444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The SaaS escrow services market is experiencing significant growth and is poised to witness substantial expansion in the coming years. SaaS, which stands for Software as a Service, has gained popularity as a software delivery model, allowing users to access software applications through the internet on a subscription basis. As the adoption of SaaS solutions continues to rise, the need for escrow services to mitigate the associated risks has become increasingly important.

Meaning

SaaS escrow services refer to the arrangements made between SaaS providers, their clients, and a neutral third-party escrow agent. These services ensure that the source code, data, and other critical assets of the SaaS application are protected and accessible to the client in the event of the provider’s failure to meet their contractual obligations. In simple terms, SaaS escrow acts as a safety net, providing reassurance to clients and mitigating the potential risks associated with SaaS adoption.

Executive Summary

The SaaS escrow services market is witnessing robust growth due to the increasing reliance on SaaS solutions across various industries. Organizations are recognizing the importance of protecting their investments in SaaS applications and are actively seeking escrow agreements to safeguard their interests. The market is characterized by the presence of both established escrow service providers and emerging players, offering a range of solutions tailored to meet the specific needs of clients.

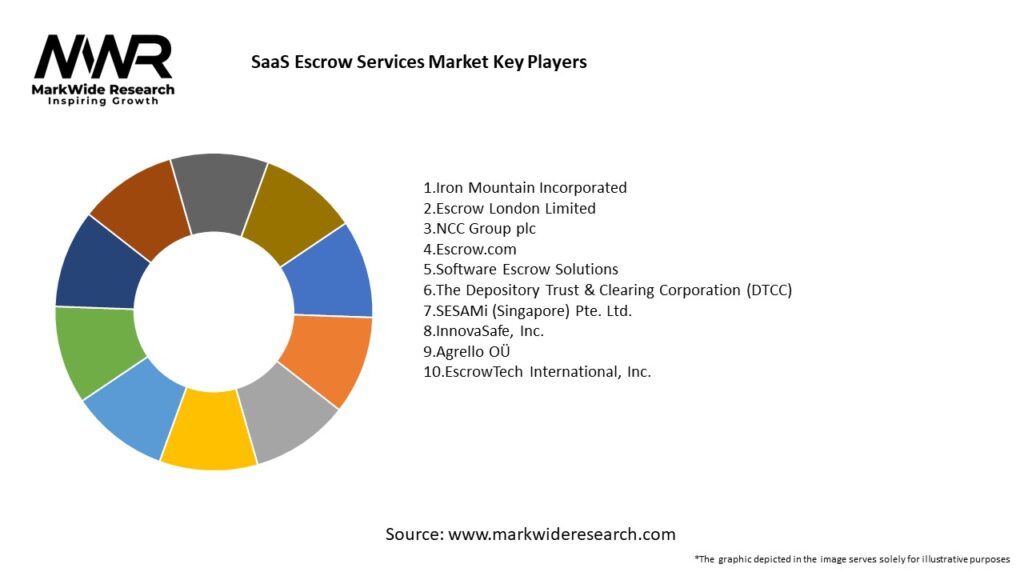

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the SaaS escrow services market:

Market Restraints

While the SaaS escrow services market holds immense growth potential, it also faces certain challenges:

Market Opportunities

The SaaS escrow services market presents several opportunities for growth and innovation:

Market Dynamics

The SaaS escrow services market is highly dynamic and influenced by various factors:

Regional Analysis

The SaaS escrow services market exhibits a global presence, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America currently holds the largest market share, driven by the high adoption of SaaS solutions and the presence of prominent technology companies. Europe and Asia Pacific are also significant markets, fueled by increasing awareness and growing SaaS adoption in various industries.

Competitive Landscape

Leading Companies in the SaaS Escrow Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

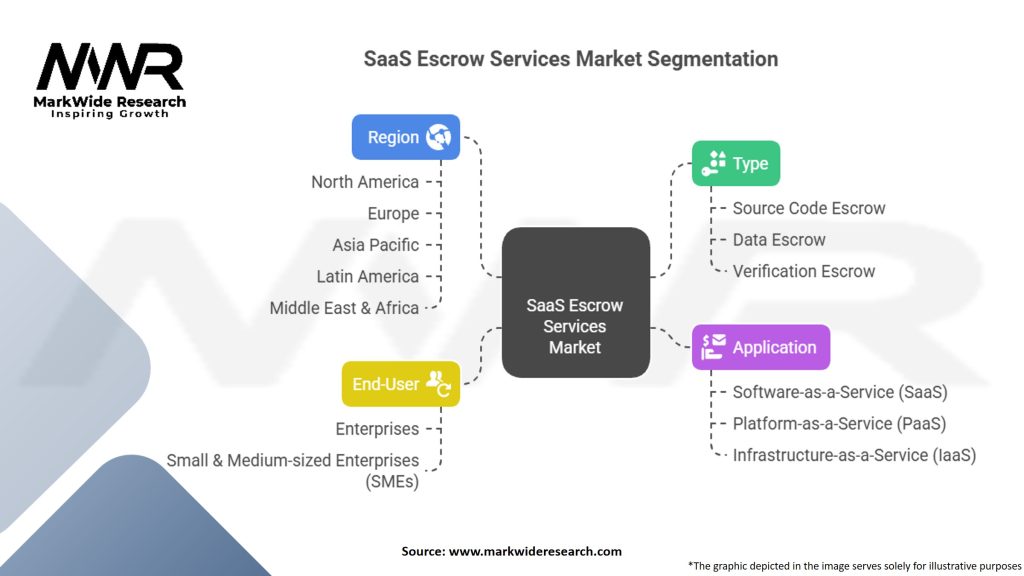

The SaaS escrow services market can be segmented based on the following criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the SaaS escrow services market. While the pandemic caused disruptions across industries, it also highlighted the importance of business continuity planning and risk mitigation. Organizations that had SaaS escrow agreements in place were better positioned to ensure uninterrupted service and access to critical SaaS assets during the crisis. As a result, the demand for SaaS escrow services increased, with organizations recognizing the need to protect their investments in SaaS applications.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the SaaS escrow services market looks promising, with sustained growth anticipated. As the adoption of SaaS solutions continues to increase, organizations will recognize the need to protect their investments and ensure business continuity. The market is likely to witness technological advancements, increased standardization, and the development of industry-specific escrow solutions. Moreover, emerging markets present untapped opportunities for expansion. SaaS escrow services will play a critical role in mitigating risks and instilling confidence in the SaaS ecosystem.

Conclusion

The SaaS escrow services market is witnessing significant growth due to the increasing adoption of SaaS solutions across industries. Escrow services offer organizations protection against the risks associated with SaaS adoption, ensuring business continuity and compliance with regulatory requirements. While the market faces challenges such as lack of awareness and complex escrow agreements, it also presents opportunities for innovation, industry-specific solutions, and market expansion. SaaS escrow service providers need to focus on awareness, standardization, and technological innovation to capitalize on the growing demand for their services. The future outlook for the market is positive, with sustained growth expected as organizations continue to rely on SaaS applications and prioritize risk mitigation.

What is SaaS Escrow Services?

SaaS Escrow Services are agreements that protect software as a service (SaaS) customers by ensuring access to the source code and data in case the service provider fails to deliver or goes out of business. This service is crucial for businesses relying on SaaS solutions, as it mitigates risks associated with vendor lock-in and service disruptions.

What are the key players in the SaaS Escrow Services Market?

Key players in the SaaS Escrow Services Market include EscrowTech, Iron Mountain, and NCC Group, among others. These companies provide various escrow solutions tailored to the needs of SaaS providers and their customers, ensuring data security and compliance.

What are the growth factors driving the SaaS Escrow Services Market?

The growth of the SaaS Escrow Services Market is driven by the increasing adoption of cloud-based solutions, the rising concerns over data security, and the need for compliance with regulations. As more businesses transition to SaaS models, the demand for escrow services to protect their investments continues to grow.

What challenges does the SaaS Escrow Services Market face?

The SaaS Escrow Services Market faces challenges such as the lack of awareness among businesses about the importance of escrow services and the complexity of integrating these services with existing SaaS solutions. Additionally, varying regulations across regions can complicate compliance for service providers.

What opportunities exist in the SaaS Escrow Services Market?

Opportunities in the SaaS Escrow Services Market include the potential for expanding services to emerging markets and developing tailored solutions for specific industries. As businesses increasingly recognize the value of data protection, there is a growing market for innovative escrow solutions.

What trends are shaping the SaaS Escrow Services Market?

Trends shaping the SaaS Escrow Services Market include the rise of automated escrow solutions and the integration of blockchain technology for enhanced security. Additionally, there is a growing emphasis on transparency and trust in vendor relationships, driving demand for reliable escrow services.

SaaS Escrow Services Market

| Segmentation | Details |

|---|---|

| Type | Source Code Escrow, Data Escrow, Verification Escrow |

| Application | Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), Infrastructure-as-a-Service (IaaS) |

| End-User | Enterprises, Small & Medium-sized Enterprises (SMEs) |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the SaaS Escrow Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at