444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Native starches are widely used as food ingredients and additives across various industries such as food and beverage, pharmaceuticals, textiles, and paper manufacturing. These starches are derived from various sources such as corn, wheat, potato, and tapioca. Native starches have gained significant popularity due to their functional properties, including thickening, stabilizing, and gelling, which make them essential components in a wide range of applications.

The global native starches market has experienced steady growth over the years, driven by increasing consumer demand for processed and convenience foods, as well as the growing application of native starches in the pharmaceutical industry. This market analysis aims to provide valuable insights into the native starches market, including key trends, market drivers, restraints, opportunities, and future outlook.

Meaning

Native starches are starches that are extracted from their natural sources without undergoing significant modifications or chemical treatments. These starches retain their original structure and functional properties, making them suitable for various applications in the food, pharmaceutical, and other industries. Native starches are widely preferred due to their clean label and natural image, as they do not contain any additives or chemical modifications.

Executive Summary

The global native starches market has witnessed steady growth in recent years, driven by the increasing demand for convenience foods, the growth of the food and beverage industry, and the rising application of native starches in the pharmaceutical sector. The market is expected to continue its growth trajectory in the coming years, fueled by emerging market opportunities and advancements in starch extraction technologies.

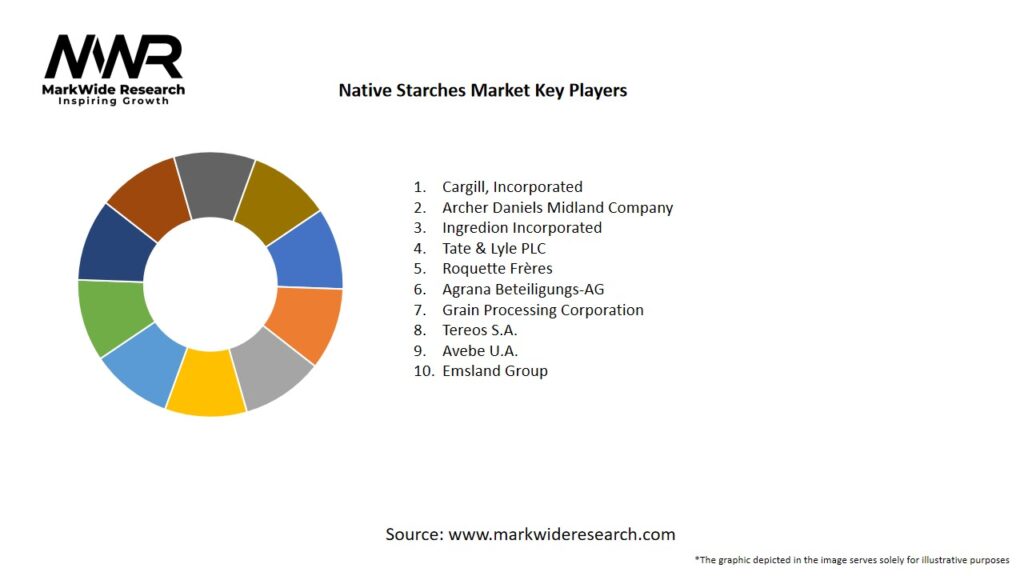

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The native starches market is dynamic and influenced by various factors such as changing consumer preferences, technological advancements, and regulatory landscapes. The market is highly competitive, with numerous players striving to gain a competitive edge through product innovations, partnerships, and mergers and acquisitions. Additionally, sustainability and environmental considerations are becoming important factors in shaping the market dynamics, as consumers and regulatory bodies emphasize eco-friendly practices.

Regional Analysis

The native starches market can be analyzed based on regional segmentation, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region exhibits distinct market trends, demand patterns, and regulatory frameworks.

Competitive Landscape

Leading Companies in the Native Starches Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

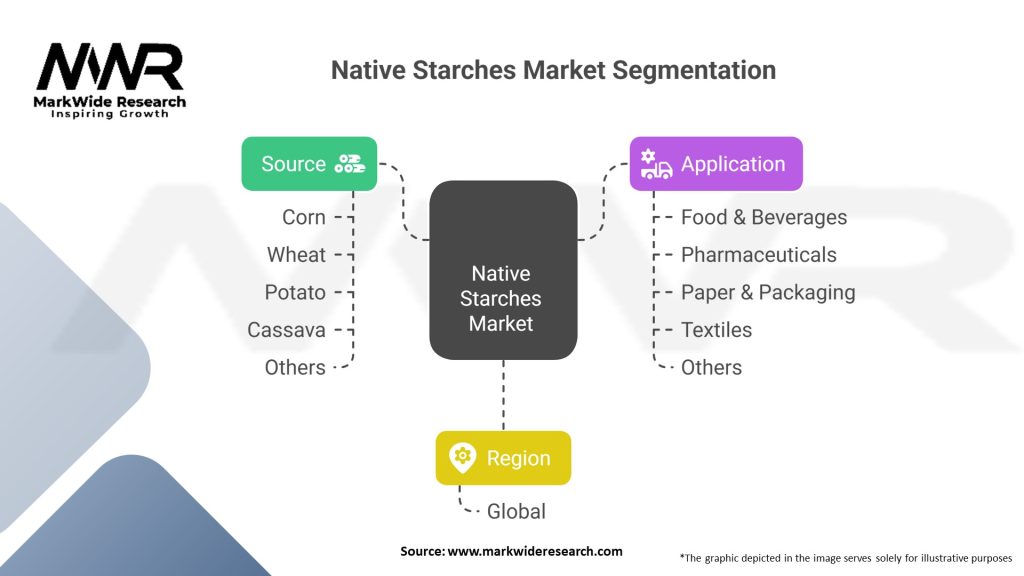

The native starches market can be segmented based on source, application, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides an overview of the native starches market’s internal and external factors.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the native starches market. While the demand for processed and convenience foods witnessed a surge during the lockdowns, the foodservice sector faced disruptions, impacting the overall market dynamics. However, the market quickly adapted to the changing consumer behavior and focused on meeting the increased demand for packaged and shelf-stable food products. The pharmaceutical sector, too, witnessed increased demand, leading to the continued use of native starches as excipients and disintegrants in drug formulations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global native starches market is poised for significant growth in the coming years. Factors such as the increasing demand for clean label products, expanding food and beverage industry, and advancements in starch extraction technologies will drive the market’s growth. Emerging economies, non-food applications, and sustainability considerations will present lucrative opportunities for market players. However, competition from substitute ingredients and price fluctuations of raw materials remain key challenges.

Conclusion

The native starches market is witnessing steady growth, driven by the demand for clean label and natural ingredients in various industries. Native starches offer functional properties suitable for food, pharmaceutical, textile, and paper applications. Advancements in extraction technologies and the growing demand from emerging economies present significant opportunities for market players. However, competition from substitutes and price fluctuations of raw materials pose challenges. With strategic investments in research and development, sustainable practices, and partnerships, native starch manufacturers can thrive in this dynamic market and meet the evolving consumer demands.

Native Starches Market

| Segmentation Details | Details |

|---|---|

| Source | Corn, Wheat, Potato, Cassava, Others |

| Application | Food & Beverages, Pharmaceuticals, Paper & Packaging, Textiles, Others |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Native Starches Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at