444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The housing finance market plays a vital role in enabling individuals and families to achieve their dream of owning a home. It encompasses a range of financial products and services designed to facilitate the purchase, construction, renovation, and refinancing of residential properties. This comprehensive analysis delves into the current state of the housing finance market, exploring its meaning, key insights, drivers, restraints, opportunities, dynamics, and regional variations.

Meaning

Housing finance refers to the financial mechanisms and instruments utilized by individuals, households, and investors to secure funds for residential property-related activities. These activities may include mortgage loans, housing loans, home equity lines of credit, and other lending and borrowing arrangements that aid in property acquisition or development.

Executive Summary

The housing finance market is a significant contributor to the overall economy, as it not only fulfills the aspirations of individuals but also fuels construction activities, creates employment opportunities, and stimulates economic growth. In this executive summary, we provide an overview of the key findings and insights gained from the analysis of the housing finance market, shedding light on its growth prospects, challenges, and emerging trends.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The housing finance market is propelled by several key drivers that fuel its growth and expansion. These drivers include:

Market Restraints

Despite the promising growth prospects, the housing finance market faces certain challenges and constraints that need to be addressed. These include:

Market Opportunities

Despite the challenges, the housing finance market presents several enticing opportunities for industry participants and stakeholders. These opportunities include:

Market Dynamics

The housing finance market operates within a dynamic environment influenced by various internal and external factors. These dynamics encompass changing consumer preferences, market competition, regulatory developments, economic conditions, and technological advancements. Understanding and adapting to these dynamics are essential for sustained success in the housing finance industry.

Regional Analysis

The housing finance market exhibits regional variations driven by factors such as cultural norms, economic conditions, government policies, and market maturity. This section provides a detailed analysis of regional trends, highlighting key markets, growth patterns, regulatory landscapes, and market dynamics across different geographies.

Competitive Landscape

Leading Companies in the Housing Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

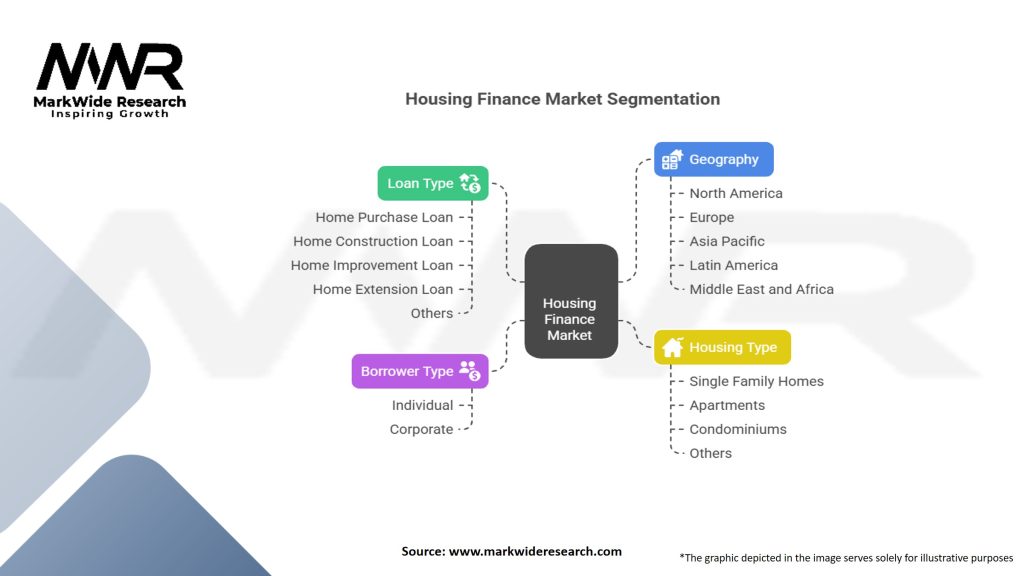

Segmentation

The housing finance market can be segmented based on various parameters, including loan type, borrower profile, interest rates, and purpose. This section provides a comprehensive segmentation analysis, offering insights into the different segments, their market size, growth potential, and competitive dynamics.

Category-wise Insights

Within the housing finance market, various categories and subcategories exist, each catering to different customer needs and preferences. This section delves into category-wise insights, exploring housing finance options such as fixed-rate mortgages, adjustable-rate mortgages, government-backed loans, and specialized loan programs.

Key Benefits for Industry Participants and Stakeholders

The housing finance market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The housing finance market is subject to evolving trends that shape consumer behavior, lending practices, and industry dynamics. This section highlights key trends, including the rise of digital mortgage platforms, green financing initiatives, the integration of big data analytics, and the emergence of peer-to-peer lending models.

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the housing finance market, disrupting the real estate industry, altering consumer preferences, and influencing lending practices. This section analyzes the pandemic’s effects on the market, including changes in demand, mortgage forbearance programs, and the role of government interventions in stabilizing the market.

Key Industry Developments

The housing finance market is subject to continuous developments and innovations. This section provides an overview of recent industry developments, such as new product launches, regulatory changes, strategic partnerships, and technological advancements, shaping the market landscape.

Analyst Suggestions

Based on the analysis of the housing finance market, industry analysts offer valuable suggestions and recommendations to industry participants, policymakers, and investors. These suggestions encompass strategies for risk management, customer-centric approaches, technological integration, and sustainable practices.

Future Outlook

The housing finance market is poised for continued growth, driven by various factors, including urbanization, population growth, favorable government policies, and technological advancements. This section presents a comprehensive outlook for the future of the market, highlighting emerging trends, growth opportunities, and potential challenges that industry participants need to be prepared for.

Conclusion

The housing finance market holds immense potential as it caters to the fundamental aspiration of homeownership while driving economic growth. As the market evolves, industry participants must stay abreast of changing dynamics, embrace technological innovations, and adapt to emerging trends to unlock opportunities and overcome challenges. By doing so, they can effectively meet the diverse needs of homebuyers and contribute to the sustainable development of the housing finance market.

What is Housing Finance?

Housing finance refers to the various financial products and services that facilitate the purchase, construction, or renovation of residential properties. This includes mortgages, home equity loans, and other lending options that support homeownership and real estate investment.

What are the key players in the Housing Finance Market?

Key players in the Housing Finance Market include major banks like Wells Fargo and JPMorgan Chase, as well as specialized mortgage lenders such as Quicken Loans and Rocket Mortgage. These companies provide a range of financing options to consumers and investors in the housing sector, among others.

What are the main drivers of growth in the Housing Finance Market?

The main drivers of growth in the Housing Finance Market include low interest rates, increasing demand for housing, and favorable government policies that promote homeownership. Additionally, urbanization and demographic shifts are contributing to a rising need for housing finance solutions.

What challenges does the Housing Finance Market face?

The Housing Finance Market faces challenges such as fluctuating interest rates, regulatory changes, and economic downturns that can impact borrowers’ ability to repay loans. Additionally, housing affordability remains a significant concern in many regions.

What opportunities exist in the Housing Finance Market?

Opportunities in the Housing Finance Market include the growth of digital mortgage platforms and the increasing use of technology to streamline the lending process. There is also potential for innovative financing solutions tailored to first-time homebuyers and underserved communities.

What trends are shaping the Housing Finance Market?

Trends shaping the Housing Finance Market include the rise of green financing options for energy-efficient homes and the integration of artificial intelligence in underwriting processes. Additionally, there is a growing emphasis on customer experience and personalized lending solutions.

Housing Finance Market

| Segmentation | Details |

|---|---|

| Loan Type | Home Purchase Loan, Home Construction Loan, Home Improvement Loan, Home Extension Loan, Others |

| Borrower Type | Individual, Corporate |

| Housing Type | Single Family Homes, Apartments, Condominiums, Others |

| Geography | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Housing Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at