444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The financial world is an intricate tapestry of opportunities, and within it, the concept of hybrid funds has emerged as a compelling investment option. The hybrid funds market presents investors with a unique blend of stability and growth potential by combining the features of both equity and debt instruments. This strategic fusion offers diversified portfolios that cater to varying risk appetites while aiming to achieve optimal returns. In this comprehensive analysis, we delve into the meaning, key insights, drivers, restraints, opportunities, and regional dynamics that shape the hybrid funds market. From exploring the competitive landscape to identifying emerging trends, we aim to equip industry participants and stakeholders with valuable insights to navigate this evolving landscape with confidence.

Meaning

Hybrid funds, also known as balanced funds, occupy a distinctive space in the investment realm. These funds amalgamate the characteristics of both equity and debt funds, seeking to strike a harmonious balance between capital appreciation and income generation. By investing in a mix of equities, bonds, and sometimes even other asset classes, hybrid funds aim to optimize returns while mitigating risk. This blend makes them an appealing option for investors who desire the stability associated with fixed income instruments, along with the growth potential of equities.

Executive Summary

The hybrid funds market represents a dynamic intersection of diverse investment strategies. Investors are drawn to hybrid funds for their potential to offer a diversified portfolio that can weather market volatility while pursuing consistent growth. The market’s appeal lies in its ability to cater to a wide range of investors, from conservative risk-averse individuals to those seeking higher returns without excessive exposure to market fluctuations. The combination of equity and debt instruments in these funds creates a unique risk-return profile that has garnered attention in recent years.

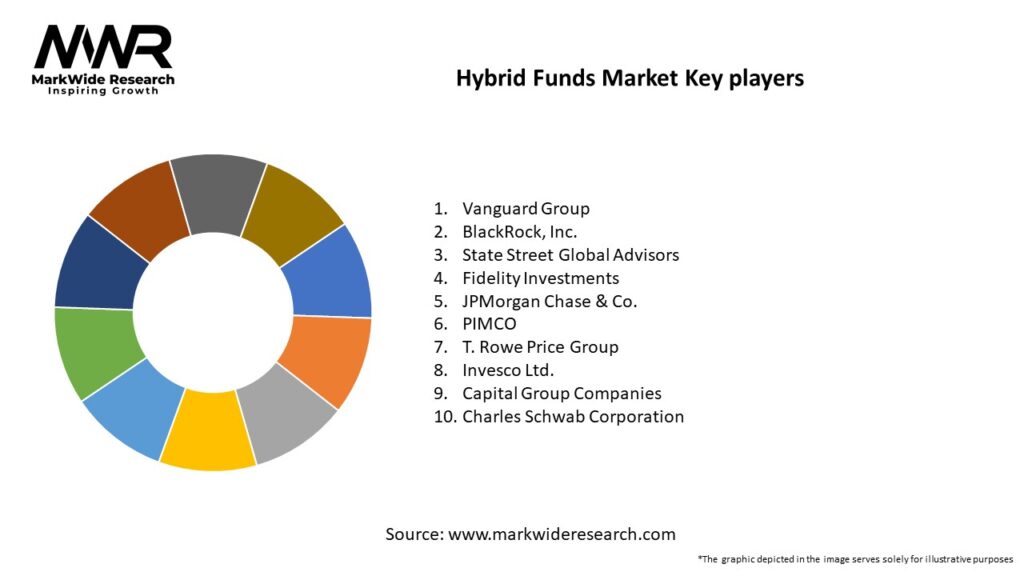

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The hybrid funds market is not just about balancing risk and reward; it’s also about adapting to changing market dynamics. The hybrid nature of these funds allows them to adjust to various market conditions, making them a valuable tool for asset allocation. As the market evolves, so do the strategies employed by hybrid fund managers. Their ability to pivot between asset classes in response to shifting market trends contributes to their appeal as a versatile investment option.

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The hybrid funds market operates in a state of perpetual flux, adapting to both macroeconomic trends and investor sentiment. The interplay between risk and reward, coupled with the evolving preferences of investors, contributes to a dynamic landscape that necessitates constant vigilance and strategic decision-making.

Regional Analysis

The hybrid funds market exhibits variations in popularity and adoption across different regions. Factors such as regulatory environments, economic stability, and cultural attitudes toward investing play a role in shaping regional dynamics.

Competitive Landscape

Leading Companies in the Hybrid Funds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

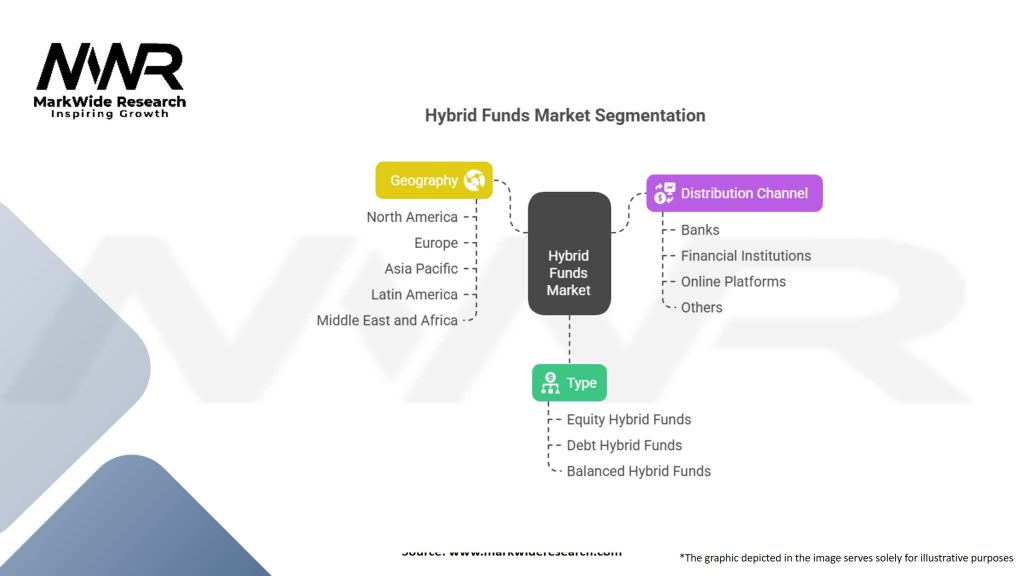

Hybrid funds can be segmented based on their asset allocation, risk profiles, and investment objectives. Conservative hybrid funds might have a higher allocation to debt instruments, while aggressive ones could tilt toward equities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic disrupted financial markets globally, impacting asset prices and investor sentiment. Hybrid funds faced challenges as market volatility tested their risk management strategies. However, their diversified nature allowed them to cushion some of the shocks, showcasing their resilience during uncertain times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The hybrid funds market is poised for continued growth and innovation. As investors seek avenues that balance risk and return, hybrid funds have the potential to carve a more significant niche within investment portfolios. The evolution of these funds, driven by technological advancements and changing investor preferences, will likely shape the financial landscape for years to come.

Conclusion

The hybrid funds market exemplifies the art of balance in the financial world. With their ability to blend the best of both equity and debt instruments, these funds offer investors a versatile tool to navigate the complexities of the market. The market’s trajectory, driven by factors such as diversification benefits, risk mitigation, and changing investor dynamics, underscores its significance in the broader investment landscape. As the hybrid funds market continues to adapt and innovate, it provides a compelling case for investors and stakeholders to explore its potential for consistent growth and stability.

What is Hybrid Funds?

Hybrid funds are investment vehicles that combine different asset classes, typically equities and fixed income, to provide investors with a balanced approach to risk and return. They aim to achieve capital appreciation while also providing some level of income.

What are the key players in the Hybrid Funds Market?

Key players in the Hybrid Funds Market include investment management firms such as Vanguard, Fidelity Investments, and BlackRock, which offer a variety of hybrid fund options to cater to different investor needs and risk profiles, among others.

What are the growth factors driving the Hybrid Funds Market?

The Hybrid Funds Market is driven by factors such as increasing investor demand for diversified portfolios, the growing popularity of balanced investment strategies, and the rising awareness of risk management among retail and institutional investors.

What challenges does the Hybrid Funds Market face?

Challenges in the Hybrid Funds Market include market volatility, which can affect the performance of both equities and fixed income, and the complexity of managing asset allocation effectively to meet investor expectations.

What opportunities exist in the Hybrid Funds Market?

Opportunities in the Hybrid Funds Market include the potential for product innovation, such as the development of ESG-focused hybrid funds, and the increasing interest from younger investors seeking balanced investment options.

What trends are shaping the Hybrid Funds Market?

Trends in the Hybrid Funds Market include a shift towards more flexible investment strategies, the integration of technology in fund management, and a growing emphasis on sustainable investing practices.

Hybrid Funds Market

| Segmentation | Details |

|---|---|

| Type | Equity Hybrid Funds, Debt Hybrid Funds, Balanced Hybrid Funds |

| Distribution Channel | Banks, Financial Institutions, Online Platforms, Others |

| Geography | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Hybrid Funds Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at