444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The exchange-traded fund (ETF) market refers to the industry involved in the creation, distribution, and trading of ETFs, which are investment funds that trade on stock exchanges like individual stocks. ETFs are designed to track the performance of a specific index, sector, commodity, or asset class. This market overview provides a comprehensive analysis of the ETF market, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Exchange-traded funds (ETFs) are investment vehicles that allow investors to gain exposure to a diversified portfolio of assets. ETFs are traded on stock exchanges and are structured as open-ended investment funds. They offer investors the opportunity to invest in a wide range of asset classes, including stocks, bonds, commodities, and more. ETFs are designed to closely track the performance of an underlying index or asset, providing investors with a cost-effective and convenient way to diversify their investment portfolios.

Executive Summary

The ETF market has experienced significant growth and popularity in recent years, driven by the increasing demand for diversified investment options, transparency, and cost-effective investment solutions. ETFs offer several advantages, including flexibility, liquidity, and tax efficiency. However, challenges such as market volatility, regulatory complexities, and competition exist. Despite these challenges, the ETF market continues to expand, driven by innovation, product development, and the growing adoption of passive investment strategies.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The ETF market is driven by several factors:

Market Restraints

The ETF market faces several challenges:

Market Opportunities

The ETF market presents several opportunities for growth and innovation:

Market Dynamics

The ETF market is influenced by various dynamic factors, including market conditions, investor sentiment, regulatory changes, technological advancements, and competition. The market dynamics also include the demand for specific asset classes, the availability of new investment products, and the overall performance of financial markets. Continuous innovation, product development, and effective marketing strategies are crucial for success in this dynamic market.

Regional Analysis

The ETF market can be analyzed on a regional level, considering different geographical regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its own regulatory frameworks, investor preferences, market infrastructure, and economic conditions. Regional analysis helps identify market trends, opportunities, and challenges specific to each region.

Competitive Landscape

Leading Companies in the Exchange Traded Fund Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

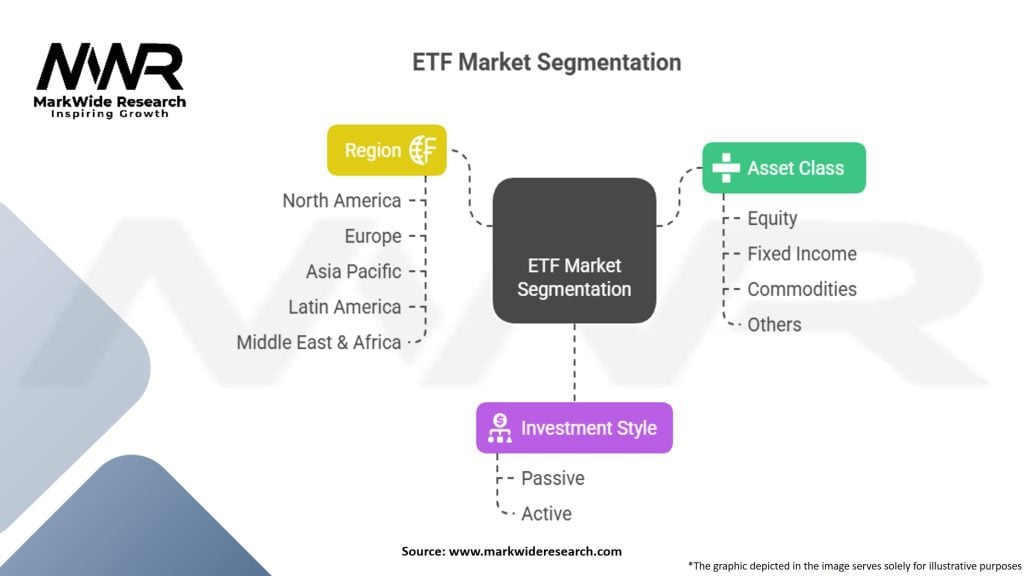

Segmentation

The ETF market can be segmented based on various factors, including asset class, investment strategy, geographic region, and investor type. By asset class, the market includes equity ETFs, fixed income ETFs, commodity ETFs, and others. By investment strategy, the market caters to passive ETFs, actively managed ETFs, leveraged/inverse ETFs, and smart-beta ETFs. By geographic region, the market covers ETFs focused on specific countries, regions, or global exposure. By investor type, the market serves retail investors, institutional investors, and high-net-worth individuals.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The ETF market offers several benefits for industry participants and stakeholders:

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had both positive and negative impacts on the ETF market. Initially, the market experienced significant volatility and disruptions as global financial markets reacted to the pandemic. However, ETFs proved resilient, and investor confidence in ETFs as liquid and transparent investment vehicles grew. The pandemic also accelerated the adoption of digital platforms and online trading, further facilitating access to ETFs.

Key Industry Developments

Analyst Suggestions

Based on market analysis and trends, analysts suggest the following strategies for industry participants:

Future Outlook

The future outlook for the ETF market is positive, with continued growth expected as investors seek diversified investment options, cost-effective solutions, and transparency. The market will likely see further innovation, including the development of new asset classes, thematic ETFs, and ESG-focused offerings. Technological advancements, digitalization, and the integration of artificial intelligence and machine learning will enhance accessibility, trading efficiency, and customization options. Collaboration among industry participants, regulatory bodies, and technology providers will drive market evolution and improve investor experiences.

Conclusion

The ETF market has experienced significant growth and popularity, offering investors diversified investment options, cost-effective solutions, and transparency. Despite challenges such as market volatility and regulatory complexities, the market presents opportunities for expansion, innovation, and customization. Technological advancements, digital platforms, and thematic investing are shaping the market landscape.

Continued education, regulatory compliance, and collaboration among industry participants will contribute to the growth and success of the ETF market, providing industry participants and stakeholders with opportunities for revenue growth, market differentiation, and investor satisfaction.

Exchange Traded Fund Market

| Segmentation | Details |

|---|---|

| Asset Class | Equity, Fixed Income, Commodities, Others |

| Investment Style | Passive, Active |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Exchange Traded Fund Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at