Key Market Insights

-

Fiber vs. Copper: Fiber-optic transceivers account for over 60% of revenue due to immunity to EMI and long-distance capabilities, while copper modules remain essential for cost-sensitive, short-reach links.

-

Ruggedization Premium: Industrial-grade transceivers rated for –40 °C to +85 °C command a price premium of 20–30% over commercial counterparts.

-

Protocol Support: Growth in PROFINET and EtherNet/IP deployments is accelerating adoption of optical modules certified for industrial Ethernet.

-

Bandwidth Trends: Demand for 10 Gbps (SFP+) and 25 Gbps (SFP28) industrial transceivers is growing at 15% annually as edge devices aggregate higher data rates.

-

Lifecycle Services: Over 35% of vendors now offer inventory management and hot-swap support contracts for transceiver replacements, reducing downtime in 24/7 operations.

Market Drivers

-

Industry 4.0 & IIoT: Automated factories and remote monitoring solutions require deterministic, low-latency networks underpinned by robust transceiver links.

-

Grid Modernization: Utilities upgrading to smart grids and substation automation deploy fiber links with high-voltage isolation via optoelectronic transceivers.

-

Transportation Networks: Rail signaling, intelligent traffic systems, and airport operations rely on rugged, long-reach communications devices.

-

Cybersecurity Mandates: Secure, hard-wired links over fiber-optic media reduce vulnerability to tampering and support encrypted industrial communications.

-

Edge Computing: Proliferation of edge servers and machine-vision systems in harsh environments demands high-bandwidth transceiver interfaces.

Market Restraints

-

High Initial Investment: Industrial-grade optical components incur higher upfront costs compared to commercial modules.

-

Standardization Gaps: Multiple competing industry-specific Ethernet extensions and wireless technologies can fragment transceiver adoption.

-

Supply Chain Complexity: Dependence on specialized semiconductor and photonics supply chains exposes manufacturers to shortages.

-

Integration Challenges: Embedding transceivers in existing control cabinets may require redesign of cooling and cable-management systems.

-

Skilled Workforce Shortage: Installing and maintaining fiber-optic links and diagnostic tools demands specialized training.

Market Opportunities

-

Multi-Protocol Modules: Development of transceivers supporting automatic protocol detection (EtherCAT, PROFINET, Modbus TCP) simplifies inventory and deployments.

-

TSN-Ready Devices: Transceivers certified for Time-Sensitive Networking enable sub-millisecond synchronization for robotics and motion control.

-

Pluggable Wireless Front-Ends: Hybrid modules combining fiber interfaces with integrated 5G/LTE radios extend connectivity to remote assets.

-

Integrated Diagnostics: Smart transceivers with SFF-8472-compliant digital-diagnostic monitoring interface (DDMI) provide real-time health data to network management systems.

-

Emerging Markets: Accelerated infrastructure spending in Southeast Asia, Latin America, and the Middle East presents new fiber-optic deployment opportunities.

Market Dynamics

-

OEM Alliances: Transceiver vendors partner with switch and gateway manufacturers to deliver turnkey, certified network components.

-

M&A Activity: Consolidation among photonics specialists and automation OEMs expands transceiver portfolios and global reach.

-

Regulatory Evolution: Updates to IEC 61850 and IEEE 802.3 standards for industrial environments drive demand for certified optical modules.

-

Digital Twin Integration: Virtual commissioning of networks uses digital-twin models that include transceiver performance parameters, expediting rollout.

-

Sustainability Initiatives: Energy-efficient transceiver designs with low-power standby modes align with corporate carbon-reduction goals.

Regional Analysis

-

Asia Pacific: Largest volume market driven by rapid industrialization in China, India, and ASEAN; local OEMs increasingly source low-cost industrial transceivers.

-

North America: High value-share region, led by oil & gas pipelines, aerospace ground networks, and automotive smart-manufacturing hubs.

-

Europe: Strong demand from automotive, machinery, and utilities sectors; stringent EN 50155 railway standards spur rugged module adoption.

-

Latin America: Emerging projects in mining automation and power-grid upgrades offer growth potential despite economic volatility.

-

Middle East & Africa: Infrastructure modernization and smart-city initiatives fuel demand, though deployment is often project-based and intermittent.

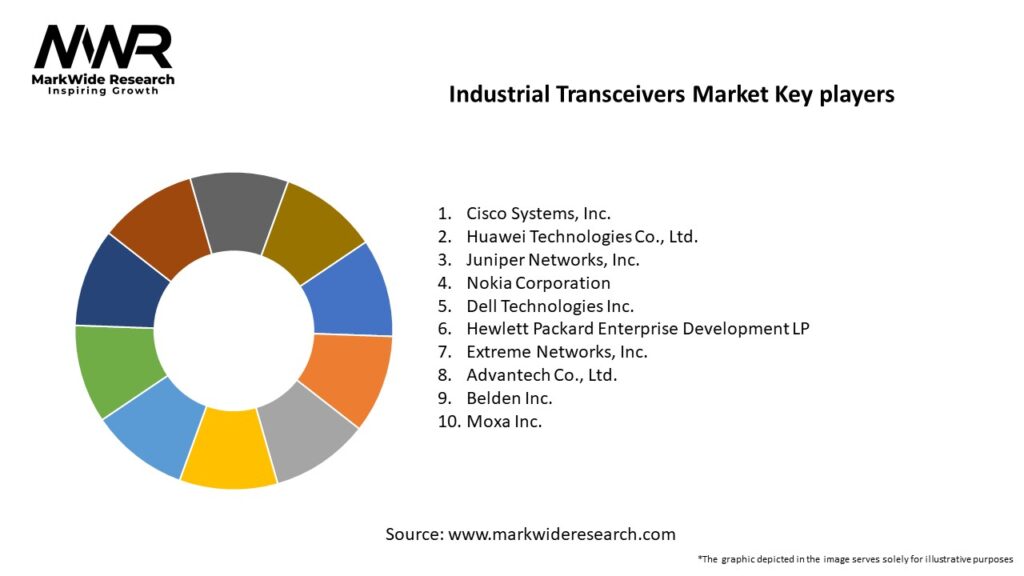

Competitive Landscape

Leading Companies in the Industrial Transceivers Market:

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Nokia Corporation

- Dell Technologies Inc.

- Hewlett Packard Enterprise Development LP

- Extreme Networks, Inc.

- Advantech Co., Ltd.

- Belden Inc.

- Moxa Inc.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

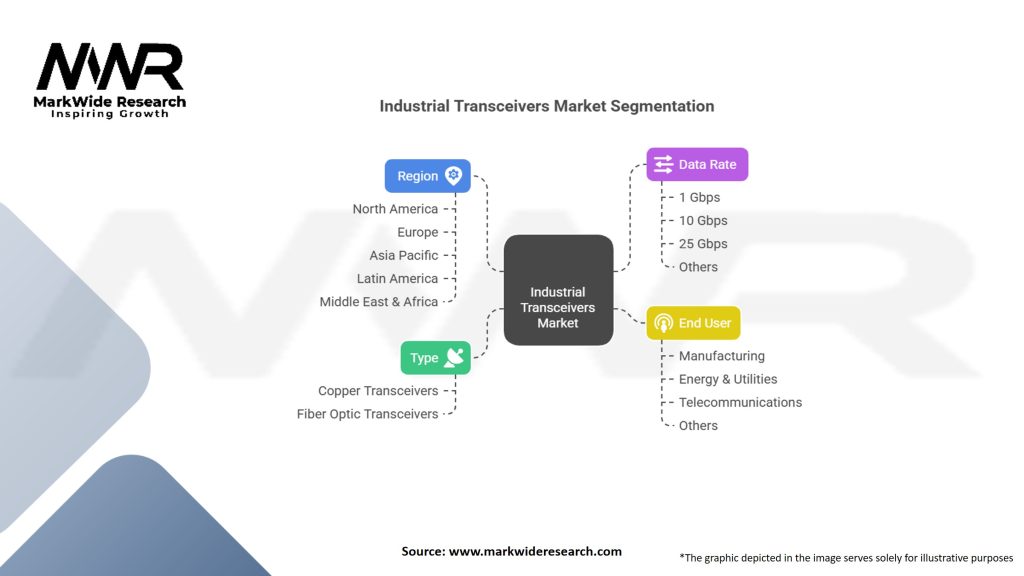

Segmentation

-

By Data Rate: 1 Gbps, 10 Gbps, 25 Gbps, 40/100 Gbps

-

By Media Type: Fiber-Optic (Single-Mode, Multi-Mode), Copper (RJ-45)

-

By Form Factor: SFP, SFP+, SFP28, QSFP+, QSFP28

-

By Protocol Support: Ethernet/IP, PROFINET, EtherCAT, Modbus TCP, TSN, Proprietary

-

By End-Use Industry: Manufacturing, Energy & Utilities, Transportation, Oil & Gas, Healthcare & Pharma, Smart Infrastructure

Category-wise Insights

-

1 Gbps SFP Modules: Widest adoption for legacy and mid-range automation links; cost-effective for standard industrial loops.

-

10 Gbps SFP+ Modules: Preferred in high-performance areas like real-time control, machine vision, and substation backbone networks.

-

25 Gbps SFP28 / 40 Gbps QSFP+: Emerging in data-center-like edge routers within large factories and utilities control centers.

-

Copper RJ-45 Transceivers: Simple plug-play modules used where fiber installation is impractical but extended reach beyond 100 m is modest.

-

Hybrid Optical-Wireless Transceivers: Provide redundancy and flexible deployment for remote monitoring of critical assets.

Key Benefits for Industry Participants and Stakeholders

-

Operational Reliability: Hardened designs ensure continuous data flow under extreme temperature, humidity, and EMI conditions.

-

Scalability: Pluggable modules allow network upgrades to higher bandwidths or protocols without replacing entire switches.

-

Reduced Downtime: Hot-swap capability and diagnostic alerts minimize maintenance windows in 24/7 operations.

-

Cost Efficiency: Standardized form factors and economies of scale lower per-module costs relative to custom cabling solutions.

-

Future-Proofing: Modular transceivers accommodate evolving protocols and speeds, protecting infrastructure investments.

SWOT Analysis

Strengths:

-

Highly flexible and upgradable connectivity solutions.

-

Broad protocol and form-factor compatibility.

-

Proven performance in mission-critical industrial networks.

Weaknesses:

-

Higher upfront cost for industrial-grade optics vs. commercial modules.

-

Specialized installation and testing tools required for fiber links.

Opportunities:

-

Integration with private-5G and TSN networks for deterministic wireless/optical hybrid topologies.

-

Development of pluggable coherent optics for ultra-long-reach industrial backbones.

-

Expansion into edge-compute and micro-data-hall interconnects within manufacturing sites.

Threats:

-

Competition from wireless mesh and 5G solutions in certain applications.

-

Component shortages impacting lead times and project schedules.

-

Rapid protocol evolution necessitating frequent hardware updates.

Market Key Trends

-

TSN-Enabled Modules: Transceivers supporting IEEE 802.1 TSN profiles for deterministic Ethernet are entering pilot deployments.

-

Co-Packaged Optics: Early R&D on integrating optics directly on switch line cards promises reduced latency and power consumption.

-

Extended-Temperature Range: Modules rated from –40 °C to +85 °C are becoming standard in rail and outdoor industrial enclosures.

-

Integrated Diagnostics: Advanced DDMI features feed into Network-Management Systems for real-time fiber-health monitoring.

-

Green Industrial Ethernet: Energy-efficient optical links and low-power standby modes align with sustainability mandates.

Covid-19 Impact

The pandemic disrupted global supply chains for optical components and delayed network expansion projects. However, increased emphasis on remote monitoring and unmanned plant operations accelerated deployments of fiber-optic networks with industrial transceivers. As companies embraced digitalization to maintain productivity during lockdowns, demand rebounded strongly in H2 2021 and has since continued on a growth trajectory.

Key Industry Developments

-

Siemens & Wolfspeed Partnership (2023): Collaboration to develop wide-bandgap GaN-based transceivers for improved power efficiency and thermal tolerance.

-

Molex Launches Hybrid Fibre Module (2022): Combines a CPRI-compliant optical front end with an LTE radio for versatile IIoT gateways.

-

Finisar Introduces Extended-Reach SFP+ (2024): Achieves 40 km single-mode links with integrated DWDM filters for long-haul utility networks.

-

Advantech’s TSN-Certified Transceivers (2021): First lineup certified for IEEE 802.1 TSN profiles, enabling 1 Gbps deterministic links in automotive and machine-control applications.

Analyst Suggestions

-

Broaden Protocol Support: Develop multi-protocol modules that auto-negotiate between industrial Ethernet variants and TSN without firmware upgrades.

-

Strengthen Supply Chains: Qualify alternate photonics and electronics suppliers to mitigate shortages and shorten lead times.

-

Advance Diagnostics: Incorporate AI-driven anomaly detection on DDMI data to predict fiber and transceiver failures before outages occur.

-

Pursue Co-Development: Partner with automation OEMs to co-engineer transceiver-optimized switches and gateways for turnkey solutions.

-

Educate End-Users: Offer training and simulation tools for network engineers to understand the benefits and installation best practices of industrial transceivers.

Future Outlook

The Industrial Transceivers market is poised for sustained double-digit growth in the low-single digits to mid-single digits CAGR through 2030 as industries worldwide digitalize their operations. Key growth vectors include TSN adoption in robotics and motion control, private-5G hybrid networks for mobility, and edge-data-hub interconnects. Suppliers who innovate with higher data-rates (40/100 Gbps), ruggedized coherent optics, and integrated management will capture premium segments. Meanwhile, broad-based demand for gigabit-class fiber links across all verticals will underpin volume growth and support the global transition to smart, connected industrial ecosystems.

Conclusion

Industrial transceivers are foundational enablers of reliable, high-performance communication in today’s data-driven industrial landscape. Their pluggable, protocol-agnostic architectures allow seamless upgrades, while rugged designs ensure uninterrupted operation in the harshest environments. As the Industry 4.0 and IIoT revolutions accelerate, transceiver innovation—spanning TSN certification, edge-optics integration, and digital diagnostics—will be pivotal in achieving deterministic, secure, and sustainable industrial networks. Suppliers who marry cutting-edge photonics with deep industry partnerships and lifecycle services will lead the market, empowering manufacturers, utilities, and transportation operators to optimize performance and drive new levels of operational excellence.