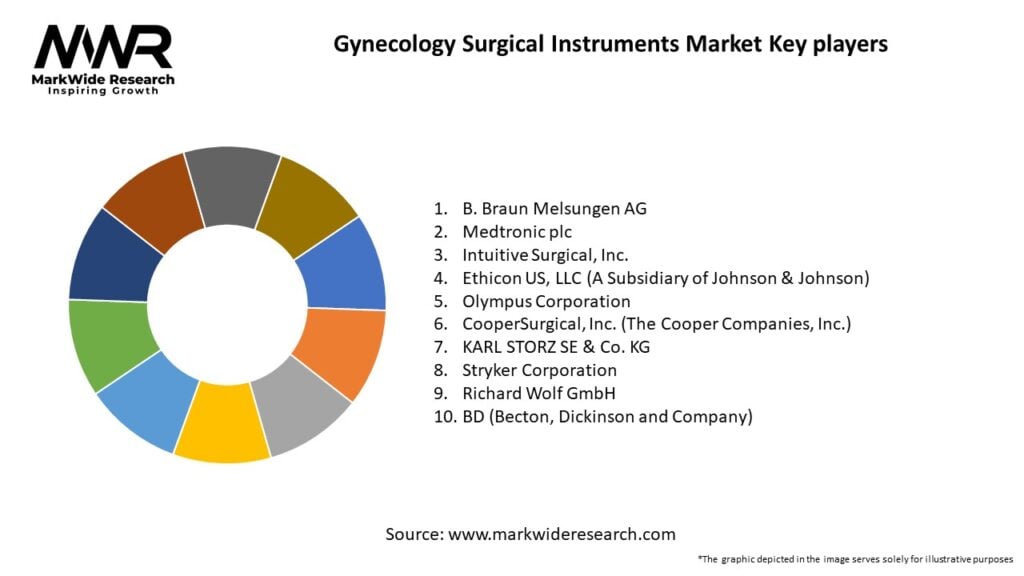

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

MIGS Penetration: Laparoscopic and robot-assisted procedures now account for over 50% of all hysterectomies in developed markets, driving demand for specialized trocars, graspers, and bipolar sealing devices.

-

Disposable Instruments: Single-use Hegar dilators and uterine manipulators are growing at 12% annually, particularly in regions with strict sterilization protocols.

-

Ergonomics & Safety: Ergonomically designed handles and integrated safety locks reduce surgeon fatigue and risk of instrument misplacement.

-

Emerging Indications: Rising diagnosis of adenomyosis and polycystic ovary syndrome (PCOS) is broadening instrument usage in novel energy- and morcellation-based interventions.

-

Training & Simulation: Adoption of virtual reality–based instrument training simulators enhances surgeon proficiency, boosting instrument utilization and turnover in teaching hospitals.

Market Drivers

-

Rising Surgical Volumes: Increasing incidence of uterine fibroids, endometriosis, and abnormal uterine bleeding elevates demand for surgical intervention.

-

Minimally Invasive Adoption: Patient preference for laparoscopic and robotic approaches—owing to shorter recovery times—propels uptake of specialized MIS instruments.

-

Technological Innovation: Advances such as articulating laparoscopic jaws and integrated energy devices (vessel sealers, ultrasonic shears) improve surgical efficiency.

-

Healthcare Infrastructure: Expansion of ambulatory surgery centers and investments in women’s health facilities increases access to gynecologic surgery.

-

Regulatory Push for Safety: Stricter infection-control guidelines favor disposable instruments, reducing cross-contamination and reprocessing costs.

Market Restraints

-

High Capital Costs: Robotic surgery platforms and compatible instrument sets require significant initial investment, limiting adoption in resource-constrained hospitals.

-

Reprocessing Challenges: Complex reusable instruments necessitate rigorous cleaning and sterilization protocols, increasing operational burden.

-

Reimbursement Constraints: In certain markets, lower reimbursement rates for outpatient MIGS procedures reduce hospital incentives to upgrade instrumentation.

-

Training Gaps: Limited access to hands-on training in advanced MIS techniques can slow instrument adoption rates, particularly in emerging markets.

-

Safety Concerns: Past safety issues with power morcellators have led to stricter guidelines, reducing usage and driving demand for containment systems.

Market Opportunities

-

Single-Use Solutions: Development of biodegradable plastics and cost-competitive disposables can expand market share in infection-sensitive environments.

-

Smart Instrumentation: Integration of force sensors and haptic feedback in laparoscopic tools can improve tissue differentiation and surgeon control.

-

Robotic Integration: Collaborations to produce instrument end-effectors optimized for next-generation robotic platforms will create new demand streams.

-

Emerging Markets: Growth in gynecologic surgical capacity in Asia-Pacific and Latin America offers significant untapped potential for instrument suppliers.

-

Tele-surgical Support: Remote instrument guidance and troubleshooting services, enabled via IoT connectivity, can support decentralized surgical teams.

Market Dynamics

-

OEM Partnerships: Strategic alliances between instrument manufacturers and robotic platform providers ensure seamless compatibility and co-marketing.

-

Value-Based Procurement: Hospitals increasingly evaluate total cost of ownership—including reprocessing, maintenance, and procedural time—when selecting instruments.

-

M&A Activity: Consolidation among mid-sized instrument suppliers is creating broader portfolios, enabling end-to-end surgical solution offerings.

-

Regulatory Harmonization: Alignment of device approval pathways across major markets (FDA, EU MDR, PMDA) accelerates time-to-market for new instrument designs.

-

Sustainability Initiatives: Pressure to reduce medical waste is spurring development of recyclable instrument components and eco-friendly packaging.

Regional Analysis

-

North America: Largest market, led by high adoption of robotic gynecologic surgery and favorable reimbursement; strong shift to disposable instruments post-2015 morcellation guidelines.

-

Europe: Rapid MIGS uptake in Western Europe; stringent environmental regulations drive interest in instrument reprocessing innovations and sustainable disposables.

-

Asia-Pacific: Fastest-growing region due to rising women’s healthcare access, expanding hospital infrastructure, and growing acceptance of MIS.

-

Latin America: Moderate growth; key drivers include government investments in women’s health programs and private-sector surgical centers in Brazil and Mexico.

-

Middle East & Africa: Early-stage market with growth potential in GCC countries, where medical tourism for advanced gynecologic care is rising.

Competitive Landscape

Leading Companies in the Gynecology Surgical Instruments Market:

- B. Braun Melsungen AG

- Medtronic plc

- Intuitive Surgical, Inc.

- Ethicon US, LLC (A Subsidiary of Johnson & Johnson)

- Olympus Corporation

- CooperSurgical, Inc. (The Cooper Companies, Inc.)

- KARL STORZ SE & Co. KG

- Stryker Corporation

- Richard Wolf GmbH

- BD (Becton, Dickinson and Company)

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

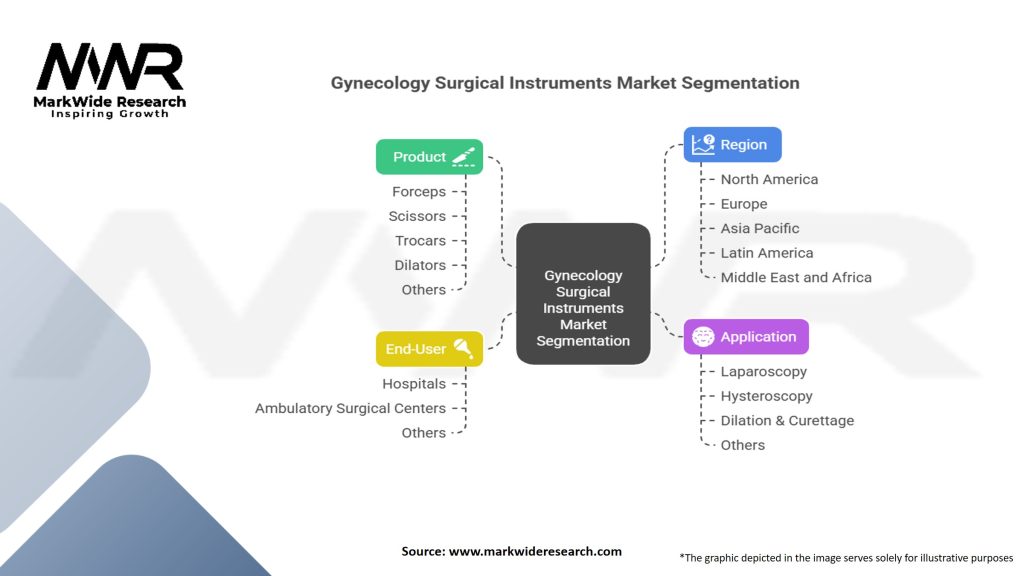

Segmentation

-

By Instrument Type:

-

Hysteroscopic Instruments (resectoscopes, tissue retrieval systems)

-

Laparoscopic Instruments (forceps, scissors, graspers, needle holders)

-

Energy Devices (ultrasonic shears, bipolar sealers)

-

Uterine Manipulators & Dilators

-

Power Morcellators & Tissue Retrieval Bags

-

-

By Usage Pattern: Reusable vs. Single-Use

-

By Procedure Type:

-

Hysterectomy & Myomectomy

-

Endometriosis Resection

-

Pelvic Organ Prolapse Repair

-

Diagnostic Hysteroscopy

-

Fertility Procedures

-

-

By End-User: Hospitals, Ambulatory Surgery Centers, Specialty Women’s Clinics

-

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Category-wise Insights

-

Hysteroscopic Instruments: Growth fueled by outpatient hysteroscopy for fibroid and polyp removal; demand for smaller-diameter scopes and integrated fluid controls.

-

Laparoscopic Instruments: High demand for articulating and 5-mm profile instruments facilitating reduced-port surgery; single-site laparoscopy tools emerging.

-

Energy Devices: Ultrasonic and advanced bipolar devices preferred for precise hemostasis with minimal thermal spread; disposables gaining share.

-

Uterine Manipulators: Essential for uterine positioning during MIGS; single-use, leak-proof designs with integrated cavity delineation features are popular.

-

Morcellators & Retrieval: Containment systems mandated post-FDA safety communications; development of in-bag power morcellation solutions is a key trend.

Key Benefits for Industry Participants and Stakeholders

-

Improved Patient Outcomes: Minimally invasive instruments reduce blood loss, postoperative pain, and recovery time.

-

Operational Efficiency: Ergonomic handles and modular sets decrease setup time and instrument turnover between cases.

-

Infection Control: Single-use tools eliminate cross-contamination risks and simplify sterilization workflows.

-

Cost Management: Value-based procurement and reusable-disposable hybrid strategies optimize total cost of ownership.

-

Market Differentiation: Hospitals offering advanced instrument–robotic integrations attract higher case volumes and specialist surgeons.

SWOT Analysis

Strengths:

-

Strong clinical evidence supporting MIGS benefits.

-

Broad portfolio of instruments tailored for various gynecologic indications.

-

Robust R&D pipelines focused on surgeon-centric innovations.

Weaknesses:

-

High capital and per-case costs for advanced disposable and robotic-compatible instruments.

-

Dependence on skilled laparoscopic surgeons limits penetration in low-resource regions.

-

Environmental concerns over medical waste from disposables.

Opportunities:

-

Expansion of tele-mentoring and digital proctoring to accelerate surgeon training globally.

-

Development of cost-effective instrument bundles for emerging markets.

-

Integration of AI-enabled instrument tracking to enhance inventory management.

Threats:

-

Potential regulatory constraints on power devices following safety reviews.

-

Competition from non-invasive alternatives such as focused ultrasound for fibroid treatment.

-

Supply-chain disruptions affecting high-precision instrument manufacturing.

Market Key Trends

-

Single-Port Laparoscopy: Growth of dedicated multi-instrument ports requiring specialized retractors and graspers.

-

Modular Handle Systems: Universal handles compatible with multiple tip modules reduce instrument inventory.

-

Smart Instrument Tracking: RFID-enabled trays and software to automate inventory control and ensure completeness.

-

Biodegradable Disposables: Development of eco-friendly instrument materials to address sustainability mandates.

-

Augmented Reality Assistance: AR overlays guiding instrument placement and suture paths in complex endometriosis resections.

Covid-19 Impact

The pandemic temporarily reduced elective gynecologic surgeries in 2020–21, leading to deferred instrument purchases. However, emphasis on ambulatory and outpatient procedures grew, accelerating adoption of compact, single-use instrument sets optimized for satellite centers. Investments in tele-mentoring platforms kept MIS training on track, ensuring rapid recovery of procedure volumes post-pandemic.

Key Industry Developments

-

Ethicon’s Hysteroscope Upgrade (2023): Launched a disposable, integrated fluid-control hysteroscope with enhanced optics and reduced diameter.

-

Medtronic’s Advanced Bipolar Sealer (2022): Released a slim-profile vessel sealer designed for transvaginal applications with real-time tissue feedback.

-

Stryker’s Smart Tray™ Launch (2024): Deployed an RFID-based instrument tray system specifically configured for gynecologic laparoscopic kits.

-

Karl Storz’s Single-Port Platform (2021): Introduced a modular single-incision laparoscopy port with dedicated curved instruments for gynecology.

Analyst Suggestions

-

Tiered Instrument Strategies: Offer bundled reusable/disposable packages to balance cost and infection control across facility types.

-

Focus on Training: Invest in virtual reality and remote-mentorship programs to expand surgeon proficiency in advanced MIS.

-

Leverage Sustainability: Develop biodegradable or recyclable disposable instruments to meet evolving environmental regulations.

-

Enhance Connectivity: Integrate instruments with OR digital ecosystems for procedure documentation, instrument tracking, and predictive maintenance.

-

Expand Emerging-Market Access: Partner with local distributors to tailor pricing models and instrument portfolios for cost-sensitive regions.

Future Outlook

The Gynecology Surgical Instruments market is poised for sustained growth at a mid-single-digit CAGR through 2030, driven by continued migration to minimally invasive and outpatient settings. Innovations in smart, ergonomic, and eco-friendly instruments—combined with digital training and telehealth support—will broaden adoption, particularly in emerging economies. Integration with robotic and AR-assisted platforms will create new demand for specialized end-effectors and tracking technologies. Manufacturers that align instrument design with surgeon workflows, hospital cost pressures, and environmental imperatives will capture the greatest share in this dynamic sector of women’s health.

Conclusion

In conclusion, the Gynecology Surgical Instruments market stands at the intersection of technological innovation, patient-centered care, and procedural efficiency. As hospitals and surgeons pursue minimally invasive, cost-effective, and sustainable solutions, instrument suppliers must deliver smart, ergonomic, and interoperable tools. By investing in advanced materials, digital integration, and global training programs, stakeholders can improve surgical outcomes, expand access to women’s health services, and lead the market through the next decade of growth.