online travel booking platforms has made it easier for consumers to purchase insurance.

What challenges does the Single Trip Travel Insurance Market face?

The Single Trip Travel Insurance Market faces challenges such as regulatory complexities, competition from alternative insurance products, and consumer skepticism regarding the necessity of travel insurance. These factors can hinder market growth and consumer adoption.

What opportunities exist in the Single Trip Travel Insurance Market?

Opportunities in the Single Trip Travel Insurance Market include the development of customized insurance products, partnerships with travel agencies, and the integration of technology for better customer experience. Additionally, the rise of adventure travel presents new coverage needs.

What trends are shaping the Single Trip Travel Insurance Market?

Trends in the Single Trip Travel Insurance Market include the increasing use of digital platforms for policy purchase, the rise of on-demand insurance, and a focus on customer-centric services. These trends reflect changing consumer preferences and the need for flexibility in travel insurance.

Single Trip Travel Insurance Market

| Segmentation | Details |

|---|---|

| Distribution Channel | Insurance Companies, Insurance Agents, Online Platforms, Others |

| Insurance Type | Domestic, International |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Single Trip Travel Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at