444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The independent insurance agents market is a thriving sector within the insurance industry. These agents play a crucial role in connecting insurance providers with consumers. They operate independently, representing multiple insurance companies and offering a wide range of insurance products to meet the diverse needs of individuals and businesses.

Meaning

Independent insurance agents, also known as insurance brokers or producers, are professionals who act as intermediaries between insurance companies and clients. Unlike captive agents who exclusively represent one insurance company, independent agents have the flexibility to work with multiple insurers, allowing them to provide unbiased advice and offer a variety of insurance options.

Executive Summary

The independent insurance agents market has experienced steady growth over the years, driven by increasing consumer demand for personalized insurance solutions and the need for expert guidance in navigating the complex insurance landscape. This report provides key insights into the market, including drivers, restraints, opportunities, and trends that are shaping the industry’s future.

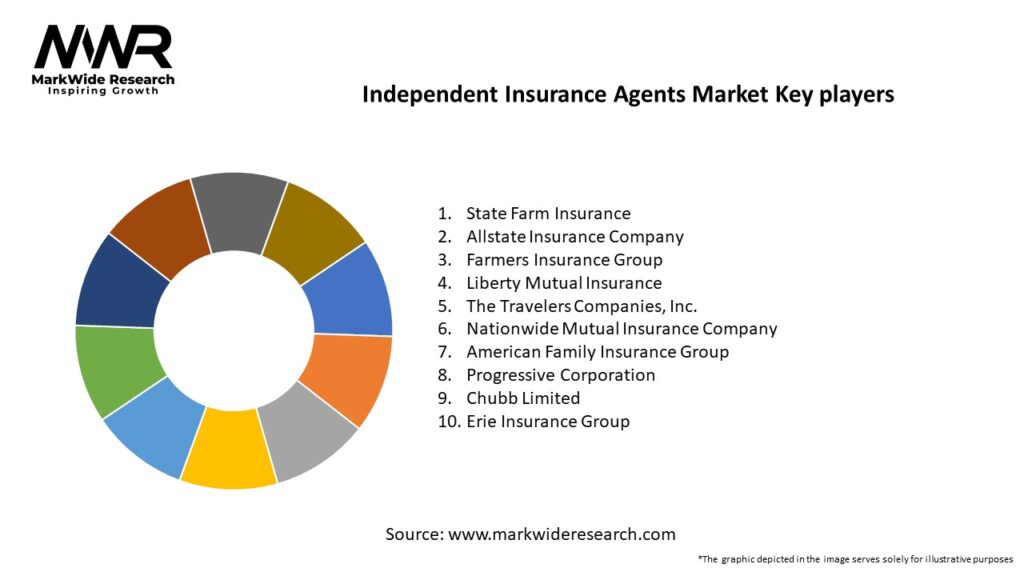

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The independent insurance agents market operates in a dynamic environment influenced by various factors. Key dynamics shaping the market include changing consumer preferences, technological advancements, regulatory developments, and competitive landscape dynamics.

Regional Analysis

The independent insurance agents market exhibits regional variations based on factors such as population demographics, economic conditions, and regulatory frameworks. It is essential for agents to understand regional nuances and tailor their strategies accordingly.

Competitive Landscape

Leading Companies in the Independent Insurance Agents Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

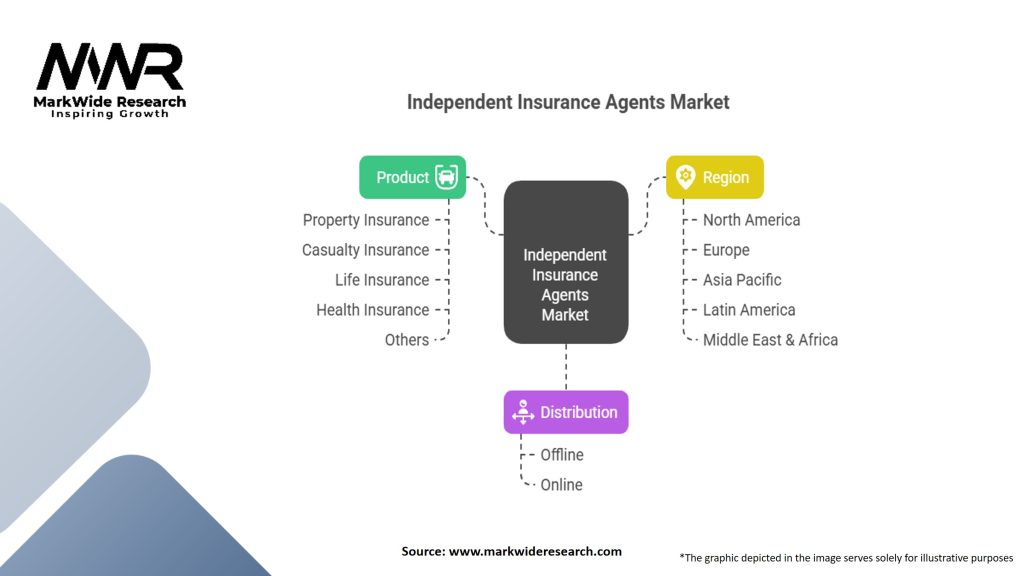

Segmentation

The independent insurance agents market can be segmented based on various criteria, including the type of insurance products offered (life insurance, property and casualty insurance, health insurance, etc.), target customer segments (individuals, small businesses, large enterprises), and geographic regions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the independent insurance agents market. It accelerated the adoption of digital tools and remote work practices, highlighting the importance of technological readiness and flexibility in serving clients during challenging times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the independent insurance agents market is promising. As consumers continue to seek personalized insurance solutions and rely on expert advice, independent agents have ample opportunities to thrive by leveraging technology, diversifying their product offerings, and delivering exceptional customer experiences.

Conclusion

The independent insurance agents market is a dynamic sector within the insurance industry, providing clients with tailored insurance solutions and expert advice. Despite challenges such as competition from direct channels and technological adoption, independent agents can capitalize on opportunities in niche segments, collaborate with insurtech startups, and cross-sell/up-sell to existing clients. By embracing technology, focusing on customer experience, and staying abreast of industry trends, independent agents can navigate the evolving landscape and secure a prosperous future.

What is Independent Insurance Agents?

Independent insurance agents are professionals who sell insurance products from multiple insurance companies, providing clients with a range of options tailored to their needs. They operate independently, allowing them to offer unbiased advice and personalized service.

What are the key players in the Independent Insurance Agents Market?

Key players in the Independent Insurance Agents Market include companies like Brown & Brown, Inc., Hub International, and Marsh & McLennan, among others. These firms provide a variety of insurance products and services, catering to both personal and commercial clients.

What are the growth factors driving the Independent Insurance Agents Market?

The growth of the Independent Insurance Agents Market is driven by increasing consumer demand for personalized insurance solutions, the rise of digital platforms facilitating agent-client interactions, and the expanding range of insurance products available in the market.

What challenges does the Independent Insurance Agents Market face?

The Independent Insurance Agents Market faces challenges such as intense competition from direct insurers, regulatory changes affecting commission structures, and the need for agents to adapt to rapidly evolving technology and consumer preferences.

What opportunities exist in the Independent Insurance Agents Market?

Opportunities in the Independent Insurance Agents Market include the potential for agents to leverage technology for better customer engagement, the growing importance of niche insurance products, and the increasing trend of consumers seeking expert advice in complex insurance matters.

What trends are shaping the Independent Insurance Agents Market?

Trends shaping the Independent Insurance Agents Market include the integration of artificial intelligence in customer service, the rise of telematics in auto insurance, and a growing focus on sustainability and socially responsible insurance practices.

Independent Insurance Agents Market

| Segmentation | Details |

|---|---|

| Product | Property Insurance, Casualty Insurance, Life Insurance, Health Insurance, Others |

| Distribution | Offline, Online |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Independent Insurance Agents Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at